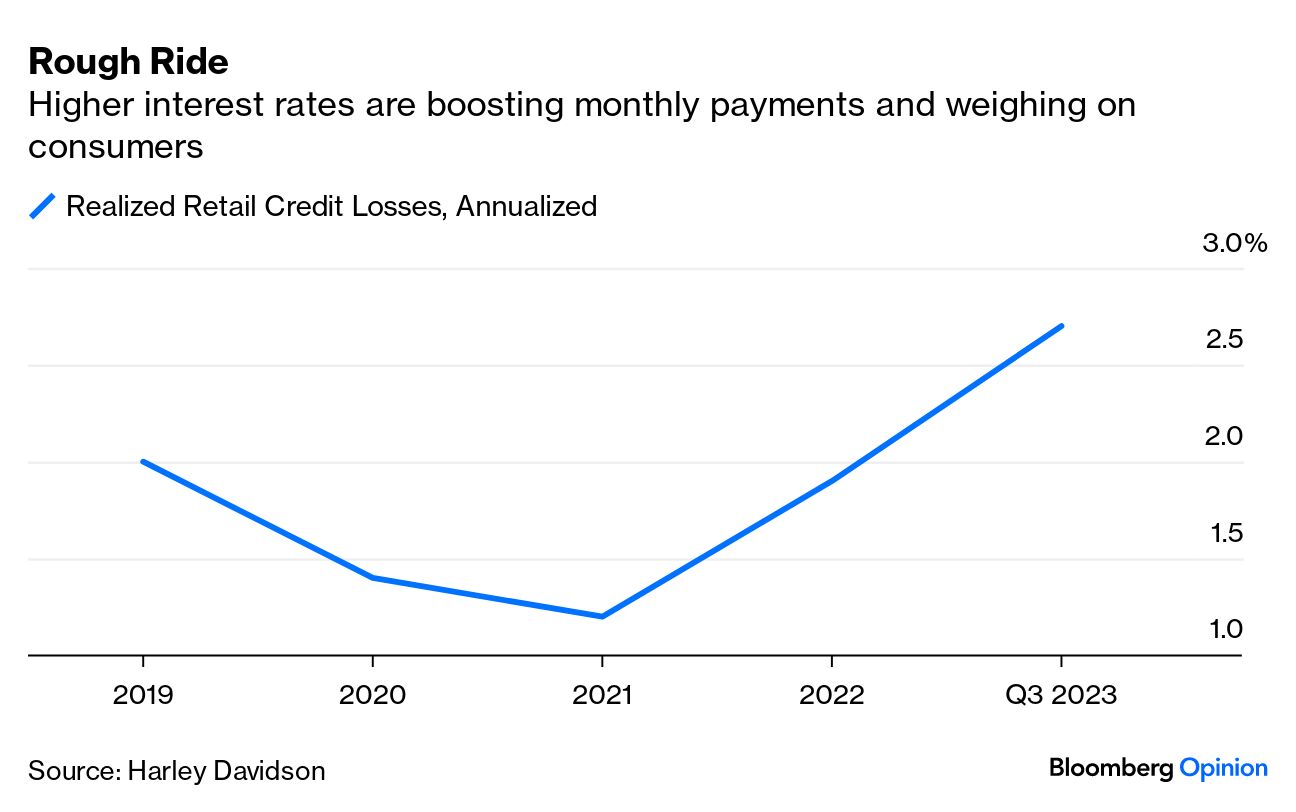

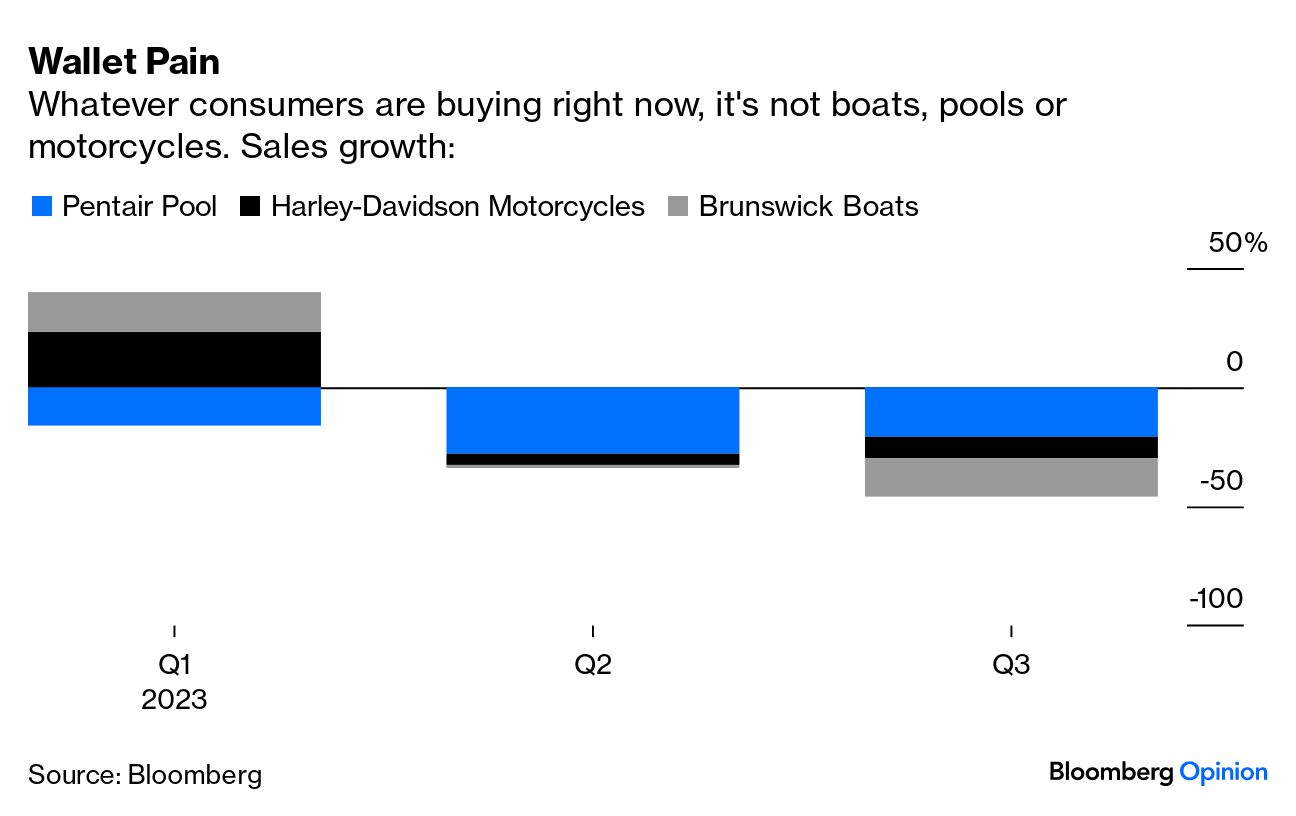

| Have thoughts or feedback? Anything I missed? Email me at bsutherland7@bloomberg.net It's not just the housing market: Sales of big-ticket, discretionary items like boats, motorcycles and swimming pools are taking a bigger-than-expected hit as higher interest rates prompt customers to hold off on purchases. At Brunswick Corp., the maker of the Boston Whaler, Sea Ray and Bayliner boat models and Mercury Marine engines, sales fell 6.2% in the third quarter relative to the same period a year earlier. "Higher prices, high interest rates and credit availability remain strong headwinds for consumers," Chief Executive Officer David Foulkes said on the earnings call. Brunswick separately this week announced plans to launch a new digital financing tool for retail boat purchases that Foulkes said would help the company offer promotional solutions to bridge consumers through this period of higher rates. Brunswick cut its revenue guidance for the full year after reiterating its previous outlook at its investor day only a month ago. Harley-Davidson Inc., meanwhile, said retail motorcycle sales in North America fell 15% in the third quarter. "We certainly, in the first place, see a lot of customers sitting on the sidelines, essentially just putting this level of a discretionary purchase to the side in 2023," Chief Commercial Officer Edel O'Sullivan said. "You see a lot of customers, maybe even those with high creditworthiness, looking at the level of the rates and having a certain amount of rate shock and saying, 'We are not going to pay those level of rates based also on many years and many decades of lower rates.'" Much of Harley's business comes from existing motorcycle owners looking to upgrade, but trade-ins are sometimes worth less today than they were a year or two ago when inflation was at a peak. That makes it even harder to swallow a higher monthly payment for a new bike, O'Sullivan said. Delinquencies have increased at Harley's financing arm and the company's year-to-date provision for credit losses is up by 80% from the year-earlier period. "We are seeing a more stressed consumer," Chief Financial Officer Jonathan Root said.  Sales of Pentair Plc pool products declined 21% on an organic basis in the third quarter relative to the same period a year ago. The company now expects revenue in the division to be down by a high-teens percentage overall in 2023, a deeper rout than it anticipated at the last earnings update in July. Distributors built up a glut of inventory as consumers shifted spending away from their backyards and supply-chain disruptions distorted ordering patterns. Most of the excess supply has now been cleared but higher interest rates are weighing on demand, Pentair CEO John Stauch said on the company's earnings call. "I think it's fair to say that we're not thinking that overall pool builds expand from here. And we don't think overall remodeling expands," he said. But "we're seeing it everywhere," Stauch said of the impact of higher rates. Financing for commercial construction is tougher, and the smaller dealers and professional trade people that make