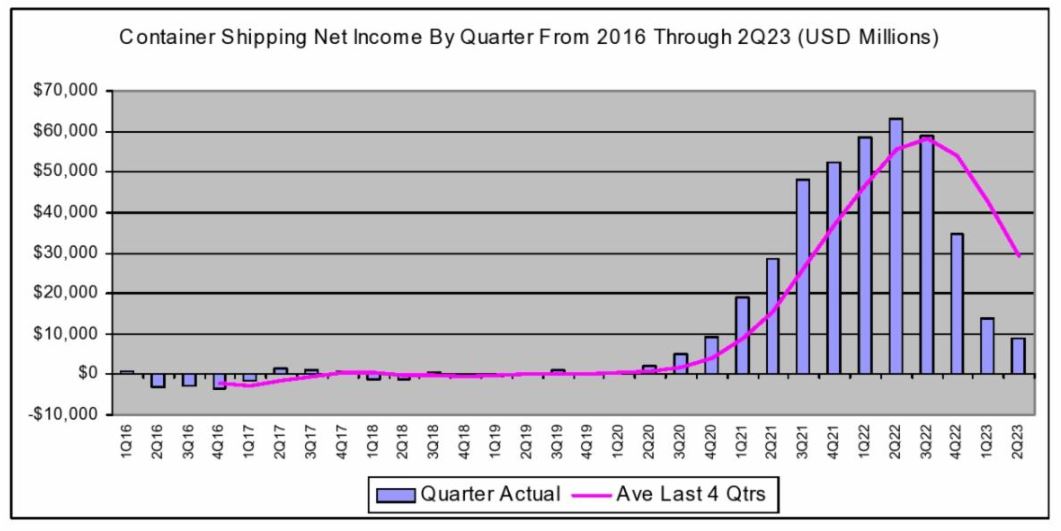

| A bidding process for a controlling stake in South Korea's biggest container carrier has revived a debate over state ownership in an industry key to the Asian country's future as an export power. Hapag-Lloyd, the top player based in Germany, didn't make the shortlist of bidders for Seoul-based HMM that included domestic investors Harim, Dongwon and LX Group. That's not surprising given that, since the 2017 bankruptcy of Hanjin Shipping, HMM is the only Korean player with the necessary heft to compete globally, according to Bloomberg Intelligence shipping analyst Kenneth Loh. What's more, the trade disruptions of the past three years have only reinforced the case for governments to have a bigger role protecting economic security with policies like foreign-ownership rules, tax breaks and preferential financing. "The pandemic and the ensuing supply-chain disruptions had also highlighted the importance of having a national champion that could safeguard domestic interests, such as by ensuring vital trade continues to flow smoothly," Loh said. "Seoul had probably always been more inclined to go with the option of keeping HMM Korean-owned." Read More: Shipping CEO Sees 'Green Shoots,' Says Rates Must Rise A spokesman for Hapag-Lloyd declined to comment, as did a spokesman for HMM. The two companies are partners in a vessel-sharing agreement called THE Alliance — one of three major container consortiums. Korean authorities have stressed the importance of having a local container carrier for the export-driven economy. Both countries' economies are large and rely on shipments abroad. Germany has the world's fourth-biggest economy and is the third-largest goods exporter, according to data compiled by Bloomberg and the WTO. Korea's economy ranks 10th overall and is sixth in total goods exports. Global trade and the industries that underpin it have been slumping all year, and an early reading of South Korea's monthly exports has served as a barometer of the slowdown. Data released Thursday showed Korean factory output fell in July, reaching its longest stretch of declines in decades. Vespucci Maritime CEO Lars Jensen said this in a LinkedIn post about Hapag-Lloyd's exclusion: "It does serve as yet another example that container carriers do not compete on a level playing field. Competition is skewed in all manner of ways and this is just one of them." Read More: Record $90 Billion in Ship Orders Loom Over Boom-Bust Industry The container shipping industry is coming off a period of record profits in 2021 and 2022 tied to pandemic-driven demand for goods. Many of the biggest companies are spending their windfalls on new, bigger vessels powered by cleaner-burning fuels to meet stricter industry emissions standards. Hapag-Lloyd's orderbook is less aggressive than its main rivals.  Source: McCown Container Results Observer According to figures released Wednesday by veteran shipping analyst John McCown, net income for the industry totaled $8.9 billion in the second quarter, an 86% drop from the all-time quarterly record a year earlier of $63.1 billion. But he still expects profit for the full year to be "well above" pre-pandemic performance. As for Hapag-Lloyd, it probably missed a chance to narrow the wide gap with China's Cosco, which Alphaliner ranks as the world's No. 4 carrier by total container capacity, according to Loh. "It's possible Hapag-Lloyd might seek other potential acquisition targets, albeit smaller ones than HMM, making use of the container-shipping downcycle to pick up targets at relatively attractive valuations," Loh said. —Brendan Murray in London |

No comments:

Post a Comment