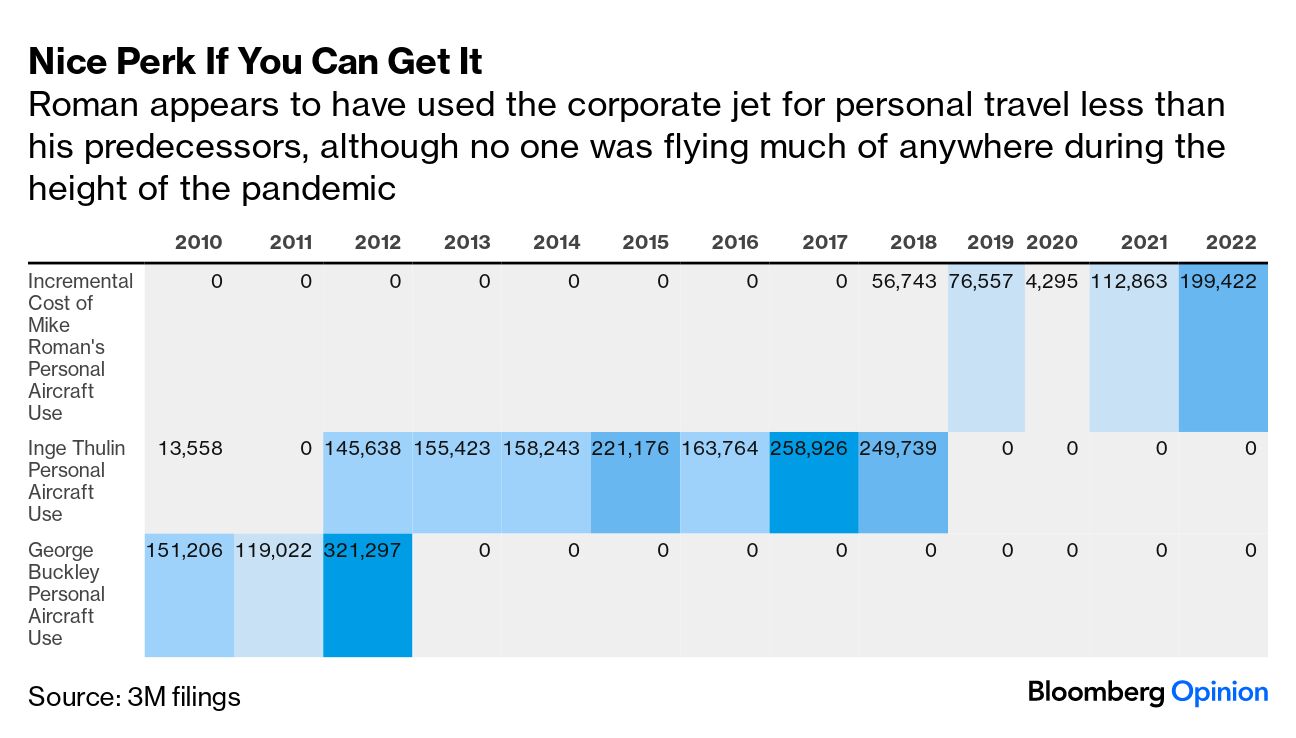

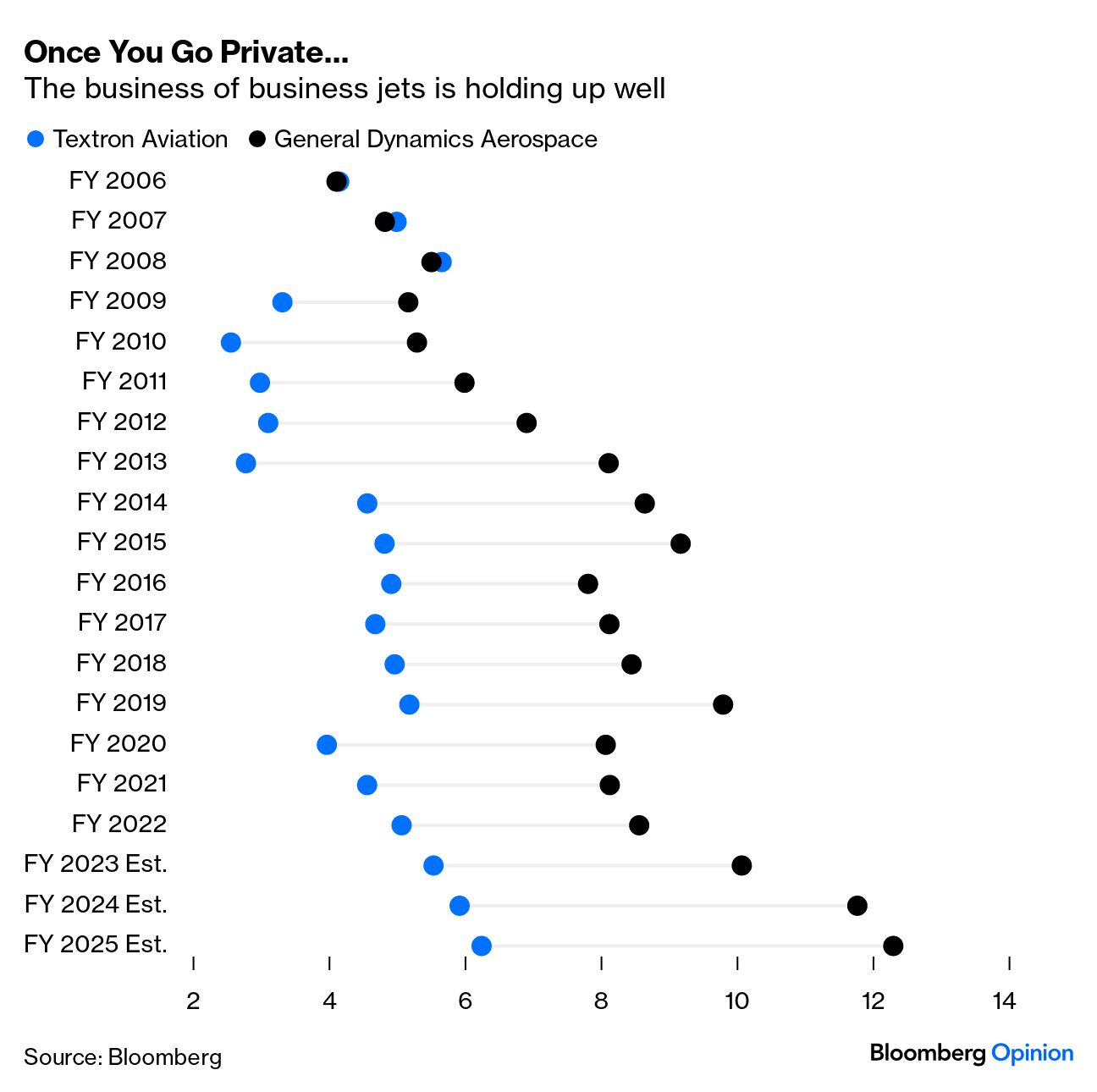

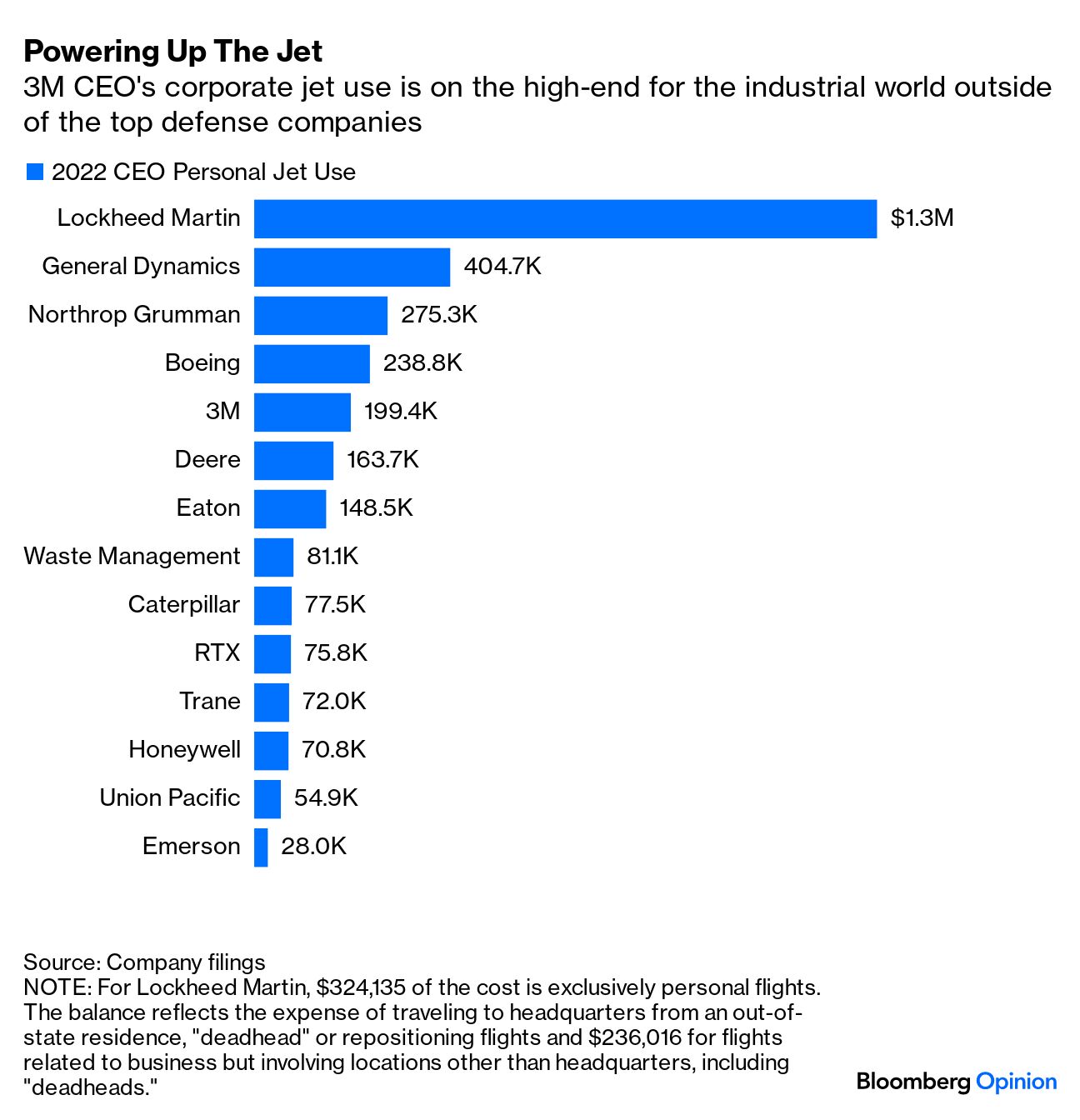

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net 3M Co. is grounding its corporate jet operations. That's more a reflection of the Post-it maker's continued struggles than a statement on a business jet market that boomed during the pandemic and has just kept booming. But the rethinking puts a spotlight on a long-standing corporate governance quibble: When is it appropriate for the chief executive officer to take the company plane on vacation? Under the mantle of CEO Mike Roman's commitment earlier this year to take "a deeper look at everything we do," 3M has announced 8,500 job cuts and a restructuring program aimed at shrinking the company's bloated corporate center, simplifying its supply chain and geographic footprint and better aligning its businesses with customers. As part of this cost-cutting push, 3M is exiting its "aviation operations and our conference center in northern Minnesota," 3M Chief Financial Officer Monish Patolawala said on a call last month to discuss the company's second-quarter results. "Conference center" calls to mind images of a single, boring building, but this is more like a corporate retreat that sits on about 680 acres and reportedly includes guest cottages, horseback riding trails and a fishing pond. A spokesman said that the aviation operations exit includes the use of 3M-operated aircraft and that the company is updating its policies accordingly. He declined to elaborate further. 3M has required its CEO to use company aircraft for both business and personal travel for security reasons since at least 2014, according to an analysis of its annual proxy filings. At that time, the company was led by Inge Thulin. His predecessor, George Buckley, was "allowed" to use planes owned by 3M for personal travel, "along with members of his family and invited guests," according to the company's filing for 2011. 