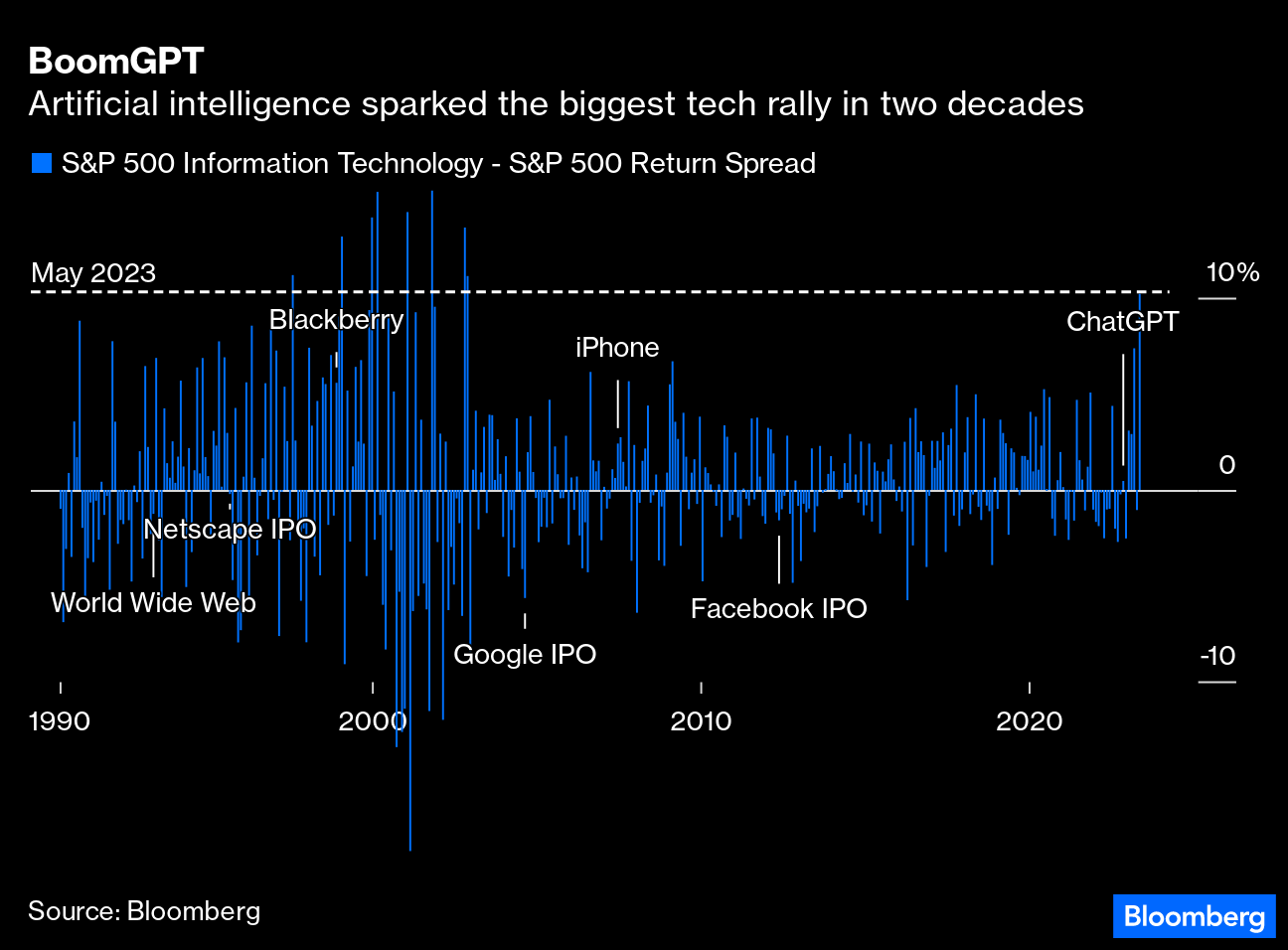

| May has been a historic month for investors in technology. How historic? Take a look at the following chart, which was suggested by Bespoke Investment Group. It shows the spread between the return on the S&P 500 Information Technology sectors and the broader S&P 500 for each month going back to 1990, three years before the World Wide Web was launched to the public. In May, tech beat the rest by more than than 10 percentage points for the first time in two decades. As we try to illustrate here, there've been plenty of innovations in those 20 years:  Obviously, the latest catalyst was the ChatGPT app six months ago, while the just-ended blowout month can be attributed to Nvidia Corp.'s astonishingly strong sales of chips as interest in artificial intelligence surged. It's also clear that while the potential of AI seems to have taken the market unawares before this dramatic attempt to catch up, this isn't unprecedented. The growth that followed the web's arrival launched, as we all know, a period of extraordinary outperformance as investors tried to work out who would benefit most from the new technology, followed by equally drastic underperformance (dot-com bubble, anyone?) as mistakes were slowly corrected. To look at that more rigorously, the increasing weight of tech within the S&P means that the individual sector is less likely to outperform it; that's because a boom for tech will have a bigger proportionate impact on the broader index as its weighting grows over time. If we compare the tech sector to the S&P 500 excluding technology index, initiated in 2000, the boom created by AI looks even bigger: The innovations of the last three decades changed all our lives, and eventually created wealth for shareholders. But it took time for them to work out exactly who would win, and there were some mistakes along the way. The AI boom has already taken some inveterate bulls by surprise; as Shuli Ren points out for Bloomberg Opinion, even Cathie Wood missed out on it. The potential is obvious, and doubtless much money will be made. But May's tech blowout suggests that there will be plenty of opportunities to lose money. Invest with optimism, but keep your eyes open. Categorizing emerging markets has always been tricky, and many think it's arbitrary. The term was coined in 1981 by a World Bank economist, Antoine van Agtmael, in an attempt to potentially reframe the conversation and lure traders to invest in promising but then-neglected stock markets. At that point, offering funds with stocks from countries across the emerging world, as a way to diversify risks and tempt investors, was a new idea that needed to be sold. EM, he wrote, "suggested progress, uplift, and dynamism." And it sounded better than "Third World," which had a negative connotation. Since then, EM