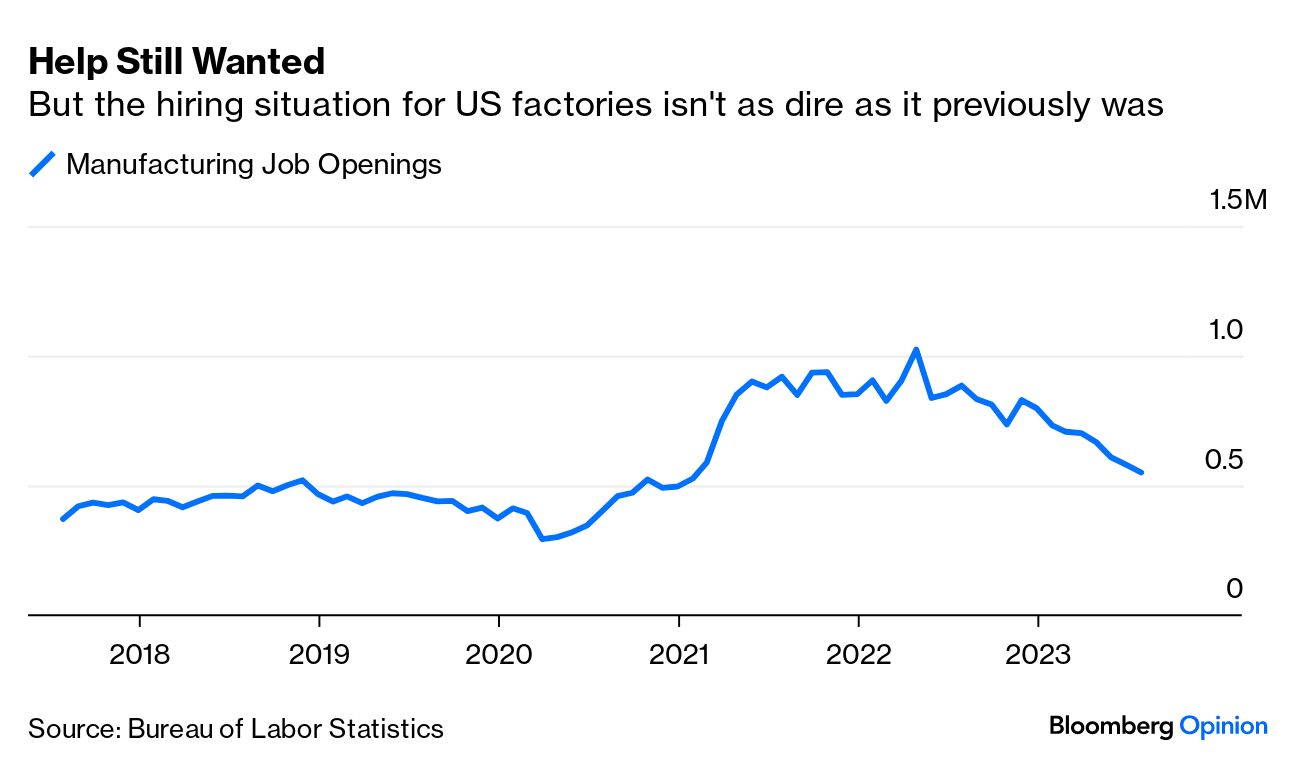

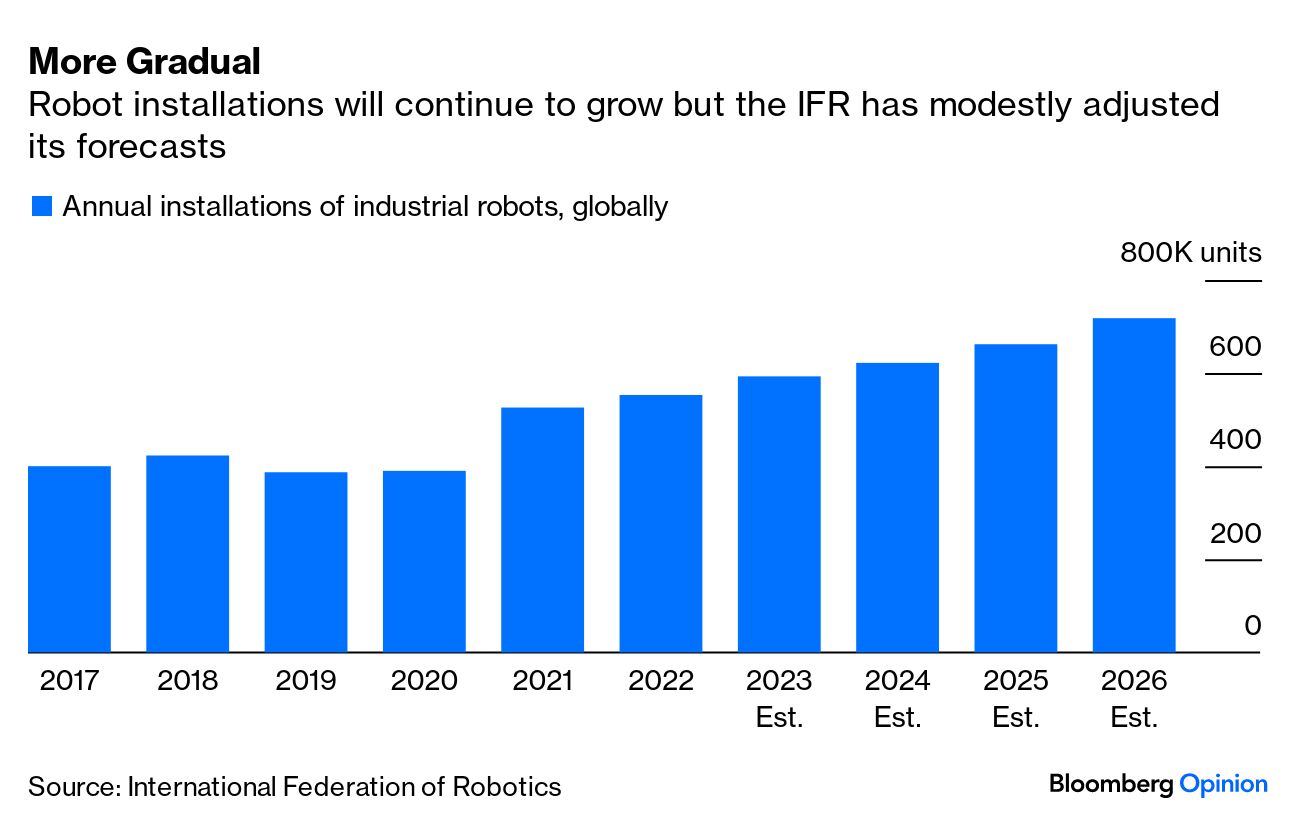

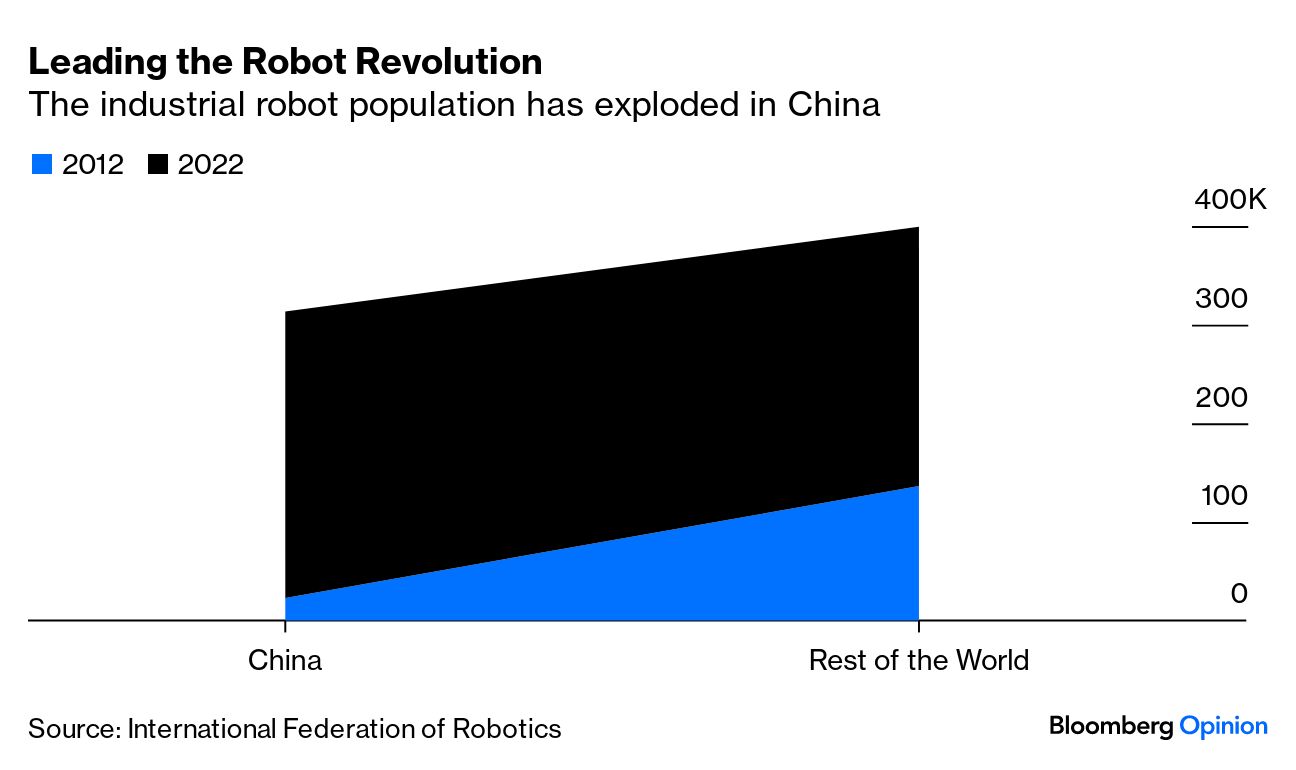

| Industrial Strength is expanding! The newsletter will now publish twice a week, so look for it on Wednesdays in addition to your usual Friday issue. We'll be experimenting with some different bells and whistles, so I appreciate any thoughts or feedback. I hope you enjoy the additional content. Anything I missed this week? Email me at bsutherland7@bloomberg.net. The US population of industrial robots isn't growing as robustly as it was during the peak of the post-pandemic labor shortages, but it's still growing much faster than the ranks of the country's manufacturing workers. US factories installed nearly 40,000 robots in 2022, up 10% from the year earlier, according to a report released this week by the International Federation of Robotics. That was actually a downshift from the pace of growth in 2021, which doesn't exactly jibe with the narrative of a reshoring boom in America (more on that in a moment). The automotive industry was the biggest driver of the expansion, with US installations in the sector jumping 47% in 2022. Factories have also been on a human hiring spree: Roughly 13 million people were employed in the US manufacturing sector as of August, according to data from the Bureau of Labor Statistics. That's the highest level since 2008 but a mere 1.3% increase from the same month in 2019. Even before the 2022 additions, 274 robots were installed for every 10,000 manufacturing workers in the US, up from 176 in 2015, IFR data show. The nonprofit organization will release data on 2022 robot density later this year. These statistics help explain why the United Auto Workers' labor negotiations with the Detroit automakers have taken on such an existential dimension. Select groups of UAW members have been on strike at Ford Motor Co., General Motors Co. and Stellantis NV factories since Sept. 15, and a resolution remains out of reach for now. The UAW plans to expand its strike to one additional plant each at Ford and GM but spared Stellantis from further escalation after a last-minute breakthrough on cost-of living adjustments and the right to strike over plant closings. While the union is reportedly willing to compromise on overall pay increases in the 30% range, it's less obvious how the two sides might bridge the gap on calls for a restoration of retirement benefits and greater job security guarantees, topics that become increasingly important to workers as more robots descend on the factory floor. Automation is frequently painted as the enemy of labor; the reality can be more complicated. The robot investment frenzy appears to have peaked alongside the post-pandemic