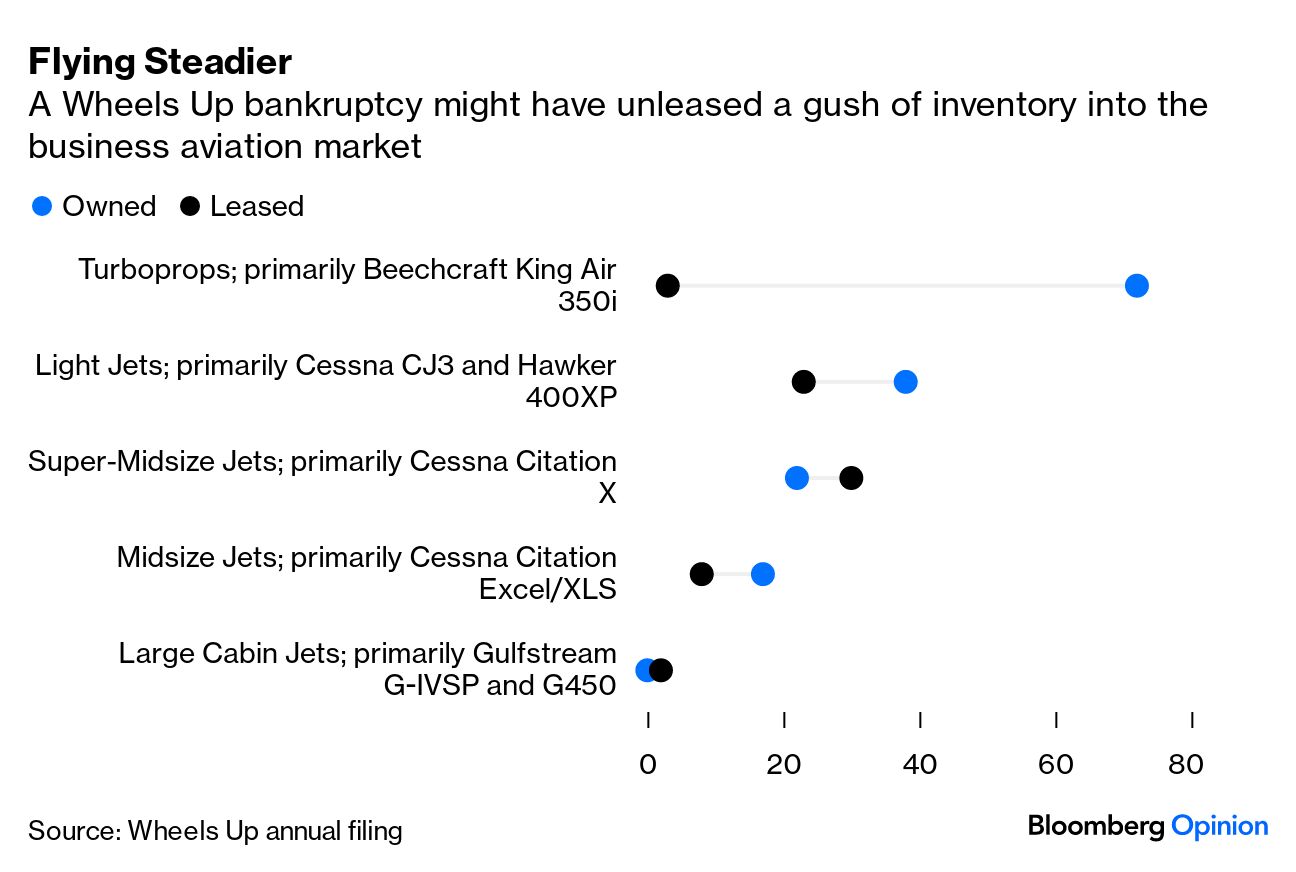

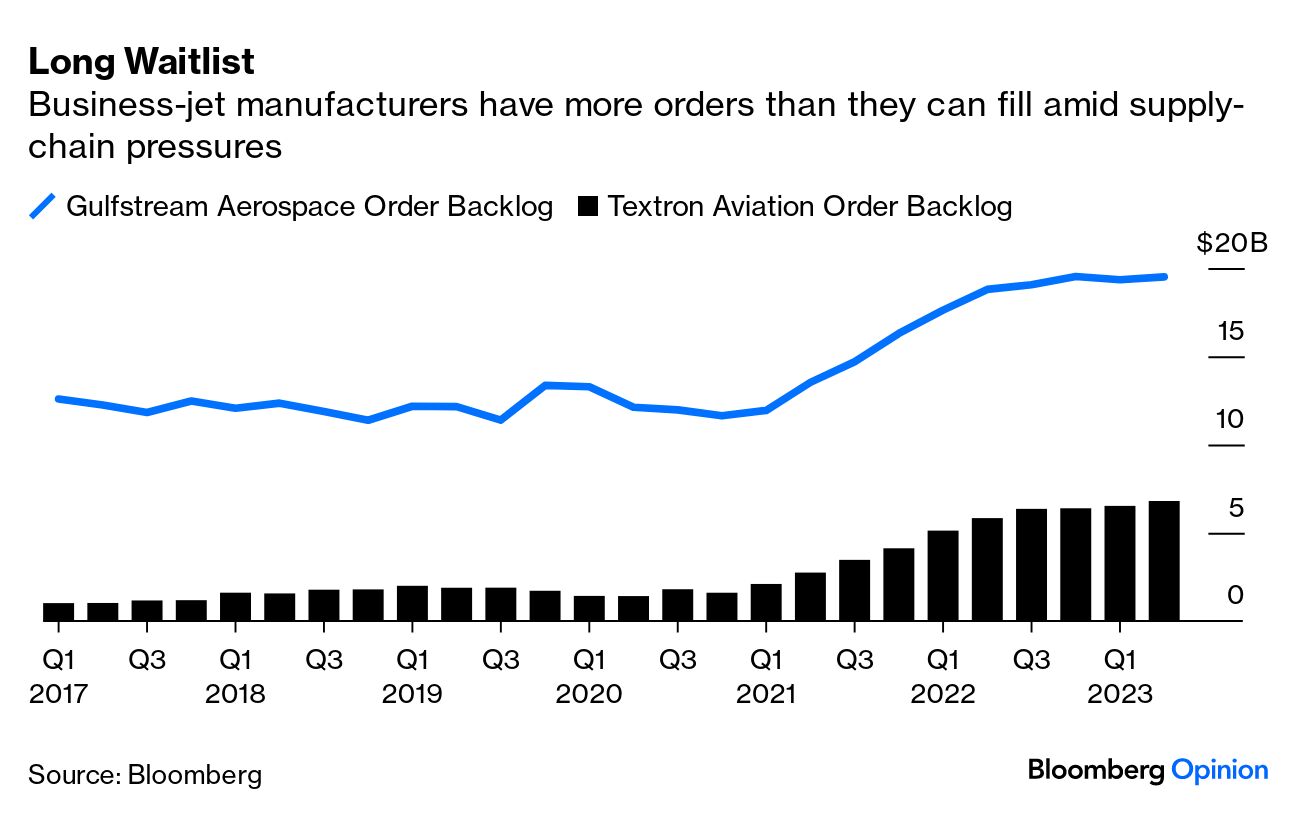

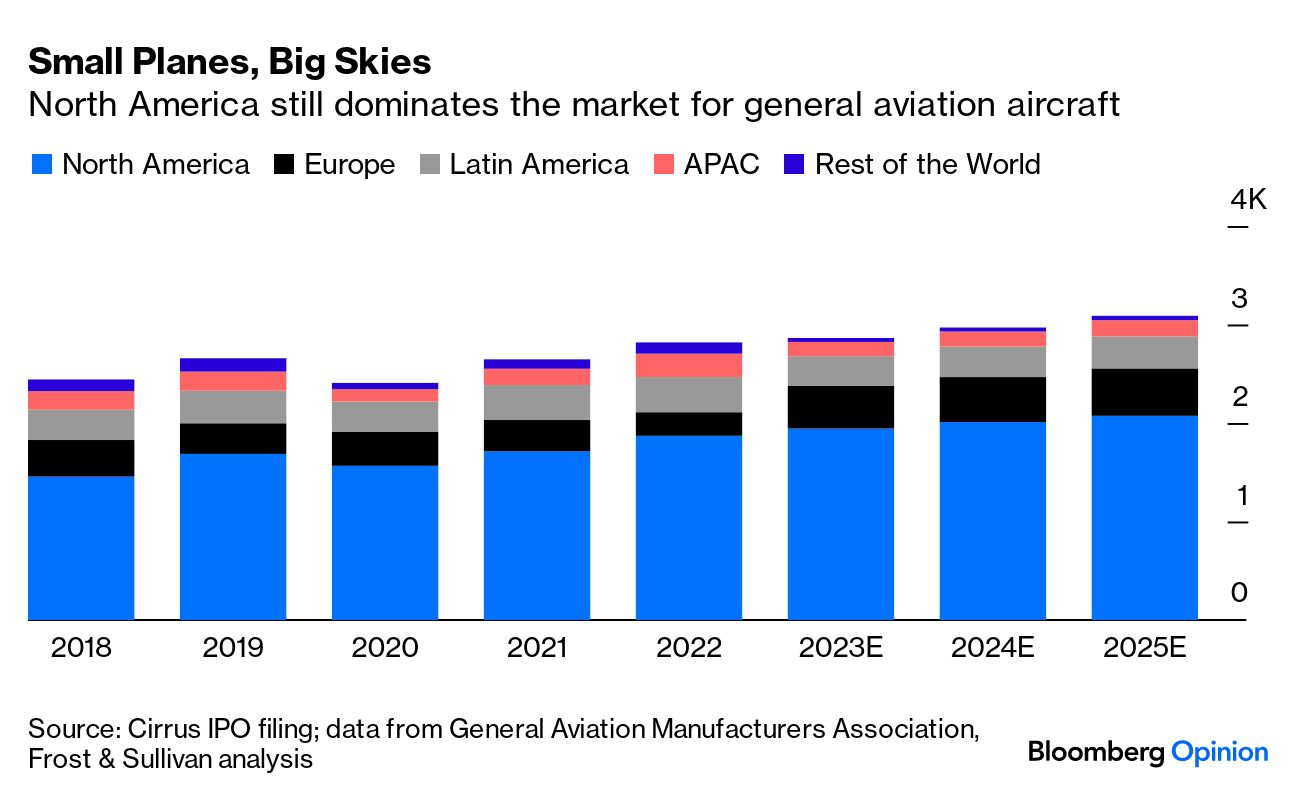

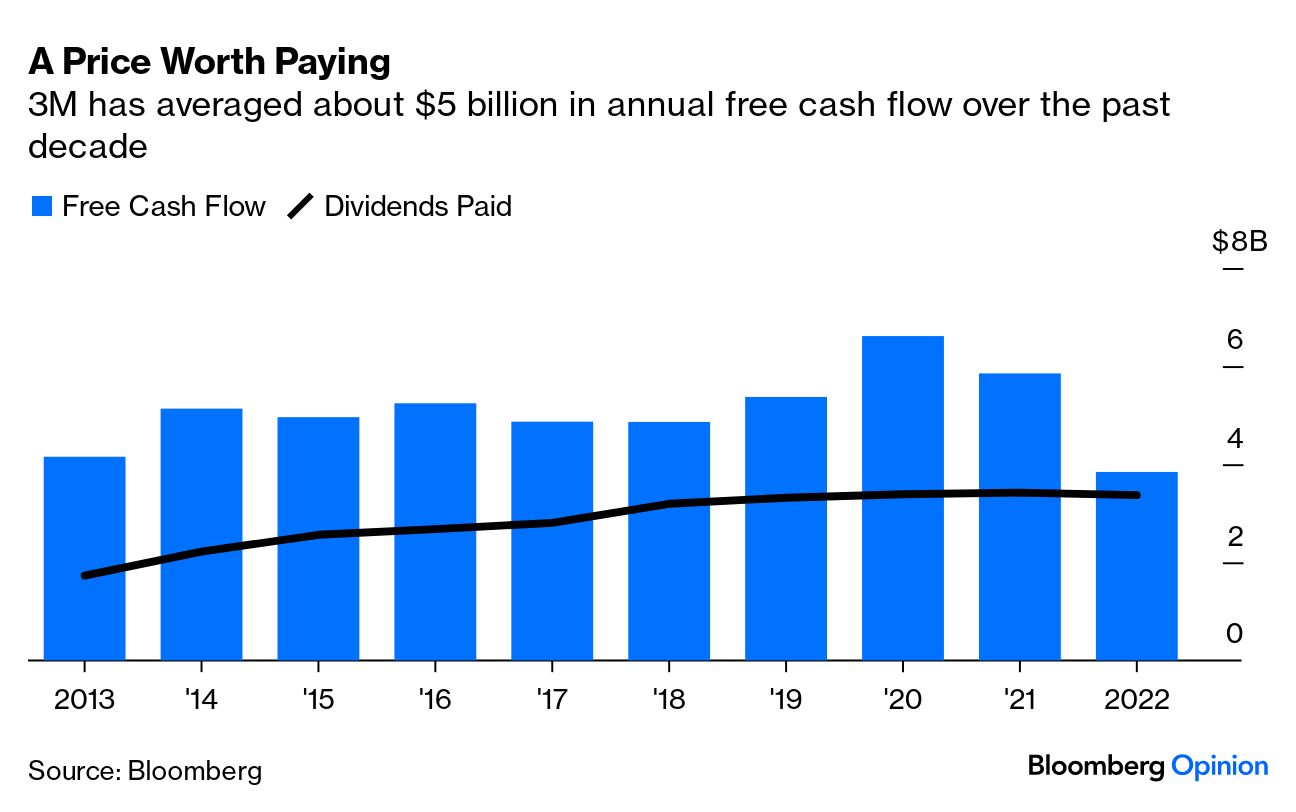

| Industrial Strength is in your inbox early this week. Look for the next regular issue on Sept. 8. Enjoy a great Labor Day weekend! Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net The private-jet industry — notorious for its booms and busts — might actually come in for a smooth financial landing this time. Demand for private planes soared during the pandemic among those able to pay for the privilege as flyers shunned commercial airports. At first this was because of health reasons, but extensive travel disruptions as the airline industry attempted to restart drastically widened the experience gap between a first-class ticket and a seat farther afield from the masses. Demand was so hot that inventory of pre-owned jets for sale shrank to historic lows; manufacturers struggled to keep up with orders. "Things got truly stupid," Neil Book, chief executive officer of Jet Support Services Inc., a provider of business aviation maintenance programs, parts sourcing and aircraft financing, said in an interview at Bloomberg's New York headquarters this week. "People who had never bought a jet before but chartered once said, 'Oh, god, I love this, I'm going to buy a jet.' They would have no conditions to closing" — including waiving pre-purchase inspections. Planes sometimes sold in a matter of hours. While that doesn't sound like a recipe for industry stability, there haven't been many distressed business-jet situations for buyers looking for a bargain, apart from a few cases involving crypto millionaires, Book said. Wheels Up Experience Inc., the private-jet service operator that went public in 2021 by merging with a blank-check firm, came uncomfortably close to a bankruptcy filing this summer but negotiated a rescue package led by Delta Air Lines Inc. and investors Knighthead Capital Management and Certares Management. Should that situation have ended differently, more than 200 Gulfstream, Cessna and Beechcraft jets could have ended up being sold to raise money for creditors, potentially creating a flood of inventory that would have depressed prices. Instead, the Delta lifeline has had a "stabilizing effect," Book said.  