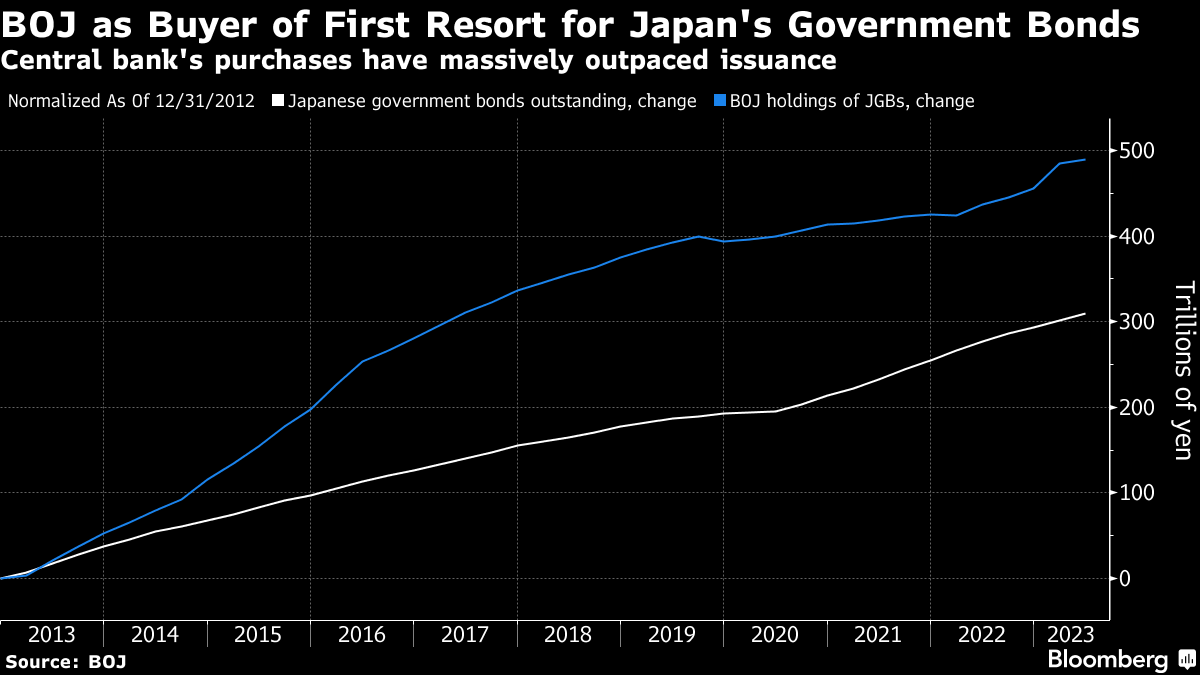

| Israel sends troops into Gaza. Evergrande faces make-or-break moment in court. Australia walks away from EU free trade deal. Here's what you need to know today. China Evergrande Group, the world's most indebted developer, faces a make-or-break moment today, at a court hearing on creditor requests for liquidation. The case in Hong Kong's High Court follows a saga that's epitomized the rise and fall of China's real estate industry. The builder must present "concrete" restructuring progress to help avoid a once-unthinkable outcome. Any wind-up order could make Evergrande, with about 2.39 trillion yuan ($327 billion) of liabilities, the biggest Chinese developer to ever face such a fate. Australia has walked away for the second time in three months from talks with the European Union toward a free trade deal. The two sides have been working on a free trade agreement for more than five years and while there was broad consensus across most areas, a few remaining agricultural issues were threatening to derail the entire compact. Australia was pushing for greater access to the European market for its beef, mutton and sugar, while Brussels wants an end to the use of certain geographic locators on products such as Prosecco and feta. Israel has sent troops and tanks into the northern Gaza Strip in what it calls the second and longer phase of its war against Hamas. But it's taking a more cautious approach than it earlier vowed after the militant group's Oct. 7 attack that killed 1,400 people. Instead of a massive ground invasion, the military has started slowly, taking a day-by-day approach. The expectation is for the campaign to last anywhere from six weeks to six months, according to officials. The expansion of the war saw the price of oil drop and has put further strain on global markets. Asian stocks look set for a cautious open Monday as investors prepare for a busy week packed with major central bank decisions. Equity futures in Australia, Japan and Hong Kong all show declines after US stocks fell Friday. The S&P 500 entered a correction, falling more than 10% from its July peak as risk appetite is dented over worries about a persistently hawkish Federal Reserve, geopolitical tensions and an underwhelming corporate earnings season. Chinese Foreign Minister Wang Yi said the road to an expected meeting between Presidents Joe Biden and Xi Jinping will not be smooth, requiring effort from both sides to reach consensus. The two countries cannot rely on "autopilot" to achieve the meeting during the San Francisco summit, the Ministry of Foreign Affairs said in a statement, citing Wang. Biden and Xi are expected to meet during the APEC gathering in San Francisco next month, although the two sides must still finalize arrangements. The Bank of Japan's meeting this week is very much live, which means global currency and rates markets could be in for some severe shocks. All of the Japanese central bank's gatherings bring with them the chance for change because it's so hard to see how it can keep policy unchanged. Inflation is looking as sticky in the nation as it does elsewhere — look at Tokyo's surprisingly robust October readings that came out Friday. And can the BOJ really go on buying up bonds faster than Japan's government can issue them?  In the decade since then-BOJ Governor Haruhiko Kuroda kicked off massive persistent easing, the BOJ has bought some 60% more than the government sold, on a net basis, just looking at bonds rather than including T-bills. It now holds well above half of the long-term debt on issue. Adding to the burden for the current Governor Kazuo Ueda is the likelihood that the BOJ would probably have to initially increase purchases when it does move to end yield-curve control and/or negative rates. That pressure also means that markets could fluctuate even more wildly if Ueda simply holds pat rather than opening the door to ending the current set up. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment