| China vows property stimulus. Musk's Twitter rebranding begins. Where on earth is China's foreign minister? Here's what you need to know today. China's top decision-making body signaled more support for the real estate sector alongside pledges to boost consumption and ease local government debt, though it fell short of announcing large-scale stimulus to support the slowing economic recovery. The 24-member Politburo, led by Xi Jinping, promised "counter-cyclical" policy, according to a readout published Monday, but did not include language indicating major fiscal or monetary loosening. US-listed shares of mainland companies recorded their biggest one-day gain since early February. Meanwhile, Xi Jinping is under pressure to explain the whereabouts of the usually busy Foreign Minister Qin Gang, who hasn't been seen in public or mentioned since June 25. Elon Musk pulled the trigger on the rebranding of Twitter, decreeing that the product name would be "X" and vowing to wipe out all traces of its bird logo and associated words that have seeped into everyday usage, like "tweet" and "retweet." A new black X logo started to appear across the site Monday, as part of the billionaire's vision of transforming the 17-year-old service into an everything app. Analysts and brand agencies called the product's renaming a mistake, estimating that Musk's move will have wiped out anywhere between $4 billion and $20 billion in value. Morgan Stanley chief James Gorman has been tapping his Australian roots to access one of the world's fastest-growing corners of global capital. The

bank's Melbourne-born boss is one of a string of executives from Wall Street and beyond doing business with the largest players in Australia's A$3.5 trillion ($2.4 trillion) pensions industry. So, what's the attraction? Quite simply, Australia's pension funds are raking in more money than they know what to do with, and that's good news for global asset managers. Get the full story here. China is set to lead Asian stocks higher on optimism of more economic stimulus to come from Beijing, while Wall Street markets started the week with gains ahead of key central bank rate decisions. Futures in Japan and Australia pointed to solid rises in early Tuesday trading. Key Federal Reserve and European Central Bank's gatherings this week will be closely watched for signs policymakers may be reaching the end of the cycle of aggressive policy tightening. Meanwhile, two-year US bond rates climbed as an auction drew the highest yield since 2007. The Bank of Japan is widely expected to stick with its negative interest rate this week, leaving the focus on whether it will risk complicating its stimulus message by tweaking its cap on benchmark yields. Since taking the helm in April, Governor Kazuo Ueda has repeatedly pushed back against the idea that a major policy pivot is looming by emphasizing his persistent doubts about the sustainability of recent price growth in Japan.

That's kept the BOJ as an outlier on monetary policy while major peers aggressively hiked rates to tackle hot prices. - Does the AI rally resemble the dotcom bubble? Are you planning to increase your exposure to tech stocks? Share your views on big tech in our latest MLIV Pulse survey.

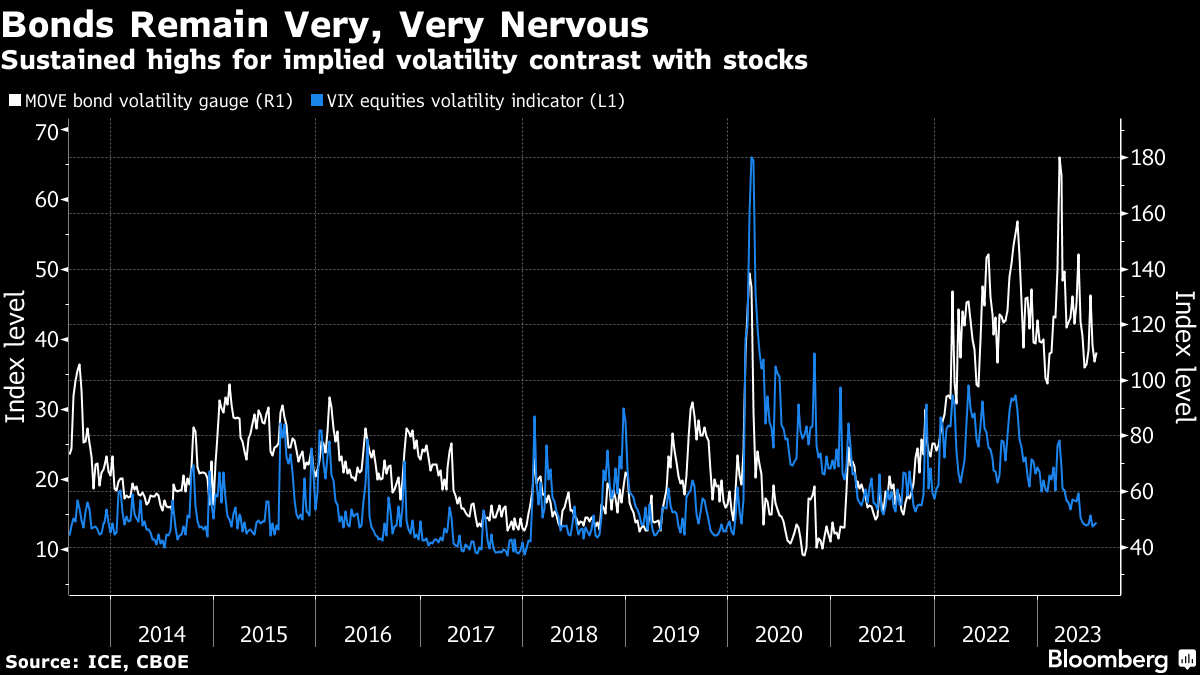

There's no doubt where the fear factor is strong in markets these days. Bond traders are far more worried about the potential for rapid price swings than their much calmer equities peers. The "fear gauge" for Treasuries — ICE BofA's MOVE Index — remains above 100 — levels last seen around the 2007-08 global financial crisis, even after retreating from March's peak. The VIX index of expected swings for the S&P 500, meantime, is sitting around the lowest since early 2020.  The positioning underscores how the bond market remains uncertain about how many more interest-rate hikes the Federal Reserve will deliver, and whether the central bank's tightening campaign will cause a severe enough slowdown to generate decent gains for Treasuries. Equities look to be focused on the idea that the US economy's success in riding out March's banking-sector wobbles means that a recession is becoming less and less likely. That may actually make them vulnerable to some nasty shocks this week as earnings season coincides with a Fed meeting — shocks that would be exacerbated by an apparent lack of preparation among investors. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment