| I'm Chris Anstey, a senior editor in Boston, and today we're looking at reporting from Olivia Raimonde and Craig Torres of the resilience in corporate credit. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X (formerly known as Twitter) via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - The Bank of Japan made a tweak to its yield curve control settings.

- China's factory activity fell back into contraction in October.

- Euro-area inflation eased to its lowest level in more than two years.

A key part of the US economy's resilience to the Federal Reserve's 1 1/2-year monetary tightening campaign has been the corporate world's continued access to credit. The key gauge of stress for corporate borrowing is the premium companies pay compared with the government. Those spreads, both for investment grade and junk-rated borrowers, has remained below their 20-year averages and well under levels seen during historical times of stress, Bloomberg reports today. Borrowing also remains robust. One measure of credit quality is even improving at a record rate. And recent earnings reports for some of the nation's most indebted companies have come in stronger than expected. For Fed policymakers, who will be deciding on interest rates Wednesday, it all raises the question once again of whether they have truly hiked their benchmark to a "sufficiently restrictive" level. At the very least it suggests that rates haven't been at current levels — the target is now a 5.25% to 5.5% range — for long enough. "If you had told me two years ago that the Fed would hike by this much in a short time, I would have said that they would leave dead bodies littered across the corporate credit landscape," said former Fed Governor Jeremy Stein. "I really don't have any good story to explain" the resilience, he said.

Since rate hikes can take a while to impact the real economy, Fed officials watch financial conditions closely as real-time gauges for how their policy is working. So far, that's really just affected Treasury yields — which are trading around the highest levels since the financial crisis — while equity and oil prices have remained largely resilient. Will the Fed have to increase rates more, or can it simply hold around current levels and give policy time to seep in to strong household and corporate balance sheets? "There's a lot of uncertainty around lags," Fed Chair Jerome Powell said at an event earlier this month. "One of the reasons why we have slowed down significantly this year is to give monetary policy time to work." Bloomberg's New Economy Forum returns to Singapore Nov. 8-10 as the world's most influential leaders gather to address critical issues facing the global economy. This year's theme, "Embracing Instability," focuses on underlying economic issues such as persistent inflation, geopolitical tensions, the rise of AI and the climate crisis. Request an invitation here. - The Bank of Japan is bringing an end to its near monopoly of control over the nation's bond market. The yen weakened as traders had priced in the chance of a bolder change to its stimulus policy.

- President Joe Biden lauded a tentative agreement between the UAW and Detroit's biggest automakers as a boost for the industry and the broader US economy.

- The US Treasury reduced its estimate for federal borrowing for the current quarter thanks to stronger-than-expected revenues.

- Inflation in UK stores fell, another sign that Britain's cost-of-living crisis is starting to ease.

- Conspicuous consumption is on the rise in India, which is one of the world's fastest growing countries for people with $100 million in wealth.

- Colombia will likely hold its interest rate steady for the fourth straight meeting

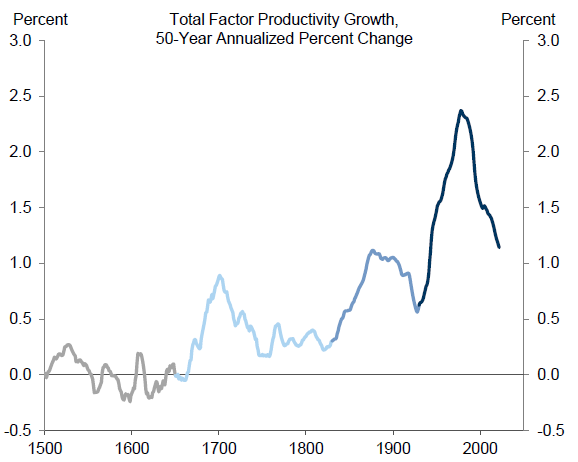

Goldman Sachs lifted its long-term growth estimates for the US and many other major economies on expectations that artificial intelligence will boost productivity over the next decade. In the US, seen as the market leader for AI adoption, it will add 0.1 percentage point to GDP gains in 2027, accelerating to a 0.4 percentage point boost in 2034. That would leave the US with a 2% expansion rate in 2027, picking up steam to 2.3% by 2034.  Source: Maddison Project Database, Haver Analytics, Goldman Sachs Global Investment Research "While considerable uncertainty remains about the timing and magnitude of AI's effects, our baseline expectation is that generative AI will affect productivity" in time, Goldman economists led by Jan Hatzius wrote in a recent note. A Treasury debate… Read more reactions on X |

No comments:

Post a Comment