up three-quarters of Pentair's end customer base are having to slow down some projects because of the increased cost of capital, he said. Read more: Inventory Glut Catches Up to Industrial Firms Winnebago Industries Inc., a maker of recreational vehicles and pontoon boats, last week reported a 35% slump in sales for the three months ended Aug. 26, despite dangling discounts to try to drum up purchases. "The headwind that probably is most prevalent at retail for our dealers, especially with existing customers, is some of the challenges around what to do with that existing unit that an existing customer has that they would like to trade in," CEO Michael Happe said on the company's earnings call. "In some cases, depending on when they bought it, they are in a negative equity situation and may have to write a sizable check to get out of that current product and upgrade or get into a new product." Meanwhile, Stanley Black & Decker Inc., maker of Craftsman drills and lawn mowers, said Friday that sales declined 5% on an organic basis in its tools and outdoor products segment in the third quarter as the rout in home improvement spending continues.  These earnings snapshots provide an interesting contrast to broader economic benchmarks that continue to signal resiliency in consumer spending. For example, gross domestic product accelerated to a 4.9% annualized rate in the third quarter, more than double the pace in the previous period and the biggest gain in almost two years, according to preliminary data released this week from the Bureau of Economic Analysis. Personal spending jumped by 4%, also the fastest pace since the end of 2021. "Obviously we just had the GDP results earlier this week which were stronger than expected. But what we've also heard is that the US consumer is being very thoughtful about where they spend their dollars," Mark Newman, CEO of chemical company Chemours Co., said in an interview. The company supplies low-global-warming refrigerants and Nafion membranes used for energy storage, fuel cells and hydrogen production, but also ingredients for paint. A new paint job is one of the cheapest ways to renovate a home, so this corner of the market is holding up relatively better than other construction activities, even as the do-it-yourself boom fades. One explanation that's been offered in the post-pandemic period is that consumers have simply shifted their dollars to experiences and shunned the physical goods that they purchased in bulk during Covid lockdowns. But travel spending growth is slowing as well. Visits to Florida's Disney World theme park have dropped 15% this year, Bloomberg News reported, citing an analysis based on ride data by the website Touring Plans. Spirit Airlines Inc. this week warned that average fares during the peak holiday travel season would be "significantly lower than previously anticipated," while Southwest Airlines Co. forecast as much as an 11% drop in revenue for each seat flown a mile in the fourth quarter. Both carriers are using fare sales to fill seats. Southwest made a meaningful cut to its planned schedule in the first quarter, with capacity now set to decline relative to the final three months of 2023. The rejiggering will allow the airline to refine markets it expanded into during the pandemic recovery period, particularly Hawaii, where fare competition is fierce. A lighter schedule is also better aligned with the stubbornly sluggish recovery in business travel, executives said. Other carriers also have reduced capacity for the first quarter, but the cuts remain primarily focused on the first three months of the year. That may not be enough to stymie price erosion amid a weaker macroeconomic backdrop, Melius Research analyst Conor Cunningham wrote in a note. "A further change of course is needed, and it needs to be more aggressive," he said. Read more: Business Travel Won't Rescue the Airlines Boats, pools, motorcycles, RVs and vacations are highly discretionary expenses, meaning these purchases are the first to get cut when budgets get tight. Put another way, these businesses are leading indicators of any kind of pullback in consumer spending. At the moment, those barometers are flashing yellow warning lights. Shares of Siemens Energy AG plunged by more than 35% on Thursday after the company confirmed it's talking to banks and the German government about providing a financial backstop to the beleaguered turbine manufacturer. Siemens Energy wants to secure as much as €16 billion ($16.9 billion) in state guarantees over a two-year period after its top shareholder and former parent company Siemens AG indicated it isn't willing to provide a lifeline, Bloomberg News reported, citing people familiar with the matter. Siemens merged its wind-turbine business with Spain's Gamesa in 2017 and then transferred its holdings in that business to the separate Siemens Energy spinoff of its gas turbine assets in 2020. Siemens Energy consolidated ownership of the Siemens Gamesa Renewable Energy operations earlier this year in a bid to get a handle on cost inflation and supply chain disruptions that caused the wind subsidiary to bleed cash and issue profit warnings. But Gamesa's problems have only gotten worse and are now threatening to drag down the larger, profitable and growing gas turbine and power network businesses. Explicit government support would help Siemens Energy continue to book and deliver on long-term projects in its gas and power operations while it works through unprofitable contracts and manufacturing defects in the wind turbine side of the house. In August, the company shocked investors by forecasting a €4.5 billion loss this year. Siemens Energy this week said net losses and cash outflow in the wind business would be worse than market expectations. Siemens Energy is considering simply starting over with a new turbine design that would replace the 5.X model that's been plagued by quality control issues and higher-than-expected failure rates on certain components, Bloomberg News reported earlier this month. Read more: Wind 'Turbinegeddon' Is a Troubling Climate Omen: Chris Bryant The deepening crisis at Siemens Energy contrasts with General Electric Co.'s rival business, which took a "one time" $500 million warranty provision last year to address turbine durability issues that appears to have actually been "one time" in nature. There were no new charges announced in GE's third-quarter update this week and the company said it should be 60% finished with repairs to the in-service fleet by the end of the year. No news is definitely good news here. While the offshore wind business is expected to lose $1 billion next year, comparable to this year, as it works through a backlog of contracts rendered unprofitable by inflation and rising interest rates, the onshore and grid businesses should make money. GE is moving ahead with a planned spinoff of its Vernova energy operations early in the second quarter. "With rising financing costs and challenges facing the broader renewables industry, there was growing concern from investors that the Vernova spin could be delayed," Melius Research analyst Robert Spingarn wrote in a report. "However, with power, onshore wind, and grid all profitable, the spin remains on track, which should alleviate investor concerns." Forward Air Corp. is having some second thoughts about its planned $3.2 billion acquisition of supply-chain management and freight forwarding company Omni Logistics. The deal has landed like a rock from the start for Forward Air's shareholder register. Forward Air shares are down more than 30% since the acquisition announcement; some investors sued over an unusual structure for the deal that would have diluted existing holders and not allowed them to vote on the transaction; and activist investor Ancora Alternatives has called for a management revamp, going so far as to call CEO Tom Schmitt the company's "chief value destroyer." A Tennessee judge had issued a temporary restraining order in September in the shareholder lawsuit that blocked Forward Air from completing the transaction; the company said this week that the order had been dissolved. Nevertheless, Forward Air says Omni hasn't complied with certain terms of the merger agreement and so the company is evaluating its rights to walk away. Omni says that the deal is legally binding and that any attempt by Forward Air to suggest it hasn't fulfilled its obligations under the agreement "is unfounded and has no basis."

Lennox International Inc. and Idex Corp. are both getting new chief financial officers. Joe Reitmeier is planning to step down in February after more than a decade as Lennox's CFO; he will be succeeded by Michael Quenzer, the current vice president of financial planning and investor relations. The company separately announced the acquisition of AES, a provider of commercial installation services for heating, ventilation and air conditioning equipment. Terms were not disclosed. Idex appointed Abhi Khandelwal — a former company executive who left in 2020 and most recently was CFO of packaging company Multi-Color Corp. — to rejoin the company as its CFO effective Nov. 20. Khandelwal fills the vacancy created when former Idex CFO William Grogan departed in September to take the same job at water-technologies company Xylem Inc. "We like that Mr. Khandelwal is both an Idex veteran and arrives with previous public company CFO experience," RBC analyst Deane Dray wrote in a note. Idex separately said it had sold its Micropump Inc. business for $110 million. |

No comments:

Post a Comment