| Beijing is promising to retaliate against the proposed US curbs on outbound investment and further export restrictions, but China's options to hit back without hurting itself just as badly may be limited, especially if it wants to remain an attractive place for foreign investment. Despite Treasury Secretary Janet Yellen's claim that the new controls would be "narrowly targeted" and wouldn't "have a fundamental impact on affecting the investment climate for China," China's representative in Washington reacted angrily last week. "The Chinese people cannot remain silent and the government cannot simply sit idly by," Ambassador Xie Feng told the Aspen Security Forum. "China definitely will make our response but definitely it's not our hope to have a tit-for-tat. We don't want a trade war, a technological war. We want to say goodbye to the Iron Curtain as well as the silicon curtain." Read More: Here's How China Supports Economy as Stimulus Awaited Over the past few years, China has been building out its legal toolbox to fight back against sanctions from the US and others. But unlike the US and its global reach, Beijing has much more limited options to retaliate and its only real tools are domestic. Based on recent history, those include measures to limit or stop exports, punish foreign firms that operate in China or prevent companies from accessing its huge market. China has tried to use these tools to push other countries to change policies it didn't like — with limited success: - Restrictions on rare-earth exports pushed Japan to set up a new source of supply in Australia and cut it's dependence on China, and recent export controls on two metals used to make semiconductors may have the same effect if Beijing uses the new licensing process to actually cut exports.

- Blocks on trade with Australia and Lithuania were unsuccessful in forcing real foreign policy changes on those countries but did drive up the price of Australian barley for Chinese companies and annoyed officials in Europe.

- Sanctions imposed on European officials and organizations in retaliation for European sanctions merely torpedoed an investment deal that China wanted to sign with the bloc.

- And the fines announced on two US defence contractors this year for involvement in arms sales to Taiwan were purely symbolic, as the companies have no business in China to fine.

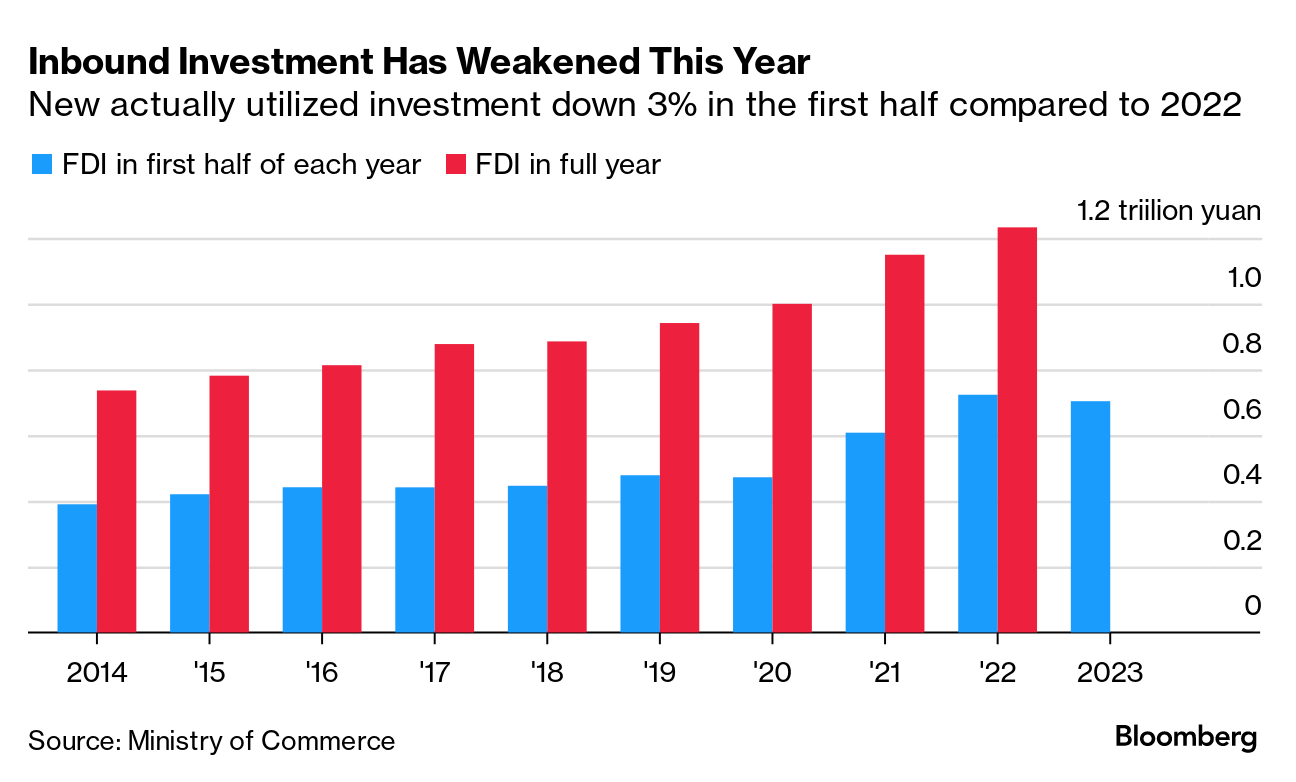

However, if Beijing were to really start punishing US firms in the country or restricting exports to retaliate, it would damage already shaky business confidence and undermine the government's own efforts to attract newforeign investment, which dropped by almost 3% in the first six months of the year. US sanctions cause pain for its own companies, with America's largest semiconductor companies recently lobbying to try and head off new curbs on their sales to China. For China, the dilemma of how to retaliate without self-inflicted economic wounds looks to be even more complicated. Related Reading: —By Bloomberg News |

No comments:

Post a Comment