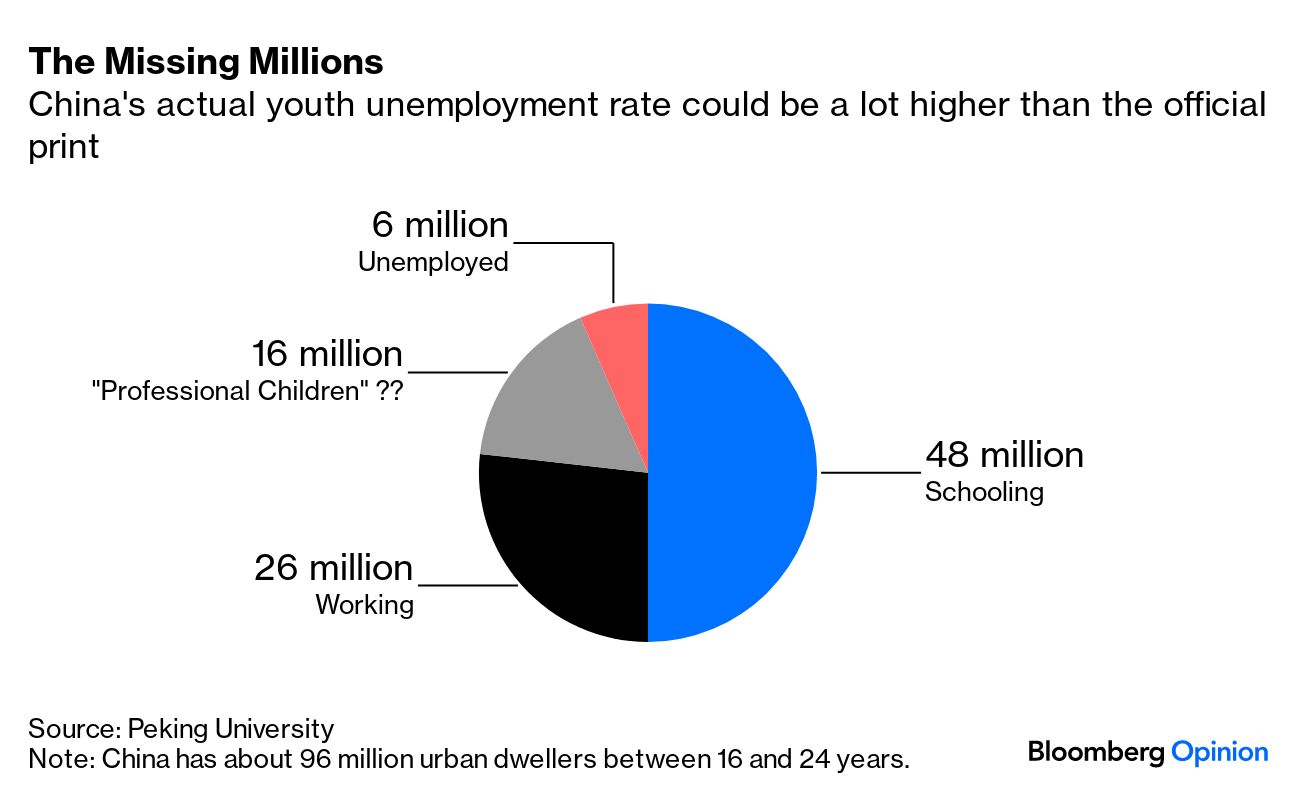

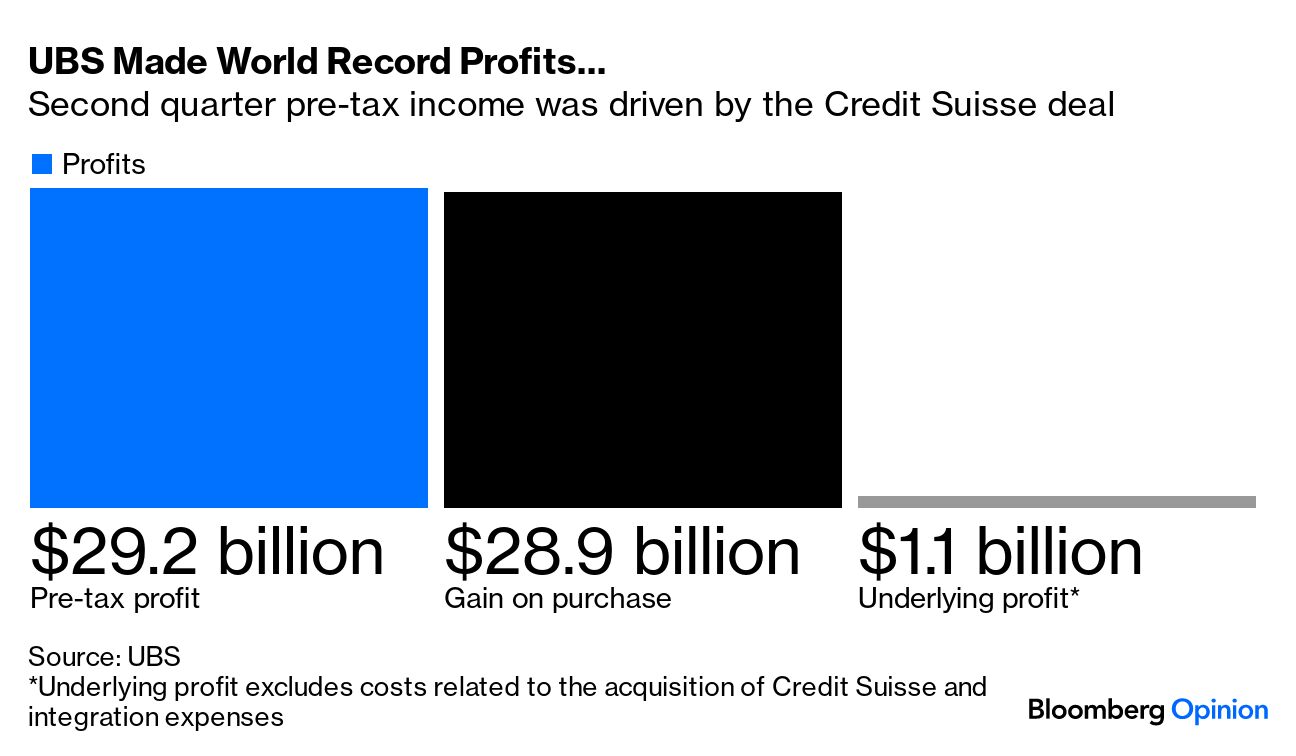

| This is Bloomberg Opinion Today, the patriarch of Bloomberg Opinion's opinions. Sign up here. I find it kind of bizarre that right now on social media, stay-at-home girlfriends are trending in the US, while in China, stay-at-home children are trending. What is going on? Our boyfriends are doubling as our bosses and our parents are signing our paychecks? Is the world so convoluted that we're being forced to regress into an era where home life and work life are one in the same? Despite hailing from totally different countries with completely different circumstances, the two trends share a lot in common: Certain American women are resigning themselves to the #TradWife life, while many young adults in China have succumbed to the lie flat movement. The economic situation for new college graduates in China is so dire that their parents are employing them to become their pseudo personal assistants, or "full-time daughters" with resumes that look like this: Full-time children are content to whip up three meals a day, do tai chi with their mom and even serve as glorified IT support if the TV stops working. About 22 million young people are sitting idle in China at the moment, and while not all of them may be privileged enough to be paid by their parents, it's certainly enough to leave a permanent dent in the economy:  President Xi Jinping has essentially told young people to suck it up, or more specifically to "eat bitterness," as souring financial circumstances ruin their job prospects. But being a full-time child is a loophole Xi may have not seen coming. Instead of blindly accepting his live-to-work mentality, Gen Zers are realizing that the economy is not serving them, so they're taking matters into their own hands. Given the youths' increased exposure to the outside world — through travel and the internet — Shuli Ren says it'll be "tough for Xi to argue for a 1960s-style live-to-work philosophy when, in the US, 'lazy girl jobs' are trending on TikTok and social influencers talk about how to strike work-life balance." The Chinese president needs to figure out how to find common ground with younger cohorts in order to keep them engaged and excited about their future. "As the patriarch of the society, is he willing to put aside his own views to listen and have a relationship with the future generation, or impose opinions that youngsters can't relate to and become even more detached from reality?" Shuli asks. If he chooses wisely, China's stay-at-home children won't need to stay home for long.  