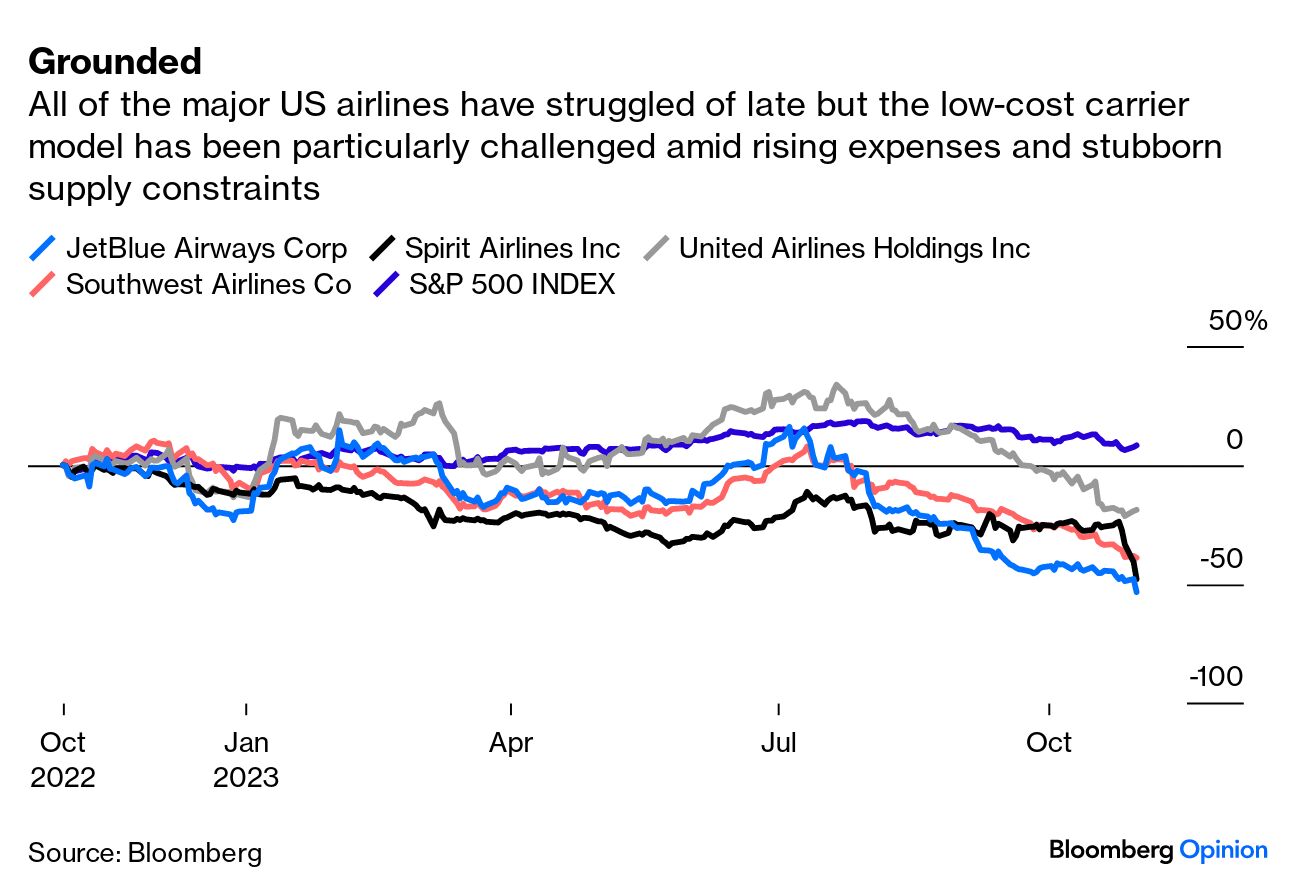

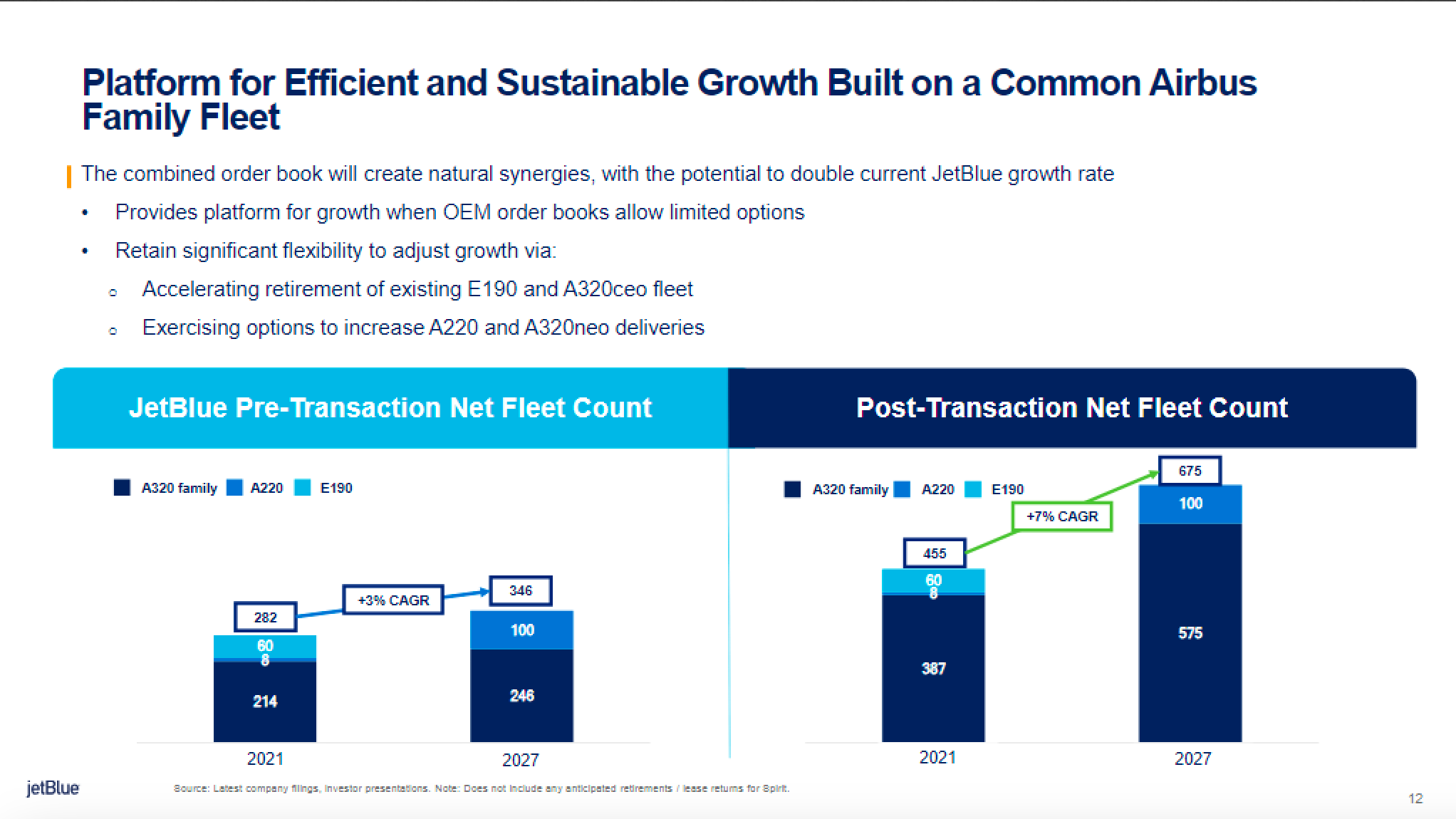

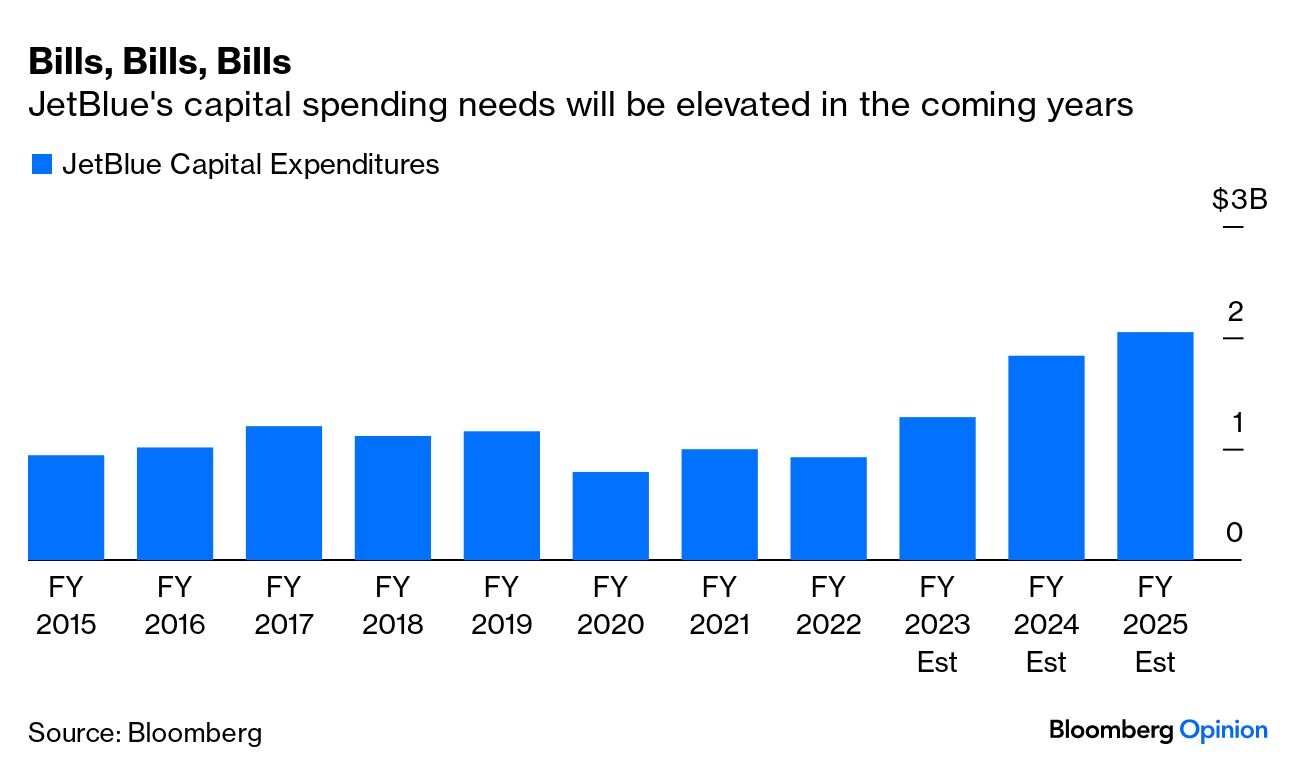

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net Also a programming note: There will be no Industrial Strength this Friday. Look for the next one on Nov. 8. It might not be the worst thing for JetBlue Airways Corp. if the government succeeds in blocking its planned takeover of ultra-low-cost carrier Spirit Airlines Inc. The Department of Justice sued in March to block the $7.6 billion deal on the grounds that the elimination of a stand-alone Spirit would lead to higher ticket prices for consumers. After several delays, a trial over that effort officially kicked off on Tuesday in Boston, scuttling hopes for a last-minute compromise similar to the one that salvaged US Airways' 2013 combination with American Airlines Group Inc.'s bankrupt parent company. Also on Tuesday, JetBlue shares plummeted as much as 19% — the biggest intraday slide since March 2020 at the peak of the pandemic rout — after the airline reported disappointing third-quarter results and warned of deepening losses in the final three months of the year.  The travel recovery is running out of momentum domestically, leaving airlines with more seats than they can fill profitably just as a tricky combination of weather and air-traffic control disruptions, stubborn supply-chain logjams and higher fuel and labor expenses push up operating costs. In short, the world looks much different for airlines than it did in the spring and summer of 2022 as JetBlue aggressively pursued Spirit. Back then, airlines had a supply problem, not a demand one, and the priority was rebuilding fleets and restoring pre-pandemic levels of utilization as quickly as possible. With waitlists for new deliveries from Boeing Co. and Airbus SE now stretching well into the next decade, buying Spirit's existing aircraft offered JetBlue one of the fastest pathways to the kind of network that Chief Executive Officer Robin Hayes has said is necessary to meaningfully compete with the entrenched legacy carriers. Read more: Airline Antitrust Scrutiny Arrives Too Late "You can't break up a large airline. You can't un-ring that bell" on consolidation, Hayes said in an interview at Bloomberg's New York Headquarters earlier this year. "You either accept a world where you have four large airlines who will call the shots … or you can create a true low-fare, high-quality national challenger to take on these guys." The combination with Spirit "significantly increases our relevance by accelerating our strategic growth plan," Hayes said in April 2022 when JetBlue first lobbed in an offer for the company, which at the time was planning to sell itself to fellow low-cost carrier Frontier Group Holdings Inc. Specifically, the acquisition will double the compounded annual growth rate for JetBlue's fleet to 7% between 2021 and 2027, the airline said in July 2022. JetBlue hasn't explicitly updated those figures since then. But with many carriers now leaning on discounts to fill seats, the last thing the industry needs is accelerated growth.  Source: JetBlue July 2022 Merger Presentation JetBlue said Tuesday that it would trim its schedule in the first quarter to below last year's levels. It recently ended service to two US cities and is curbing flights out of lower-yielding markets and New York's LaGuardia airport to prioritize regions with stronger demand such as the Caribbean and international routes. Capacity plans can be adjusted, as can aircraft order timelines, and there's a longer-term value for JetBlue in simply being a bigger airline. JetBlue and Spirit are the sixth- and seventh-largest US airlines by revenue, respectively. Theoretically, the combination will allow JetBlue to spread its costs over a more significant revenue base. But the pitch for the deal was growth, not cost-cutting, and timing is everything in M&A. JetBlue-Spirit was a match made in weirdness from the start: Spirit compensates for its rock-bottom fares by nickel-and-diming customers on everything from carry-on bags to printed boarding passes and bottles of water, while JetBlue has operated on the philosophy that cheaper fares don't have to mean a cattle-car experience and has invested in top class in-flight entertainment options and brand-name snacks. As I wrote when JetBlue's offer was first announced, this is exactly the kind of deal that happens in tightly consolidated industries where there's at best one more megamerger yet to come. Deals done out of the process of elimination don't tend to be the wisest, however, and that's especially true in the notoriously boom-and-bust airline industry. In its effort to wrest Spirit away from Frontier, JetBlue got creative and aggressive with its deal terms. The airline took the unusual step of offering to prepay a portion of its offer through a special dividend to tide Spirit holders over while they waited for the deal to close. The airline also agreed to a ticking fee of 10 cents a share