| I'm Ben Holland, a senior editor in Washington. Today we're looking at the recession call at Bloomberg Economics. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X (formerly known as Twitter) via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - China's precarious economic recovery may be in need of more support.

- The BOJ will buy more bonds to curb the rise in sovereign yields.

- US pay increases are won't rise as much next year.

When everyone expects a soft landing, brace for impact. That's the lesson of recent economic history. And it's an uncomfortable one for the US right now, Anna Wong and Tom Orlik of Bloomberg Economics write here, outlining why they still expect the world's biggest economy to fall into a recession soon. A summer in which inflation trended lower, jobs remained plentiful and consumers kept spending has bolstered confidence — not least at the Federal Reserve — that the economy will avoid a slump. A last-minute deal to avoid a government closure kicks one immediate risk a little further into the future. But a major auto strike, the resumption of student-loan repayments, and a shutdown that may yet come back after the stop-gap spending deal lapses could easily shave a percentage point off GDP growth in the fourth quarter. Add those shocks to other powerful forces at work, and the combined impact could be enough to tip the US into a downturn this year. The strength of consumer spending, heralded by the soft-landing optimists, isn't historically a good indicator of whether recession is coming — and in any case, the pandemic savings that funded it are running out fast. By contrast, bank credit conditions are a good guide, and the latest Fed survey of loan officers show they're tightening fast. Oil prices and long-term borrowing costs both spiked higher in September: The former will add to strains on household budgets, and the latter could deter business investment. And the global economy could drag the US down, with China and Europe both faltering. Of course, the optimists have some solid arguments too. A drop in job vacancies could cool the labor market – a key Fed goal to tame inflation – without any rapid increase in unemployment. If artificial intelligence lives up to the hype, productivity gains might keep growth on track. And the Biden administration's industrial policy is boosting business investment, which could sustain the expansion even if consumers pull back a bit. So a soft landing remains possible. But with all the forces pushing in the other direction, the view at Bloomberg Economics is that recession is a more likely outcome. Get the Eastern Europe Edition newsletter, delivered every Tuesday, for insights from our reporters into what's shaping economics and investments from the Baltic Sea to the Balkans. - The Fed's Barkin says housing strength needs to be offset elsewhere.

- Strong Australian home prices outweigh the RBA's tightening campaign.

- Indonesia has finally opened Southeast Asia's first high-speed rail.

- Inflation is dragging down approval ratings for the Philippine president.

- The UK will pledge to raise wages for the lowest-paid amid tax cut calls, while Italy's factories are "trapped" in recession.

Policymakers from Washington to Frankfurt are entering the final quarter of 2023 with tentative grounds for optimism that their fight against inflation is making progress. With Fed chief Jerome Powell and his European Central Bank counterpart Christine Lagarde both due to speak this week, investors will scrutinize any reaction from them to a transatlantic double whammy of data that offered each of them hints of cheer. Elsewhere, several central-bank decisions are due around the world, with outcomes for rates unchanged seen likely from Australia to India. See here for the rest of the week's economic events. Is the Bank of Japan finally ready to plot out its exit strategy from ultra-easy policy?

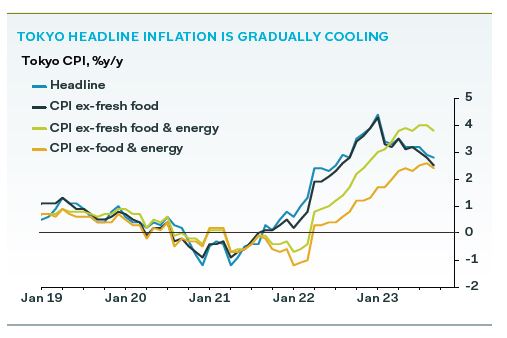

We're not quite there yet. September's Tokyo CPI print "strengthens the case" for the BOJ to keep policy rates on hold in the final quarter of the year "while gradually phasing out the yield curve control policy," according economists at Pantheon Macroeconomics. "The weak yen and higher international oil prices are likely to spur another round of import cost-push inflation, but probably smaller than last time; in any case this is unlikely to alter the BOJ's view that Japan still needs accommodative monetary policy," economists Duncan Wrigley and Kelvin Lam wrote in a Monday research note. "The Bank is looking for signs of demand-pull — rather than cost-push — inflation as evidence that its target of sustainable inflation has been achieved. The minutes of September's BOJ meeting show that many policymakers believe this goal is not even in sight yet."  Pantheon Macroeconomics

BOJ watchers expect the central bank will adjust policy in early 2024. One member of the central bank — likely among the most hawkish — said a 2% inflation target is "clearly" in sight, according to a summary of the September meeting. Read more reactions on X The sixth annual Bloomberg New Economy Forum returns to Singapore Nov. 8-10 as the world's most influential leaders gather to address the critical issues facing the global economy. This year's theme — "Embracing Instability" — focuses on opportunities to better understand underlying economic issues such as persistent inflation, geopolitical tension, the rise of artificial intelligence and the precarious state of the world's climate. Request an invitation here. |

No comments:

Post a Comment