factory labor shortages and is now moderating as hiring difficulties ease. There were 550,000 unfilled job openings in the US manufacturing industry in July, the lowest level since January 2021 and a significant drop from the peak of more than 1 million in April 2022, according to BLS data. A shortage of skilled workers was a key motivation for companies that accelerated automation investments in the wake of the pandemic, including trash-hauler Waste Management Inc., air-conditioner maker Carrier Global Corp. and Howmet Aerospace Inc., a supplier of fasteners and other metal parts for aircraft.  Howmet recently finalized a five-year agreement with the UAW for its plant in Whitehall, Michigan, which makes engine airfoils. Details haven't been disclosed, and Howmet declined to comment, but that deal doesn't appear to have precluded automation investments, which the company highlighted earlier this month when it hosted a tour of the factory for Wall Street analysts. Certain work functions at the plant that previously required four people now require only one, Truist Securities analyst Michael Ciarmoli wrote in a report. Indeed, "much of the heavy lifting is automated, including the dipping of the waxed forms into casting slurry to form the shell, movement of the forms between stages, and melting of the alloys in the furnaces and cooling," Vertical Research Partners analysts led by Rob Stallard added in a separate note. The company is also using artificial intelligence and machine learning to assist in inspection and recognition of defects, with the technology improving through repetition and human correction. During the visit, Howmet representatives noted that "the union is generally on board with increased automation as that drives product and volume growth necessary to support the organization," according to the Vertical Research report. With Boeing Co. and Airbus SE pushing to ramp production of top-selling jets ever higher and lingering difficulties in attracting skilled labor, many aerospace suppliers need to invest in automation simply to keep up, Stallard said in an interview. United Parcel Service Inc.'s recent labor deal is widely touted as a victory for workers, and yet the company "retains flexibility to implement technology to further drive productivity inside our buildings," Chief Financial Officer Brian Newman said on a recorded call earlier this month to discuss the terms of the agreement. It would have been much more difficult for UPS to afford such significant wage increases — veteran drivers will earn $49 an hour by the end of the five-year contract, while part-timers will have a starting salary of $21 an hour — without the prospect of cost savings from automation. Existing