It took over six weeks, but it looks like a strike that threatened to upend the American auto industry is coming to an end. General Motors (

GM) has become the last of the Big Three Detroit automakers to

ink a tentative deal with the United Auto Workers union, which had

threatened to expand its strike to GM's key engine plant in Tennessee (the automaker's largest facility in North America). In total, the series of walkouts that began on Sept. 15 ended up involving nearly 50,000 workers, with the labor action costing GM, Ford (

F) and Stellantis (

STLA), as well as their suppliers, billions of dollars.

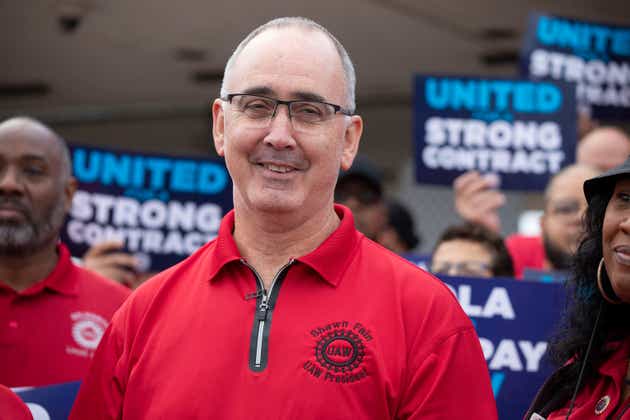

Quote: "We wholeheartedly believe our strike squeezed every last dime out of General Motors," UAW President Shawn Fain declared. "They underestimated us. They underestimated you. We have shown the companies, the American public and the whole world that the working class is not done fighting. In fact, we're just getting started."

Union members will get hefty double-digit pay raises that are said to cost GM nearly $7B over the next 4.5 years. Higher labor costs will also hit the bottom line of Ford, which last week

suspended its guidance and said the new deal with the UAW would add $850 to $900 to the cost of each car. Other terms in the contracts include restricting the use of lower-paid temporary workers, as well as having influence over what plants stay open as the automakers shift to electric vehicles.

"GM has moved firmly into a medium-term downtrend, with buyers giving up the critical $30 support zone decisively,"

wrote SA Investing Group Leader

JR Research. "Investors are right to question whether General Motors's 2030 business plan is still on track, notwithstanding management's optimism."

Outlook: The new UAW contracts will significantly raise costs for the automakers, which will attempt to pass some of those along to consumers, seek out production efficiencies, or change their focus to the most profitable models. EV leader Tesla (

TSLA) and non-union foreign brands like Toyota (

TM) could also now be in the crosshairs of the UAW, and it may drive other industries to secure better compensation and working conditions. Pharmacy staff from CVS (

CVS) and Walgreens (

WBA) just went on strike in what has been

dubbed as "Pharmageddon." "This is more than an auto industry story," according to the Anderson Economic Group. "It is a signal to the entire country that unionized workers can demand and get big wage increases." (

34 comments)

No comments:

Post a Comment