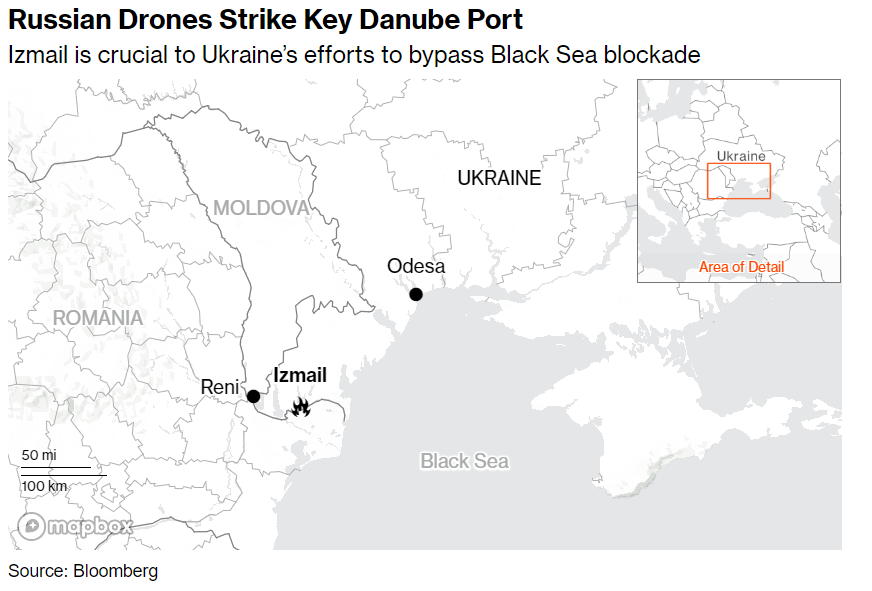

| Russia's exit from the Black Sea grain export deal last month raised the stakes in the effort to keep Ukrainian supplies flowing. At issue is global access to food and affordability at a time when inflation shows few signs of letting up. Food supply risks are multiplying again, with extreme weather and India's rice export restrictions adding to the concerns. As a result, global food prices are on the rise. According to data released Friday, the United Nations' global food index rose for the first time in three months in July. The rice index reached its highest nominal level since 2011. Ukraine has redirected some crop exports by rail, road and river through its European neighbors, but those volumes are causing tensions. Poland, Slovakia and Hungary, along with Bulgaria and Romania, have banned purchases of Ukrainian grain after declining prices spurred protests from local farmers. A key route to ship Ukrainian grain is the Danube, though that's expensive and lacks capacity. The Kremlin has also escalated assaults on grain infrastructure in Ukraine, including attacking Danube ports. It also fired missiles that damaged equipment at a cargo terminal in the Odesa region.  The options for farmers who made Ukraine a global breadbasket are narrowing as the economics of their business deteriorates. They have limited storage space as this year's harvest piles up. Major farm companies are curbing winter crop plantings. Decisions taken over the next few weeks in Ukraine — for wheat, barley and rapeseed — will have repercussions for the 2024 harvest. That will hit both Kyiv's precious wartime revenues, and global supplies of key food staples. Meanwhile, more than 90 countries joined the US in signing a joint communique condemning the weaponization of food, according to US Secretary of State Antony Blinken. Leading a UN debate on efforts to combat global hunger, he zeroed in on Russia for disrupting the flow of food with its war on Ukraine and the grain deal exit. Another sign of Russia using food as a political tool: It may offer cheaper grain exports to countries that have not imposed sanctions. The government could get the power to lower duties on commodities exports including grain and fertilizers to "friendly" countries, Prime Minister Mikhail Mishustin said this week. Diplomatic efforts are still underway to persuade Russia to return to talks on the export deal from countries including South Africa, which has adopted a non-aligned stance toward the war. |

No comments:

Post a Comment