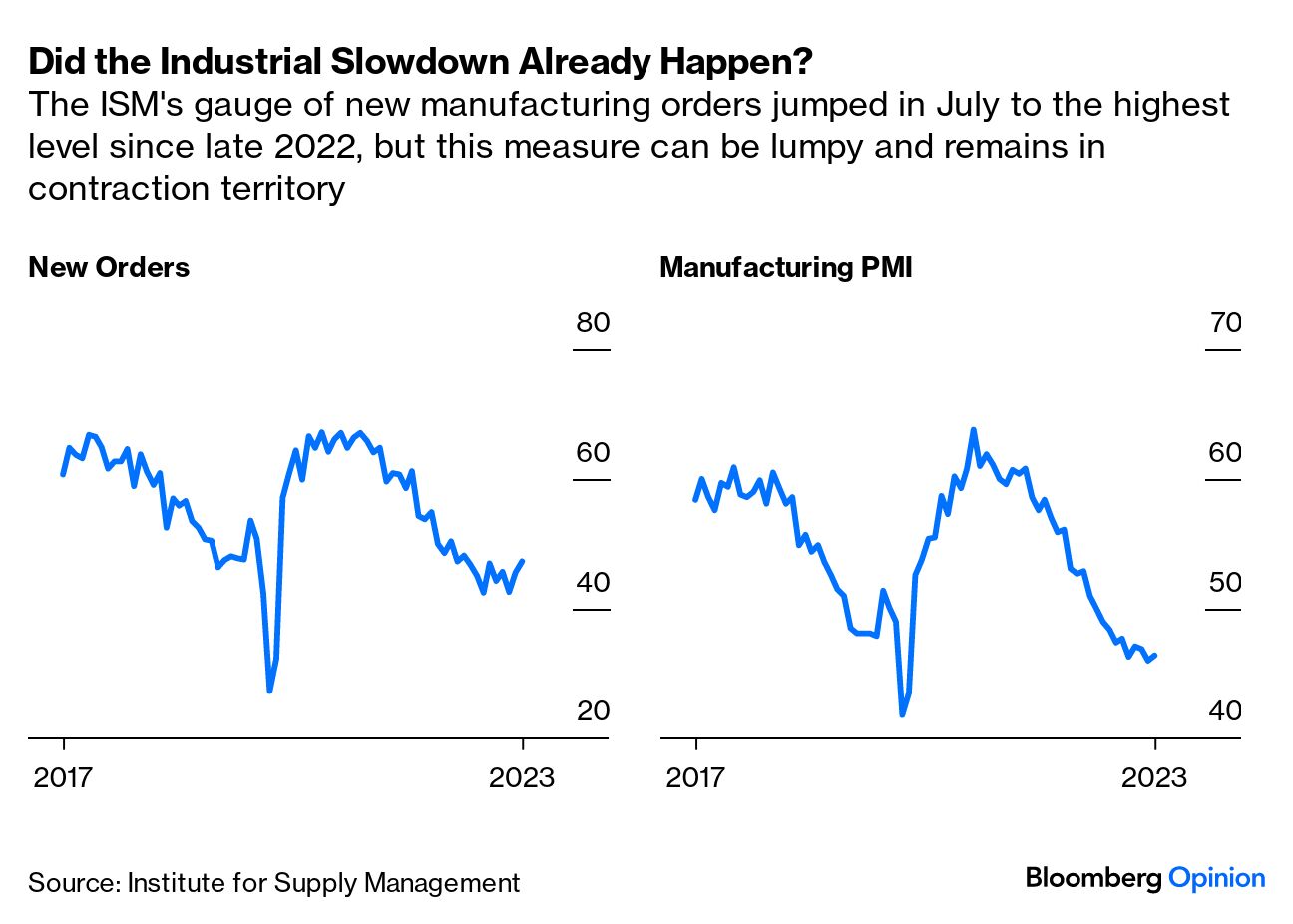

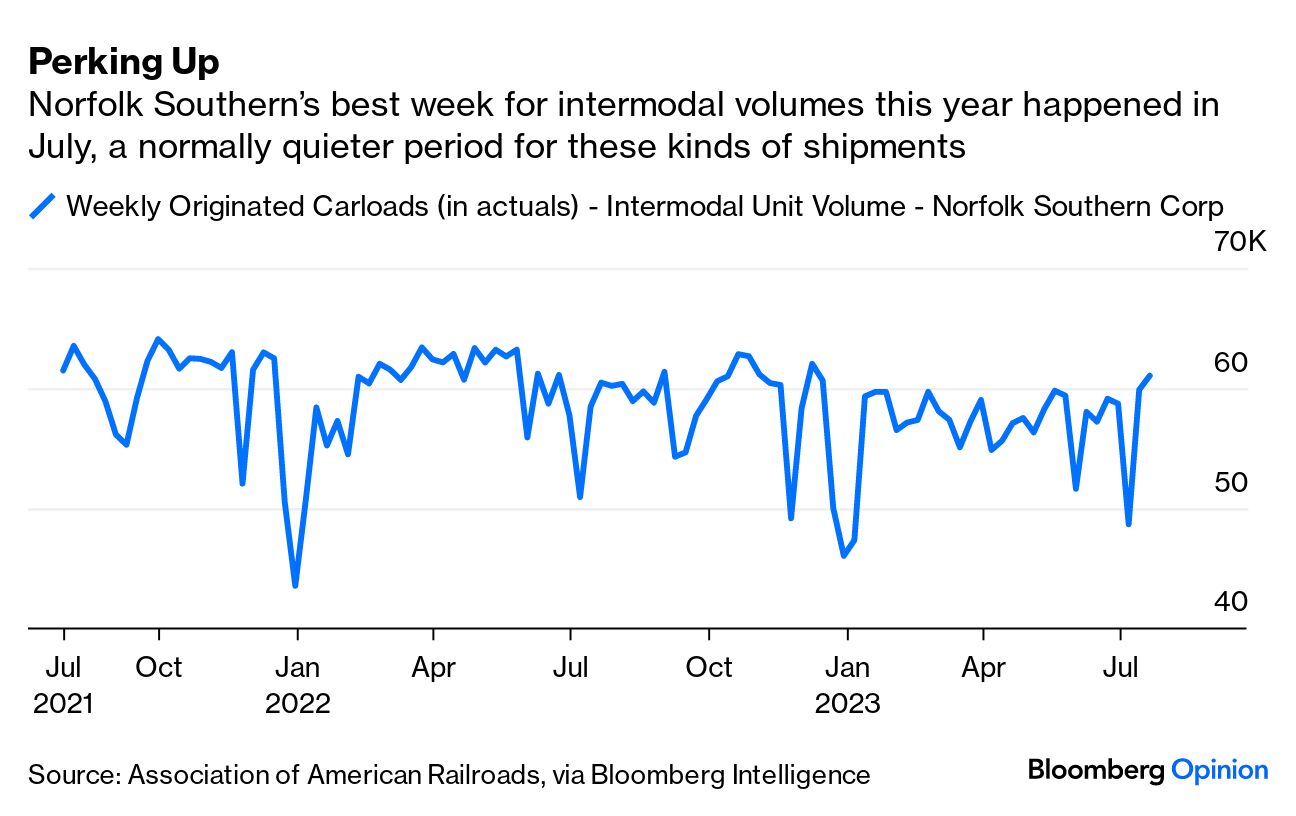

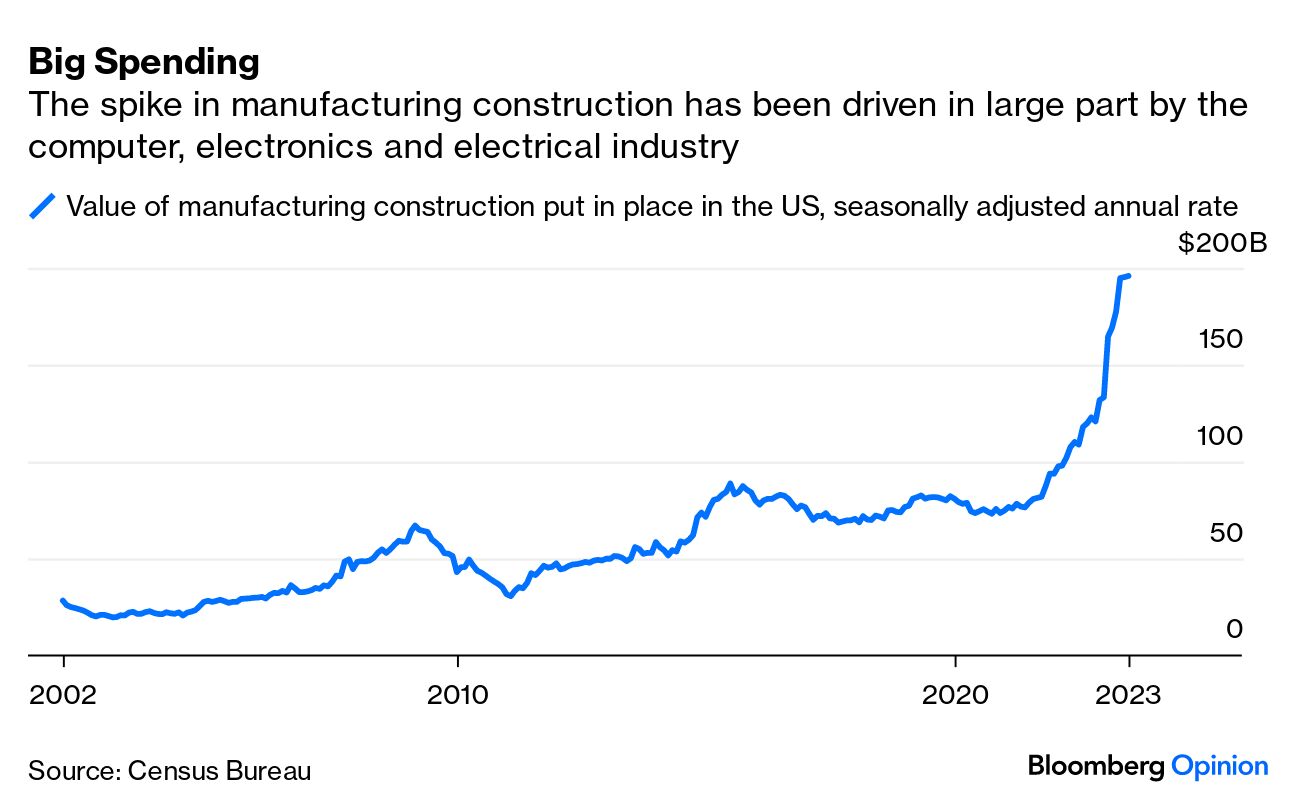

| It has been a fascinating earnings season, worthy of a bonus newsletter. Look for the regular issue on Friday. Have thoughts or feedback? Email me at bsutherland7@bloomberg.net US factory activity contracted for the ninth consecutive month in July, according to data released Tuesday by the Institute for Supply Management. But so far this earnings season, more than three-quarters of S&P 500 industrial companies have beaten analysts' earnings estimates, and about two-thirds have surpassed sales expectations. There were some signs of waning demand in this latest batch of earnings reports: Sales growth slowed at industrial distributors Fastenal Co. and W.W. Grainger Inc. amid more cautious spending by manufacturers, particularly small businesses; Dover Corp. cut its 2023 earnings guidance on weaker sales expectations for its clean-energy and fueling and imaging and identification units; Rockwell Automation Inc. trimmed its outlook for fiscal 2023 orders and its year-end backlog and lowered the high end of its organic growth forecast; and evidence is building that the post-pandemic travel boom is running out of steam domestically. The ISM's gauges of factory production and new orders, however, have moved well beyond early warning signs. The former measure in July bounced off the weakest levels since the depths of the pandemic. Granted, these are diffusion indexes, but they still suggest a much different narrative for the industrial economy this year. Moody's Investors Service has a negative outlook on the global manufacturing sector. And yet the S&P 500 Industrial Index keeps chugging higher and is heading for a fresh record.  This divergence between benchmark data and individual company narratives has added another confounding wrinkle to the debate about when the most-anticipated recession might happen or whether it will happen at all. Is the industrial economy finding a bottom, just starting to slow or simply hitting a speed bump? One explanation for the contrast between manufacturing data points and earnings is that the current economic climate is more challenging for small companies that aren't included in the S&P 500 and may not even be publicly traded but account for a much larger portion of the overall industrial economy than the biggest names. These enterprises are more vulnerable to the effects of rising interest rates and are less likely to participate in a wave of multibillion-dollar semiconductor and electric-vehicle factory projects for which companies prefer the reliability of larger manufacturers and service providers. But a world in which business booms only at the top of the industrial food chain isn't sustainable because these companies tend to sell to one another and rely on supply chains composed of hundreds of different entities. Examples of big industrials pulling back on capital expenditures remain few and far between.  