has evolved into a distinct investment class, and indexing giant MSCI Inc. has effectively controlled the membership since launching the MSCI Emerging Markets Index in 1988. This index seeks to capture "large and mid-cap representation across 24 EM countries." At present, $1.3 trillion in assets under management are benchmarked to its EM indexes, meaning that decisions whether to reshuffle it, announced each year in June, can move a lot of money. Which countries fall into this definition? The Economist in 2017 put it aptly: "An economy that is not too rich, not too poor and not too closed to foreign capital." As someone (Isabelle) who grew up in the Philippines, I can attest that it is definitely an EM no matter how anyone defines it. And indeed, the country has had an uninterrupted membership of the index. But South Korea? Arguable. It looks and feels developed. I'm not the only one who's confused, as many in the world of finance think it should have graduated to developed status long ago.  Kia Corp. vehicles bound for shipment at the port of Pyeongtaek, South Korea. Photographer: SeongJoon Cho/Bloomberg Korea also seems to believe that it should have officially "emerged" by now. Ahead of MSCI's annual review, regulators have launched multiple reforms to revamp capital markets, and make the country's assessment assets more accessible. If all goes as hoped for the Koreans, MSCI will announce that it's consulting for a potential upgrade to the developed market World index at its meeting later this month, and confirm that in June next year. Full accession would not happen until 2025 at the earliest.

It's a huge deal for Korea. Much as with the long-running saga of China, which spent years trying to persuade MSCI to promote its A-shares to the EM index, the incident demonstrates the power that index providers now have. This fascinating Bloomberg Big Take shows that money managers are beginning to have second thoughts on whether a Korean move to developed status would actually be a good idea. So, How Does MSCI Define Emerging? For MSCI, classifying a market is based on three main metrics: economic development, the size and liquidity of equity trading, and accessibility for international investors. The latter two issues are the problem for Korea. This is what Henry Fernandez, MSCI's CEO, said about this to the Financial Times back in 2018: The issue with Korea is that because of the financial crisis and being an export-led economy, it's decided that they don't want to liberalise trade in their foreign exchange. They want to keep the spot market in the Korean won in Seoul only. That creates enormous complications for investors who are used to a more open market in developed markets. Taiwan is similar. That's going to be a difficult thing for them to deal with if they want to be a developed market.

