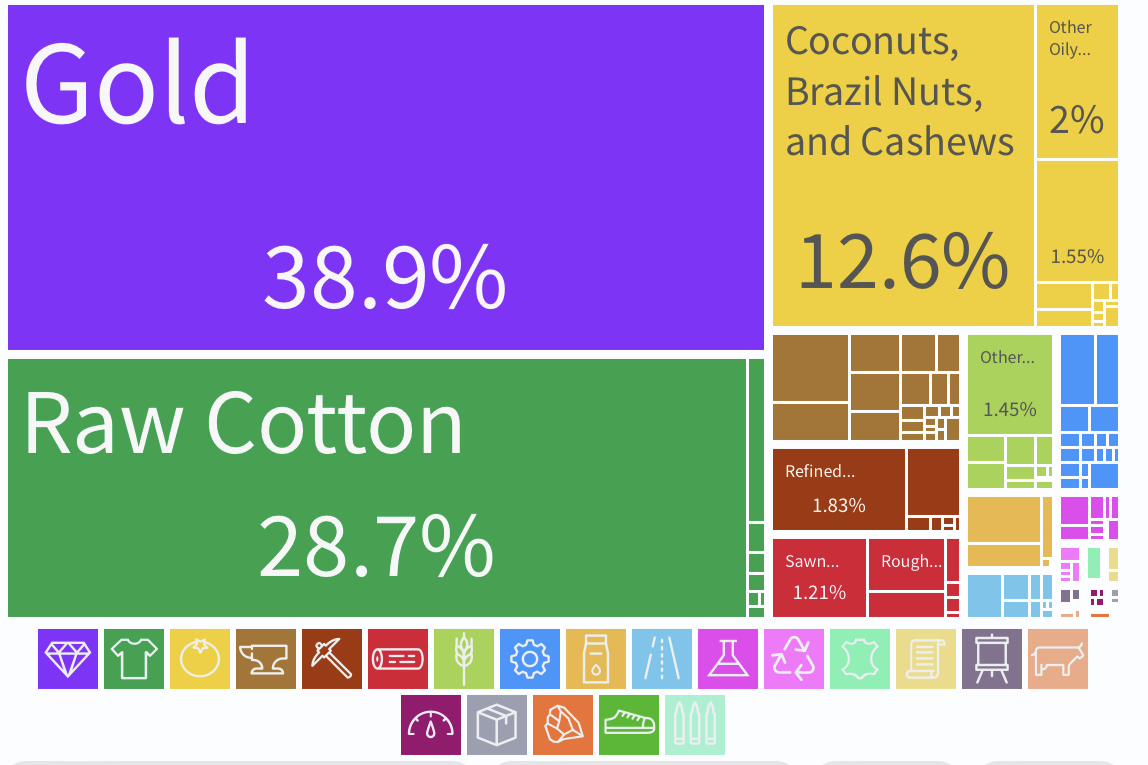

| In the hierarchy of economists, trade wonks revel in their wonkiness more than most. Their jargon is a secret language that few can decode. Acronyms for the latest regional frameworks are welcomed like newborn cubs — the longer and more unpronounceable the better. Every Valentine's Day, the world's leading commentators on cross-border flows take to social media to outdo each other with roses-are-red zingers that would make David Ricardo either wince or cheer. Now, everybody can geek-out on trade data, thanks to an online game called Tradle. Borrowing the concept from Wordle, the addictive New York Times game featuring one word puzzle a day, Tradle presents a colorful matrix — called a treemap — showing the breakdown of an unnamed country's exports. You get six guesses, each one accompanied by hints about the geographic distance between your guess and the correct answer. Which country's exports are 38.9% gold, 28.7% raw cotton and 12.6% coconuts, brazil nuts and cashews?  Source: OEC, Tradle Benin, of course. Such exercises are entertaining and educational, and no longer the realm of the wonks. As globalization adapts to multiple shocks — a pandemic, a war, digital commerce and climate change — understanding how the movement of goods and services is changing is an increasingly sought-after skill in economics and business more broadly. Private data providers are racing to meet the demand. Tradle is produced by the Observatory of Economic Complexity, which had its roots in an MIT master's thesis back in 2012. The OEC, which sells subscriptions to its platform, is owned by Datawheel, a technology company based in Cambridge, Massachusetts. Gilberto García-Vazquez, Datawheel's chief economist, said Tradle was launched in March 2022 and initially saw more than 1 million page views a month. "The surge in our website traffic following Tradle's launch surprised us, as it rapidly became one of the most popular sites we have developed," he said in an email. Monthly views since inception has average 480,000 and recently crept above 600,000. García said the OEC plans to add more datasets, such as company-specific figures. "Our goal is to evolve the OEC into a comprehensive hub for economic data, understanding the larger global economic picture and uncovering the complex network of interconnections within it," he said. It's also exploring the use of artificial intelligence. "This innovation can help users understand trade data better and even predict trends," he said. If the economic disruptions of the past six years have taught the masses anything, they've "highlighted the value of a comprehensive understanding of global trade data," García said. "Individuals and organizations, regardless of their trade expertise, have recognized the vital role of this trade data." —Brendan Murray in London |

No comments:

Post a Comment