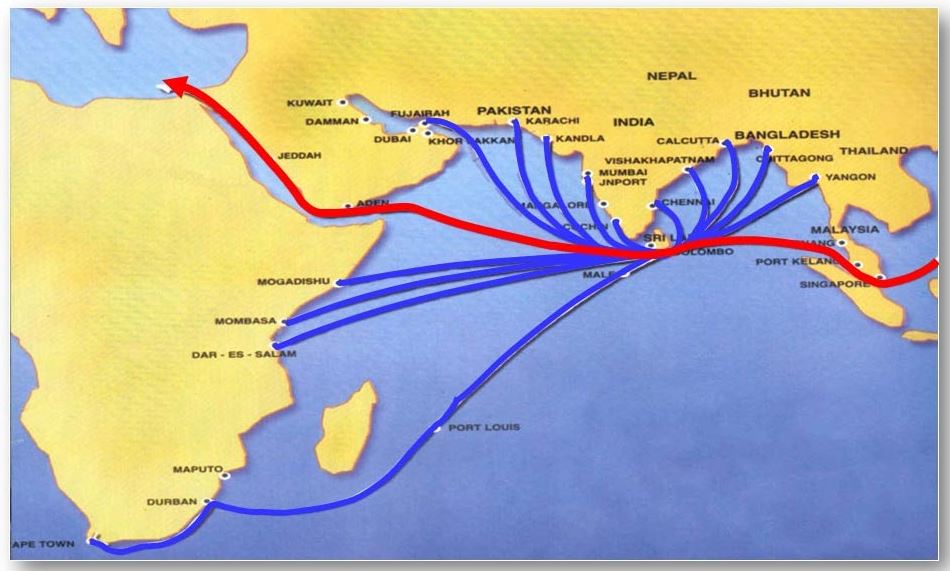

| A little-known US government agency is providing $553 million in financing to help develop a port terminal in Sri Lanka's capital as Washington looks for counterweights to China's trade dominance in South Asia. The deep-water West Container Terminal in Colombo is the International Development Finance Corp.'s largest infrastructure investment in Asia, and among its biggest globally. It will bolster Sri Lanka's economic growth and regional trade integration, including with India, "a key partner to both countries," the agency said in a statement. DFC said it will be working with sponsors John Keells Holdings and Adani Ports, owned by an Indian billionaire. The funding is part of a global acceleration of DFC investments that totaled $9.3 billion in 2023, as Bloomberg reports here. "It is a high priority for the US to be active in the Indo-Pacific region," Scott Nathan, the DFC's chief executive officer told reporters in Colombo Wednesday. "It is obviously the engine of economic growth for the world." China Merchants Port Holdings runs a separate terminal in Colombo's port and is developing an industrial park in Sri Lanka.  Source: Sri Lanka Ports Authority Colombo's port is one of the busiest in the Indian Ocean, given its proximity to international shipping routes where nearly half of all container ships pass through. The DFC said it's been operating at more than 90% utilization for two years and needs new capacity. DFC, a development finance agency launched under the Trump administration, was established to aid poorer nations while advancing US foreign policy goals. It struggled at first to stake out projects during the Covid-19 pandemic. China's state-0wned shipping companies have long sought control of logistics capacity to keep its goods flowing around the world. China's $3.6 trillion in exports last year amounted to 14.4% of the world total, with the US's 8.3% share coming in second, according to World Trade Organization data. Earlier this year, Germany approved a minority stake by China's Cosco in a Hamburg terminal — raising broader questions in the European Union about Beijing's strategic interest in maritime gateways. The DFC's announcement was made as government and corporate leaders are gathering for day one of the Bloomberg New Economy Forum in Singapore. War, geopolitical tension and inflation were among the litany of risks identified at the conference. Click here for the NEF agenda through Nov. 10, and read more highlights from today's events: —Brendan Murray in London |

No comments:

Post a Comment