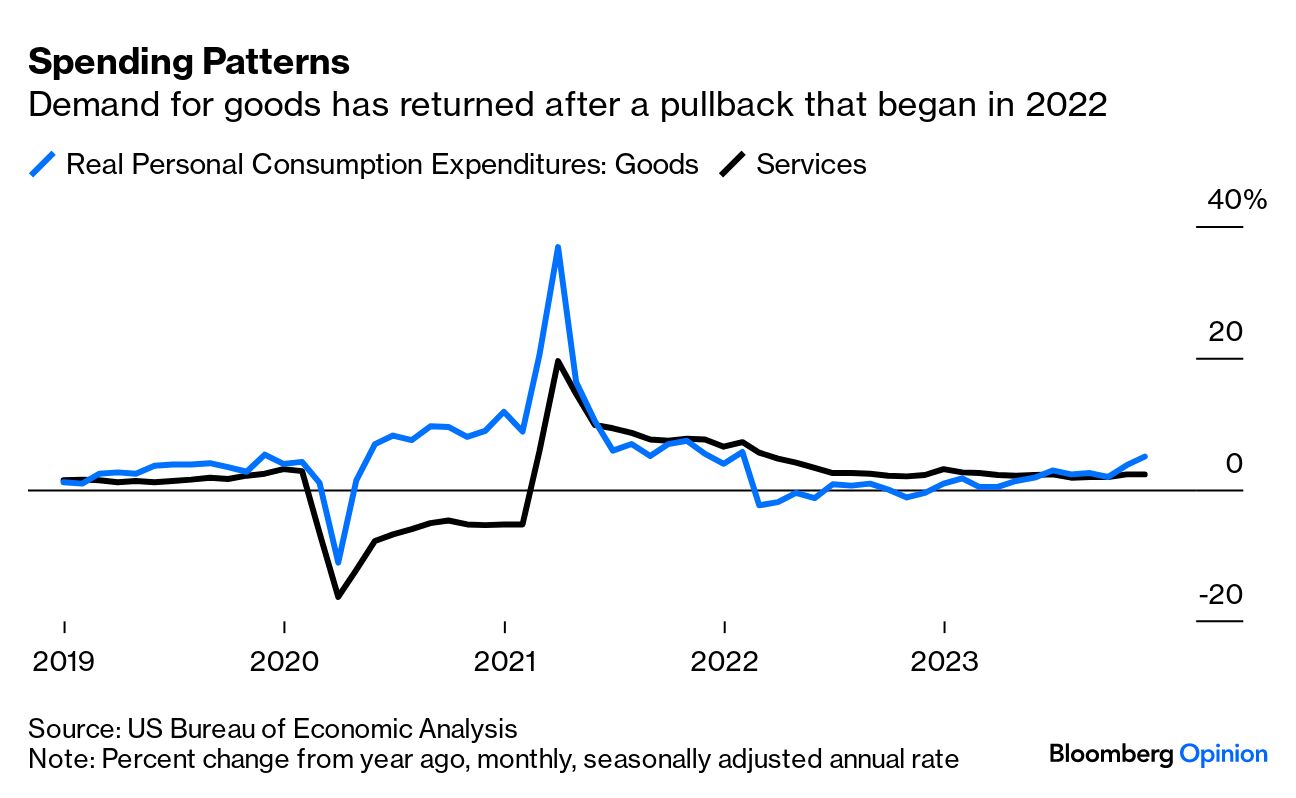

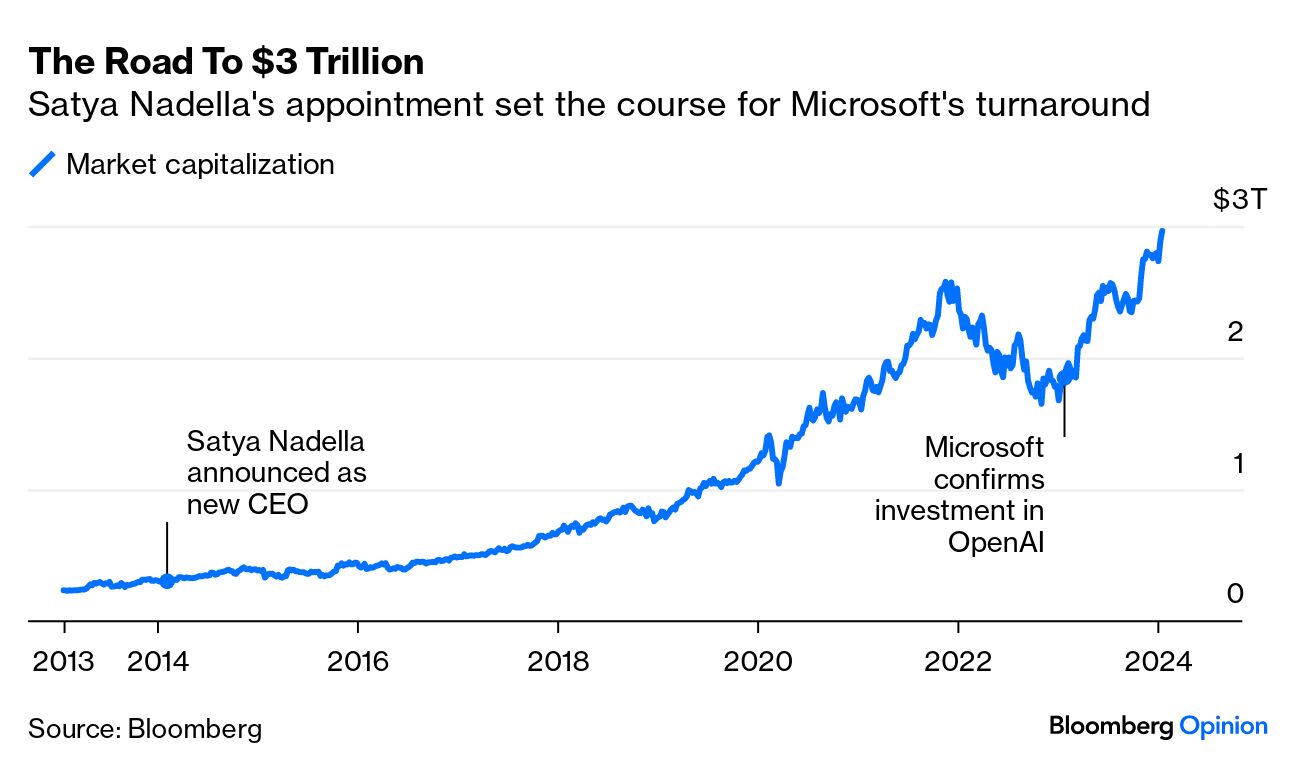

| This is Bloomberg Opinion Today, a mass-market electric vehicle of Bloomberg Opinion's opinions. Sign up here. The five CEOs of Meta, X, Snap, Discord and TikTok spent their mornings getting ripped to shreds by senators. The subject of the hearing was the spread of child sexual exploitation online and the tech companies' failure to protect kids from predators. Although each of the tech chiefs drew the ire of the 21-member Senate Judiciary Committee, Mark Zuckerberg stood at the center of the firing line. Senator Lindsey Graham told the Meta CEO he had "blood on his hands." Senator Ted Cruz discussed a damning screenshot of an Instagram warning screen about sexual abuse that gave users a choice to "get resources" or "see results anyway." Senator Josh Hawley even called on Zuckerberg to apologize directly to the families whose children were harmed by his platform's algorithm. Zuckerberg acquiesced, turning around to address the crowd as they held up pictures of the victims:  Photograph via Bloomberg Although the Meta CEO made a massive error in judgement and the video clips of him are going viral, Dave Lee says everyone has grown frustrated by this process. "It's not the first time that Mark Zuckerberg has been called in front of Congress for a dressing down in front of the cameras. And it seems with all these hearings, very little progress is being made. If there's laws that can be passed and they can be passed soon, then maybe now it's up to Congress to do its job." There's just one problem with that: The public trusts businesses more than politicians to solve social problems. So what's a CEO to do? "Activists beat the drum of corporate responsibility more loudly by the day. Yet the idea of ethical business is a conceptual and practical minefield," Adrian Wooldridge writes. A new book by Alison Taylor, Higher Ground: How Business Can Do the Right Thing in a Turbulent World, provides some clues: "US companies are particularly prone to ethical scandals because their boards are so often beholden to CEOs rather than providing a robust system of oversight." And if the throne is up for grabs, Beth Kowitt suggests that companies play it straight when it comes to their succession plans, just like Levi Strauss & Co. did with its new CEO Michelle Gass. "Research has shown that the market value erased by bad CEO and C-suite transitions among the S&P 1500 is almost $1 trillion a year. Nearly a third of directors say companies don't spend enough time on succession planning," she writes. Getting this stuff wrong doesn't just taint the legacy of the CEO, it can cost a company its reputation. Speaking of questionable CEO behavior: Can you imagine sending this email to your former divorce attorney who also doubles as your company's chief legal officer?? Although this certainly isn't a conventional way to ask for a raise, he does get points for creativity! And wanting to expand the scope and scale of human consciousness is not an out-of-the-ordinary request, by Elon Musk standards: "If he wants some weird thing — a hypothetical gold statue, a flamethrower, a glass mansion, a pointless fight with a cave diver, Twitter — he will naturally ask one of his companies to help him get it," says Matt Levine. But the whole "this is just what Weird Elon does" rationale wasn't cutting it for Tesla stockholder/former thrash metal drummer Richard Tornetta, who decided to challenge Musk's compensation and won. Late last night, the Delaware Court of Chancery voided the $55 billion pay package that Tesla awarded the CEO in 2018. The ruling — which will likely be appealed — means that the Tesla CEO has lost his WRP crown (World's Richest Person) once again. "All of this comes at a moment of weakness on the corporate front. Tesla has just abandoned its growth target for the core autos business while it works on developing a new mass-market electric vehicle," Liam Denning writes. "Losing 50% of shareholder worth since the November 2021 all-time high in the stock price while suffering the longest consecutive weekly decline in seven years is a foreboding trend," Matthew A. Winkler warns. But at the same time, he says there doesn't appear to be a ceiling for Tesla shares — or its superior earnings power: "Tesla is turning $100 of revenue into $14 of earnings, delivering an Ebitda margin of 14%. Back in 2016, Tesla lost $8 for every $100 of sales." While that's probably not enough money to make humans an interplanetary species and colonize Mars, it might be enough to put a smile on Richard Tornetta's face. Let me get this straight: "The economy sucks, there's global warming, there's constant political and social unrest globally." And yet Gen Zers are dropping $2,500 on vintage Chanel lambskin totes with 24-carat chains? Make it make sense. Although the desire to own knockoff Hermès is slightly concerning, I think the "doom spending" habit speaks volumes about how we in the US handle stress. Shopping is the purest form of American therapy! We're going to Coachella. We're remodeling our kitchens. We're sleeping on silk pillowcases. "With the labor market still resilient, workers — who are continuing to get raises — have the income to buy more stuff, and they're choosing to do so," Conor Sen writes.  But Europe handles stress a little differently. In France, for instance, people prefer sieges to shopping; Lionel Laurent says angry farmers are blocking highways around Paris. "We may be witnessing residual rage following the wartime spike in inflation from farm gates to dinner plates," he writes. Prices are cooling, but farmers and consumers say they're squeezed after a 29% rise in EU food prices since January 2021. "While a majority of domestic poll respondents support the protests, a majority also cut back on food last year — especially the feel-good organic kind," he notes. Although a tractor blockade is far more badass than buying a fake Birkin, it's not economically rewarding. No wonder "the US is currently seeing the widest gap between S&P 500 current earnings yield