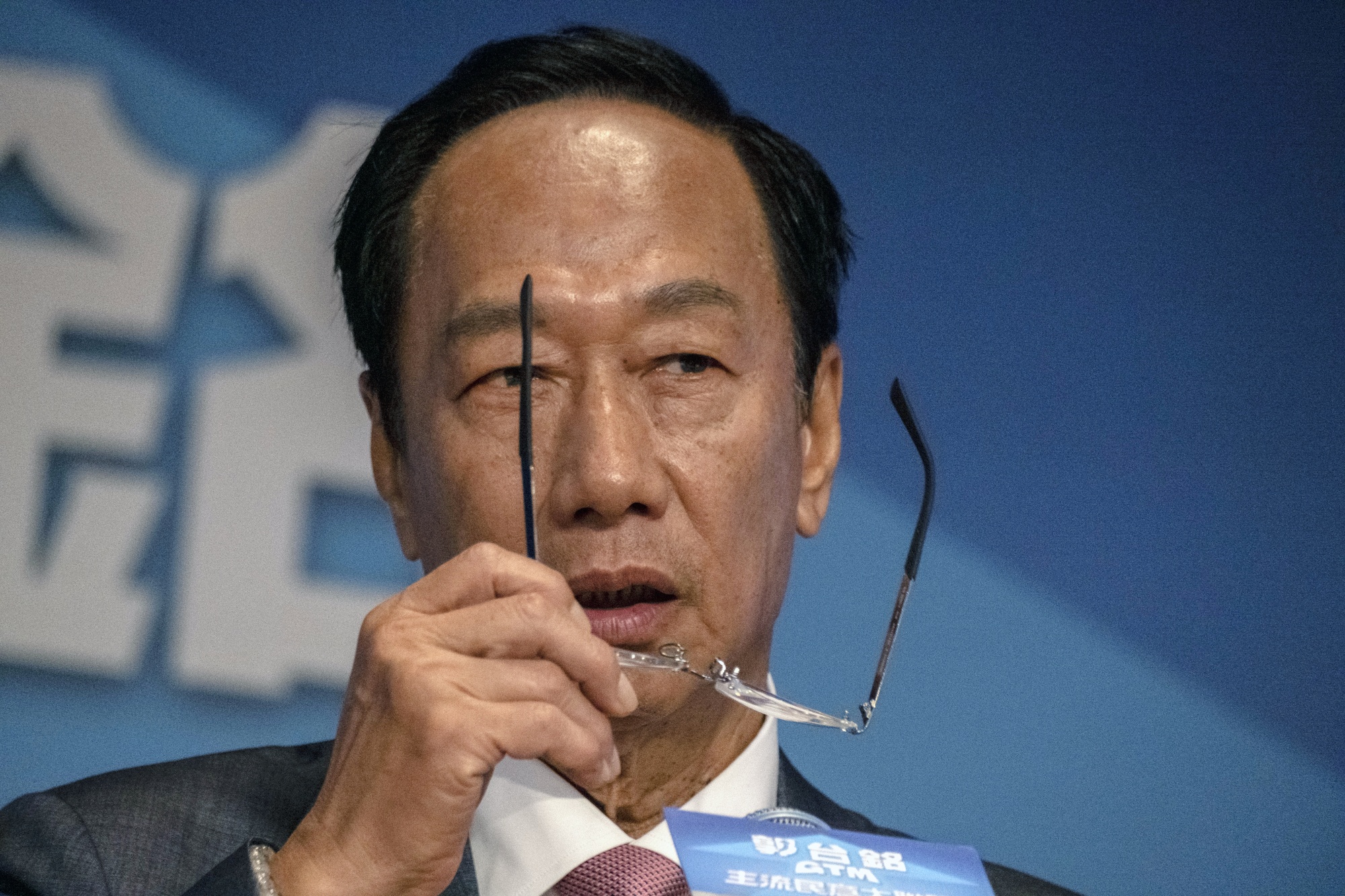

| Hello, this is Alan Wong in Hong Kong. Former Chinese Premier Li Keqiang, 68, died in the early hours of Friday, after suffering a heart attack. His death, coming just months after he handed off the post to President Xi Jinping's ally Li Qiang, was a shock to many in China.  Li Keqiang Photographer: Qilai Shen/Bloomberg The death of the former No. 2 – who earned a reputation as a man of the people and economic liberal – has sparked conversation about his relationship with the current No. 1. While the Chinese leadership has always been keen to project unity, the differences between Li and Xi was a frequent topic of discussion. That contrast came to the fore during the pandemic, when officials had to figure out how to balance Xi's absolutist approach to fighting Covid and Li's urgent calls to boost growth. In the coming hours and days, the world will surely continue to look back at Li's role in steering the world's second-largest economy, even as Xi diminished the role of premier. A good starting point would be an opinion piece Li himself wrote for Bloomberg Businessweek back in 2017, about his efforts to take "a lighter, more balanced touch" to the economy. Trying to gauge how welcome Apple should feel in China right now is hard. On one hand, there are many of reasons why the world's most-valuable company should feel welcome. Chinese consumers buy a great number of iPhones, iPads and various other Apple products each year. The firm's China region, which includes Hong Kong and Taiwan, generated $15.7 billion of revenue in the quarter ended July 1.  Customers queue at an Apple store during the first day of sale of the iPhone 15 in Beijing on Sept. 22. Photographer: Andrea Verdelli/Bloomberg Warm welcomes are also what Chief Executive Tim Cook gets when he visits. On a trip earlier this month, he spoke with Vice Premier Ding Xuexiang, Vice President Han Zheng and the ministers overseeing information technology and trade. Not every executive gets that sort of VIP treatment. Cook is not every executive. The 62-year-old runs a company that directly and indirectly accounts for more upwards of a million jobs in China. Put more bluntly, Apple would seem too important to China's economy for it to be anything but welcome. It was that idea that Taiwanese tycoon Terry Gou, who founded the contract-manufacturing firm that makes much of Apple's products in China, flicked at when he announced in August he was running to be the self-governing island's next president. Asked if China, which claims Taiwan as its territory, could exert pressure on him through Foxconn's factories, Gou said no. Disrupting Foxconn's plants would disrupt global supply chains for companies such as Apple, and Beijing wouldn't want to do that, Gou argued. Read: Taiwan's Gou Says Apple Is a Reason China Won't Pressure Him He may have spoken too soon. The Global Times, a Chinese newspaper that often has a nationalistic bent, was first to report Foxconn was being investigated by tax authorities. The group's main listed entity, Hon Hai Precision Industry, soon followed with a statement confirming it was collaborating with Chinese authorities on some unspecified probes. There hasn't been any indication that Foxconn's operations have been disrupted, but the question remains why would China launch these investigations. A few days later, Beijing sort of addressed the issue when a spokeswoman for the Taiwan Affairs Office called the probes "normal law enforcement." Still, she added that Taiwanese businesses "should also assume corresponding social responsibility and play a more active role in promoting peaceful development of cross-strait ties." Her comments seemed to both suggest the probe was not Beijing trying to send a shot across presidential candidate Gou's bow, while also not shutting the door on the possibility that it was.  Terry Gou Photographer: Lam Yik Fei/Bloomberg Even less clear is what implications this might have for Apple. On the face of it, there don't appear to be any, given the probes are of Foxconn and not of Apple. But the two companies' operations in China are so closely linked – Foxconn's best-known facility in the country is called iPhone city – that it's also hard to think that what affects one wouldn't affect the other. Compounding the complexity for Apple is the fact that China has also recently taken steps to limit the use of its gadgets by those working for government institutions. Furthermore, the new iPhone 15 has gotten off to a worse sales start in China than its predecessor and an advanced 5G smartphone launched by Huawei in August has stoked nationalistic calls to support the home-grown champion. Apple's relationship with China has been a very profitable one for both sides — that remains unchanged. The welcome, though, might get a little chillier. China announced a one trillion yuan ($137 billion) sovereign bond issuance that means the government's headline deficit-to-GDP ratio will increase to 3.8% from 3% this year, signaling a determination by Beijing to shore up economic growth and resist deflationary pressures in the next few months and into 2024. The method by which Beijing is delivering this package may be more significant than its size. The budget boost, at 0.8% of GDP, is small relative to "bazooka" stimulus worth multiple percentage points of GDP that China used during past downturns. The move to use the central government's balance sheet by issuing sovereign bonds suggests a shift away from China's previous stimulus model, which relied on local governments adding leverage to fund construction projects. It's the first time central government bond issuance has been used to finance infrastructure investment since at least 2015, according to JPMorgan Chase chief China economist Zhu Haibin. That combines with a separate 1 trillion yuan initiative launched last month allowing local governments to swap high-interest debt for lower-interest government bonds. Together, it suggests Beijing is taking a co-ordinated approach to improving local governments' balance sheets amid a housing downturn that's straining their finances. The budget revision could also signal a more flexible approach to fiscal policy. China has rarely adjusted the budget outside its annual parliamentary gathering and stuck to a headline deficit limit of 3% of GDP. Watch: Bloomberg Originals explores how China's real estate sector became such a mess and what the implications could be for the global economy. Economists will be watching if Beijing's flexibility and willingness to leverage the central government's balance sheet are a one off, or a sign of more to come. The mystery is over. Li Shangfu was officially bounced from his job as China's defense minister, making him the shortest-tenured official in that post.  Li Shangfu Photographer: ALEXANDER NEMENOV/AFP The nation's top legislative body removed the US-sanctioned general after only seven months without explanation, according to state media. While there is no suggestion that President Xi is facing any threat to his authority, the abrupt personnel moves have tainted his government's image of stability. That comes at a time when investors are dumping Chinese assets in the wake of a property-induced economic slowdown and concerns over recent detentions of employees at foreign firms. Li's departure paves the way for high-level military talks with the US to resume after a suspension of more than a year. Still, that's probably not the reason why Li, the son of a veteran Red Army soldier, got the boot. In July, the military announced a corruption probe into the hardware procurement department he once led. The US will attend the Beijing Xiangshan Forum, China's answer to Singapore's Shangri-la Dialogue, which is set to be held from Oct. 29-31. Despite signs that US-China ties are mending amid a flurry of official visits from both sides, Taiwan and the South China Sea remain potential flashpoints, with President Joe Biden warning Beijing that the US would be forced to intervene if Philippine vessels were to be attacked in disputed seas. No replacement for Li was announced — possibly due to pressure on Xi's government to vet candidates more carefully. Back in July, Xi's handpicked foreign minister Qin Gang was removed over "lifestyle issues," according to media reports, a phrase that usually means sexual misbehavior of some type in the parlance of Chinese officialdom. Both Li and Qin were stripped of their state councilor titles that had entitled them to a seat on the nation's cabinet. Li's membership in the government's highest national defense body was also forfeited. "Stripping Li and Qin of their state titles all but confirms they are being investigated for corruption or other violations of party discipline," said Neil Thomas, a fellow for Chinese politics at the Asia Society Policy Institute's Center for China Analysis. Each weekday, The Big Take podcast brings you one story — one big, important story from Bloomberg's global newsroom. Subscribe and listen on iHeart, Apple and Spotify. What We're Reading |

No comments:

Post a Comment