| The $520 billion Israeli economy's resilience is being tested to the limit as its war against Hamas enters the "second stage."  People take cover as warning sirens sound at a demonstration in Tel Aviv on Oct. 28 calling for the release of hostages held in Gaza. Photographer: Ahmad Gharabli/AFP Israel mobilized a record 350,000 reservists before its ground offensive on Gaza, draining roughly 8% of the workforce. Those numbers are even higher for the country's bellwether technology sector, according to non-profit Startup Nation Central's estimates. Meanwhile, more than 120,000 Israelis have been forced to leave their homes as the conflict escalates. The military call-ups, combined with partial shutdowns of offices and construction sites, have triggered a sudden crash in activity and upended everything from banking to agriculture — prompting comparisons to the impact of the Covid-19 pandemic lockdowns. Also Read: How This Israel-Hamas Conflict Is Like Nothing That's Happened Before Here are some estimates for the impact of the war on the economy: - The government is losing an equivalent of $2.5 billion a month, according to Mizrahi-Tefahot, a top Israeli lender.

- Private consumption fell by nearly a third in the days after the war broke out, relative to an average week in 2023, according to the Shva payments-system clearinghouse.

- By one measure, the decline in credit-card purchases was more dire than what Israel experienced at the height of the pandemic in 2020, according to Tel Aviv-based Bank Leumi.

- Nearly half of the 500 high-tech companies surveyed last week reported a cancellation or delay of an investment agreement.

- The economic cost of the conflict will probably run to at least 27 billion shekels, according to Bank Hapoalim, or 1.5% of Israel's GDP.

Israel declared war on Hamas — which the US and the EU designate as a terrorist organization — when it rampaged through southern communities on Oct. 7, killing around 1,400 people. Thousands of Palestinians have died in retaliatory airstrikes on Gaza, the Mediterranean enclave ruled by Hamas. Also Read: Israel Taps Blacklisted Pegasus Maker to Track Hostages in Gaza The Israeli government has pledged a bigger stimulus than that during the coronavirus pandemic. But lawmakers and business owners have criticized the support program — initially set at 4.5 billion shekels ($1.1 billion) for October and possibly more than triple that for later — as insufficient. Rating agencies have responded with warnings, bringing Israel closer to a first-ever downgrade. The financial costs of the war are also clearly visible in the markets. Israeli stocks are the world's worst performers since fighting erupted, with the main index in Tel Aviv down 15% in dollar terms, equivalent to $25 billion. The shekel has weakened to its lowest level since 2012, before paring some of its losses. With Prime Minister Benjamin Netanyahu warning of a "long and difficult" military campaign, the geographical reach and duration of the conflict will determine the extent of its long-term economic impact. Despite the latest round of conflict, some in Israel still see a path to coexistence. But for that, Israelis and Palestinians must acknowledge each others' pain, Marc Champion writes for Bloomberg Opinion. Turkey's central bank lifted its benchmark rate to 35% from 30%,

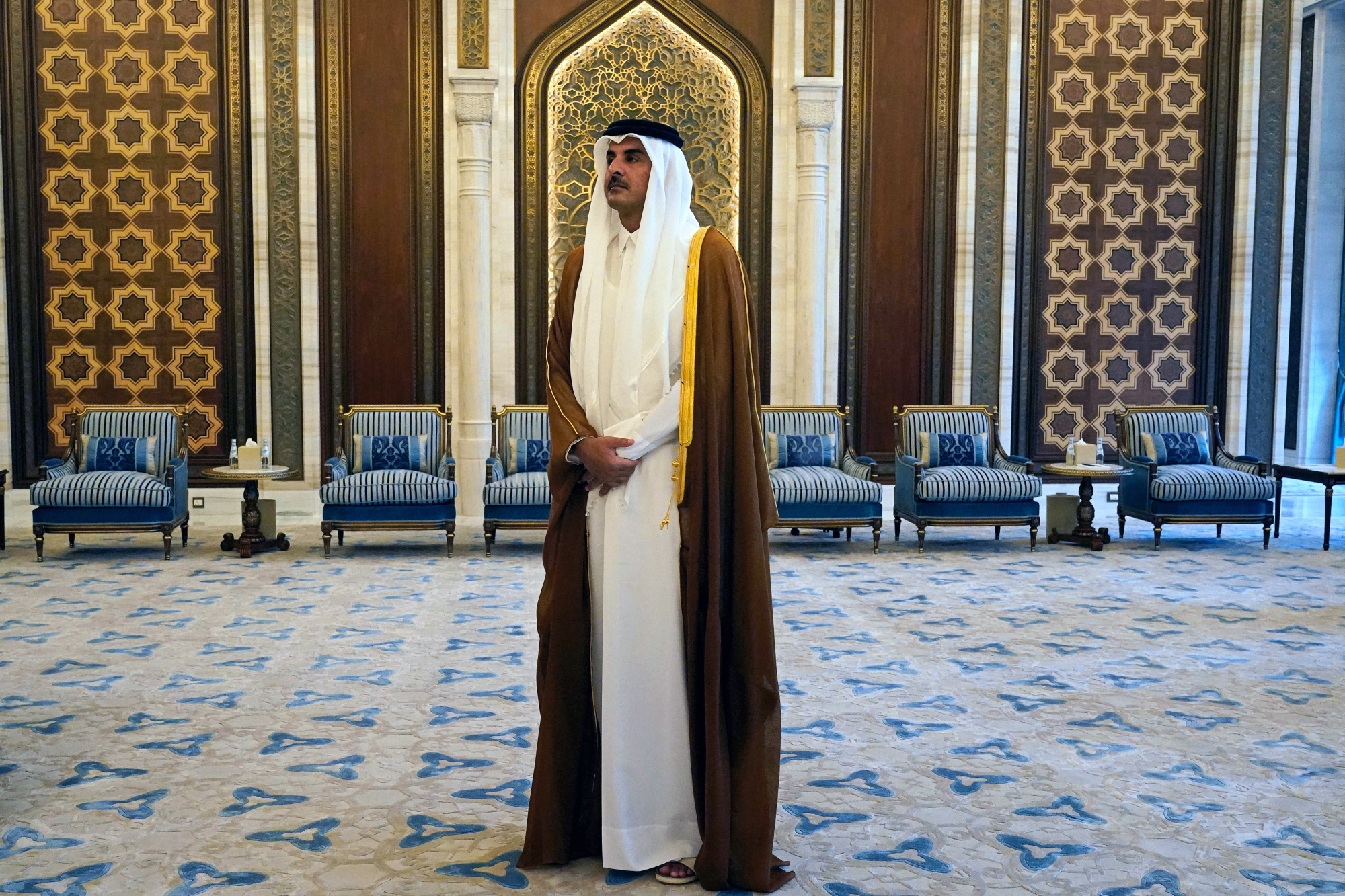

and signaled it could tighten policy further to rein in inflation that's on track to end this year near 70%. In another step toward normalization, authorities also scrapped rules forcing banks to buy government bonds as a penalty for lending at interest rates above certain limits or falling short of targets for business loans, ending a practice widely reviled by local lenders and foreign investors. Diversification drive: Saudi Arabia is looking to sign more free trade agreements and still considering joining the BRICS club of emerging nations, as it looks to boost non-oil exports. Meanwhile, the kingdom plans to open its domestic aviation industry to more competition, part of an overhaul that the government estimates will drive a $100 billion investment in the sector by the end of the decade. Also Read: War Not Money Dominates Saudi Arabia's Major Investor Summit $550 million plant: Pirelli is preparing to begin tire production in Saudi Arabia, in a joint venture with the sovereign Public Investment Fund. Related CoveragePause mode: Saudi Arabia may refrain from increasing its flagship oil price for Asian customers for the first time in six months. IPO pipeline: Dubai Taxi, a unit of the emirate's transport authority, is seeking to raise about $300 million from a share sale next month in what's set to be city's first privatization of the year. Saudi Arabia's Milling Company 4 is planning a domestic initial public offering that could raise more than $200 million. Meanwhile, Goldman Sachs and Citigroup have dropped off the planned Abu Dhabi IPO of an investment vehicle backed by Investcorp, the Middle East's biggest alternative asset manager. $9 billion credit line: UBS is extending the financing to former Qatari Prime Minister Sheikh Hamad bin Jassim bin Jaber Al Thani, one of the Middle East's most influential investors, as the Swiss lender seeks to retain the region's ultra wealthy following the takeover of Credit Suisse.  Sheikh Hamad bin Jassim bin Jaber Al Thani, former Qatar prime minister. Photographer: Christopher Pike/Bloomberg Pound's recovery: Egypt's currency strengthened from a record low against the US dollar on the black market after the central bank eased rules on the use of credit cards abroad. "Budgetary rigor": Morocco will start phasing out subsidies on cooking gas next year, a show of resolve by the cash-tight country as it tries to balance hefty spending commitments arising from 2030's football World Cup and an earthquake recovery. The escalating war in Gaza has become the ultimate test of Qatar's ability to show its Western allies they need it as much as it needs them. The gas-rich nation has spent more than a decade trying to position itself as the Middle East's indispensable go-between, criticized by its neighbors for housing Hamas leaders while maintaining channels to Israel.  US Secretary of State Antony Blinken, left, and Qatar Prime Minister Mohammed bin Abdulrahman Al Thani during a news conference in Doha on Oct. 13. Photographer: Jacquelyn Martin/AFP Within a few hours after Hamas' assault on Israel, Qatar's prime minister assembled a team in Doha, consisting of experts who have mediated in the war of attrition between the two sides for more than five years. As the days unfolded from Oct. 7, the round-the-clock operation worked the phone lines — one to Hamas, another to the Israelis — to mediate as retaliatory bombs rained on Gaza, according to a person familiar with the negotiations.  Qatar's Emir Sheikh Tamim bin Hamad Al Thani waits for the US Secretary of State Antony Blinken in Lusail, Qatar, on Oct. 13. Photographer: Jacquelyn Martin/AFP Also Read: Iran Warns of New Fronts Against the US If Gaza War Drags On For the government in Doha, it's about being a useful and reliable partner, according to one of the people close to it, and getting a place at the table with international power brokers. A Qatari official said that Hamas opened a political office in Qatar more than a decade ago in coordination with the US after it requested a channel to communicate with the group. The office "has frequently been used in key mediation efforts coordinated across multiple US administrations to stabilize the situation in Gaza and Israel," the official said. Also Read: Putin Calls Meeting to Discuss Anti-Israel Mob in Dagestan |

No comments:

Post a Comment