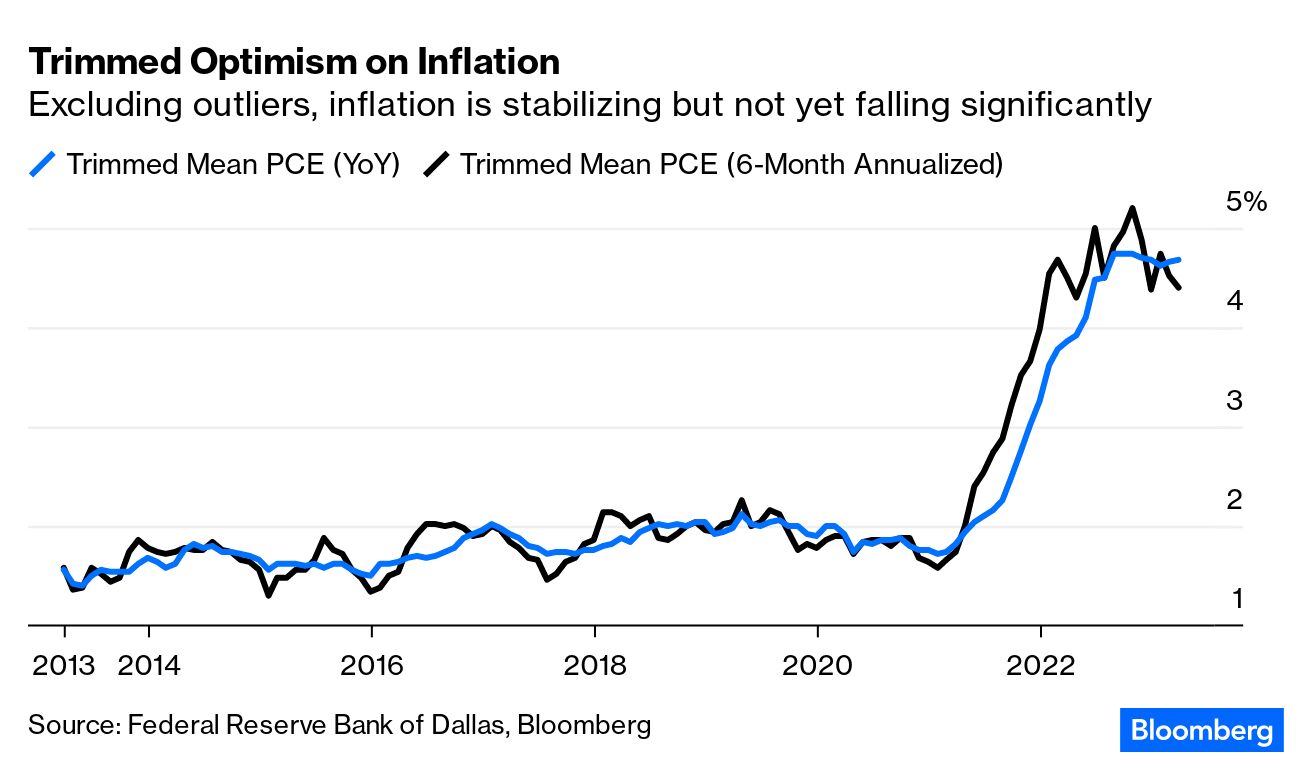

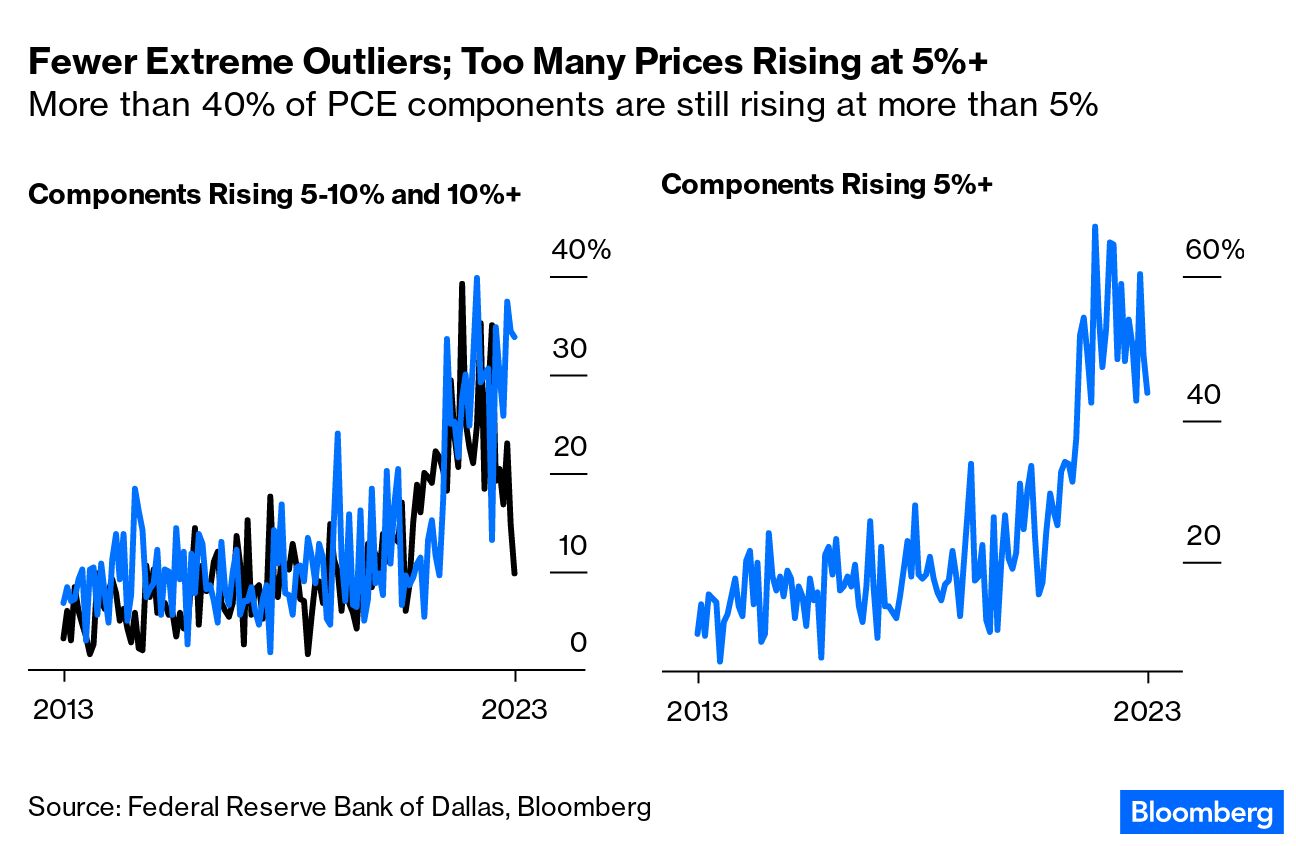

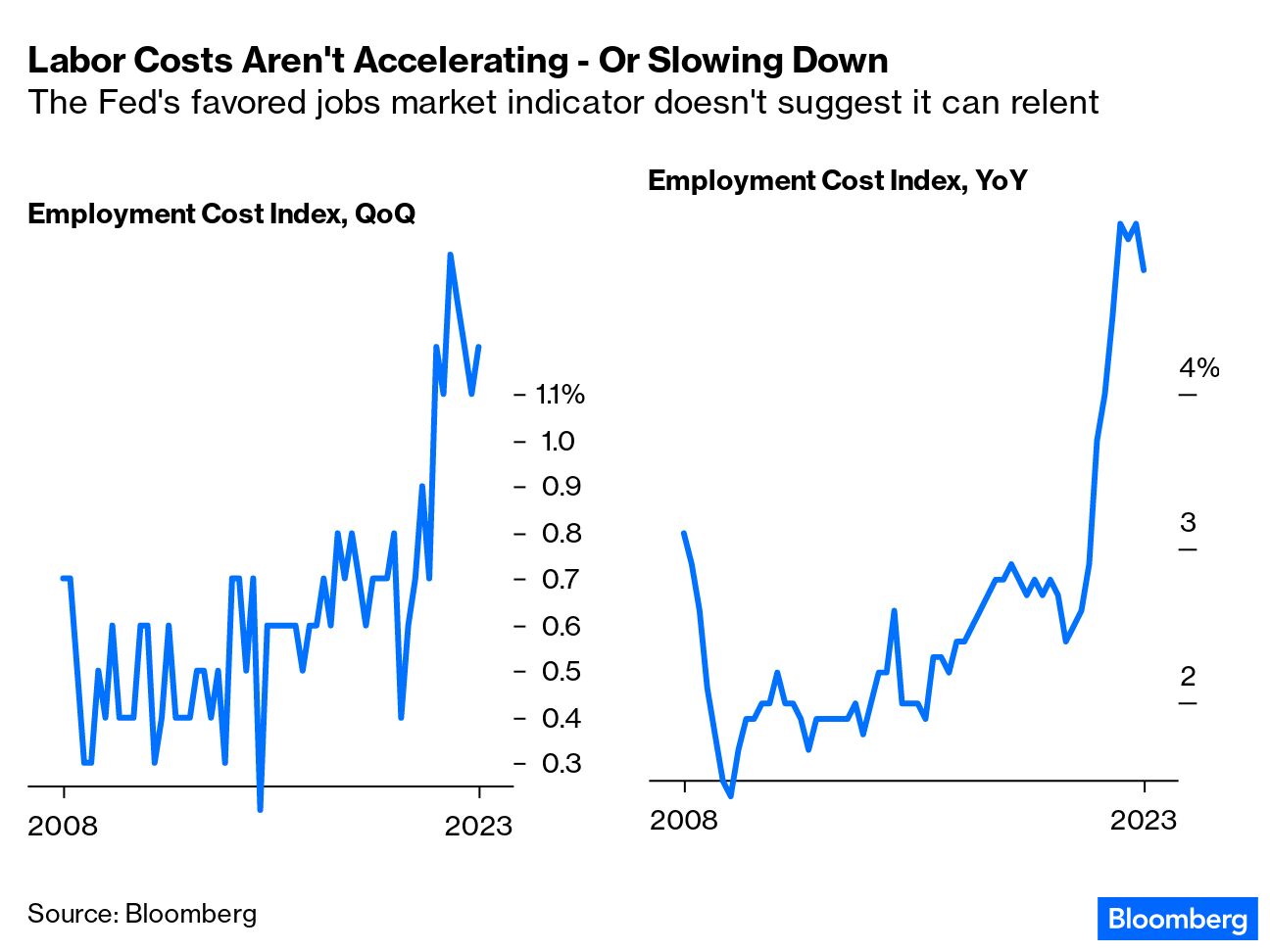

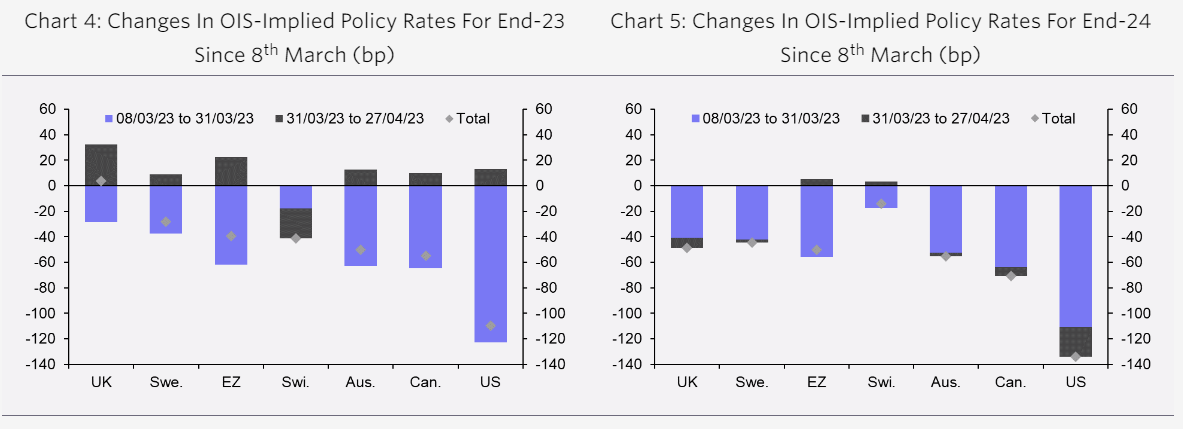

| As I write, there is still no white smoke over First Republic. I had been hoping to cover what looks set to be the second-biggest bank failure in US history, but as I write, approaching midnight in New York, negotiations between regulators and potential buyers are dragging on. High-stakes discussions with a midnight deadline are all very well, but they're a tad trying if you're hoping to write something about them, also with a midnight deadline. Particularly if that deadline is missed. Thankfully, it looks for now as though what happened immediately before the weekend might matter far more than the fate of First Republic. Friday saw a welter of US inflation data, none of which gave any special reason to expect that the Federal Reserve would relent in its rate-hiking campaign. Across the Atlantic, economic figures from Germany suggested pressure on the European Central Bank to tone down its rate increases would grow greater. As both central banks have monetary policy meetings this week, and it doesn't look as though the banking situation will be any let or hindrance to them, inflation dynamics are back front and center, and they suggest some difficult decisions ahead. US Inflation Most important, arguably, is the Personal Consumption Expenditure (PCE) deflator, compiled as part of the gross domestic product calculations. It takes a while to compute, which is why it comes out four weeks in arrears, but the Fed takes it more seriously than other inflation metrics. For a purists' approach, the Dallas Fed publishes a "trimmed mean" PCE, in which the biggest outlying components in either direction are excluded and an average taken of the rest. This leaves out extremes such as the surge in used-car prices in 2021, and gives what should be a good measure of core underlying inflation pressures. It suggests that inflation has stopped increasing, but also that the decline has barely started:  The Dallas Fed also provides data on how many PCE components are inflating at different rates. The good news is that the number inflating at 10% or more has dipped very sharply. The bad news is that price rises between 5% and 10% are still close to their highs, and more than 40% of PCE components are rising at more than 5%. The direction of travel is healthy, but inflation has not been vanquished:  This will be encouraging for the Fed, but gives it no impetus to ease off rate hikes absent other compelling reasons to do so. At one point, it looked as though the regional banking crisis would force them to change course. Investors now seem convinced that the banks won't force the Fed into emergency cuts. A big rise in employment might be another reason to pivot, and we haven't had one of those, as yet. (The next US data come out Friday.) However, the employment cost index reading also came out Friday. This is even more of a lagging indicator of the PCE, covering quarterly changes in the total costs of keeping employees, and doing it a month after the period's end. But it's about as good a measure of how much pressure the labor market might be putting on prices as we have, and central bankers watch it closely. As with the PCE, it suggests that inflationary pressures aren't accelerating any more — but also that they remain too high for comfort:  A reasonable reading for Federal Open Market Committee members would be that this was validating their actions to date, and that it made sense to press on with more hikes. It's possible that divisions within the FOMC are increasing. If so, those will more likely be reflected in guidance for the future, rather than in any dissent from a 25 basis-point hike this week. Just before the March FOMC meeting, the chance of a 25 basis point-hike at this week's meeting was put at 39% in the futures market. Since then, the travails of First Republic have not stopped sentiment from firming toward expecting another rate hike. Entering this weekend, the odds had risen to 83.6%. A belief that the banking crisis isn't such a big deal (correct or otherwise) is now written into expectations for May. International Perspective The same is not true of expectations for the rest of the year, however. And investors seem confident that the US will be more lenient than anyone else. The following charts from Capital Economics show overnight index swaps-implied rates for the end of this year and next for the biggest western central banks. As shown in blue, expectations for the end of 2023 fell massively in the three weeks between the outbreak of the problems at SVB Financial and the end of March. During April, expectations rebounded. In the UK, thanks largely to ongoing awful inflation numbers, that was enough to recoup all the decline. In the US, however, forecasts for year-end only ticked up a little, while they continued to tick down for the end of 2024:  The US sticks out like a sore thumb partly because its hiking campaign was more advanced to begin with, and mainly because the banking crisis happened there. When the FOMC last reported on its members' projections for the end of 2023, days after SVB, all bar one thought that the fed funds rate would be above 5%, with some thinking it could be closer to 6%. There's usually a gap between market expectations and Fed guidance, but this is an unusually wide one. If the market thought the banking crisis would force the Fed into a massive volte-face back in March, and no longer thinks it is so much of a problem, why the continuing confidence in a volte-face? Why even be so confident that rates aren't going higher and staying there for a while? Marc Chandler of Bannockburn Global Forex points out that there are reasons why markets should expect more hikes elsewhere: What makes the May rate hikes important is that the derivatives markets are confident (again) this is the last hike for the Fed. The swaps market anticipates two more hikes from the BOE and the ECB. Headline CPI in the UK has been above 10% for seven consecutive months through March. The ECB, which was slower than the others to initiate the tightening cycle, is understood not to be quite finished either. Before the bank stress emerged, the market had priced in a peak Fed funds rate of nearly 5.75%. Now, the May hike to 5.25% is expected to be the top. Similarly, the swaps market had the ECB's target rate rising to 4.0% by the end of September, and now it sees the peak between 3.50% and 3.75%.

Meanwhile, continuing dreadful inflation numbers in the UK have brought predictions for the Bank of England's Bank Rate back to where they were before the bank stress started. And the Bank of Japan's decision to change nothing at its meeting last week, despite the highest inflation in four decades, shook some assumptions: The overwhelming consensus for several months now has been that yield-curve control — the policy of intervening to keep 10-year bond yields lower — is bound to be abandoned this year. Now, judging by the sudden fall in the yen against the dollar at the end of last week, some foreign-exchange traders are beginning to wonder whether the BOJ really might keep to its present course: The dance between markets and central banks continues to matter more than the fate of First Republic. Despite all the banking tremors and the ongoing worries about inflation, stock markets seem impregnable. Complacency might have something to do with this. So might the extra liquidity that has been flowing to avert any major banking implosions. But more than anything else, it is about tech. That's more true now than at any time since the pandemic. To illustrate, look at this chart from Jitesh Kumar of Societe Generale. It shows the cumulative proportion of the S&P 500's return in each of the last few quarters that can be attributed to each stock, with those that made the greatest contribution to the rise or fall coming first. All will end at 100. So far this year, the S&P 500 has been far more top-heavy than in the previous quarters, with the top 10 stocks on their own accounting for 86% of the index's returns: The mood might be very different, then, if the tech stocks were not rebounding so impressively. They do at least, however, seem to have good reason to do so. What follows is the rolling 12-month forward earnings estimate, as compiled by Bloomberg, for the Nasdaq 100. After a serious slide last year, estimates are bouncing equally impressively: If earnings are reaccelerating, that can only be good news for the stock market. The fly in the ointment is that their surprising strength is due to margins, rather than to growing revenues. That implies reasons for concern about inflation, and more cause for popular anger about price-gouging by corporations, along with less reassurance that the economy is in decent shape. But it's also a surprise to those (like me) who thought margins were going to revert to the mean at last. This is the comment of Tallbacken Capital Advisors' Michael Purves: Thus far, it is earnings, not revenues, which are putting in the impressive beats. This negates the narrative that margins would collapse against a deflating topline. The average revenue beat thus far is slightly above 2%, down slightly from the prior quarters not by a lot – and still pretty impressive. What is more striking is that the average earnings beat has jumped to 7%, really a 2021 type level beat and among the highest beat levels in the recent years:

If companies have enough pricing power to maintain their margins, that helps their shares for now — but the longer-term implications could be much trickier. Stop Press: First Republic The chances are that many of you reading this are already aware of the deal that was thrashed out for First Republic. Without knowing the identity of the buyer, the amount the government has to contribute, and the provisions for depositors (particularly uninsured ones, headed by the banks that sank $30 billion into the lender in March), there's nothing worth saying now. My apologies, and let's hope the parties use this extra time to come to an agreement that keeps the financial system sound without creating even more moral hazard. It won't be easy. You won't have seen the name of my colleague Isabelle Lee in this newsletter for the last few days. That's because she took time off to get married. Many congratulations, Isabelle. And, as you might have guessed, here comes a list of appropriate songs for the occasion: Marry You by Bruno Mars, Marry Me by Train, Be My Wife by David Bowie, White Wedding by Billy Idol, anything from Duran Duran's Wedding Album, or My Favourite Dress by The Wedding Present. As some of those aren't terribly romantic, you could also try some songs with wedding-themed videos, such as Love Is All Around by Wet Wet Wet, (theme tune for Four Weddings and a Funeral and later Love, Actually), the cover of the Bee Gees' Tragedy by Steps or Sugar by Maroon 5 (although it does rather bother me that all the brides in the video seem more excited by Adam Levine than by their newly minted husbands). For something more classical, try Se Vuol Ballare, Figaro's advice to his master who is hoping to sow his wild oats before marrying in the The Marriage of Figaro, or the finale in which everyone is reconciled in one of the most perfect moments in all of Mozart (this is what Salieri thought of it in Amadeus). On a more practical level (as I gather my colleague has a number of celebrations ahead of her), there are plenty of lists of great songs to play at weddings. Not all of them are schlock. Crowd-sourcing efforts from another crowd, the New York Times put together this list in March, while The Washingtonian put together a list of the 99 most popular wedding songs of the moment (including Living on a Prayer by Bon Jovi, which makes me despair of humanity). There's an already-existing Spotify list, while Brides.com offers this list of the 80 most romantic songs. I hope all this is of use to my colleague; if anyone else out there has nominations for great songs about weddings or to play at weddings, do let me know. Congratulations Isabelle, and have a great week everyone else. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment