| Today we're coming to you from Powerscourt near Dublin at the Bloomberg New Economy Gateway Europe conference. Just days after the head of the International Monetary Fund warned that fragmentation in the global economy can have negative consequences, the key takeaway from Bloomberg's Gateway Europe conference Wednesday was how Brexit clearly proves that point. Michael O'Leary, chief executive of Ryanair Holdings Plc, said that while the airline is still adding capacity in the UK, hiring is "incredibly difficult." Back when it was in the European Union, Britain's borders were more open to labor migration from the continent. But no more. Brexit will continue to have a "net negative" impact on the UK economy over the short to medium term, O'Leary said. Pharmaceuticals giant AstraZeneca warned that Britain is falling behind in innovation, after the UK-based company opted to build a new manufacturing facility in Ireland. The UK should "act faster around innovation" and "really give incentive for companies to be driving that innovation," AstraZeneca Executive Vice President Pam Cheng said.  From left are Pam Cheng, executive vice president at AstraZeneca Plc, Shannon O'Neil, vice president of the Council on Foreign Relations, Denis Redonnet, the European Union's chief trade enforcement officer, and Bloomberg Senior Executive Editor Stephanie Flanders at the Bloomberg New Economy Gateway Europe conference Wednesday. Photographer: Paulo Nunes dos Santos/Bloomberg London's status as Europe's most-important financial hub is increasingly in question, having lost a large swath of business to Paris, Dublin and other euro zone cities. Citibank Europe Plc Chief Executive Officer Kristine Braden said her bank—a unit of Citigroup Inc.—has had to redirect clients to its offices in the EU as a result of Brexit. Already in the process of moving employees, it's now entering a third phase, moving some of its products from the UK to other European countries. Worst of all, the most negative consequences for Britain may have yet to fully materialize. "The messier part is yet to come" in terms of the impact on financial services, Braden said. Her view was backed up by APCO Worldwide LLC adviser Declan Kelleher, who said cross-border trade frictions are likely to increase as the UK begins to implement new rules. While Prime Minister Rishi Sunak has been working on rebooting ties with the giant economic bloc to the east, seven years years after Britons narrowly voted to leave the EU, the tally is sobering. The government's fiscal watchdog estimates Brexit will knock 4% off GDP in the long run. —Chris Anstey - China Engagement | Relations with China will continue to be an important feature of how the global economy develops in spite of pressure from the US to decouple from Beijing, said Paschal Donohoe, president of the Eurogroup. He also said the EU will reach an agreement on the review of its common fiscal rules.

- ECB Policy | European Central Bank Chief Economist Philip Lane said another increase in interest rates is appropriate next month, with data due in the coming weeks to determine the size of the move.

- Airfare Hikes | Developing more sustainable aviation fuel is vital, but will end up being reflected in airfares, according to Willie Walsh, director general of the International Air Transport Association.

- Isolated Cases | Italian banking honcho Andrea Orcel of UniCredit SpA played down the recent bank failures, saying they were "isolated cases, they were pretty much idiosyncratic."

- Ireland's Appeal | The country is moving to address its housing shortage, but the limited supply hasn't prevented companies from doing business there, according to the new head of Ireland's investment promotion agency.

Among the highlights on Day Two of the conference will be: - Europe's role in a divided world, with former Croatia President Kolinda Grabar-Kitarović and ex-UK ambassador to the US Kim Darroch.

- A discussion of how Brussels is shaping global regulations, with panelists including Helen Dixon, Ireland's commissioner for data protection.

- Spotlight on the financial system with BlackRock Inc. Vice Chairman and former Swiss central bank chief Philipp Hildebrand.

- A conversation with Irish Prime Minister Leo Varadkar.

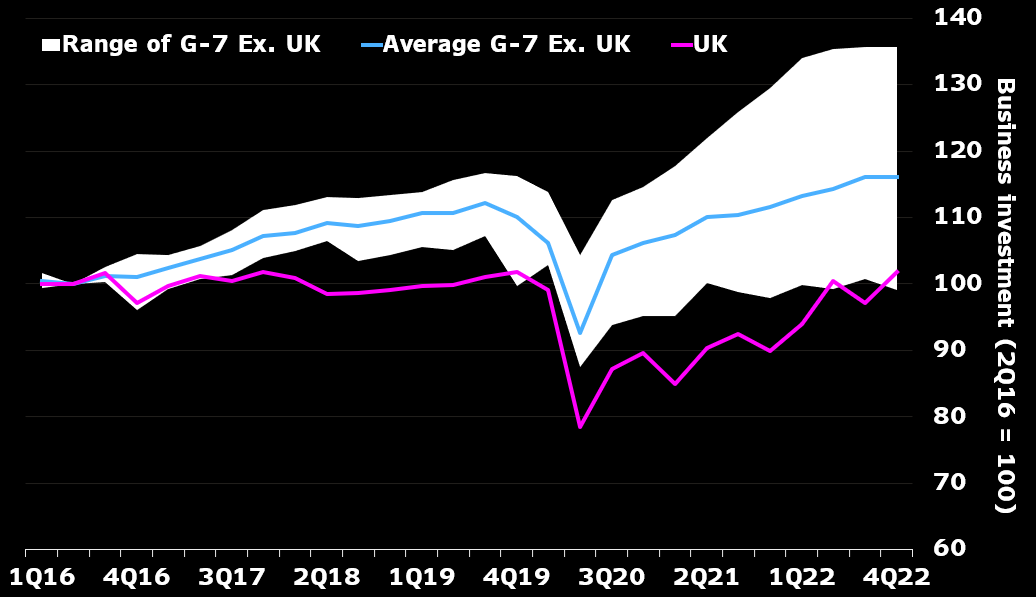

UK business investment has performed dismally in recent years, growing by only 1.8% since the Brexit referendum in 2016, according to analysis published last month by Bloomberg Economics.  Bloomberg Intelligence Capital spending also has expanded by 10% less than its main global peers, economist Ana Andrade wrote. Accounting for 10% of GDP—but highly procyclical—capex is an important driver of short-term growth. "It is also fundamental for an economy's long-term prospects, as it lifts the capital stock and productivity," she said. |

No comments:

Post a Comment