The biggest industrial companies are the biggest for a reason. So what do their chief executive officers think about the trajectory of the economy? Here's some perspective from interviews with leaders across a wide swath of the industrial sector, from rail and steel to chemicals, electrical equipment and factory automation: Norfolk Southern Corp. "Even though there is some economic uncertainty out there and demand is somewhat muted, particularly in truck-competitive markets, our population of conductor trainees is near an all-time high because I know that the economy is going to recover. I know that the consumer is going to recover. We're investing through that. We're investing in locomotives and intermodal facilities. We're investing in technology. We're investing in rail cars and we're investing in our people as well." — CEO Alan Shaw Norfolk Southern had 961 conductors in training as of July. While that pipeline will shrink as the railroad fills its staffing needs, the company is still hiring, Shaw said. The company is planning to spend $2.2 billion on capital expenditures this year, the highest annual outlay since 2015. Second-quarter operating results at Norfolk Southern were dragged down by a slump in revenues from intermodal shipments, a category of freight that involves goods that can be transferred from ships to either rails or trucks and is dominated by consumer products. But the company is forecasting a modest uptick in rail volumes in the second half of the year, in part because of improving service levels as it gets operations back on track after the February derailment in East Palestine, Ohio. Norfolk Southern doubled its estimate for costs associated with the accident, including environmental cleanup, to about $800 million, resulting in a $416 million charge in the second quarter. The accrual doesn't reflect potential payouts from insurance or recoveries from third parties that may bear some responsibility for the accident. Read more: Norfolk Southern Chooses a Different Track Shaw also pointed to data from the Conference Board showing consumer confidence rebounded to a two-year high in July and retail sales that are still growing, if not outperforming expectations. Norfolk Southern's best week for intermodal volumes this year was in July, a normally quieter period for these kinds of shipments, suggesting at least a stabilization if not a recovery as retailers work through the glut of inventory they built up during the post-pandemic supply chain snarls. "The US consumer is a little bit stronger than what a lot of economists thought," Shaw said. "What we're seeing as I talk to our channel partners and intermodal customers is that the inventory destocking that had marked the beginning of the year is probably at an end." Meanwhile, "frankly there's a manufacturing super-cycle going on right now," he said. Shipments of aggregates, metals and other construction materials are booming amid a surge in spending on new factory investments. By Norfolk Southern's count, more than $70 billion worth of North American projects have been announced in the electric-vehicle battery supply chain in the past 18 months, with about a third of those investments targeting facility construction near the railroad's lines.  Rockwell Automation Inc. "For now, we have decoupled from the traditional indicator that we were most highly correlated to for decades, and that is industrial production. ... With the volatility from supply chain shortages, Covid and so on, as well as generational-high levels of automation in certain industries like EV and battery, we are decoupled." — CEO Blake Moret US industrial production declined in June for the second consecutive month, according to Federal Reserve data. Rockwell's results for the three months ending in June fell short of analysts' expectations, but organic sales still jumped 13.2% relative to the period a year earlier, and the company is forecasting growth of as much as 16% for fiscal 2023. The company expects to end the year with $4.5 billion to $5 billion of orders in its backlog. At that level of demand, "it's fair to assume we're going to remain decoupled" from broader manufacturing benchmarks, Moret said. While the high levels of spending in the electric vehicle, battery, life sciences and renewables markets provide a robust backstop for Rockwell, concerns about cybersecurity, operational resiliency and labor shortages are driving greater investment in automation across the economy, from food processors to tissue manufacturers. Still, Rockwell shares tumbled on Tuesday by the most in more than a year after the company trimmed its outlook for order activity. As lead times for supply chain inputs improve, machine builders don't need to place unusually large advance orders to guarantee availability even though underlying demand remains strong, Moret said. Distributors are still sitting on a high level of equipment that's been committed to a specific customer but is missing some final components. Once that inventory can be cleared and free cash flow freed up, distributors should start placing orders to restock, he said. While Rockwell is experiencing an uptick in cancellations from China and among e-commerce customers who have realized they don't need quite as many fulfillment centers right now, the overall rate remains low. "The vast majority of customers, they want their stuff, and fortunately with every week that goes by we're able to deliver more," Moret said. Nucor Corp. "Like every other CEO and company, maybe I'm a little optimistic but I also feel like I'm a realist. ... There's much more resiliency in the market place than we give it credit for. Consumer spending continues to be strong. The piece that's different from 2008 and 2009 is manufacturing spend and buildout is at historic highs. There's $190 billion in manufacturing spending. The 2010-2020 average was $60 billion. So that's three times the spend. We've never seen that kind of stimulus." — CEO Leon Topalian Nucor's second-quarter sales slipped 19% relative to the period a year earlier, and the company forecast a sequential declaration in earnings in the current period amid lower prices for steel and related products. But volumes for its steel mill and steel products operations are expected to be stable amid robust demand for nonresidential construction activity, including data center, infrastructure and factory investments. Topalian pointed out that dire forecasts for paltry gross domestic product growth in the second quarter ended up being wildly off base. "We would have to have a deadly Omicron variant and for the entire economy to shut down" for those economic predictions to have been accurate, he said.  Nucor is working its way through a $10 billion capital expenditure plan that includes a $3.1 billion sheet mill in West Virginia for which the company locked up final government permits last week. Separately, "there are a lot of irons in the fire" on potential acquisitions as part of Nucor's strategy to expand beyond traditional steelmaking into scrap processing and finished products, Topalian said. The company has already spent a combined $4.4 billion buying garage-door manufacturer C.H. I. Overhead Doors, Cornerstone Building Brands Inc.'s insulated metal panel business and a pair of steel-racking companies. Read more: Nucor Sees a Big Opening in Garage Doors Chemours Co. "People did buy a lot of inventory because there was so much risk in the supply chain dynamics during Covid. Input costs are coming down, so there could be a view of 'Hey, I'm willing to start restocking, but I want to see more moderation in input costs and prices.' And then third, interest rates are higher so the carrying costs of inventory are higher. That along with, 'Are we going to have a soft landing?' and 'When we will have a US recession?' or 'Will we have a recession?' That uncertainty is playing into the desire for folks to be more cautious on the inventory front ." — CEO Mark Newman Chemours' sales in the second quarter dropped 14% from the period a year earlier amid a slump in its unit that sells titanium dioxide used in coatings, plastics and laminates and parts of its advanced performance materials division that are tied to broad industrial markets or construction, such as cabling. The company cut its adjusted profit guidance for the year and also announced that it would close a titanium technologies plant in Taiwan. The shutdown reflects progress Chemours has made at clearing bottlenecks and boosting productivity at its remaining titanium plants and also a need to be proactive on managing operating expenses now that the downturn in that market appears to be more sustained, Newman said. Coming into 2023, Chemours had expected a gradual recovery in the first half of the year and then a more significant pickup in demand in the back half. Now, "our view is this gradual recovery is going to continue. The expectation of a more robust second half is not playing out," Newman said. "There's probably less visibility on the order book in some of the more economically sensitive areas, such as construction and remodeling. But it doesn't mean we won't ultimately see a recovery. It's just not materializing in a meaningful way in the second half." On the other hand, Chemours is sold out of Teflon resins that are used in semiconductor manufacturing and Nafion membranes used for energy storage, fuel cells and hydrogen production. Continued strong demand for low-global-warming refrigerants is supporting the company's thermal and specialized solutions division. "It's not like all aspects of the economy are down," Newman said, adding that he didn't agree with the characterization of Lanxess AG CEO Matthias Zachert that the chemicals industry is facing a "Lehman II" moment. To that end, Chemours still expects to spend $400 million on capital expenditures this year. Schneider Electric SE

"If I only looked at office and residential, I would sit here crying. But I don't." — CEO Peter Herweck Schneider raised its targets for revenue and profit growth this year as booming demand for data centers capable of processing artificial intelligence and the electrification of the energy supply draws customers to its equipment. Orders are still growing faster than revenue across the company, even as Schneider posted double-digit organic sales gains in both its energy management and industrial automation businesses globally in the second quarter. There's some "weakness" in residential building construction but also signs of stabilization in certain geographies based on economic indicators, Herweck said. On the other hand, New York's empty office space could fill 26 Empire State buildings, as a recent New York Times analysis showed. That market is what it is, but Schneider is seeing demand for refurbishments focused on improving resiliency or lowering energy costs. Where Schneider truly thrives is in what Herweck calls "more complex buildings" such as hospitals that require sophisticated power management systems or warehouses and hotels that need more automation and sustainability improvements; that business is strong. |

No comments:

Post a Comment