and MSCI Europe Index ever. Put simply, Europe has never been this cheap versus the US," Isabelle Lee writes. So instead of feeling guilty about your silk pillowcase, you can rest easy knowing that you've made a vital contribution to American exceptionalism. It's no secret that Microsoft's $3 trillion glow up couldn't have happened without AI. But what happens if that investment goes sour? The tech company's "strength and soaring valuation have come on the back of it being the most diversified of the big tech players. But what hurled it into the $3 trillion club — where it stands alone now, though not for long if Apple Inc. can impress shareholders when it reports its results on Thursday — was the promise of turning AI functionality into revenue," Dave Lee explains. So far, that revenue hasn't appeared on its income statement. As costs continue to mount, shareholders are yearning for reassurance that things are going according to plan.  Somewhere in this world, there's a Macy's exec sitting in a corner office plucking petals off a sunflower, alternating between, "go private," "stay public," "go private," "stay public." If that's you, please read Leticia Miranda's column, where she says — in so many words — to get over yourself, already! Sure, you might be holding out for a better offer to go private. But you're in desperate need of a makeover! And $5.8 billion is more than enough to take a trip to the beauty counter. "As a private company, Macy's could avoid public scrutiny of its finances and it would have room to experiment with new ideas and innovations. As a public company, it's difficult to make big changes without shaking the nerves of Wall Street," she argues. The absence of Americans studying in China will hurt the US. — Bloomberg's editorial board Biden sounds like Trump on the border. It's good politics. — Nia-Malika Henderson Google is inching its way toward a healthier, less ad-dependent business model. — Parmy Olson Boeing's strong fourth-quarter earnings results are just an asterisk. — Brooke Sutherland From fertility worries to financial troubles, young cancer patients aren't getting the help they need. — Lisa Jarvis Stealth taxes aren't just annoying for taxpayers. They reduce incentives to work and invest. — Stuart Trow The Chinese transformation of Hong Kong is almost complete. — Karishma Vaswani Walmart is expanding its already massive footprint. If guilty, Trump could lose half of swing-state voters. Experts are horrified by Egypt's pyramid renovation. The NFL is more popular among young women than ever. The Messenger is shutting down. The Lidls are coming to New York City. The TikTok girlies are eating mold. A stuffed 500-pound polar bear was stolen in Canada. A woman returned her 2.5-year-old Costco couch and got a full refund. Lamborghini's founder may have a secret granddaughter. (h/t Andrea Felsted) Notes: Please send Costco furniture and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and follow us on Threads, TikTok, Twitter, Instagram and Facebook. |

No comments:

Post a Comment