| Yen tumbles. US workers win record wage hikes. Consumer confidence falls. Here's what you need to know today. Bank of Japan Governor Kazuo Ueda received a reminder of the pitfalls he faces in trying to tiptoe toward policy normalization without disrupting markets. The yen unexpectedly tumbled after the central bank loosened its grip on bond yields, as the move appeared to fall short of investors' hopes for a clearer sign of progress toward policy tightening. Still, even if Tuesday's step was a bit of a stumble, it brought Japan closer to a more conventional policy approach after decades of experimentation with quantitative easing, negative interest rates and yield curve control. Workers in the US are getting record-breaking wage hikes this year thanks to strategic strikes and stunning contract wins. The result is a boost in middle-income wages and a shift in the balance of power between companies and their employees. Even before the United Auto Workers reached historic contract deals with carmakers, unions across the country had already won their members 6.6% raises on average in 2023 — the biggest bump in more than three decades, according to an analysis by Bloomberg Law. US consumer confidence dropped to a five-month low in October, weighed down by dimmer views of business conditions and concerns about high prices. The Conference Board's index fell to 102.6 from an upwardly revised 104.3 in September. A measure of expectations — which reflects consumers' six-month outlook — eased to a five-month low. A gauge of expected inflation picked up. Zillow Group Inc. and other real estate stocks plunged after a Missouri jury found the National Association of Realtors and other industry players guilty of colluding to maintain high brokerage commissions. In a worst-case scenario for the industry, the federal government could seek to ban sharing commissions, prohibiting sellers' agents from compensating buyers' agents. The surprising resilience of American consumers is about to be tested over the coming months as rising delinquencies, growing debt payments and dwindling cash piles put pressure on households. Whether consumers pull back or power through is the biggest question facing Federal Reserve officials at their meeting this week. The central bank is expected to hold the target for its benchmark interest rate in a range of 5.25% to 5.5% Wednesday. Wall Street bond dealers expect the US Treasury to unveil another round of increases to its note and bond auctions at the quarterly refunding earlier that day. Catch up with what's moving China's markets -- in Chinese -- with Bloomberg's new, free daily newsletter and podcast. Sign up for 彭博财经早茶 here. Here's what caught our eye over the past 24 hours. And finally, here's what Garfield is interested in this morning.

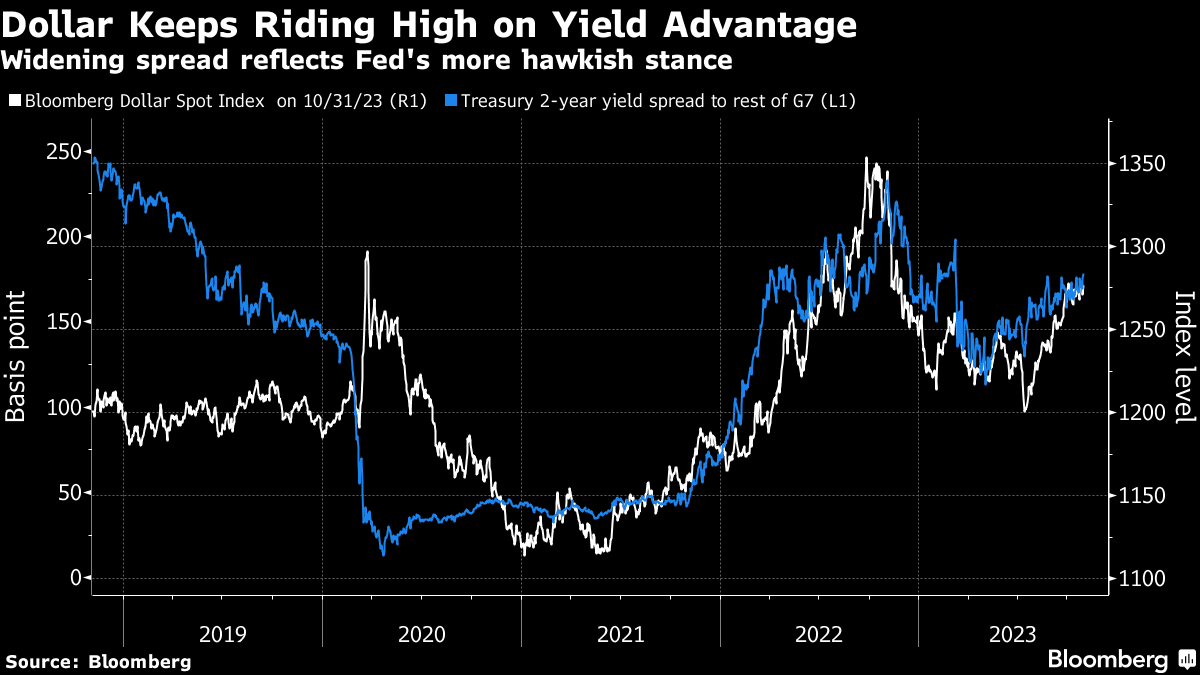

The US dollar's climbing fresh heights, and that's only partly due to its surge against Japan's currency after the central bank on Tuesday disappointed yen bulls and Tokyo bond bears. The Federal Reserve remains the outstanding hawk in the field. It has the highest cash rate across developed economies outside New Zealand, it has sounded more determined than most to keep borrowing costs elevated, and it's busy trimming its balance sheet.  That's widened the gap between US two-year yields and the average for the rest of the Group of Seven major nations to 178 basis points — a surge of 65 basis points since it touched a nadir in May. The dollar has tracked very closely with that spread during the current tightening cycle, and there's little reason to expect that dynamic to fade any time soon. Even if the Fed doesn't raise its cash rate target again it has signaled a determination to keep it elevated for a lengthy spell. The US economy is showing more resilience than its peers, and economists forecast it will outpace them over 2023 and 2024. |

No comments:

Post a Comment