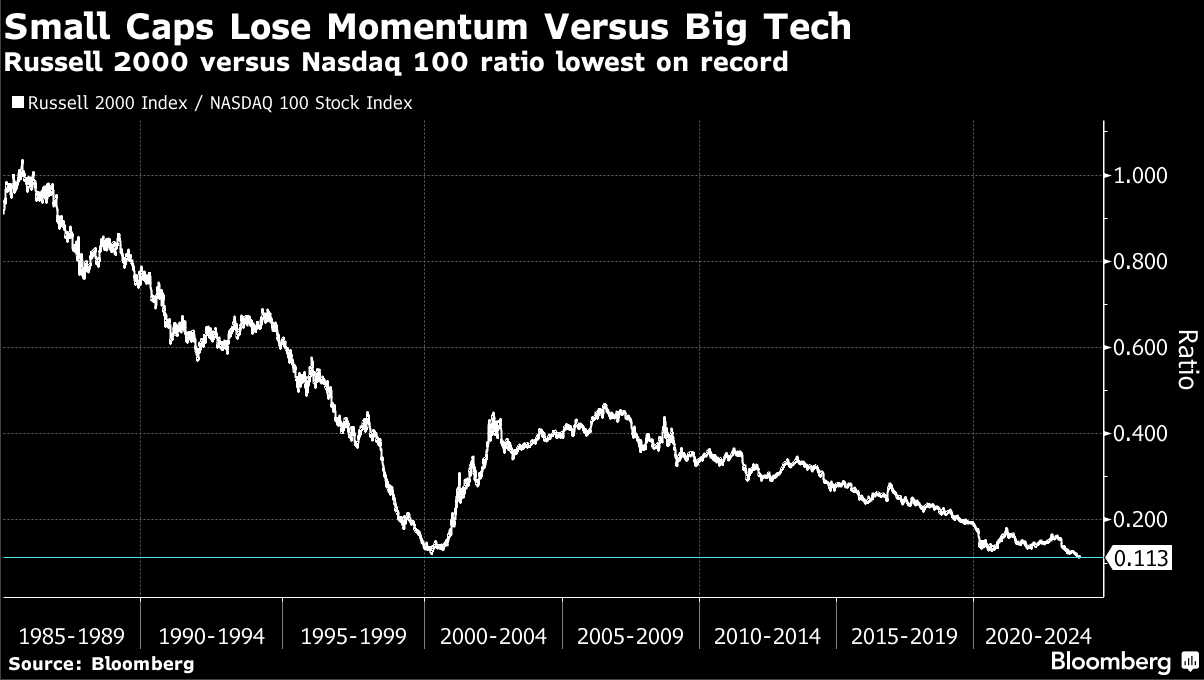

| Good morning. Portugal's prime minister resigns amid a corruption probe, China's Vice President Han Zheng notes 'positive signals' in US ties, and 2023 on track to be the hottest year on record. Here's what people are talking about. Portugal's Antonio Costa unexpectedly ended his eight years as prime minister amid an investigation into possible government corruption involving lithium and hydrogen projects. The resignation on Tuesday came as police raided locations including offices used by the premier's chief of staff as well as the environment ministry and the infrastructure ministry. Costa, who has been prime minister since 2015, said he has a "clear conscience" and is "fully available" to cooperate with the investigation. Recent high-level meetings have helped improve the China-US relationship, a top Beijing official said before an expected meeting between Xi Jinping and Joe Biden next week. The sitdowns "have sent out positive signals and raised the expectations of the international community on the improvement of China-US relations," Vice President Han Zheng said Wednesday at the Bloomberg New Economy Forum in Singapore. The comments come after the nations traded visits by a host of top officials in recent months. The countries also held rare talks on nuclear arms control. The bond market is betting on a "dovish pivot" for the seventh time since the Federal Reserve and other central banks embarked on a tightening cycle, raising the prospect of another false dawn, according to Deutsche Bank macro strategist Henry Allen. US Treasury yields turned sharply lower and bonds rallied in the wake of last week's Fed policy meeting, at which US central bank Chair Jerome Powell hinted that the current rate-hike cycle may be near an end. The buoyant mood gained further momentum from signs of a softening US jobs market. This October was the warmest on record and 2023 is "virtually certain" to be the hottest year ever recorded, climate scientists said on Wednesday. The average global temperature for October was 0.4C above the previous record for the month, set in 2019, 0.85C warmer than the 1991 to 2020 average and 1.7C warmer than an estimate of pre-industrial levels between 1850 and 1900, analysis by the European Union-funded Copernicus Climate Change Service showed. This year is so far 1.43C warmer than the pre-industrial average. The EU is expected to release its assessment of Ukraine's reforms needed to start accessions talks. ECB governing council members Martins Kazaks and Pierre Wunsch speak. BOE Governor Andrew Bailey will also make an address in Ireland. Economic data set for release include inflation data for Germany and retail sales figures for Italy. Telefonica, Airbus, Credit Argicole and Commerzbank are among the companies set to release earnings. This is what's caught our eye over the past 24 hours Big tech is in the driver's seat as stocks gain on optimism rates have peaked this cycle. Small caps aren't seeing the benefit as the Nasdaq 100 outperforms the Russell 2000 by the most in decades. Small caps' underperformance suggests some underlying jitters about an economic downturn, inflation and the impact of continued Fed hikes. These companies have more limited revenue streams than mega caps and are less able to pass through higher costs. They're also more sensitive to slowing growth and changes in borrowing costs.  Bloomberg The Russell 2000 rallied last week, but it's nowhere near enough to build up lost momentum. The gauge has gone more than 500 days without hitting a fresh high. Its ratio versus the Nasdaq 100 is also the lowest on record in data going back over 35 years, eclipsing even the dot-com bust. Only a few companies are responsible for much of this year's stock gains. But tech continues to be in favor. BlackRock's model portfolio favors megacaps because of strong balance sheets. Big tech also has less need to borrow in a market rattled by Fed hikes. Heather Burke is an editor in the Markets Live team for Bloomberg News, based in London. |

No comments:

Post a Comment