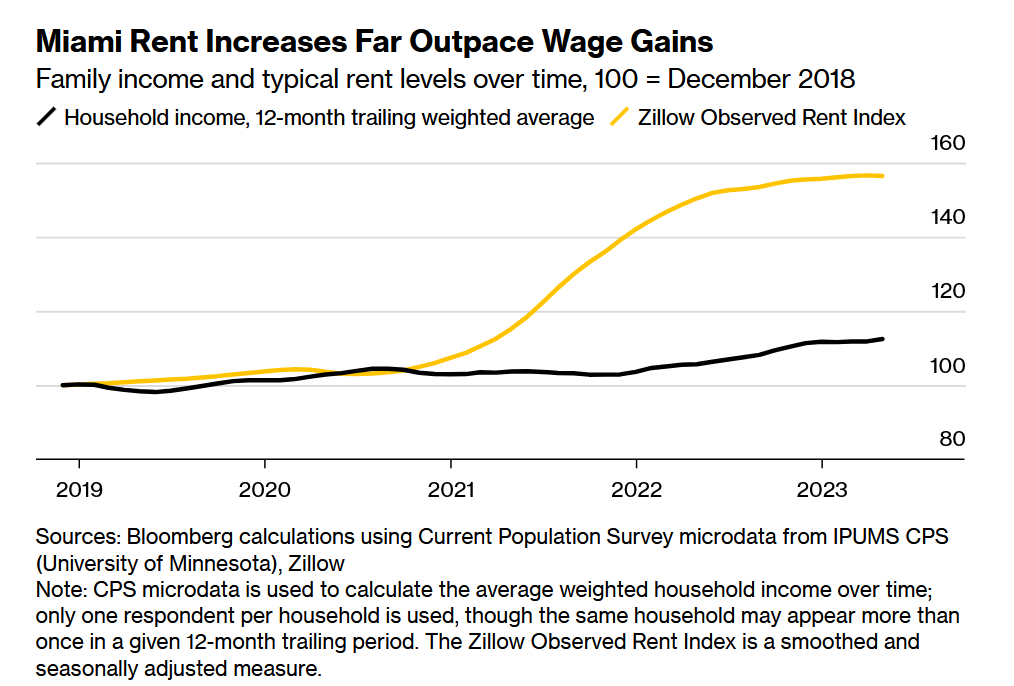

| Here are the two charts from the Miami piece that got me thinking. This first one encapsulates the situation Marte describes in the quote above. Sure, your salary is going up. But look at the rent prices. You're effectively poorer, even after a raise. And even though rent increases have moderated in recent months, you still have that massive gap to overcome. What's more, after a brief pause, purchase prices are perking up again. And that's sure to feed into rents as well.  What Powell would tell you is that the Fed's got this. Maybe he'll even say as much tomorrow at the press conference. He'll say the Fed is succeeding in its goals, fostering a soft landing akin to the one we saw after it began raising rates early in the business cycle in 1994. Back then, that killed returns for a lot of bond investors — just as it has this go round. But eventually the economy recovered and went from strength to strength, with inflation actually declining in the process beginning in 1996. That's what he could say we're poised for now that inflation is already declining. But the second Miami chart undermines his case. The red arrow points to a steep rise in unemployment that can only be attributed to the rate hikes. The Fed's tool is, after all, a blunt one. Behind the euphemisms, cooling the economy means slowing investment, stifling the job market, and taking money out of people's pockets. Effectively, the Fed's medicine kills some of the patients — at least when it comes to Black Americans. In fact, nationwide Black workers have accounted for close to 90% of the recent rise in unemployment. And the cooling labor market has meant a rise in unemployment for Hispanic workers and those without a high school degree too. It has also meant fewer temp jobs for those trying to get a toe back into the workforce. So some will see their paychecks go further as inflation comes down. Others will see their paychecks disappear altogether. I think the Fed gets this, to be honest. They know they're walking a fine line between recession, unemployment and lower inflation. And I suspect one of the reasons the Fed paused in June was that some members feel like the cracks in the American economic edifice are growing too big to keep hiking every meeting. I fully expect the Fed to raise rates tomorrow, as does the rest of the market. Fed fund futures show near certainty that another quarter-point hike will be announced. And when the Fed Chair talks about the economy, he will continue to stress the fact that the high level of inflation warrants more rate hikes. But underneath that may be an acknowledgement that the Fed will slow the pace and may even stop altogether. That's certainly what the market thinks. If they do hike again, it probably won't be in September. And if they do, it will only be because the inflation data are really bad — something I see as unlikely given that the math associated with comparing this year to the high levels last year virtually guarantees a slowing of inflation. So, this is it. We're probably at the end of the line for rate hikes. And let's be thankful for that. If the Fed wants to help protect lower income people from inflation, it needs to make sure they still have jobs. And that means it may need to stop before those cracks in the edifice widen even more. |

No comments:

Post a Comment