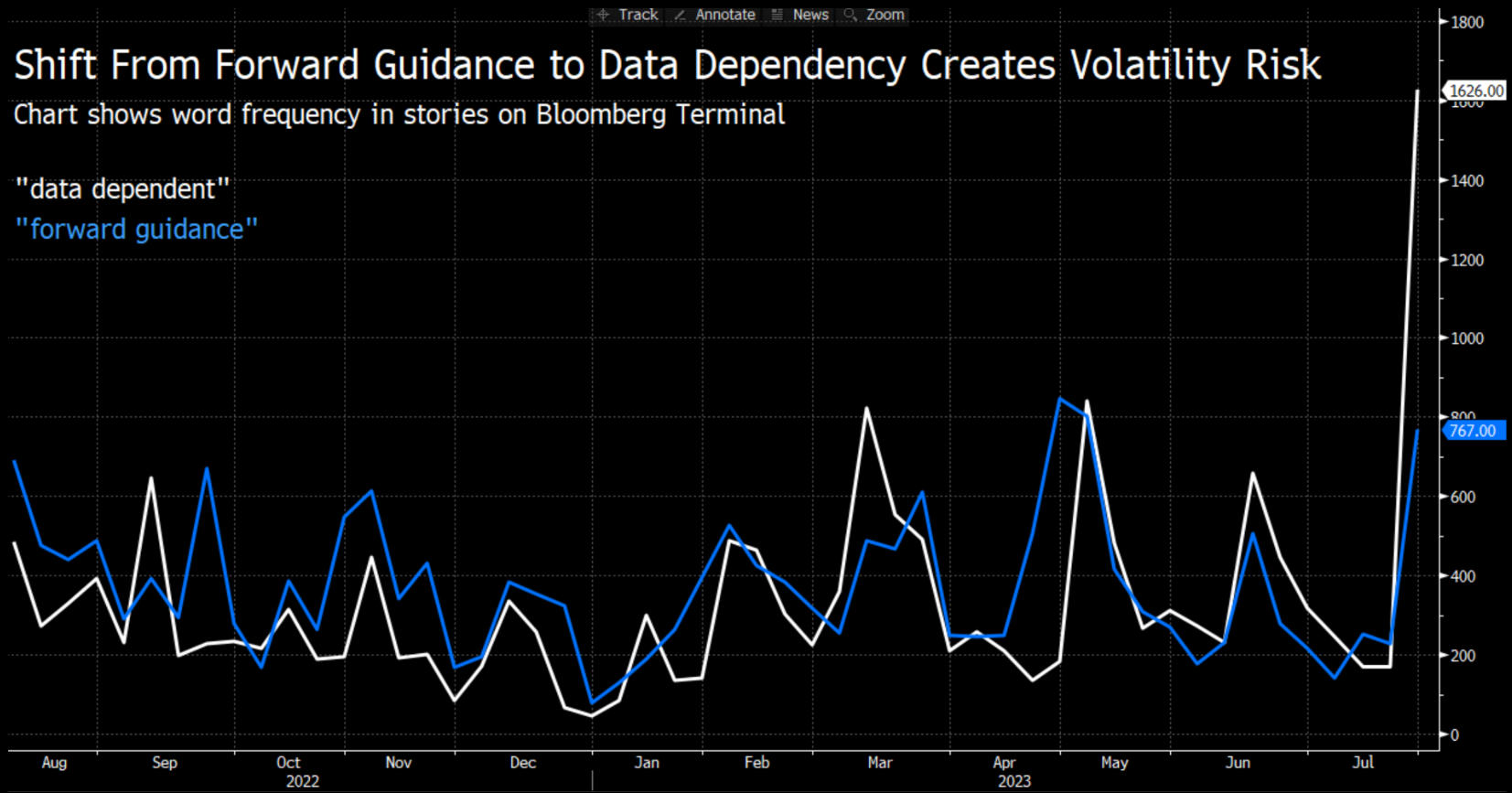

| Good morning. Fitch Ratings downgrades the US, Donald Trump faces new charges, and the UK's energy industry discusses security and net zero at Downing Street. Here's what people are talking about. The US was stripped of its top-tier sovereign credit grade by Fitch Ratings, which criticized the country's ballooning fiscal deficits and an "erosion of governance" that's led to repeated debt limit clashes over the past two decades. The credit grader cut the US one level from AAA to AA+, echoing a move made more than a decade ago by S&P Global Ratings. Tax cuts and new spending initiatives coupled with multiple economic shocks have swelled budget deficits, Fitch said, while medium-term challenges related to rising entitlement costs remain largely unaddressed. The decision drew criticism from leading economists. Donald Trump has been indicted in Washington on federal charges over his efforts to overturn the 2020 presidential election, the third politically explosive criminal prosecution of the former president as he makes his latest run for the White House. Trump, 77, was charged with conspiracy to defraud the US, conspiracy to obstruct an official proceeding, obstruction of and attempt to obstruct an official proceeding, and conspiracy against the right to vote and have that vote counted, according to the indictment filed Tuesday in federal court. The indictment alleges Trump for months knowingly spread lies about the election being rigged in order to undermine public faith in the vote and remain in power. Britain's energy industry will sit down with Energy Security Secretary Grant Shapps on Wednesday to discuss energy security and accelerating investments into low and zero carbon projects. The meeting at Downing Street, with leaders from Shell, BP, SSE, Electricite de France and National Grid, will focus on existing plans by the companies to invest more than £100 billion into the UK's energy industry including spending on renewables, nuclear power, and North Sea oil and gas. The meeting comes just days after Prime Minister Rishi Sunak committed to granting hundreds of new licenses for oil and gas production in the North Sea. China is turning its focus to rolling out various policy promises to help spur the economy's recovery as it loses further traction. Regulators are pushing local governments to speed up bond sales for infrastructure spending, according to a local media report, and the central bank urged banks on Tuesday to cut mortgage rates to revive the struggling property market. The moves suggest Beijing is keen to pick up the pace of implementing the raft of policy measures announced in recent days to bolster the economy. European shares are poised for declines after Fitch's US downgrade damped investor sentiment. Pope Francis visits Portugal to take part in a World Youth Day global gathering of Catholics. Expected data include Swiss manufacturing PMI and Irish unemployment. Siemens Healthineers, Haleon and BAE are among companies on tap for earnings. This is what's caught our eye over the past 24 hours Language matters. Particularly the words central bankers choose to use. When they stop saying things like "forward guidance" and start saying things like "data dependent" it has implications for markets. And in this case, it means greater volatility at every new statistical release.  Bloomberg Take this week's non-farm payrolls for instance. Rates markets are currently pricing a less-than-even chance of a Federal Reserve interest-rate hike by November. Yet if the (wage) data comes in hot, traders will be forced to pivot — at least partially — toward pricing one more hike. And then, they'll have to wait until next week, when they might be forced to price out any hikes with a slow CPI reading. And then, the week after, retail sales might throw a spanner in the works. Followed by PMIs. Etc, etc, ad infinitum. Now, that makes for interesting writing if you happen to be a markets reporter, but it also makes for stomach-churning twists if you're managing a portfolio. Eddie van der Walt is Deputy Managing Editor of the Markets Live blog on the Bloomberg Terminal, based in London. Follow him on Twitter at @EdVanDerWalt |

No comments:

Post a Comment