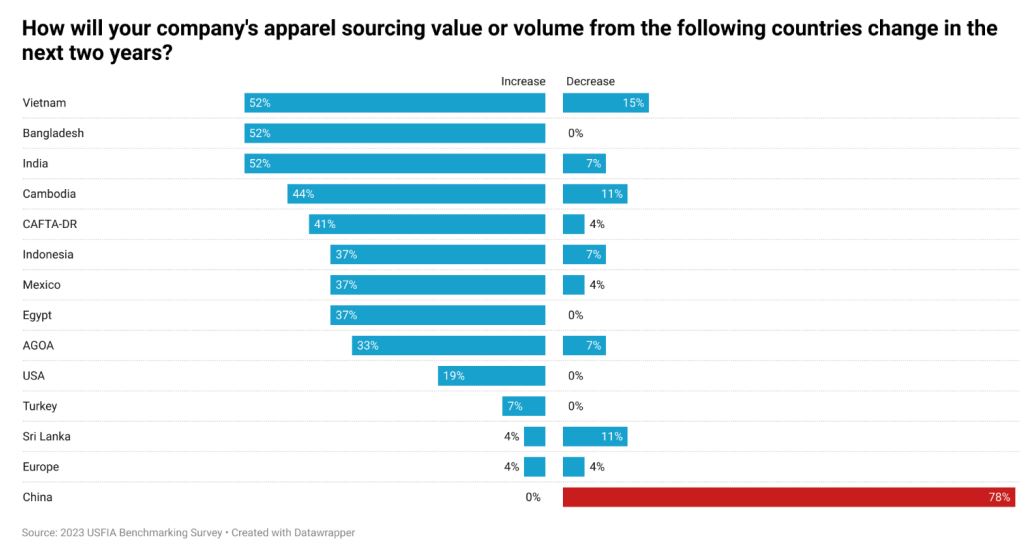

| A record number of US fashion companies no longer list China as their top supplier, the result of growing diplomatic uncertainty and concerns about forced labor. About 61% of apparel retail CEOs haves stopped using China as their primary supplier, up from 30% before the pandemic, according to a new survey by the US Fashion Industry Association and Sheng Lu, an associate professor of fashion and apparel studies at the University of Delaware. Almost 80% plan to reduce their sourcing from China over the next two years. Those companies are primarily leaving China for Vietnam, Bangladesh and India, which have relatively large-scale production capacity and stable economic and political situations, according to the report. "One of the few issues that unites Republicans and Democrats in the US Congress is their focus on the threat from China," USFIA president Julia Hughes wrote in the report. "Diversification seems like an appropriate way to summarize how the fashion industry is responding to the new level of economic and diplomatic uncertainty." QuickTake: Why US-China 'Decoupling' Prospect Is Getting Serious Breaking up with China is easier said than done for American fashion retailers, which for decades haverelied on the region for efficient and low-cost production. China also has machinery and a skilled workforce that can produce certain stitches, fabrics and styles that are hard to find in other garment-producing countries. But fears about weakening US-China relations, as well as the enforcement of the Uyghur Forced Labor Prevention Act — which bans imports of goods from the Xinjiang region of China — have been the impetus this year for retailers to find a supplier base elsewhere.  Source: USFIA survey Cotton products have been of particular concern, because Xinjiang is one of China's largest cotton-producing regions. Managing forced-labor risks in the supply chain ranked as the second-largest business challenge in 2023, following inflation and the economic outlook. Measured in value, US apparel imports from China fell to 18.3% in the first five months of this year, compared with 30% in 2019, the USFIA report found. China accounted for just 10% of cotton imports to the US, the lowest level since 2017. Read More: US Fashion Brands Urge Early Renewal of Africa Trade Program Meanwhile, US apparel imports from the five largest Asian suppliers other than China — Vietnam, Bangladesh, Indonesia, India and Cambodia — reached a new high of 44.3% over that same period. While there's no sign that US apparel companies are pursuing domestic production, many are nearshoring. Mexico, Guatemala and Nicaragua made it into the list of top 10 fashion suppliers this year, the report showed. The report was based on a survey of executives from 30 leading US fashion companies from April to June 2023, a majority of which have more than 1,000 employees. Relevant Stories: —Olivia Rockeman in New York |

No comments:

Post a Comment