JPMorgan Chase, the largest U.S. bank by a wide margin, scooped up First Republic for ~$10.6B after regulators took possession of the distressed company earlier this morning. JPM is acquiring roughly $92B in deposits, $173B in loans, and $30B of securities.

The FDIC has agreed to split the losses on mortgages and commercial loans that JPM assumed in the transaction, while also offering JPM a $50B line of credit to ensure First Republic's smooth acquisition.

Jack Farley pointed out that JPM will NOT be assuming First Republic's debt or preferred stock, which is in contrast to the Bear Sterns situation in 2008 when JPM fully assumed Bear's preferred stock.

It's set to be a big week on the macro front, with the FOMC and ECB's rate hike decisions due Wednesday and Thursday respectively, followed by the non-farm payrolls report on Friday. The consensus for the former two events is 25bps hikes and 180k expected for NFP.

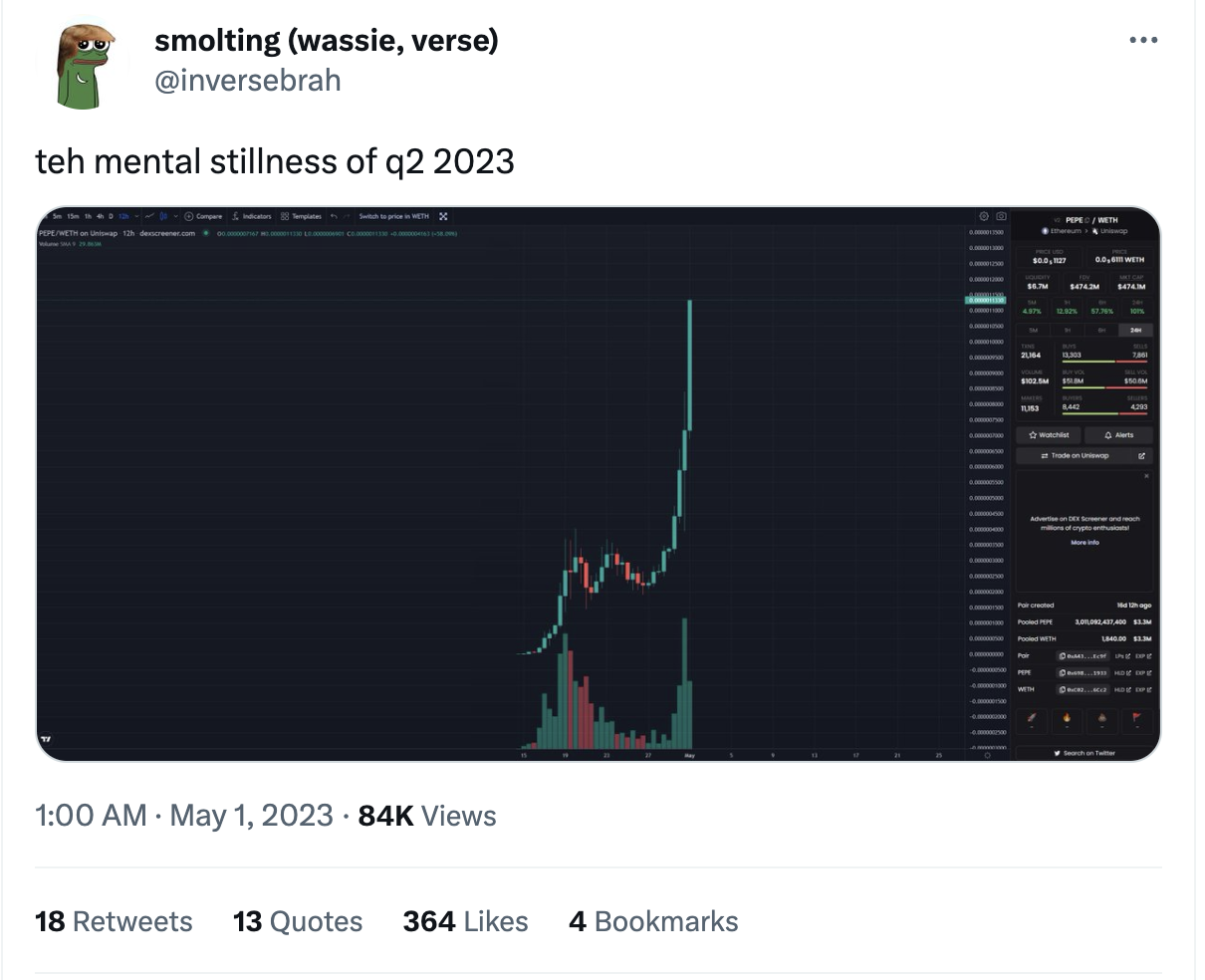

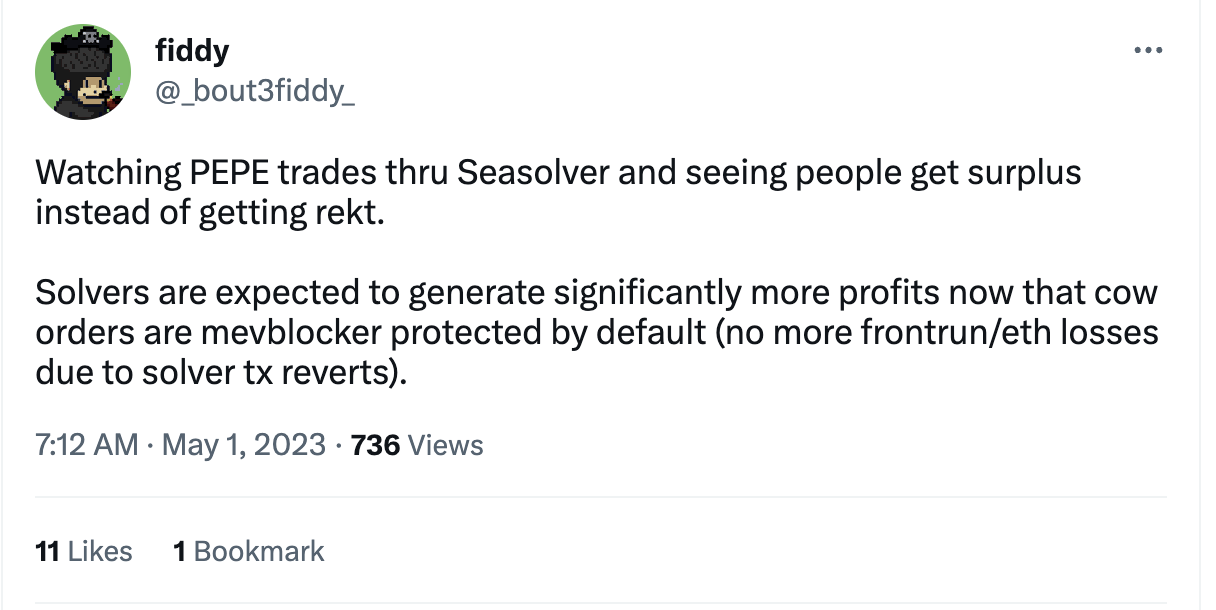

BTC and ETH have retraced over the past 24 hours but remain in the same range as the past month. Traders making plays on majors over the past few weeks have been getting chopped to death when all they really had to do was long PEPE.

The hottest new meme coin is near cracking the top 100 crypto assets by market cap, currently sitting around 120th with a market cap of over $500M. First it was DOGE, then it was SHIB, and now it's PEPE. When will the Blockworks Research team quit fading the meme coins?

- Sam Martin

No comments:

Post a Comment