| By Ben Elgin The integrity of one of the largest single sources of credits in the $2 billion carbon market faces serious doubt following the collapse of the partnership behind Kariba, a mega-project in Zimbabwe backed by the world's top seller of carbon offsets. South Pole, the company that sold most of the credits tied to the forest-protection project, said on Friday that it terminated its contract with Carbon Green Investments, which owns and develops the site. Dozens of corporate giants, including Volkswagen AG, Nestle SA, L'Oreal SA, Gucci and McKinsey, have purchased credits from Kariba representing millions of tons of greenhouse gas emissions.  A patch of regenerating woodlands in Binga, Zimbabwe. Photographer: Zinyange Auntony/AFP Business practices at the mega-project have come under repeated scrutiny, including an investigation by Bloomberg Green in March that found significant flaws in accounting behind carbon credits from Kariba. Most of the project's proceeds have gone to the two partners rather than people in the rural communities who fight deforestation, as the companies have claimed. The decision to pull out of agreements at Kariba "follows careful consideration of the project, issues involved and allegations that have been raised publicly," South Pole said in a statement. "All activities related to carbon certification and carbon credits" from Kariba, a mega-project the size of Puerto Rico, "will now be the responsibility of CGI, and South Pole's role as the carbon asset developer has ended." Over the past decade, Kariba's carbon credits have underpinned claims of breakthrough progress on cutting emissions from its corporate clients. The project has generated nearly $100 million by selling credits for more than 23 million tons of heat-trapping emissions, roughly equivalent to half the annual climate footprint of Switzerland. Corporate emissions accounting backed by Kariba's credits will be thrown into turmoil by Friday's developments. While large brands have stayed quiet on how they're treating Kariba credits up to now, at least one smaller company has written them off, according to a person familiar with the matter who asked not to be identified discussing sensitive information.

