| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it's headed. Sign up here to have it delivered to your email. South Africa's finance minister, Enoch Godongwana, is in a bind. He won't be able to please his boss, his political party or a shrinking pool of investors when he presents the mid-term budget next week: There's simply no easy fix for the fiscal crunch facing the continent's most industrialized economy. President Cyril Ramaphosa poured cold water on proposed spending cuts amid waning revenue, while the ruling African National Congress has warned him not to compromise its priorities. And even if he does find some way to narrow a revenue shortfall, the fiscal deficit and debt are bound to grow.  Godongwana outside parliament in Cape Town in February 2022. Photographer: Dwayne Senior/Bloomberg Government departments have been advocating for more spending, putting it at loggerheads with the Treasury, which argues the money it's handed out in the past hasn't translated into economic growth. That tough trade-offs will have to be made is clear. The commodity boom of the past few years has tailed off and a broken rail network means the nation can't capitalize on demand for its minerals. Together with a lack of reliable electricity, that's stifled industry and with it, tax revenue. Some economists say the forecasted miss for the current year — to be announced on Nov. 1 — may be as much as 80 billion rand ($4.2 billion), with the budget shortfall likely climbing back up above 5% of gross domestic product. The head of the Treasury's budget office, Edgar Sishi, recently commented that things have never been this bad. Godongwana must decide whether to cut back on money for services or infrastructure, anger labor unions by reneging on a wage agreement with public servants, abandon a temporary jobless grant that some say is keeping social unrest at bay or hike value-added tax — which would irk everyone. The well-trodden route of adding more taxes targeting the middle and upper classes may add to a brain drain and foster new ways to hide income. All this against the backdrop of a looming election, with the ANC facing the very real risk of losing its majority for the first time since coming to power in 1994. The minister appears to be stuck between vote-sapping austerity and a debt spiral. — S'thembile Cele Key stories and opinion:

South Africa's Treasury Pressured to Water Down Spending Cuts

South Africa Central Bank Warns Fiscal Policy Hindering Economy

South Africa's Finances Are in a Parlous State, Minister Warns

South Africa's Ruling ANC Sees Support Slip to 45% in Survey

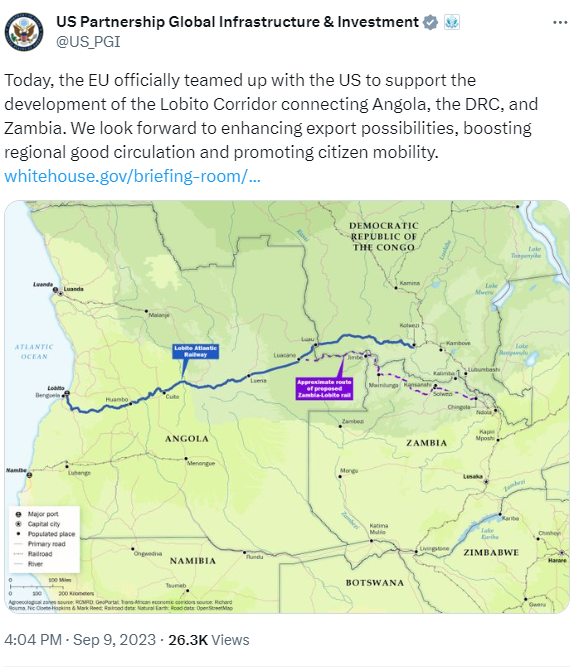

Cape Town Is Making the ANC Look Worse and Worse: Alex Parker Iran is quietly rebuilding ties with Sudan, stoking concern the Islamic Republic will widen its military influence on the fringes of the Middle East and deepen a disastrous civil war. With cease-fire talks resuming this week, Tehran's recent rapprochement with the Sudanese army throws a potential wildcard into the conflict. The battle for control of Sudan, a resource-rich nation situated on the Red Sea near a choke-point for global shipping, has already killed more than 9,000 people and forced 5.6 million from their homes.  Smoke rises during fighting in Khartoum in June. Photographer: Getty Images Nigeria's Supreme Court rejected petitions by two opposition leaders to have President Bola Tinubu's election declared illegal, bringing an end to an eight-month legal battle to overturn the results of the nation's closest vote since the return to democracy in 1999. The ruling came after Atiku Abubakar of the Peoples Democratic Party and Peter Obi of the Labour Party appealed an election tribunal decision to reject their cases. The threshold for overturning a presidential election in Nigeria makes it almost impossible for an announced victor to be removed. Ethiopia won't use force to attain direct access to a Red Sea port, Prime Minister Abiy Ahmed said, toning down earlier remarks directed at the landlocked Horn of Africa nation's neighbors. In a televised lecture this month, Abiy identified access to the ocean as a strategic objective and warned that failure to secure it could lead to conflict. That drew rebukes from Eritrea, Somalia and Djibouti. "We don't have a plan to achieve our objectives through force and I want to assure you that we won't pull a trigger on our brothers," Abiy said in speech in Addis Ababa.  A guard participates in a ceremony held in support of the Ethiopian military in Addis Ababa in November 2021. Photographer: Getty Images Zambia's government reached an in-principle restructuring agreement with a group representing investors holding $3 billion of its eurobonds, three years after first defaulting on the debt. The deal comes less than two weeks after the southern African nation agreed to a pact with official creditors on $6.3 billion of liabilities. That accord paved the way for the disbursement of another portion of an International Monetary Fund bailout and brings the copper producer closer to resolving its debt crisis. The European Union and the US signed an agreement to develop a corridor to connect resource-rich Democratic Republic of Congo and Zambia with the Atlantic Ocean through Angola as the allies compete with China to access critical minerals. The EU and the US said last month that a first step would include feasibility studies for the new railway expansion to Lobito port. The pact was concluded at a summit in Brussels to roll out the Global Gateway, the EU's €300 billion infrastructure plan aimed at competing with the Chinese Belt and Road Initiative.  A mining company in Congo backed by commodity trader Trafigura has put itself up for sale after a slump in the cobalt price left it struggling to finish key projects. The attempted sale of Chemaf Resources comes after its ambitious expansion drive ran into financial trouble, leaving it in need of fresh investment. Meanwhile, a long-running dispute over one of the world's largest hard-rock lithium deposits in Congo took a new turn with China's Zijin Mining Group announcing a venture to develop part of the site. Next Africa Quiz — Which African country is vying to win a record fourth Rugby World Cup title this weekend? Send your answer to gbell16@bloomberg.net. Data Watch - Senegal is borrowing almost $1 billion more in 2023 to help it service debt in the first four months of next year, to avoid potentially higher rates in 2024 — an election year.

- Namibia's central bank left its key interest rate at 7.75%, even though it expects inflation for the year to be higher than previously thought. Botswana kept its benchmark rate at 2.65% for a seventh straight meeting, in new governor Cornelius Dekop's first week in the job.

- Angola's central bank is stepping up restrictions on foreign-exchange trading to stop the kwanza from weakening further. The currency is down nearly 40% against the dollar this year.

Zimbabwe gave up the unenviable position of having the world's highest interest rate to Argentina, after slashing borrowing costs to help boost economic growth. Policymakers cut the rate to 130% after inflation slowed following another change in how the Zimbabwean statistics agency calculates price growth. Inflation measured 17.8% in October. Coming Up - Oct. 30 South African money supply & monthly budget data for September

- Oct. 31 Kenya and Uganda inflation for October, South Africa's trade balance and Namibian money supply data for September, the UK's King Charles III on state visit to Kenya

- Nov. 1 South African mid-term budget, manufacturing PMI & new vehicle sales for October, Angola reserves

- Nov. 2 South Africa hosts a two-day summit on the US's Africa Growth & Opportunities Act

- Nov. 3 PMI reports for Mozambique, Uganda, South Africa, Kenya, Zambia and Ghana

"The new rail line, connecting northwest Zambia to the Lobito Atlantic Railway and the port of Lobito, represents the most significant transport infrastructure that the United States has helped develop on the African continent in a generation," the US State Department said in a statement on the Lobito rail corridor.  The Lobito port, Angola. Photographer: Wolfgang Kaehler/LightRocket/Getty Images Nigeria's first lithium-processing plant launched to great fanfare this month with the backing of three companies that, at first glance, look a lot like heavyweights of China's battery-metals industry. Yet the firms behind the planned $250 million investment — Ganfeng Lithium Industry, Tianqi Lithium Industrial and Ningde Era Industrial — have nothing to do with three nearly identically-named behemoths listed on the Shenzhen and Hong Kong stock exchanges. Instead, the West African country's corporate register shows they are local ventures controlled by Chinese nationals and founded last year at an address in a medium-sized southwestern Nigerian town. "We are independent companies," Kelvin Dai, managing director of the Nigerian Ganfeng, said. "Please don't make any confusion," he added, without answering questions on how and why the firm and its shareholders selected such recognizable names.  A lithium ore stockpile. Photographer: Carla Gottgens/Bloomberg Thanks for reading. We'll be back in your inbox with the next edition on Tuesday. Send any feedback to gbell16@bloomberg.net. |

No comments:

Post a Comment