investments include radio-frequency identification tags that allow for human-free scanning of a truck's contents, unloading technology and driverless tugs for heavy loads. "We are not taking our eye off of the productivity ball," UPS Chief Executive Officer Carol Tomé said in an interview with Bloomberg News. The issue of automation is more protracted in the UAW's negotiations with the Detroit automakers because the companies need productivity savings to offset not only higher labor costs but the gargantuan expense of transitioning the industry away from traditional combustion vehicles. Autoworkers aren't in as short of supply as aerospace welders or machinists, while electric vehicles lend themselves more easily to automation and naturally require fewer parts and thus fewer people to produce. But the robots are coming, one way or another. While global economic growth looks set to slow in 2023, robot installations "are not expected to follow this pattern," the IFR said. "There is no indication that the overall long-term growth trend will come to an end soon: rather the contrary will be the case." And yet interestingly, the momentum of robot installations does appear to have downshifted somewhat in 2022. Globally, factories installed around 553,000 industrial robots in 2022, with more than half the expansion taking place in China, according to the IFR. While the global total represented a fresh annual record, installations trailed the 570,000 target laid out by the organization in its report a year earlier, and the 5% overall growth in 2022 compares with a 35% surge in 2021. The IFR now expects a 7% increase in global robot installations in 2023 and another 5% jump in 2024 — respectable levels of growth but a slower pace in both instances than what the organization had previously forecast.  To some extent, the deceleration reflects challenging comparisons with a 2021 growth baseline that ended up being about double what the IFR had anticipated in that year's report and an explosion in order backlogs amid supply-chain constraints. Yet the more muted out-year trend line does suggest that some of the optimism around an accelerated shift toward industrial robots in the wake of the pandemic was a bit overdone and that perhaps this industry isn't entirely immune from economic mood swings. A similar phenomenon is playing out in the factory automation equipment industry, where companies including Siemens AG, Rockwell Automation Inc. and Emerson Electric Co. have flagged sagging order activity as customers prioritize shrinking existing inventory stockpiles. This isn't what one would expect in the middle of a reshoring boom. Read more: A 'Bidenomics' Boost May Not Mean Reshoring The expectation has been that any factories built in the US would need to be heavily automated to mitigate an unfavorable reversal of the globalization labor arbitrage, but there's little evidence that the region is experiencing outsized growth in robot installations relative to the rest of the world, according to an analysis of IFR data by Barclays Plc's Julian Mitchell. While US installations jumped 10% in 2022, that took the annual unit growth back to 2018 levels. By contrast, China accounted for just 14% of annual robot installations in 2012 but 52% last year, according to the IFR.  There continue to be misconceptions about what exactly reshoring means and what it looks like in practice. Industrial manufacturers are adding North American capacity to respond to demand growth in that region and to build more resiliency into their supply chains, but they are also investing in other countries, and it's rare to see a factory announcement in one corner of the world accompanied by a shutdown elsewhere. There's also some confusion about the kinds of companies that need to rewire their geographic footprint; it's usually not the large end manufacturers of industrial equipment that often already have localized operations but smaller entities in their supply chain that need to develop more of a global presence. "What does a sole supplier mean? What is the definition? Is a sole supplier a company or you can get it from different plants that they have in different parts of the world and can they make their manufacturing footprint more resilient for you?" Trane Technologies Plc CEO Dave Regnery said in an interview this week. "We like some of our suppliers, and we want them to be global suppliers. We encourage some of them to reshore to areas where we are just to build in that resiliency which is important for the long term." "If you look at the heat pump growth on a year-to-date basis, we're 40% above prior year. If you look at just the single month of September, on a month-to-date basis, we're even above that. So I would say, in the summary, we're doing OK." — Max Viessmann, CEO of Viessmann Group Viessmann made the comments in a presentation this week moderated by Barclays analyst Julian Mitchell and hosted by Carrier, which is buying the company's climate-solutions business for €12 billion ($13.2 billion). The upbeat commentary on heat-pump demand provided some reassurance to investors after other providers of heating and cooling technology had warned of a temporary slowdown in European markets amid a shifting regulatory landscape. For example, Italy earlier this year halted a controversial (and very expensive) "superbonus" tax-credit program that was meant to incentivize homeowners to invest in energy efficiency upgrades, while Germany's