3M's current policy also lets the CEO's spouse and other guests accompany him on personal flights. Roman became CEO in 2018. His personal use of 3M aircraft cost the company $199,422 in 2022, although this measure captures only "incremental cost" including fuel, landing and parking fees, trip preparation and on-board catering. Roman's total compensation in 2022 was $14 million.  3M's market value has shrunk by more than $50 billion during Roman's tenure as legacy legal headaches came to a head and the company delivered a lackluster operating performance marked by a string of earnings guidance cuts. 3M in June announced a deal to pay as much as $12.5 billion over 13 years to resolve claims that per- and polyfluoroalkyl substances (PFAS) made by the company polluted drinking water supplies. These substances are known as "forever chemicals" because they break down slowly in the environment and can accumulate in the body and cause health problems. Barclays Plc analyst Julian Mitchell estimates 3M faces an additional $24 billion in liabilities between additional outstanding PFAS exposure and separate litigation over earplugs sold to the US military that veterans contend were defective. The current restructuring push is the latest in a running trend of "streamlining" programs that 3M has announced since 2019. If anything, it's surprising that the corporate jets and the conference center didn't come under the cost-cutting knife sooner. But even as interest rates rise and economic worries continue to fester, most big companies are buying, not selling, private jets. Orders for General Dynamics Corp.'s Gulfstream jet have continued to grow faster than the company can deliver the planes. As of the second quarter, there are more Gulfstream jets in the backlog than there have been at any point in more than a decade. Large corporations