| Amazon beats. GDP is faster than expected. ECB holds rates. Here's what you need to know today. Amazon.com Inc. reported revenue and profit that topped analysts' estimates, buoyed by rising sales in its retail unit and cost cutting. Sales for Amazon Web Services were slightly less than expected. Ford Motor Co.'s third-quarter results fell short of expectations. The automaker withdrew its full-year outlook. Stocks tumbled in regular trading Thursday even though long-term Treasury yields fell. The tech-heavy Nasdaq 100 has now fallen more than 10% since its July peak. The US economy grew at the fastest pace in nearly two years last quarter on a burst of consumer spending, which will be tested in coming months. Gross domestic product accelerated to a 4.9% annualized rate, more than double the second-quarter pace, according to the government's preliminary estimate Thursday. The economy's main growth engine — personal spending — jumped 4%, also the most since 2021. European Central Bank President Christine Lagarde just visited the scene of one of the bleakest moments in the euro's history, and managed to avoid creating another one for now. Speaking in Athens after one of the ECB's occasional gatherings away from its Frankfurt home, she unveiled the first pause in interest-rate hikes since June 2022, and insisted any faster wind-down in bond holdings — a prospect that could heap pressure on highly indebted Italy — wasn't even discussed. The outcome offers respite to Prime Minister Giorgia Meloni at a time when investors are wondering if the country could soon be cut to junk. Embattled debt investors like the look of 5% Treasury yields as they weigh the risk-versus-reward scales for the world's biggest bond market. The rise in yields to levels last seen before the financial crisis reflects a run of solid data, with the US economy growing last quarter at the fastest pace since 2021. And a rising tide of Treasury debt issuance, meanwhile, has prompted the return of a positive risk premium for owning longer-dated bonds. For all the pain in the bond market — and some traders are betting there's more to come — the notes look a lot more attractive to long-term buyers once Treasury yields are running at 5% or higher. Israel's military said it killed Hamas's deputy head of intelligence, who it said was responsible for helping plan the Oct. 7 attacks that killed 1,400 people. The army overnight also made a limited ground raid into northern Gaza with infantry and tanks. A small number of humanitarian aid trucks reached Gaza Thursday, but there have been no indications of fuel being supplied. The United Nations, which has said the fuel shortages risk it halting relief operations, is seeking to ration existing reserves for its facilities, including bakeries and health centers. Here's what caught our eye over the past 24 hours. And finally, here's what Garfield is interested in this morning.

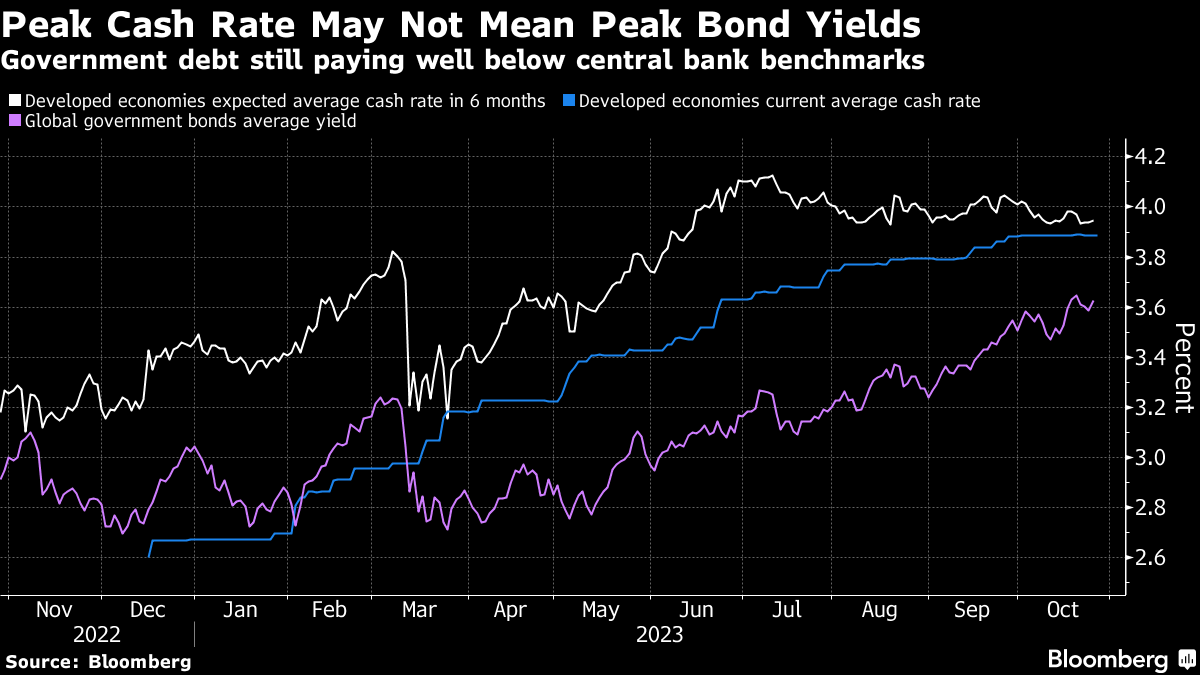

Global bonds had a much better time of it on Thursday as investors turned their focus once more to the idea that policymakers are just about done with the tightening cycle that has done the asset class so much harm. The European Central Bank held rates, and US GDP came in about where it was expected to, so the more-than 10 basis point move for 10-year Treasury yields was to the downside this time.  However, there are plenty of reasons to fret that an end to rate hikes doesn't necessarily signal the peak is in for yields, especially for longer-end bonds. For one thing, inflation rates are still elevated, and for another there's a lot more supply coming as central banks trim balance sheets and governments boost borrowings amid war, onshoring and efforts to transition to green their economies. For another, yields are still some distance below cash rates, so unless a severe economic slowdown hits we could expect those rates to keep rising for some time yet. |

No comments:

Post a Comment