parliament has been debating the timing of proposals to phase out boilers powered by fossil fuels. Viessmann said robust subsidies for heat pumps are still in place in European countries, even if the exact terms are changing. "It's not like there's no support; it's quite the contrary," he said. The company's heat pumps and boilers have a comparable design and use similar components. Its factories are also integrated, meaning it can flex manufacturing capacity back and forth between the two more easily than many of its rivals. Innovation, not the political climate, is what's driving growth for Trane's European business right now, CEO Regnery said in an interview. Conventionally, buildings would be heated and cooled by a boiler and a chiller, respectively, that each operated independently. Trane's thermal-management system combines these functions into one, a technological revolution that greatly improves efficiency because it allows heat that normally would have been lost into the atmosphere to be repurposed elsewhere in a building where it might be needed, Regnery said. Trane's thermal-management systems can generate three to four times as much heating and cooling capacity for every one unit of power as the traditional, separate chiller and boiler plants they're typically replacing. Trane also offers thermal energy storage products that operate like batteries, stockpiling heating and cooling capacity during off-peak hours to help lower electric bills and demands on the grid. "When you have a financial payback, subsidies just become more of a tailwind," Regnery said. AGCO Corp. agreed to pay $2 billion for a majority stake in a joint venture that combines most of Trimble Inc.'s agriculture technology assets with its own autonomous tractor and crop-yield software business. Trimble has traded at a discount both to industrial peers and the broader software industry lately. This is partly because its mix of construction, geospatial, transportation, utility and agricultural technology assets was perceived by investors as being too complex and because of concerns about the company's ability to compete with the likes of tractor giant Deere & Co., which has been investing heavily in precision planting tools, Melius Research analyst Rob Wertheimer wrote in a note. The deal with AGCO helps mitigate both concerns and the tie-up with a legacy tractor manufacturer (albeit a less dominant one than Deere) also likely makes the Trimble agriculture assets more valuable. Trimble will retain a 15% stake in the joint venture. The transaction implies an enterprise value of about 13.8 times the businesses' combined estimated 2023 earnings before interest, taxes, depreciation and amortization of about $170 million.