in the US were the largest source of "vibrant" activity in the most recent period, with orders from the Middle East and Asia contributing to a lesser degree, General Dynamics CEO Phebe Novakovic said on a call to discuss the company's results. "It's really the Fortune 500s that are really driving the demand," she said. "These are long-established customers as well as new Fortune 500 customers."  Textron Inc. — which makes Cessna and Beechcraft planes — said its aviation backlog expanded by $350 million to $6.8 billion in the second quarter. "We continue to be really happy with how the market is behaving in terms of demand and pricing," CEO Scott Donnelly said on the company's earnings call. Pricing on new jets is outpacing inflation and the drag from supply-chain inefficiencies, even though cost pressures still linger, he said. Bombardier Inc. reported no cancellations in the second quarter, and its order intake in the first half of the year roughly matched its shipments. Business jet activity across North America in 2023 is trending 6% below last year's levels through July 30 but is up 18% compared with pre-pandemic levels, according to data from WingX, an aviation data and consultancy company. "Given the concerns over a potential bizjet down turn, the signs to date are that we are seeing market stabilization rather than a decline," Vertical Research analyst Rob Stallard wrote in a note. 3M is far from the first company to decide corporate jets are an unnecessary extravagance at a time of turmoil. General Electric Co., which makes jet engines, shut down its corporate aviation department in 2017 and started selling its fleet as John Flannery, the CEO at the time, grappled with a severe cash flow problem. The company scrapped its policy of requiring the CEO to use company planes and said executives would instead fly commercial or on chartered flights. GE also put a stop to a practice under former CEO Jeff Immelt of having a backup, empty plane follow the top executive's corporate jet on some trips. Today, GE permits named executives to use leased corporate aircraft for personal use, but to the extent members of the management team did so in 2022, they reimbursed the company at rates sufficient to cover the variable cost, other than certain incrementals such as catering, according to the most recent proxy filing. CEO Larry Culp didn't bill GE for personal use of company planes last year, the filing shows. Deere & Co. and Boeing Co. are among those that still require their CEOs to use corporate jets for business and personal travel for security reasons. This is a bit odd in Boeing's case as the policy seems to imply it's not safe for Fortune 500 executives to fly with its commercial airline customers, although the company does have a large defense business as well. It would probably be weird for the planemaker not to not have corporate jets at all, but Boeing did reportedly part with a luxury mega-yacht it used to wine and dine potential clients after the combined effects of the 737 Max crisis and the pandemic left it with more than $50 billion of debt.  Honeywell International Inc., another aerospace supplier, also requires its CEO to use company jets for personal travel, although this can be waived in certain situations and allows other top executives to use the planes if approved by the CEO. Rockwell Automation Inc. generally prohibits personal use of its company aircraft, with some exceptions, while Eaton Corp. doesn't require the CEO to use corporate jets for personal trips but does allow it. Railroad CSX Corp. capped its CEO's personal use of company aircraft at $175,000 annually in response to "concern expressed by some stakeholders" after low support for its say-on-pay proposal at the 2022 annual meeting. All policies are outlined in the companies' most recent proxy filings.

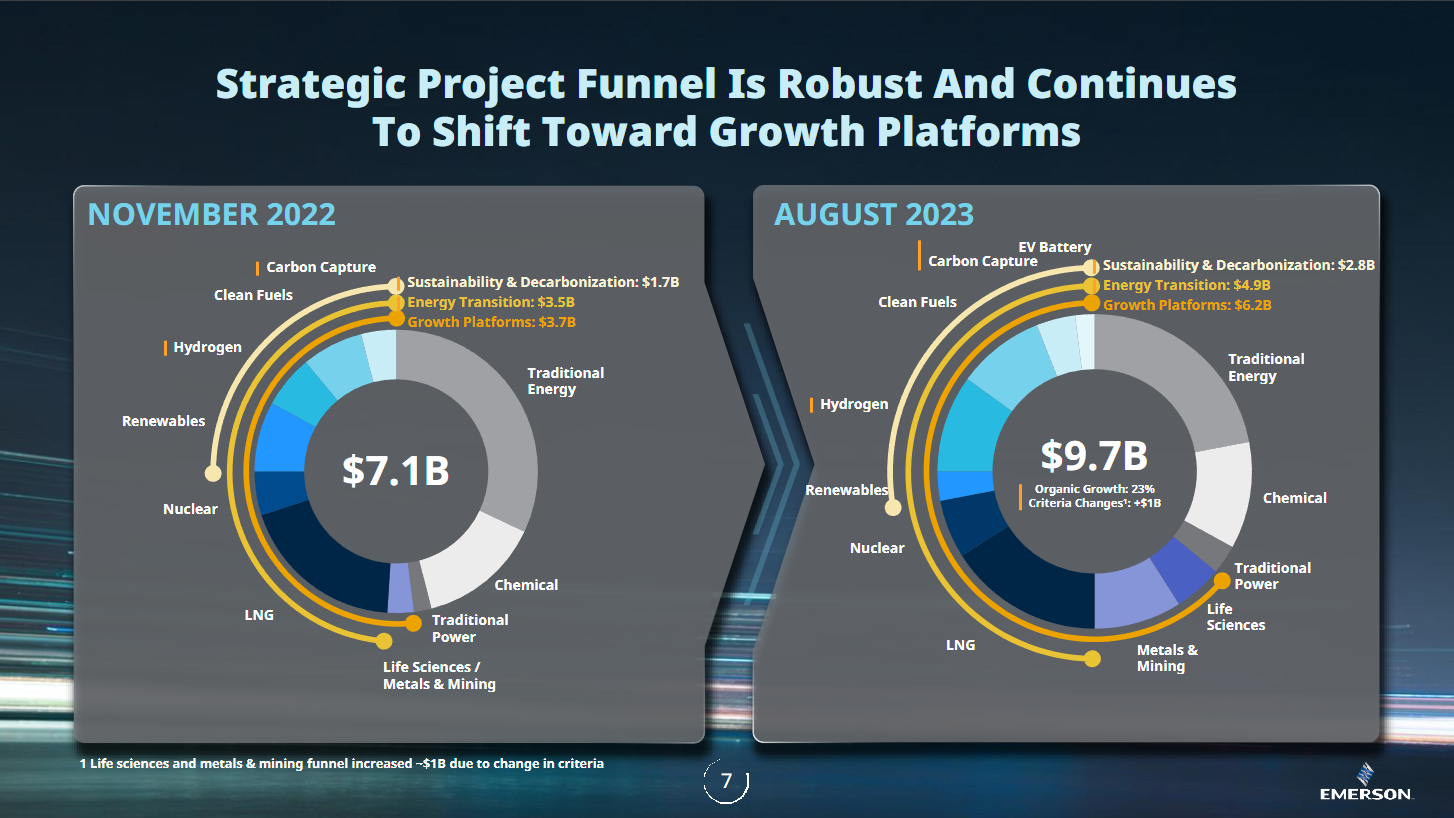

Emerson Electric Co.'s fleet of eight corporate jets, plus a helicopter, attracted the attention of activist investor D.E. Shaw & Co. in 2019. Under CEO Lal Karsanbhai, the company has shrunk its aircraft operations to three planes and no longer requires the CEO to use the jets for all travel. "It was important to change the policy," Karsanbhai said in an interview. "I don't think the board should require the CEO to fly the jet for non-corporate reasons." He's taking a commercial flight for coming personal trip. Officially, according to its proxy filing, the Emerson CEO is "encouraged" to use company jets for personal travel, and the head of security must review any plans to fly commercially. The CEO reimburses the company for personal air travel at 400% of the standard fare rate. Read more: Emerson Is Stuck in the Past. Ask Its New CEO. It makes sense for Emerson to still have corporate jets because "they're a productive time machine," and executives can't fly everywhere they need to go commercially, Karsanbhai said. Some of the company's factories are in small towns, and the airport in Emerson's hometown of St. Louis isn't known for its breadth of available flights. But Emerson is being more discerning about when executives use the planes and is more likely to use commercial alternatives for trips to Europe and Asia, he said. Booming business jet sales aside, this is the direction in which all industrial companies should be moving when it comes to corporate aircraft use. It's not clear to me why it's necessary for the vast majority of CEOs to have free access to the company plane for vacations. GE's Culp and Emerson's Karsanbhai don't seem to be suffering from productivity issues as a result of rethinking this perk. Goldman Sachs Group Inc. CEO David Solomon's trips on the company's jets have reportedly sparked internal grumbling, but the bank's official policy is to limit personal use of its aircraft by top executives and to require reimbursement. Presumably, if the CEOs of Goldman Sachs, GE and Emerson can pay for their personal plane use or find alternative transportation, then the well-compensated CEOs of other companies can, too. It shouldn't take a crisis for companies to be more judicious about how their executives use corporate jets. Willfully or not, 3M seems to have stumbled its way into updating a corporate jet use policy that seems behind the times. "These days I have to sleep with one eye open when it comes to the economic environment. There are many mixed signals. … Can we get through a recession and continue to invest in energy security and affordability or transitional energy sources and renewables, life sciences and nearshoring? So far the answer is yes." — Emerson Electric Co. CEO Lal Karsanbhai Emerson this week reported better-than-expected results for the quarter ended in June and raised its growth and profit outlook for the full year. The company maintained its forecast for mid-single-digit order growth over fiscal 2023, but bookings grew by just 3% in the quarter compared with those in the period a year earlier amid a slide in demand from discrete manufacturing customers. This type of production deals with distinct items such as consumer products like furniture or cars on a factory assembly line, while process automation focuses on products produced in batches, such as chemicals or oil derivatives. What started as weakness primarily in German automotive and packaging markets in the previous quarter broadened out "significantly" with softness in the US and Asia as well, dragging discrete automation orders down by a high-single-digit percentage, Karsanbhai said in an interview. "It's a demand issue at this point," he said.  Source: Emerson Fiscal Third Quarter Earnings Presentation But this is why it's helpful for companies to not put all their eggs in one basket. Emerson is expecting double-digit sales growth in its process and hybrid automation businesses for fiscal 2023 amid strong investment activity in sustainability and alternative energy sources. The company highlighted an almost $10 billion funnel of potential projects that it's chasing over the next few years, with the greatest opportunities in decarbonization and the energy transition, including carbon capture, LNG, hydrogen and renewables. For more thoughts on the state of the industrial economy from CEOs in the steelmaking, rail, chemicals, factory automation and electrical equipment industries, check out the bonus newsletter from earlier this week. Interestingly, the nearshoring and reshoring conversations that Emerson is having with customers are most concentrated on life sciences and metals and mining markets. "For Emerson, it's really around medicine and the lessons learned around availability of things like vaccines through the pandemic. Countries got caught out, and they don't want that to happen again," Karsanbhai said. "I went to Australia during the quarter. Typically when I go to Australia, I'm talking about the energy transition, sustainability and mining. My first meeting was with a consortium of life sciences" entities. While no amount of political willpower can move a mine for key electric vehicle battery materials such as lithium, there's no reason the processing components of the supply chain have to remain concentrated in China. Companies are starting to shift lithium refining and production capabilities to places such as the US and Australia and are using Emerson automation equipment to make this transition more efficient, Karsanbhai said. This adds another layer to understanding what the reshoring phenomenon actually looks like in practice. It's not necessarily Nike Inc. setting up a US factory for its shoes. Yellow Corp., a 99-year-old trucking company, told workers it's shutting down and plans to file for bankruptcy, according to the Teamsters union. Yellow's collapse was sealed by a fatal mix of too much debt and a string of acquisitions that weren't properly integrated. The company sued the Teamsters in late June for blocking operational changes, while the union, which represents about 22,000 Yellow workers out of a total staff of 30,000, threatened to strike in July after the company fell behind on benefits payments. The tense relations potentially hastened a shipper withdrawal. The Treasury Department has a roughly 30% stake in Yellow, and the Trump administration approved a controversial $700 million loan to the less-than-truckload specialist in 2020. The equity stake is at risk of being wiped out in a potential bankruptcy, and it's unclear how much the government would get paid back for its loan. The Teamsters employees will be hoping to get absorbed in a still relatively tight labor market, although they may not be able to get trucking jobs with the kind of schedules they had at Yellow. As for the freight market as a whole, the elimination of Yellow's capacity should help set a floor on pricing as the oversupplied industry struggles with a reset after a surge in demand for physical goods during the pandemic. L3Harris Technologies Inc.'s avionics business has attracted the attention of GE, TransDigm Group Inc. and CVC Capital Partners, among others, Bloomberg News reported, citing people with knowledge of the matter. The business reportedly could be valued at about $1 billion, and the bidding deadline is mid-August. A deal would add to a burgeoning aerospace asset-swap trend, with Safran SA agreeing last month to buy a flight-control and actuation business from RTX Corp. for $1.8 billion. Ball Corp. is also exploring options for its aerospace business. Goodyear Tire & Rubber Co., meanwhile, announced a review of strategic alternatives last month as part of an agreement with activist investor Elliott Investment Management. The company has an aviation tire business that could be a better fit within a larger aerospace parts company. In other related news, private jet service company Volato is going public through a merger with a special purpose acquisition company in a transaction that values the combined entity at $261 million. Siemens Energy AG is still trying to get to the bottom of quality issues with its wind turbines. The company is seeking to delay deliveries from its 5.X platform by as much as seven months to contain the fallout while it assesses whether the problems stem from the supply chain or the design itself, Bloomberg News reported, citing people familiar with the matter. Siemens Energy said in June that it was scrapping its annual profit guidance and warned that the cost of investigating and repairing the turbine flaws is likely to exceed €1 billion ($1.1 billion). The company is scheduled to report its third-quarter results next week.

