| This is Bloomberg Opinion Today, a high-end AI processor of Bloomberg Opinion's opinions. Sign up here.  Nvidia CEO Jen-Hsun Huang Source: Engadget Before last week, if you were to ask a random person on the street what Nvidia was, maybe they'd tell you it was a lip balm or one of those constipation relief ads you see on cable TV: "If you have joint pain while using Nvidia, make sure you are not taking more than the recommended dosage. If you experience symptoms of fluid loss and dehydration while taking Nvidia, consult with your doctor immediately. They can help determine the right treatment …"

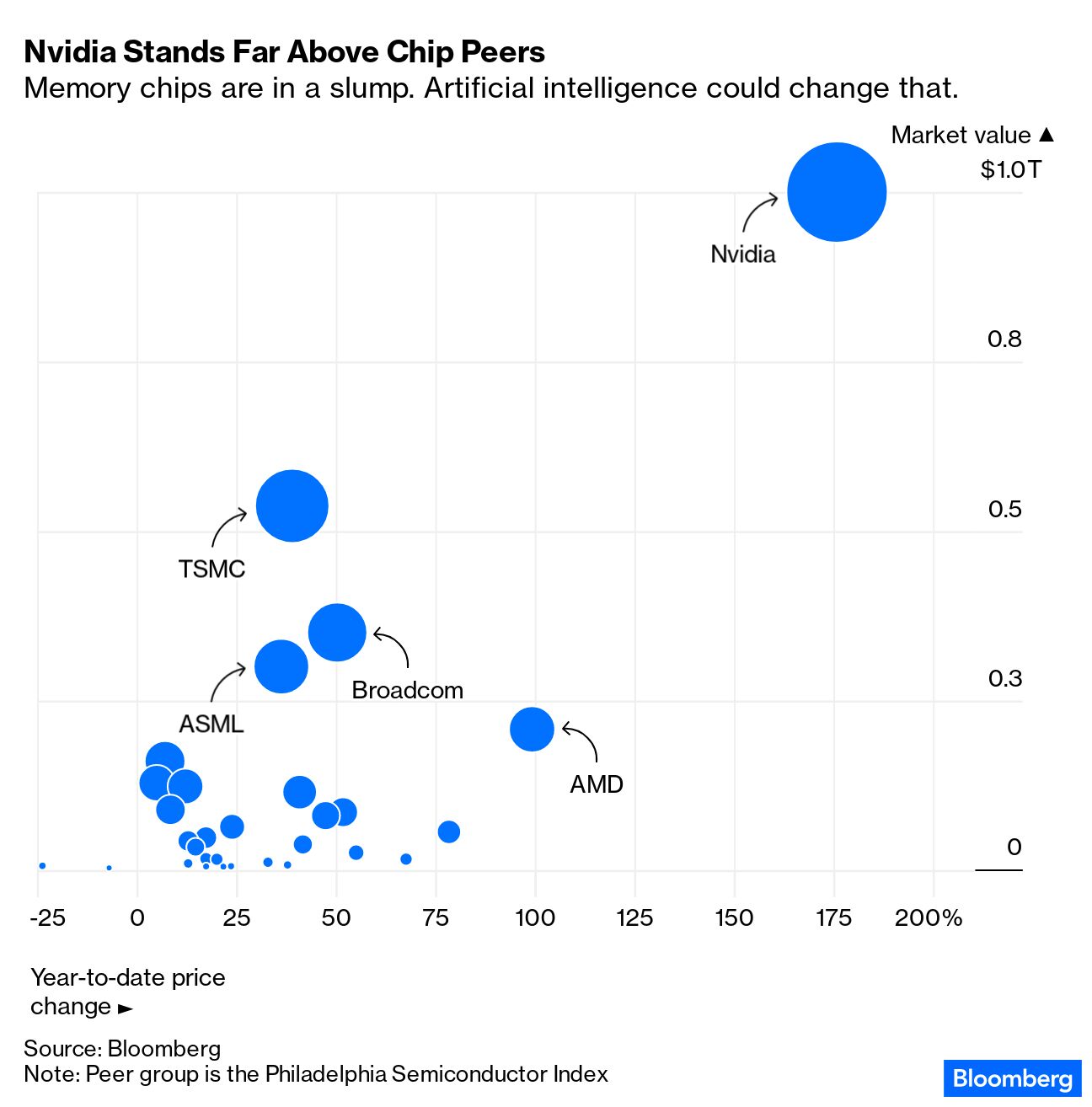

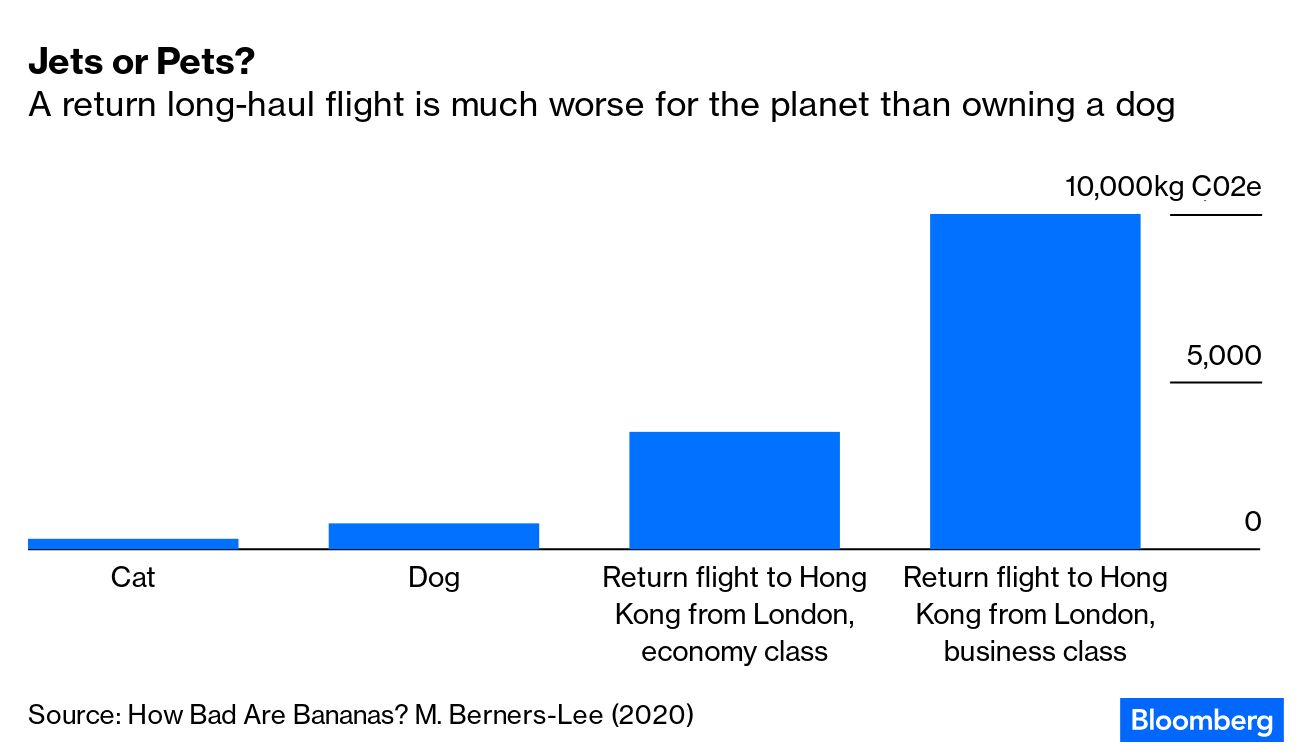

Or maybe, if the person was into Counter-Strike or StarCraft in high school, they'd tell you that Nvidia's GPU (graphics processing unit) has been the lifeblood of the gaming industry since the early 2000s, all the way back when LAN parties were big. For the uninitiated, LAN stands for "local area network," and back in the early aughts, "legions of PC brethren" would gather for days on end — monitors and mattresses in hand — to play multiplayer video games together like one big, happy, smelly family:  DreamHack 2000 Source: @modernnotoriety on Instagram Nvidia CEO Jen-Hsun Huang made a very wise bet on these gamers 30 years ago when he founded his chip-making empire. "Huang has a knack for riding tech trends — selling graphics chips that powered everything from the video game boom to the rise of cryptocurrency," Ryan Vlastelica and Ian King write for Bloomberg Technology. And now the tattooed CEO is riding the latest trend — artificial intelligence — all the way to $1 trillion, joining the ranks of just four other American companies with valuations that high: Nvidia has "become the market's ultimate story stock — that rare bird that's capable of riding a good yarn to retina-burning valuations even amid tight monetary policy and a potentially looming recession," Jonathan Levin writes. At the end of last week, Nvidia's … While some may call Huang's buzzworthy bet on AI half-baked, Jonathan points out that the company doesn't have all its chips in one basket. From carmakers to crypto, many industries already rely on Nvidia to power their technology. Its AI chips, which Tim Culpan says "differ from standard processors by inhaling huge amounts of data in a single gulp," will likely further that dependence. Tim also notes that makers of clunky, old memory chips will stand to gain as a result: "For every high-end AI processor bought, as much as 1 Terabyte of DRAM may be installed — that's 30-times more than a high-end laptop," he writes.  In order to make semiconductors, manufacturers need to gather a ton of information — enough to fill a 170-year-long YouTube video. "It was only a matter of time before artificial intelligence was deployed to try to more efficiently design artificial intelligence chips," Tim writes. In other words: Nvidia is using AI to create AI chips. Things are getting meta, but perhaps not in the way Mark Zuckerberg predicted. "The AI phenomenon has administered what now looks like a historic shock to markets that even rivals the ructions when the pandemic hit three years ago," Isabelle Lee writes, adding that "ChatGPT has changed perceptions as radically — albeit thankfully in a more positive way — as the coronavirus did." But not everyone is in a celebratory mood. Cathie Wood, in what might be the worst market call of the year, decided to yank her Nvidia shares in January. Less than five months later, the ARK CEO is awkwardly defending herself on TV and Twitter, insisting that Nvidia is "priced ahead of the curve." Shuli Ren argues Wood would be better off keeping her mouth shut. She made a bet on Nvidia all the way back in 2014, and walking out on her investment right before its euphoric boom is embarrassing, to say the least. "Wood's flagship ARK Innovation ETF has missed out on most of Nvidia's $600 billion rally this year," Shuli writes. I'd say Wood has a chip on her shoulder — but alas, she doesn't even have that. Bonus AI Reading: "The paradox of AI is that while it can write humanlike essays, machines can still barely walk or pick up a cup. Why?" Parmy Olson asks. Uhhh. Waiiit, what?? How can it be that Saudi Aramco, with a valuation just north of $2 trillion, has such appalling liquidity? It seems as though most of the buyers and sellers of the world's third-largest publicly traded company "are involved in what looks like merry-go-rounds," Javier Blas observes, pointing to "Middle East investors, often controlled by regional governments or royals" that "trade with each other, back and forth," with nary an institutional investor or short seller in sight. To put that into context: On any given day, a paltry $51 million worth of Saudi Aramco stock changes hands, compared to $2 billion for Exxon, $7.5 billion for Microsoft and $11.2 billion for Apple. Ever since the oil behemoth's IPO four years ago, a lot of investors have simply held onto their shares — and 98% of the company is still under the grip of the Saudi government. Another stock offering may soon be on the table, but given the $2 trillion valuation, that won't be enough to lure foreign investors — many of whom skipped the 2019 IPO — to the table. "Aramco trades at a price-to-earnings ratio of 13.5 times, nearly double that of Exxon," which Javier says would be "appropriate for shoot-for-the-moon tech stocks, not an old-fashioned oil company." And that's not even addressing the energy elephant in the room. Time and time again, David Fickling says, the world's largest oil producer has exhibited signs that it's "underestimating the way that an accelerating energy transition and short-term economic weakness are squeezing demand for its product." A national oil company that is in denial about the inevitable decline of oil isn't an investment that suits in London, Hong Kong or New York are looking to make. "Jets or Pets?" sounds like a card game that someone should invent, as long as they give Lara Williams the royalties. Last week, the CEO of private aircraft operator Luxaviation defended his industry's environmental record with a doozy of a statement, saying "one of his company's customers produced the same amount of CO2 flying privately as three dogs did in a year." But the thing is, " private aviation serves a handful of very wealthy people, while pets bring people of all backgrounds joy and companionship," Lara writes, noting that "private jets are 5-to-14 times more polluting per passenger than commercial planes, and 50 times more polluting than trains." The choice is obvious: Pets > Jets.  While you weren't paying attention, WeWork managed to fall even farther from grace by failing to break even. Lionel Laurent says "its share price has fallen to levels that could see it delisted." Occupancy levels of the co-working space are below their target and investors are finally realizing that no amount of "fun" after-work cocktails can lessen the pain of a long commute. |

No comments:

Post a Comment