Despite rising interest rates and a regional banking scare earlier this year, the economy overall has proved remarkably resilient. Even those sectors that have faced a serious downturn — such as freight markets — are starting to anticipate a rebound. Economists from JPMorgan Chase & Co. and Bank of America Corp. and the staff at the Federal Reserve have all pushed out forecasts for a broader recession in recent months. While there are some worrisome data points on the health of the US consumer and an expanding inventory glut across the industrial sector, there's nothing so dire in the economic tea leaves that would suggest a mass fire sale of private planes akin to what took place in the wake of the 2008 financial crisis. The "carelessness and naïveté" of some buyers during the pandemic boom is being offset by production discipline among the private-jet manufacturers, Book said. Vertical Research analyst Rob Stallard estimates about 650 business jets will be delivered this year, compared with 1,100 at the peak in 2008 and about 680 pre-Covid. Orders for General Dynamics Corp.'s Gulfstream jets have continued to grow faster than the company can deliver them. As of the second quarter, more Gulfstream jets are in the backlog than at any point in more than a decade. Textron Inc. — which makes Cessna and Beechcraft planes — said pricing on new jets is outpacing inflation and the drag from supply-chain inefficiencies, even though cost pressures still linger. Bombardier Inc. reported no cancellations in the second quarter, and its order intake in the first half of the year roughly matched its shipments.  Honeywell International Inc. — which makes cockpit controls and engines for private jets — publishes an annual survey on the market, with the most recent update in October 2022 calling for 8,500 deliveries over the next decade. That marked a 15% increase from the 2021 forecast and was 12% higher than the pre-pandemic survey. Business-jet demand is moderating: Global activity is trending down about 4% in August compared with 2022 levels, according to data from WingX, an aviation data and consultancy company. But the industry is stabilizing at an elevated level rather than slumping. In North America, the largest market for business jets, year-to-date activity is still up 18% compared with pre-pandemic levels, WingX says. There are some states where private plane flights are below the pace of 2019, most notably New York and California, but on the other hand, activity is up 37% in Florida and about 25% in Tennessee, so this may simply reflect a population shift. "The volume of pre-owned transactions is normalizing, and the days on market for aircraft is a bit longer now compared to what it was before," Megha Bhatia, JSSI's chief marketing and strategy officer, said. Prices are still higher than 2019, though, and are settling at a healthier level that indicates more thoughtful purchases, she said.  Interestingly, while the commercial airline industry is hoping that China will add another leg to the post-Covid travel recovery, "I see it going the other direction for business aviation," Book said. The market for private planes in the country has remained quite small compared with those for North America and Europe amid a tougher regulatory backdrop despite frequent bouts of optimism. There were about 300 private planes in mainland China at the end of 2022, a decline of 11% from the previous year, according to aviation data company Global Sky Media. "Deliveries are way down, transactions are all going one way — largely aircraft selling from China elsewhere," Book said. "We just don't see — at least short term — a lot of growth opportunities there." Negotiating financing for Chinese-registered aircraft would also be a struggle amid concerns about operational control, he said. Read more: Ties to China Weren't a Problem. Now They Are "$6 billion sounds like a lot of money. But it's really not." — Elizabeth Burch, a University of Georgia law professor who specializes in multidistrict litigation Burch made the comments in an interview with Bloomberg News in reference to 3M's agreement to pay $5 billion in cash and $1 billion in common stock to resolve claims that the company knowingly sold defective earplugs to the US military, leading to hearing loss and tinnitus for service members. 