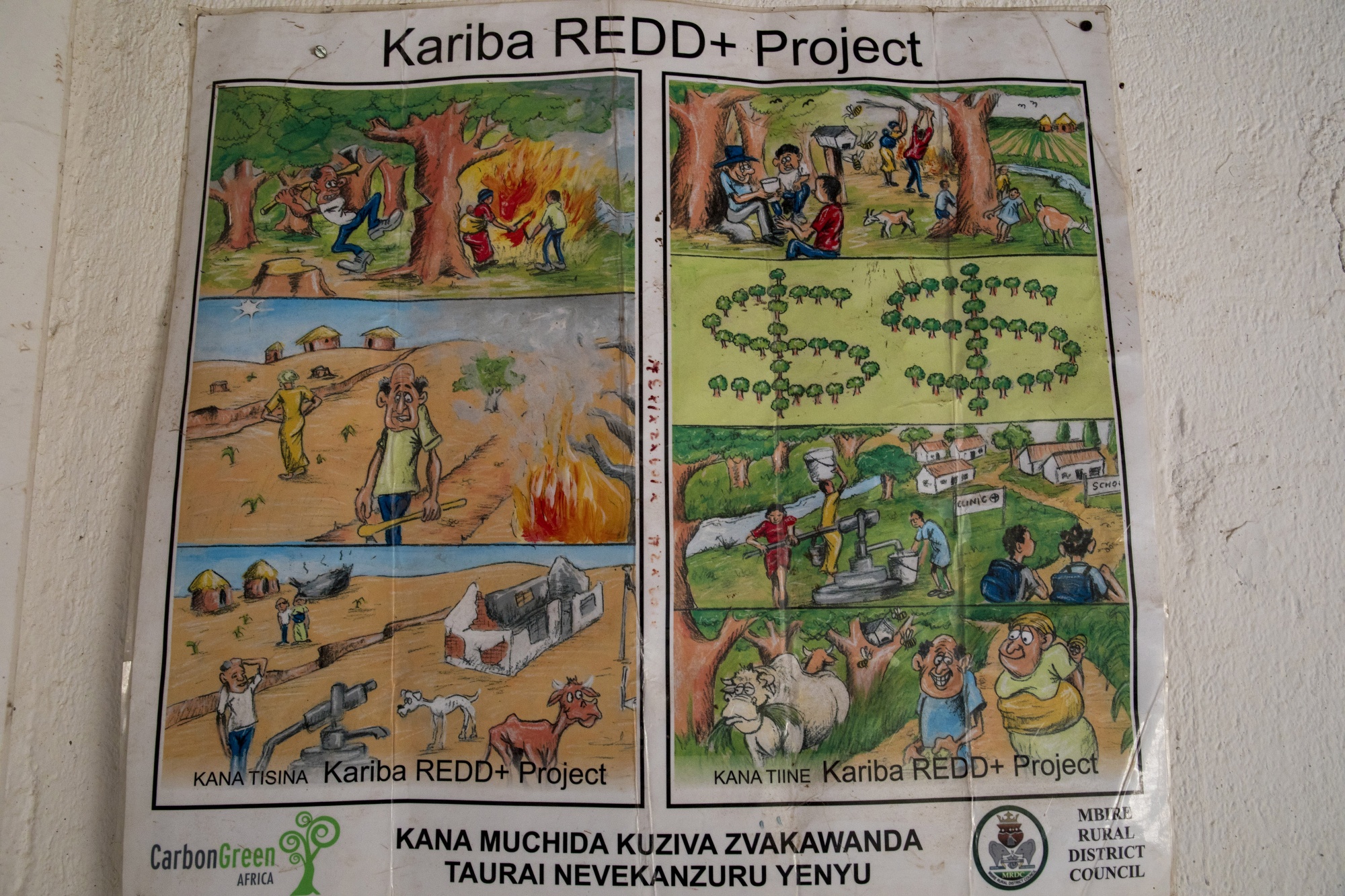

The collapse of Kariba could also pose a danger to the rest of carbon market, which has slowed this year amid quality concerns and accusations of greenwashing. The news risks undermining one of the market's underlying insurance mechanisms, known in the industry as the credit buffer pool. Such backstops are necessary because hundreds of carbon projects around the world are tied to forests or other natural landscapes that are vulnerable to wildfires and droughts. A buffer pool is supposed to guarantee climate benefits aren't eliminated by any unexpected setbacks. News reports earlier this year, including from Bloomberg Green, found the project had overestimated its climate benefits by at least a factor of five while delivering less money than indicated to communities in Zimbabwe tasked with protecting against deforestation. Earlier this month, a report in The New Yorker raised additional concerns. Steve Wentzel, operator of Carbon Green Investments, described an untraceable way of routing funds into Zimbabwe. "It was illegal," he told the magazine. (Wentzel didn't respond to recent requests for comment, before the release of South Pole's statement.)  A poster for the Kariba project in an office of the Mbire District Council in Mbire, Zimbabwe, on Thursday, May 13, 2021. Photographer: Cynthia R Matonhodze/Bloomberg Fallout from multiple investigations into the project had already put Kariba's credits into doubt, even before the breakup of the project's backers. Verra, the Washington, DC-based nonprofit that creates rules for carbon offsets and oversees the Kariba project, announced it would put the project "on hold" pending an investigation. But mounting problems on Friday raise the real possibility that the Kariba project could collapse. After all, South Pole has put the cost of continued operations at a minimum of $60,000 per month. And making up for excess credits that have already been issued could require operating the site for years — or even decades — without new sales, according to Sylvera, a London-based firm that examines the quality of carbon projects. South Pole told Bloomberg Green earlier this year that the forces driving deforestation in Zimbabwe had changed since it launched the project, leading to the issuing of credits beyond what the project's carbon savings could support. At the time, the company said it would sell credits more slowly to close the gap. But the market for Kariba credits has dwindled as scrutiny of the project increases. If Kariba shuts down, meaning the trees in the vast forest are no longer under a protective program, all the credits awarded since its inception would be canceled. This would render meaningless the already-shaky claims corporations have made based on these credits. To prevent this, Verra says it would replace these canceled credits by dipping into its buffer pool. Verra officials told Bloomberg Green earlier this year that doing this for a project the size of Kariba would be an "unprecedented situation" and could wipe out between 38% to 51% of its whole buffer pool. "This is maybe the biggest real-world test we're seeing so far on the use of buffer pools," says Gilles Dufrasne, policy lead at Carbon Market Watch. "Sure, the buffer pool can sustain one big project. It's going to impact it massively, but the numbers show it can compensate for those credits. But you can't do it if it's four, five or six projects." Read the full version of this story on Bloomberg.com. |

No comments:

Post a Comment