per month starting in January 2023. The all-in merger consideration could rise to $34.15 a share if the deal doesn't close until July 2024. JetBlue also repeatedly upsized the reverse termination payout. Should regulators succeed in blocking the deal, JetBlue will owe $70 million to Spirit and $400 million to its shareholders. Frontier never really made much of a serious effort to match JetBlue's terms, particularly on the core economic proposition, meaning the latter company was largely bidding against itself by dangling all of these sweeteners that now look financially irresponsible. Airline stocks have sold off sharply over the past year amid concerns about weakening demand trends and rising costs, but the backstop of the JetBlue cash offer provided some support for Spirit. That's changed: Spirit shares have plummeted more than 30% over the past week as it became clear the antitrust trial would take place and investors wagered the companies would lose. With the stock currently trading at about $11.50, JetBlue's baseline cash offer of $33.50 a share implies an absolutely insane premium of almost 200%. Frontier's own crumbling stock price means its "best and final" offer would have been valued at just shy of $11 on Tuesday's trading values — a price tag that's much closer to the neighborhood of what Spirit's business is actually worth today.  Spirit warned last week that average fares during the peak holiday travel season this year would be "significantly lower than previously anticipated." As the largest US operator of Airbus jets powered by RTX Corp.'s geared turbofan jet engine, Spirit is also set to feel the brunt of that propulsion system's quality control issues. An average of 26 planes from the carrier's Airbus fleet will be grounded during 2024 for engine inspections and repairs, with the number rising from 13 in January to 41 in December. "Having 41 aircraft parked during the holiday season means 4Q24 is likely to be another loss-making quarter. In fact, we don't see how the airline can be profitable for the foreseeable future," TD Cowen analyst Helane Becker wrote in a note on Spirit last week. "Since this is a material adverse change in the outlook for the company, it is also possible that JetBlue tries to renegotiate the price, especially if they win their case against the DOJ." An annual loss in 2023 would be Spirit's fourth consecutive one. "We're expecting it to continue to get worse into 2025," CEO Ted Christie said at the antitrust trial on Wednesday. Even a cheaper price tag for Spirit could weigh on JetBlue's finances, however. JetBlue's current market value is a mere $1.3 billion. It already has more than $3 billion of net debt. The company is set to spend about $1.2 billion on capital expenditures this year, mostly in connection with aircraft purchases, and Chief Financial Officer Ursula Hurley said the outlay would increase next year alongside a step-up in jet deliveries. The company has previously indicated it would rejigger the layout of Spirit's aircraft to give customers more leg room and improve the target airline's service offerings to be more in line with JetBlue's. That will be a "multiyear" capital spending investment, Hurley said in April 2022.  JetBlue's near-term debt payment obligations are manageable; the company has a healthy balance of assets that it has yet to borrow against, and a $600 million revolving credit facility remains untapped and was extended by a year, Hurley said on Tuesday's earnings call. Other airlines are also dealing with elevated leverage. Still, it's usually not a great sign if a company includes a slide in its earnings deck titled "Focused on Managing Liquidity and Earnings Risk." Interest rates are significantly higher than when JetBlue committed to financing a big portion of the Spirit deal with debt. Its plan was to pay down the borrowings for the deal with the expected $600 million to $700 million in cost savings and revenue benefits, but the more challenging operating environment for both airlines calls those figures into question. JetBlue management isn't showing any signs of buyer's remorse: "We look forward to presenting our case to court over the next few weeks as we strongly believe our combination with Spirit is the best opportunity to disrupt the industry by increasing competition and choice," CEO Hayes said on the earnings call this week. But investors seem to be. "While the Inflation Reduction Act has created significant tax incentives that are expected to have a materially positive impact on the solar industry and our business, the delay on clear defining the specifics of the law — for example, domestic content — has created a significant delay to certain customers' ability to access tax equity. While this delay has impacted our ability to achieve our projected revenue, I'd like to make clear that these projects haven't been canceled, but rather delayed." — Jose Mas, CEO of MasTec Inc. Mas, whose family is the largest shareholder of MasTec, made the comments on the company's earnings call after the infrastructure construction contractor reported weaker-than-expected third-quarter results and cut its full-year profit guidance by more than half. "Over the course of 2023, clean energy projects have been delayed due to various factors, including interconnect agreement lead times, supply chain issues, permitting delays and tax equity funding uncertainty," MasTec said in its earnings statement. Li-Cycle Holdings Corp., for example, recently announced it was pausing construction of a battery-recycling plant in Rochester, New York, because of rising costs; MasTec was providing construction management services for that project. Sales in the company's communications and power delivery divisions are also coming in weaker than expected as customers defer previously planned activity because of higher financing costs and budget limitations. The profit warning adds to evidence that economic realities are eroding the megaproject enthusiasm that buoyed the industrial sector in the post-pandemic era. Ford Motor Co. and General Motors Co. are also scaling back ambitious ramp-ups of electric vehicle production and rethinking the timing of some planned factory investments. The energy transition is still an important priority for many governments around the world, and to Mas' point, the trend isn't going away. But higher interest rates and cost inflation have made many projects significantly more expensive, and typical government bureaucracy is slowing down the flow of stimulus funds. The timelines for these investments have a high degree of variability, and someone has to pay for them. The certainty around larger capital investments "is not very good. And you've got some people that are — they're still talking about them, but they start to move that time horizon," Eric Ashleman, CEO of Idex Corp., said on the company's earnings call last week. "We're getting closer to 2024 like a magnet. And so it becomes a reference point and a point in the calendar where people are pointing to where things might come to fruition." Ametek Inc. agreed to buy Paragon Medical, a provider of surgical instruments, implantable components and drug delivery devices, for $1.9 billion. Paragon has annual sales of about $500 million and is owned by private equity firm American Securities. Ametek is a serial acquirer, but this is its largest deal yet. Paragon fits right in Ametek's wheelhouse of highly engineered products while doubling its sales exposure to the medical industry, RBC analyst Deane Dray wrote in a note. The purchase price works out to about 15 times Paragon's earnings before interest, taxes, depreciation and amortization in the past year, a fairly reasonable multiple for a medical technology company. Ametek separately announced the purchase of Amplifier Research Corp., a manufacturer of radio frequency and electromagnetic compatibility testing equipment with annual sales of $60 million. Terms of that deal weren't disclosed. After the Paragon takeover, Ametek's debt will amount to only 1.5 times its Ebitda, leaving the company plenty of financial firepower to continue pursuing acquisitions.

Hubbell Inc. agreed to buy Northern Star Holdings Inc., a provider of electrical equipment including substation control and relay panels, for $1.1 billion in cash. Northern Star is commercially known as Systems Control and is owned by private equity firm Comvest Partners. The business is expected to generate $400 million of revenue in 2024. "Substation automation is critical to upgrading aged infrastructure and enabling the integration of renewables and electrification on the grid," Greg Gumbs, president of Hubbell's utility solutions division, said in a statement announcing the transaction. Idex Corp. agreed to acquire STC Material Solutions, a material science company that specializes in making technical ceramics and hermetic sealing products, for $206 million. STC is expected to generate $50 million of sales in 2024 with margins comparable to Idex's own high levels of profitability. Its customers include manufacturers of semiconductors, aerospace and defense products, industrial technology and medical devices and energy companies. Idex is another serial acquirer that prioritizes highly engineered products with robust pricing power in niche markets. Dray of RBC says it's encouraging to see the company pushing ahead on its dealmaking strategy even as it switches CFOs. Abhi Khandelwal, a former Idex executive and most recently the CFO of packaging company Multi-Color Corp., is taking over the role at Idex on Nov. 20. He fills the vacancy created when former Idex CFO William Grogan departed in September to take the same job at water-technologies company Xylem Inc.

MRC Global Inc., a distributor of pipes, valves and fittings, is taking activist investor Engine Capital's advice and exploring a sale, Bloomberg News reported, citing people familiar with the matter. MRC has drawn interest from private equity firms, the people said. |

No comments:

Post a Comment