3M acquired the Aearo Technologies subsidiary that made the earplugs in 2008, and the products in question were sold from 1999 to 2015. Plaintiffs had increasingly been winning bellwether trials with an average award of more than $20 million before 3M decided to put Aearo into bankruptcy as a means of speeding a resolution. The payouts to date implied a total liability far greater than the company's roughly $60 billion market value, and analysts had coalesced around settlement estimates in the $10 billion range, so by comparison, a $6 billion deal is a bargain. For context, 3M has averaged about $5 billion in annual free cash flow over the past decade and is on track to pocket a decent chunk of cash by loading up its health-care business with debt for a spinoff later this year. 3M and Aearo are also seeking recoveries from insurers that could offset some of the settlement payments.  A settlement was the only real solution, and the greater sense of urgency the company is showing on resolving its myriad legal issues is a welcome development. 3M's market value has shrunk by almost $20 billion since it announced the Aearo bankruptcy last July — even after factoring in this week's gains on news of the settlement — and is down more than $50 billion from what it was when Mike Roman became chief executive officer in 2018 as uncertainties around the company's various legal woes turned investors off from the stock. 3M separately this week fine-tuned the details of deal that could be worth as much as $12.5 billion to resolve claims that per- and polyfluoroalkyl substances (PFAS) made by the company polluted drinking water supplies. But the earplug settlement is structured around participation from at least 98% of plaintiffs, and the full settlement amount is contingent on even higher levels of agreement. More than 250,000 cases were pending as of Aug. 15, according to the US Judicial Panel on Multidistrict Litigation. Not all of those plaintiffs will qualify for compensation, and some affected veterans will merit larger payouts than others, but the average implied award is a little more than $20,000 — before subtracting out legal fees. Recall that the successful plaintiffs in the bellwether trials had received more than $20 million on average. To Burch's point, when you start digging into the details, $6 billion isn't really that much money. Read more: 3M Earplug Payout Would Still Just Be a Start Somewhat curiously, Bryan Aylstock, a Florida-based lawyer for the earplug plaintiffs, touted the deal to Bloomberg News as achieving "real value" for clients "without pushing the company into bankruptcy." 3M's various multibillion-dollar settlement deals are certainly a drag on its finances; S&P Global Ratings this week cut the company's credit rating to BBB+ from A-. The company's legal headaches are also far from over. The pending PFAS settlement is specific to drinking water claims by public US water systems. Other remaining outstanding PFAS items could include claims from state attorneys general, the federal Environmental Protection Agency and US military, foreign governments such as Belgium and the Netherlands, personal injury and property lawsuits from the broader population, the cost of cleaning up areas near 3M's legacy PFAS manufacturing sites and legal action from commercial and industrial customers that the company supplied with PFAS. Wastewater utilities may also require a separate payout. All told, Barclays Plc analyst Julian Mitchell estimates that an additional $16 billion of potential PFAS liabilities for 3M are yet to be resolved — and that excludes any settlements with foreign governments. But these aren't new issues. At no point in covering this saga have I ever had any serious conversations with anyone worried about a 3M bankruptcy — and remember many analysts were estimating an earplug settlement closer to $10 billion. Sure, the dividend might get cut and probably should be lower, with the PFAS water settlement alone soaking up much of the company's free cash flow after the health-care spinoff. But one reason a judge threw out Aearo's bankruptcy filing was because the unit was supported by a "financially healthy, Fortune 500 multinational conglomerate." Asked on a call with analysts whether 3M's decision to fund part of the earplugs settlement with stock should be interpreted as a sign that the balance sheet is in under pressure, executives said they wouldn't characterize it like that. 3M has maintained that the earplugs were safe and effective when used properly and says the tentative settlement agreement isn't an admission of liability. Boeing Co. may soon deliver its first 737 Max jet to China since the country led the way in grounding the model in March 2019 after the second of two fatal crashes. The planemaker this month moved two aircraft originally built for Chinese airlines out of storage, with Bloomberg News reporting that China Southern Airlines Co., the country's largest carrier, would be the first to restart deliveries. Separately, Air China Ltd. signaled this week that it would take deliveries of 12 Max planes this year and double that number in 2024. China was slower than much of the world to allow the Max back into its airspace amid the pandemic drag on travel demand and a complicated trading relationship with the US, for which airplanes are one of the largest exports on a dollar basis. But Max jets began flying again in China earlier this year, and the country has since returned nearly all of its planes to commercial service. Of the 220 Max jets that Boeing had in inventory at the end of the second quarter, 85 are for Chinese customers and an additional 55 were initially destined for the country but have since been remarketed to other customers. Restarting deliveries to China is an important part of Boeing's plan to clear out most of the Max inventory accumulated over the course of that plane's struggles by the end of 2024 and to boost the company's free cash flow to $10 billion by the middle of the decade. It's unclear at this point how the timing of any deliveries to China might be affected by the latest manufacturing glitch on the Max, this one involving improperly drilled fastener holes on a structural component that helps maintain cabin pressure. Reimagining building materials for climate change

Italy airfare caps may just be the beginning

The future of making steel isn't blast furnaces

This isn't a good time to cut wages for TSA staff

Tolerance wanes for hotels charging high prices for poor service

A suburb that runs on electric golf carts

Why is Wi-Fi so terrible on trains? |

No comments:

Post a Comment