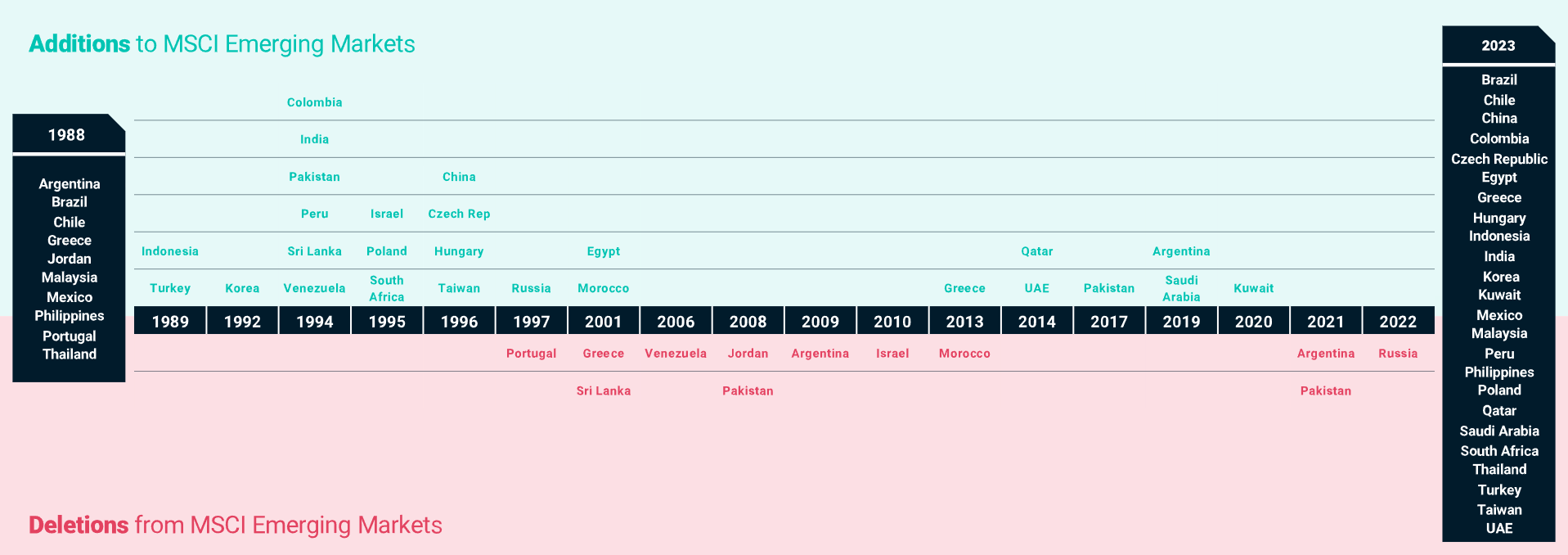

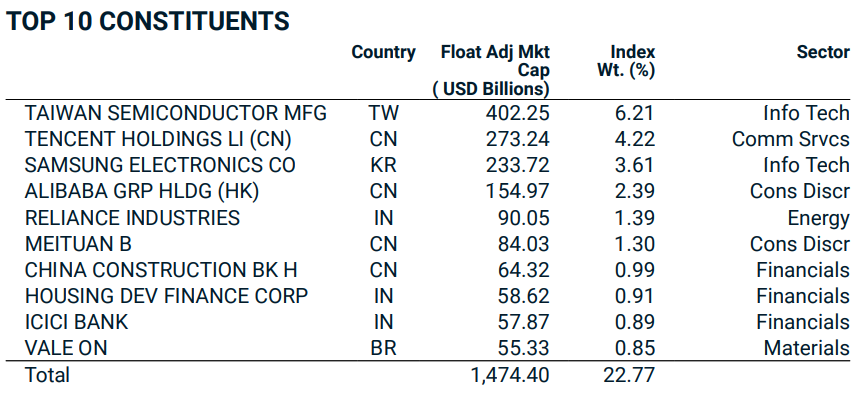

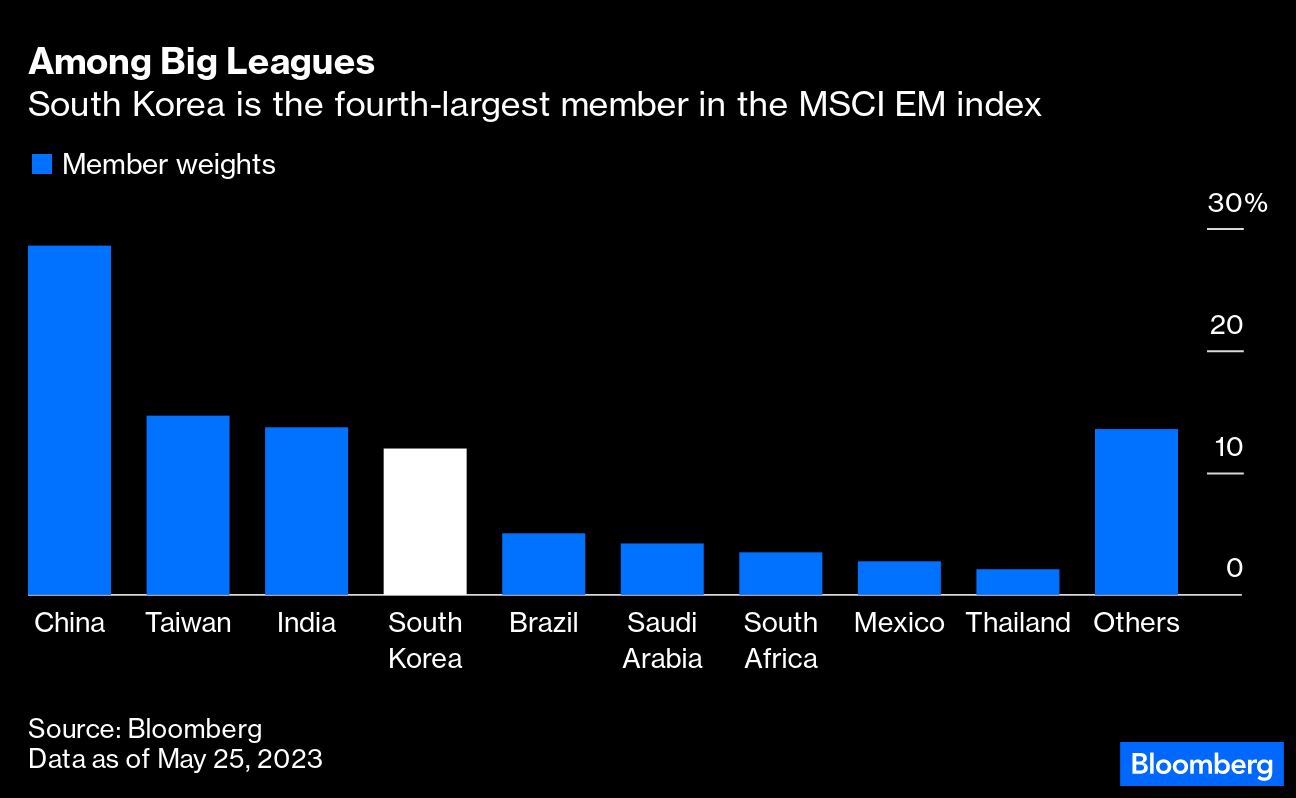

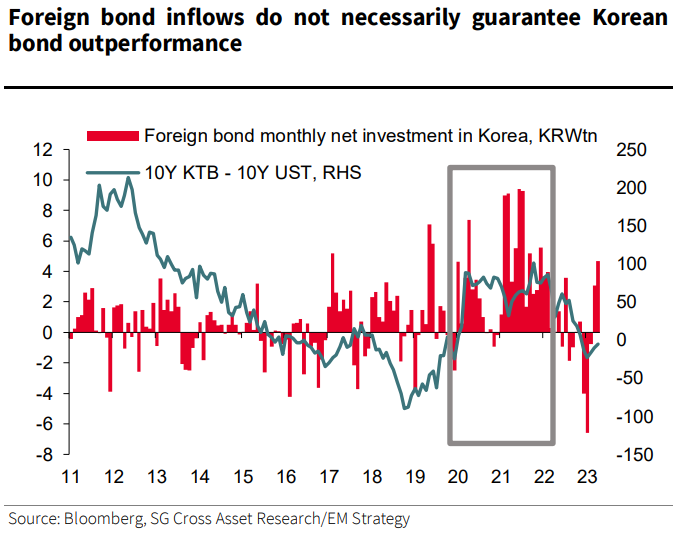

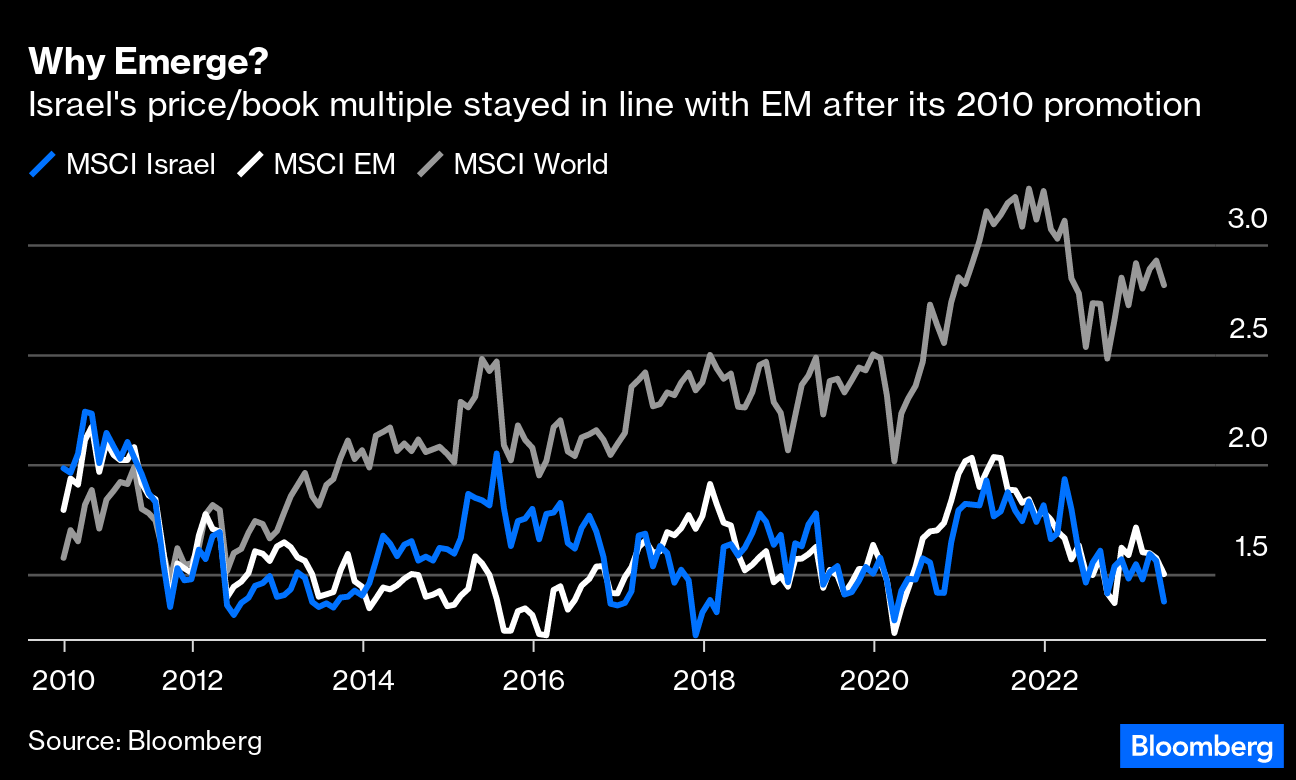

But MSCI hasn't set criteria that can't eventually be met. Membership of the EM index has been very fluid over the years. The graph below shows all the additions and subtractions since 1988:  Source: MSCI Interestingly, three countries that weren't even in the MSCI EM index when it was launched — Korea, Taiwan and China — now account for two thirds of its market value. The Philippines was already officially "emerging," but none of those three reached the index until 1992 (Korea) and 1996 (China and Taiwan). As of April 28, China dominated the top constituents of the index, claiming four spots out of 10. India has three companies while Taiwan has only one, though that one holds the heaviest weighting (and is likely to continue doing so as it manufactures chips for Nvidia).  Source: MSCI Is 'Emerging Markets' Still a Useful Classification? Peter van Dooijeweert, head of multi-asset solutions at Man Group, thinks investing in EM has recently been made more tricky by the growing influence of China. "It used to be a broad basket of emerging economies and now it is very much a concentrated China bet," he said in an interview. "Part of that reason is that the global market caps are so concentrated in China and the US that classes like EM are kind of trivial to the global market cap as well." These are the latest weights, with Korea in fourth place:  A more detailed look at the change in the index's composition shows that China has displaced Korea over the last 20 years. The following chart shows all the countries that have permanently been members since 2003. Back then, five years after the Asia Crisis, Korea had the biggest weighting, but South Africa, Brazil, Mexico, Malaysia, India and Russia all also accounted for significantly more of the index than China. That made sense. The stratospheric phase of Chinese growth had only just started, while its domestic A-share market was effectively closed to foreigners. The index offered the kind of broad exposure to many different idiosyncratic and geographic risks that van Agtmael had envisaged. It's hard to say that now: What Effect Would Korea's Departure From EM Have? For the rest of the world, China would grow even more important. Jonathan Krane, founder and chief executive officer of KraneShares, which offers a suite of China-focused ETFs, suggests that the bigger question is what would come next. "China's already going to 40% to 50% of EM," he said. "Korea comes out, China can go to 60%. So that's more of a reason why we think China has to become its own asset." In other words, just as investors long referred to "Asia Excluding Japan" as a geographic entity, it will probably make sense now to adopt the concept of "Emerging Markets Excluding China." It's possible that with political tensions rising and many investment managers under pressure to divest from China, this could direct flows to the larger emerging markets that have been left behind, such as Brazil, Mexico or South Africa. What Effect Would Promotion Have on Korea? Societe Generale strategists led by Kiyong Seong wrote that a Korean equity reclassification would result in massive equity and bond inflows, thanks to the much greater pools of capital that are benchmarked against developed market indexes. As such, market participants are positioning for large portfolio inflows to boost all Korean assets, including equity, the currency and bonds. The ramifications, however, "may be more complicated than many expect," they said in a Tuesday note. For bonds, where passive investing tends to follow the rival indexing group FTSE Russell, there won't be an "immediate absolute positive" and practical issues, including the timeframe of changes, will have an effect. SocGen's base case is an inclusion announcement in September 2023, followed by a preparation period of nine to 12 months for actually joining, and then a phasing-in over 18 to 24 months. Any positive repercussions would "likely not be visible this year." Long term, however, the transition to DM status and the inclusion of Korean bonds in the FTSE World Government Bond Index would "certainly be positive for market sentiment." It might also stabilize capital flows that at present are dominated by yield differentials — when Korean bonds yield more than Treasuries, they tend to attract more money:  As for rates, the strategists estimate that foreign bond inflows associated with FTSE bond index inclusion are "unlikely to be substantial enough to offset deteriorating local bond market technicals over the remainder of 2023." For equities, two reasons prevent a "meaningful positive impact" from an upgrade. "First and foremost is the risk of net outflows, as calculated by the SG Index team," they said. Emerging market managers would need to exit Korea, and might do so before developed market counterparts began to arrive in force. The second is the valuation: "We think expectations of a market rerating thanks to a reclassification to developed market status are misplaced." They give Israel as an example. Reclassification into a DM, announced in 2010, didn't trigger a material rerating. Here is how the country's price/book multiple has moved compared to both the MSCI EM and MSCI World indexes since then:  It was not just its "emerging" status that was holding Israel back. For all the importance of benchmarking, investors were more comfortable pricing Israeli assets much as they would have done if the promotion never took place. In the case of Korea, SocGen's team suggests that Korean stocks' relatively low valuation, with the MSCI Korea's current book multiple of 0.99 making it considerably cheaper than Israel, is down to two factors that have