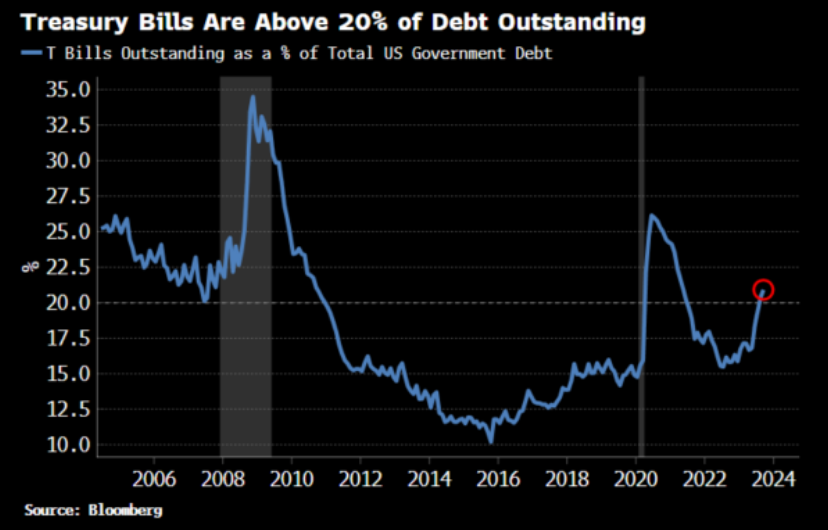

| Good morning. The Federal Reserve is likely to hold interest rates, US Secretary of State Antony Blinken is set to head back to Israel, and Bayer ordered to pay $332 million in the latest weedkiller verdict. Here's what people are talking about. The Federal Reserve is poised to hold interest rates steady at a 22-year high for a second meeting, while leaving open the possibility of another hike as soon as December with economic growth staying resilient. Powell has signaled that Fed leaders would prefer to wait to evaluate the impact of past increases on the economy as they near the end of their rate-hiking campaign. "It will be kind of a hawkish pause," said Thomas Simons, senior economist at Jefferies LLC. US Secretary of State Antony Blinken is set to head back to Israel after dozens were reported killed and wounded at a Gaza refugee camp, stoking concerns about the mounting toll from weeks of fighting. Health officials in the Hamas-controlled territory said the Jabaliya camp was hit by a series of Israeli airstrikes. Israel's military said it targeted Hamas infrastructure in the area and killed a senior leader of the organization, which is designated as a terrorist group by the US and European Union. Bayer AG's Monsanto unit was ordered by a California jury to pay $332 million to a former land surveyor who blamed his cancer on his use of the company's controversial Roundup weedkiller – the third trial loss this month for the company. Jurors in state court in San Diego on Tuesday awarded Michael Dennis, 57, a total of $7 million in actual damages and $325 million in punitive damages over his claims 35 years of using Roundup on his lawns and gardens caused his non-Hodgkin's lymphoma. Mikhail Fridman and Petr Aven epitomized the Russian oligarchs who used their fortunes to integrate into the global economy and shake off association with President Vladimir Putin's regime. Now the wheel of fortune is turning full circle. Fridman has fled to Moscow from London via Israel, bitterly unhappy with life as a sanctioned businessman in Britain since Putin ordered Russia's invasion of Ukraine. Aven may also have to weigh a return to Russia from Latvia, where authorities are threatening to revoke his passport. European equity futures edged up ahead of the Fed's interest rate decision. Much of the region celebrates the All Saints holiday. Fabio Panetta starts his six-year term as Bank of Italy governor and ECB Governing Council member. Expected data include UK manufacturing PMI figures. GSK, Aston Martin and Tenaris are among companies scheduled to report earnings. This is what's caught our eye over the past 24 hours: Yields and risk assets face rising risks from the Treasury Department's borrowing report Wednesday. The BOJ's underwhelming move Tuesday has taken some of the pressure off global rates, with US 10-year yields lower on the session. That puts the ball back in Treasury's court on whether yields resume their upwards trend this week, with the remainder of its quarterly refunding announcement on Wednesday. We got their borrowing estimates on Monday. The total was lower than expected, but it is still the largest amount borrowed in the fourth quarter. However, it's the split between bills and bonds (by bonds here I mean all debt more than one-year maturity) that has the most significant near-term implications for liquidity and longer-term yields.  Bloomberg Issuance has been skewed towards bills this year, which has limited the liquidity impact on risk assets as money market funds (MMFs) have been able to absorb them by using inert liquidity already parked in the reverse repo (RRP) facility at the Fed. But bills are now over 20% of total debt outstanding, normally towards the higher end of where the Treasury prefers it. The Treasury has stated it will remain above 20% for now, but it will gradually skew issuance away from bills. MMFs cannot directly buy longer-term debt, so the buying will shift to higher-velocity holders of reserves, e.g. households. This will extract liquidity from of the system, leaving stocks and other risk assets more vulnerable (read more here). The Treasury's account at the Fed (the TGA) will be increasingly pivotal here. Treasury aims for this to be $750 billion at the end of 4Q and 1Q (it's ~$850 billion at the moment). Currently it is de facto backed by bill issuance. But if its size is maintained as the Treasury expects and issuance moves away from bills, or the RRP becomes too low, then it will be increasingly backed by longer-term debt that will deplete higher-velocity reserves and pose a serious headwind for risk assets. Simon White is a macro strategist for Bloomberg News, based in London. |

No comments:

Post a Comment