Johnson Controls International Plc is assessing whether it will need to delay the release of its next batch of financial results after its internal information technology operations were disrupted by a cyberattack. Many of the building product company's applications are "largely unaffected and remain operational," and Johnson Controls is installing workarounds where possible to continue servicing customers, but "the incident has caused, and is expected to continue to cause, disruption to parts of the company's business operations," the company said in a statement. Johnson Controls' stock was already under pressure after management flagged inventory destocking pressures — particularly in the fire and security products business — and lowered guidance for how much free cash flow the company will be able to squeeze out of its income this year. Cyberattacks are never a welcome development, but the timing of this one may particularly sting for Johnson Controls because the company operates on a fiscal year that ends in September, meaning the attack took place toward the end of its most important quarter. It's far from the only industrial company to be targeted by hackers: Gates Industrial Corp. and Ingersoll Rand Inc. also experienced cyberattacks, and those are just the examples from this year. Manufacturers were the most targeted industry group for cyberattacks in 2022 after the financial sector, according to a report from International Business Machines Corp.'s X-Force cybersecurity group.

Regal Rexnord Corp. agreed to sell its industrial motors and generators business to Brazilian machinery company WEG SA for $400 million. Regal Rexnord had announced a strategic review of the operations in November, about a month after announcing the $5 billion acquisition of Altra Industrial Motion Corp. The motors and generators business makes up the bulk of Regal Rexnord's Industrial Systems division, which has lower margins than its other key units. Proceeds from the sale to WEG will be used to pay down debt accumulated for the Altra acquisition. Allegiant Travel Co., the parent company of the low-cost airline is bringing back founder Maury Gallagher to be its CEO after John Redmond resigned just more than a year into the job. While the departure of Redmond was more sudden than expected, his resignation is because of personal reasons and not because of issues related to the construction of Allegiant's much-delayed Sunseeker resort in Florida, President Greg Anderson told Bloomberg News in an interview. Allegiant in August warned that lingering setbacks related to Hurricane Ian in 2022, seasonal weather issues and construction worker shortages would push out the opening of Sunseeker to later in the fourth quarter. It had previously targeted mid-October. The shake-up at Allegiant comes amid a deepening slowdown in the domestic travel market. Separately this week, JetBlue Airways Corp. said third-quarter revenue would likely be at the low end of its guidance range amid air-traffic control and weather disruptions and weaker short-term leisure booking activity in September than previously expected.

TAP SA, Portugal's state-owned airline, is officially up for sale. The government is aiming to sell at least 51% of TAP, with as much as a 5% equity position expected to be carved out for airline employees, Finance Minister Fernando Medina said this week after the Cabinet approved the privatization process. Air France-KLM, Deutsche Lufthansa AG and IAG SA, the parent company of British Airways and Iberia, have already publicly expressed interest in buying TAP and continuing to consolidate their already dominant positions in the European market. |

No comments:

Post a Comment