nothing to do with indexes. As they illustrate, Korea is still regarded as highly cyclical, which will deter investors from paying up a lot, while its companies tend to be shareholder-unfriendly. They don't pay out a generous dividend yield: It's difficult not to view the world through the lenses of indexes these days. But whatever benchmark a company is in, if it's particularly vulnerable to an economic downturn and you don't trust the management to share its profits with shareholders, you won't want to pay much for it.

—Reporting by Isabelle Lee  The WFH versus RTO debate keeps going. Photographer: Amir Hamja/Bloomberg The monthly ritual of new purchasing managers' surveys and non-farm payroll data is about to break out. There'll be time to write about that tomorrow, but for now, can we solicit your help with the way work is changing? The "Great Resignation" seems to be subsiding, judging by numbers showing the quits rate declining, but WFH (Working From Home) continues to be a thing, while RTO (Return To Office) still doesn't seem to be happening. The latest MLIV Pulse survey is digging in to how this is affecting you, and your business. To paraphrase Matt Levine, in this great piece, there are two theories related to working from home and financial crimes. One says that those working among colleagues in an office don't want to be seen committing any mischief, and so they don't. The other states that those working among peers in the office do want to be seen committing crimes, and so they do. So, let us know if you're more concerned about any shenanigans during financial transactions when your counterpart is working from home or from the office, and whether you find yourself more or less risk-averse when you work at home. The survey above is quick to fill out, it goes far beyond Matt's ideas of criminality, and it might help us all to survive our strange new working environment.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment