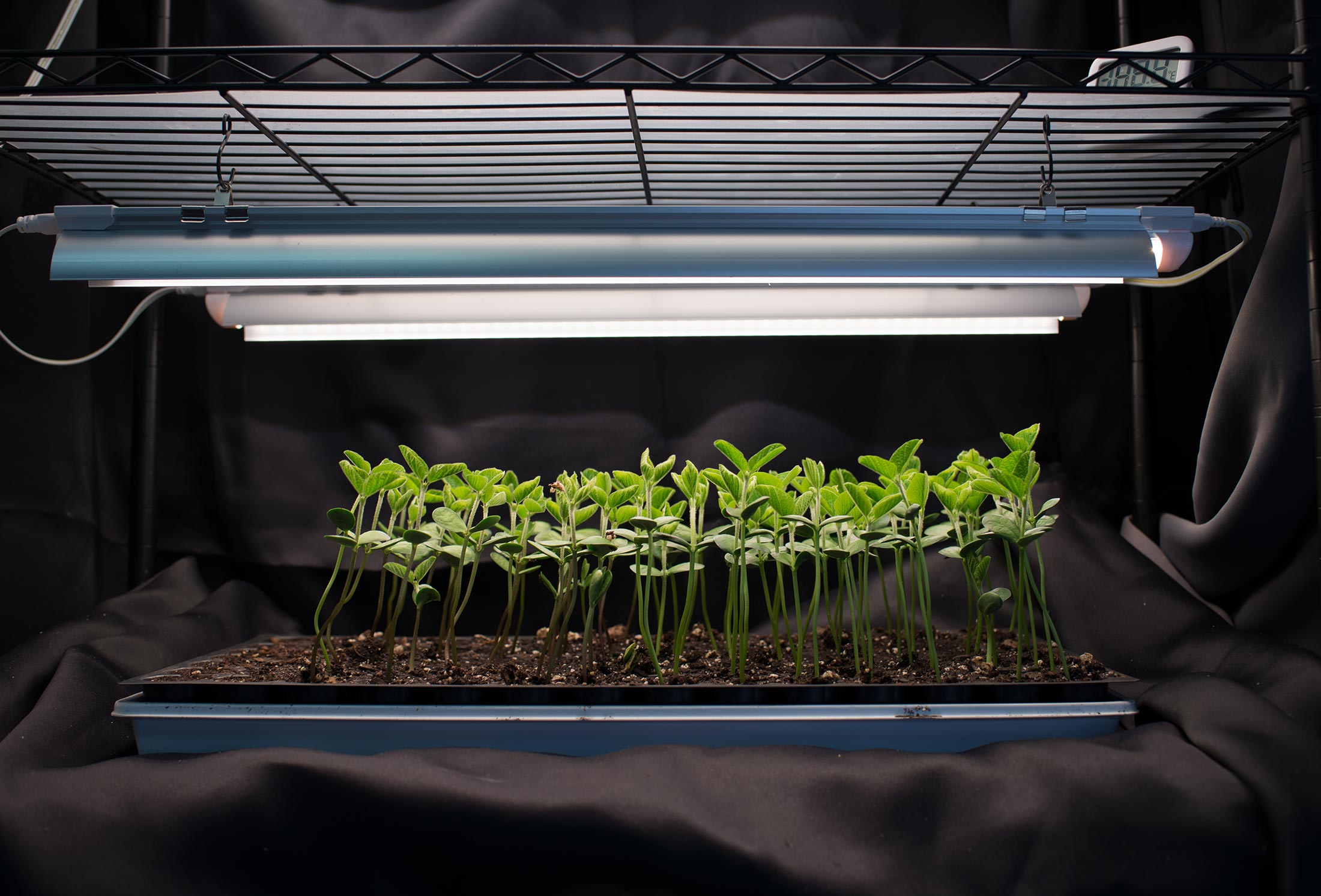

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. The historic transition from the century-long era of the internal combustion engine to the electric-vehicle age is creating flashpoints in surprising corners of the world economy. And it's only just beginning. In Canada's resource-rich "Ring of Fire," green goals are colliding as permits to dig up EV minerals are slowed by concerns over environmental degradation. In Thailand — dubbed Asia's Detroit — Japanese automakers are losing ground to Chinese companies. In Mexico, Western automakers are expanding fast to sell EVs across the northern border, but Chinese firms are ramping up sales to local consumers in the meantime.  The EV revolution is creating geopolitical, environmental and societal tensions across the globe. Photographers: Waldo Swiegers/Bloomberg; Luke Duggleby/Bloomberg; Akos Stiller/Bloomberg; Jeoffrey Guillemard/Bloomberg China is the standout leader in the EV race with a more than 80% share of the world's lithium-ion battery capacity and huge leads in most other critical components. President Joe Biden wants to change that, with the US's Inflation Reduction Act spending billions of dollars to lure producers to America and its closest trading partners. Playing catchup is the European Union, with its investigation into Beijing's EV subsidies as surging sales of Made-in-China cars put millions of jobs at risk. Caught in the crossfire are smaller economies — some winning out as Chinese investment floods in, others benefitting from the IRA's friend-sourcing rules and an equal measure losing ground as their car industries built for a bygone era face obsolescence. The stakes are enormous: BloombergNEF forecasts the cumulative value of all forms of EV sales will hit $8.8 trillion by 2030 and $57 trillion by 2050 in its base case scenario. That jumps to over $88 trillion by the middle of the century if the world ditches its gas-guzzling vehicles even more quickly. "The automotive sector is a major source of manufacturing jobs, R&D investment, and innovation, but not everyone is going to make this transition smoothly," said Colin McKerracher, head of transport and automotive analysis at BNEF. "It's all up for grabs, and nobody wants to be left behind." Click here to read more on five examples of how the EV revolution is creating geopolitical, environmental and societal tensions across the globe, drawing on BNEF's micro analysis of the industry and Bloomberg Economics's macro view on what comes next. Elon Musk's sprawling business empire has granted the billionaire a degree of power and global influence that transcends the industries he's reshaped. Find out how his companies and his decisions impact all of us on Bloomberg Businessweek's podcast Elon, Inc. Subscribe and listen on Apple, Spotify, iHeart or wherever you get your podcasts.  Next-generation ZeaKal PhotoSeed bean seedlings. Photographer: Neeta Satam/Bloomberg To reduce the carbon emissions from passenger jets and long-haul trucks, a vast volume of soy-based renewable fuel will be needed. To produce it, American farmers could rip up existing cornfields to clear space, plant millions of additional acres of soybeans and halt all soybean exports. Or, someone could make a better bean. Researchers at startups and biotech giants alike are exploring ways to formulate a new kind of legume through selective breeding or genetic modification that generates more oil per bushel. |

No comments:

Post a Comment