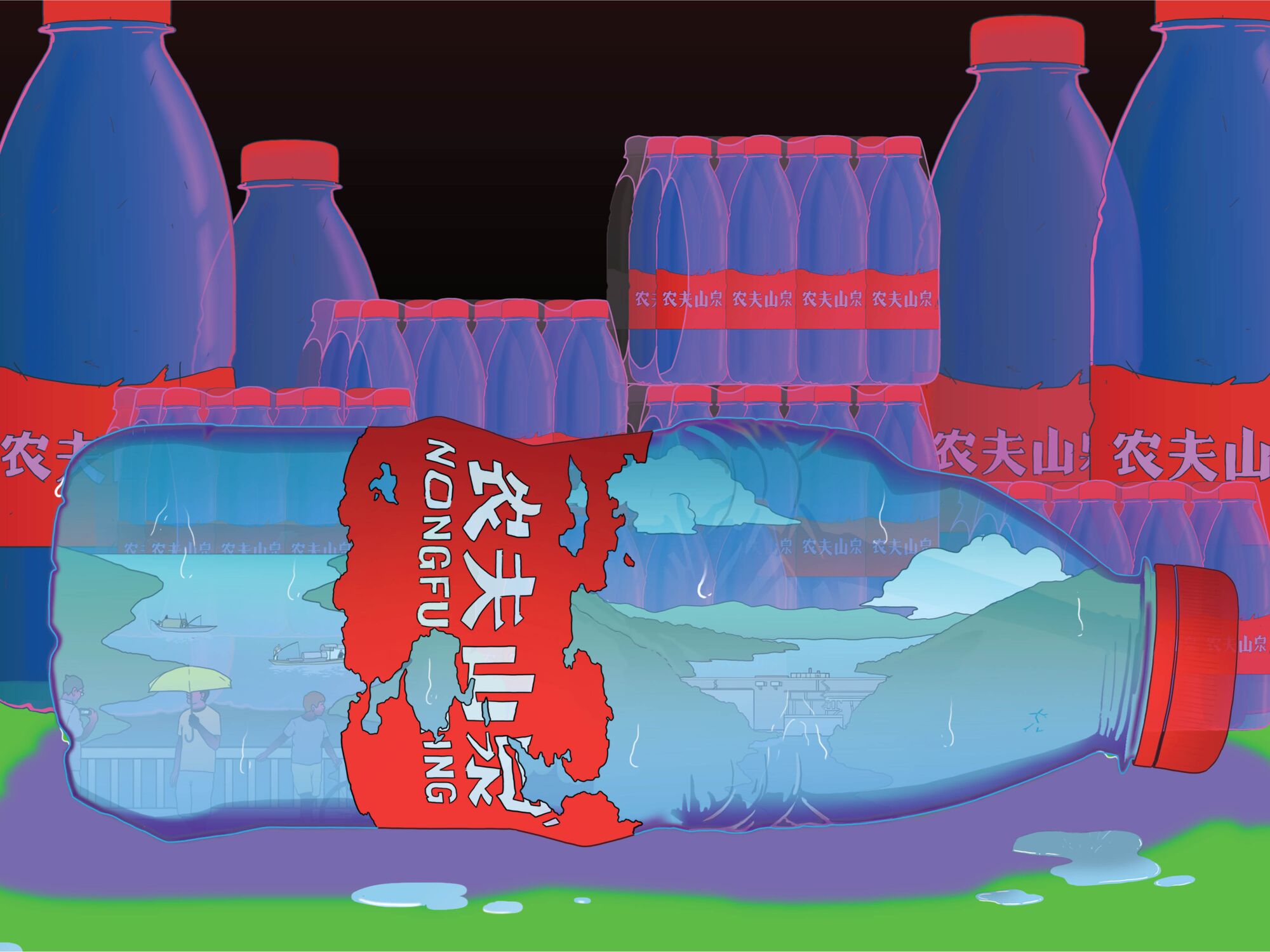

| More bottled water is consumed in China than anywhere else. In most major cities, it's not just a convenient way to hydrate on the go; it's a necessity. The government advises against directly consuming tap water. All of this has helped make Zhong Shanshan the richest man in the country. Zhong built his Nongfu Spring water bottle empire by extracting from some of the country's most ecologically important rivers and mountains. To keep increasing his riches and meet rising demand, however, he'll have to find ever more water sources.  Illustration: Derek Zheng for Bloomberg Green Trump voters love Biden's green jobs. In a deep-red Alabama district, First Solar is building a $1.1 billion solar-panel factory. The plant will span an area close to the size of 40 football fields and create more than 700 jobs. Airlines push for green fuel tax policy. Boeing Co., Archer-Daniels-Midland Co., Delta Air Lines Inc. say the market needs certainty to build a thriving US industry for green jet fuel. Extreme heat has unleashed rain like never before. Unusually violent downpours have hit every inhabited continent this year. From Storm Daniel in Libya to Typhoon Doksuri in China, the damage has been severe. By Brian K. Sullivan Storm Ciaran will strike the southern UK in a matter of hours bringing hurricane-strength wind gusts and heavy rain certain to disrupt rail and air traffic, as well as cause widespread flooding, but the worst impacts will be Thursday. Winds will start to pickup in the southwest as Ciaran approaches later Wednesday, said Alex Deakin, a meteorologist with the UK Met Office in a video briefing. By Thursday, wind gusts could reach as high as 80 miles per hour "perhaps even a little more in some exposed places," he said. While not as severe, London will still see some damaging gusts. "It's been intensifying way out in the Atlantic overnight, but it is still picking up strength as we go through this morning," Deakin said.  A vehicle drives through flood water near Whitley Bay, UK, on Nov. 1. Photographer: Owen Humphreys/PA Images/Getty Images The World Meteorological Organization says Ciaran could bring waves up to 10 meters in the Atlantic. As is the case with tropical systems, the exact track Ciaran makes as it crosses the UK late Wednesday into Thursday will determine where the strongest winds and potentially most damage will occur. In addition to the UK, parts of France will also be buffeted by high winds, crashing waves and heavy rain. The highest winds could occur on both coasts of the English Channel. In addition, because the storm is spinning counter-clockwise, it will pump heavy rain into central and northern England throughout the day Thursday as it moves along the Channel. Several rail services across the UK could be affected by the storm, including Gatwick Express, Southern and Thameslink services, according to National Rail's website. Gatwick Express is already experiencing delays due to signaling issues on the line. The jet stream across the Atlantic helping fuel Ciaran's power has also given airlines traveling from North America to Europe and beyond a boost in speed with many reaching or exceeding 700 miles per hour. On average, planes usually make the crossing at about 550 to 600 mph. A quick sampling of flights this morning shows a Martinair Cargo 747 out of Miami bound for Amsterdam was cruising along at 706 mph, according to FlightRadar24's website. British Airways Airbus A350 traveling from Las Vegas to London had hit 760 mph, while a nearby Aeromexico Boeing 787 was jetting along at 761 mph. In comparison, flights coming the other way aren't reaching such high speeds, a United Airlines Boeing 767 traveling from London to New York was chugging along at 497 mph and a TUI flight from Amsterdam to Punta Cana, Dominican Republic was moving at 445 mph as it crosses the Atlantic. US: A cold snap in the southern and eastern US is potentially bringing an end to the growing seasons there as temperatures drop. Wednesday's low in Atlanta is forecast to hit 32F (0C) or the freezing mark, according to the National Weather Service. In addition, there is an elevated risk of fire weather across the US Gulf Coast. Tropic: The only storm out there right now is Tropical Storm Pilar, which is pulling away from Central America and heading out into the Pacific. Today is the start of the last official month of the Atlantic hurricane season. Last week, the International Energy Agency published its flagship report: The World Energy Outlook. It's dominating climate news because what the IEA says makes a big difference to how governments tweak their energy policies. But how did an organization formed by a handful of countries in response to the 1973 oil crisis come to hold so much influence over our response to the climate crisis? For the answer, we're revisiting one of our favorite episodes: an interview with Fatih Birol, the head of the IEA about how the IEA has cemented its role in the energy transition. Subscribe to Zero on Apple or Spotify to get new episodes every Thursday.  World leaders will gather in Dubai on Dec.4-5 in an effort to accelerate global climate action. Against the backdrop of the United Nations Climate Change Conference, Bloomberg will convene corporate leaders, government officials and industry specialists from NGOs, IGOs, business and academia for events and conversations focused on creating solutions to support the goals set forth at COP28. Register here. |

No comments:

Post a Comment