RB Global Inc., the company formerly known as Ritchie Bros. Auctioneers Inc., is going through some drama … again. The industrial equipment auctioneer fought and won a contentious battle to muster enough shareholder support for its takeover of junked-car dealer IAA Inc., which ultimately closed earlier this year. But the company announced this week that the champion of that effort, CEO Ann Fandozzi, is going to be replaced after a disagreement about compensation. Jim Kessler, RB Global's chief operating officer, is taking over, with Chief Financial Officer Eric Jacobs also departing. RB Global says that Fandozzi demanded large, upfront equity grants for herself and other executives. Fandozzi said that the board made certain compensation commitments before the IAA takeover that she was trying to see honored. Both she and Jacobs said they didn't resign. In a word, this seems messy and that's typically not ideal when a company is trying to integrate its largest-ever acquisition. Capital spending is in, buybacks are out

What happens to planes in a heat wave? Hint: it's not good

American Airlines is looking to buy new planes

Manufacturing investment at the highest level since the 1950s

FAA approves largest unmanned aircraft yet

The US needs to show more urgency on EV supply chains

$90 billion in orders threaten next bust for shipping industry

Heating homes does more climate damage than cooling them

Unpacking the many financial challenges of offshore wind

Lots of homeowners want to move but there's nothing to buy |

No comments:

Post a Comment