Photographer: Bloomberg Way back in January, you may recall that Hindenburg Research published a scathing report about the sketchy business dealings of Indian infrastructure tycoon Gautam Adani. In it, the US short-seller claimed the billionaire had pulled off "the most egregious example of corporate fraud in history." Ever since, Adani's tactics for dealing with these accusations has been eerily similar to those employed by former US President Donald Trump: Deny, deny, deny. But just today, the Financial Times came out with a scoop about a secret paper trail in Bermuda that shielded the identity of two Adani investors from regulators and the public. Although Adani claims the "recycled allegations" are "yet another concerted bid by Soros-funded interests supported by a section of the foreign media to revive the meritless Hindenburg report," Andy Mukherjee warns (free read!) that patience is wearing thin as the saga gets murkier. It all hinges around a simple rule in India that at least a quarter of the stock in listed companies must be owned by public shareholders. Some people suspect that the rule was breached at firms belonging to Adani. But others believe the allegations are a sign of Western jealousy over one of India's most formidable entrepreneurs, a man who has helped fortify the country's ports, airports, roads and energy grid. It's clear that a joint parliamentary probe is urgently needed, especially since the Securities and Exchange Board of India has been of no help. Andy says the regulatory body was made aware of the two Adani investors and their funds in Bermuda way back in August 2013 — before Adani's ally Narendra Modi was made prime minister. A decade later, SEBI's investigation is conspicuously still underway. "What couldn't get resolved over a decade is highly unlikely to get concluded under judicial directions in a few months," he argues. The world remains divided on whether Adani is at fault. "Knowing who exactly owns India Inc. is not a diktat from Soros or the US state department," Andy concludes, it's a necessary step to keep bad actors out of India's financial system. In honor of the lazy girl job, I'm just gonna let these spectacular headlines speak for themselves: Deal of the century!!! $29 billion!! It sounds good because it is good. But while it might be extremely fun to say "hey guys, we just hit a FREAKING WORLD RECORD for the largest profit any bank has ever posted," Paul J. Davies says it's a rather meaningless benchmark given that it's basically just the gain UBS made on the difference between what it paid for Credit Suisse and the target's net asset value. Still, the record profit gives the bank "more than enough capital for its enlarged balance sheet," Paul writes. Plus, UBS managed to skirt around Credit Suisse's stigma (free read!), which is just as much, if not more, impressive than this chart:  Germany's property market is looking rather sad these days, like the plant you've been neglecting to water on your windowsill. It's still alive, but leaves are dropping daily — and by leaves, I mean the developers who are filing for insolvency in droves. "Having set a target of building 400,000 new homes a year to ease pressure on the rental market, Germany will be lucky if it builds half that next year," Chris Bryant writes. If the government fails to step in, the country's down-in-the-dumps housing market may end up dragging the entire economy down with it. "Bidenomics" may be catchy marketing, but it's a confusing policy. — Bloomberg's editorial board Don't cover up or destroy murals accused of racism, add context to them. — Stephen Carter Last year marked the worst period since 1990 for IPOs. Will this year be any better? — Jonathan Levin From Amazon to Alibaba, companies are busy designing private lines of AI chips. — Tim Culpan The Republican House members trying to protect Trump are a disgrace. — Jonathan Bernstein European banks are getting a warmer welcome in the capital markets. — Marcus Ashworth Dollar General is in general decline. Taylor Swift is coming soon to theaters near you. Fake plane parts were sold to Boeing and Airbus. Clarence Thomas disclosed his Harlan Crow trips. Adam Driver cried a little. This woman has the world's longest mullet. 12% of Americans eat half the beef. Burger King's Whopper has legal beef. NYC's illegal weed shops are selling snacks. US Open ball crew tryouts are no joke. Notes: Please send fancy foreign snacks and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and follow us on Threads, TikTok, Twitter, Instagram and Facebook. |

No comments:

Post a Comment