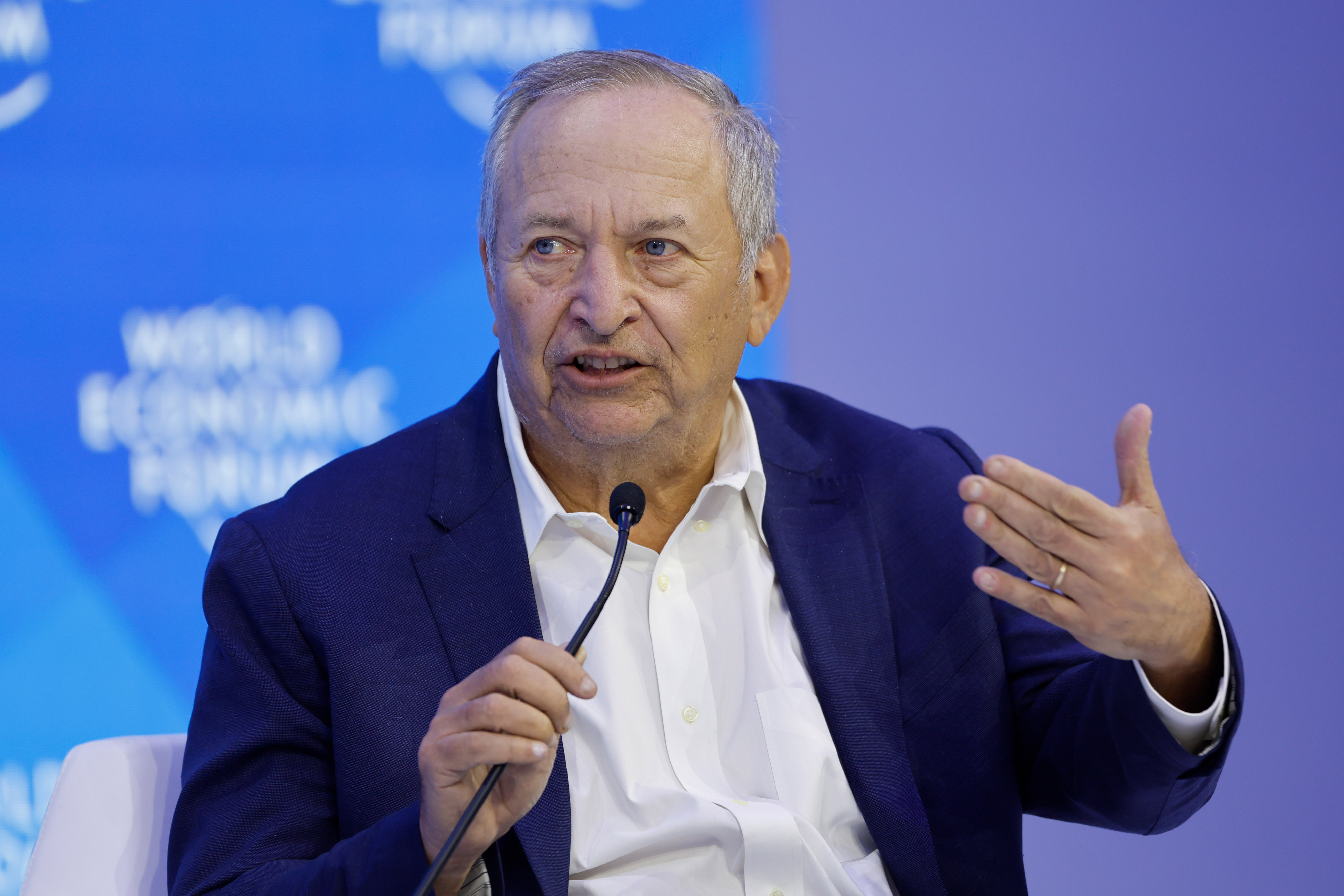

| Navigating this world of rapid change and instability poses huge challenges for businesses, policymakers and investors. That's why, on April 19-20, we're convening the Bloomberg New Economy Gateway Europe in Dublin (click here for details). This event will explore the forces transforming trade and industry everywhere, from banking to aviation, energy to semiconductors. Join us for conversations with UniCredit's Andrea Orcel, DeepMind's Lila Ibrahim, the ECB's Pablo Hernández de Cos and Magic Leap's Peggy Johnson, among others. —Erik Schatzker, editorial director of Bloomberg New Economy Economic growth ultimately depends on two things: adding workers and boosting their productivity. On both counts, in most major economies, things have been looking bleak. Populations are aging and in some cases shrinking. And the great internet productivity boom is long gone. But in recent days a trio of analyst reports identified developments that could lift productivity over time. Goldman Sachs looked at artificial intelligence. Citigroup considered the much-less-sexy, but potentially transformative, blockchain technology. Perhaps most prosaically, Oxford Economics highlighted the implications of 5G mobile networks. If these scenarios pan out, it would be a game changer. Trend growth rates would be higher. Government debt loads that look menacing now would shrink over time. Real income gains would be stronger. There's certainly danger in hyping up new technology that ends up having marginal macroeconomic effects, but at the same time history does show periods when major changes occurred. The adoption of the electric motor starting in the late 1800s, and personal computing in the 1970s proved transformational. An MIT paper last year found that roughly 60% of employment as of 2018 was in occupations that didn't exist in 1940.  Gordon Moore, the late co-founder of Intel, in San Francisco in 2007. Photographer: Kimberly White The recent passing of Gordon Moore—author of the law that became a yardstick for measuring the speed, memory and capabilities of an electronic device—also reminds of the power of technology. Indeed, it was the exponential surge in computing power that Moore first helped to unleash in the 1960s that enabled, as Goldman economists Joseph Briggs and Devesh Kodnani put it, the current rapid advances in the complexity of tasks AI can perform with accuracy. The latest step came in mid-March, with the unveiling of ChatGPT-4 by artificial intelligence company OpenAI. It's an even more powerful iteration of the interactive program that went viral late last year. "The genie is out of the bottle—there are going to be all kinds of people doing all kinds of things" with the new offering, said former Treasury Secretary Lawrence Summers (a paid contributor to Bloomberg TV). "This is going to be a story like other technology stories—it may take longer to happen than you think it will, but ultimately it will happen faster and more pervasively than you thought it could."  Larry Summers Photographer: Stefan Wermuth/Bloomberg Briggs and Kodnani liken the ease of use of new chatbots to the introduction of the mouse and icons on personal computers. Those advances made computers much more user-friendly than the old MS-DOS command-line programming. The Goldman duo concluded, in a March 26 note to clients, that about 7% of current US employment could be replaced by AI, with 63% being complemented and 30% unaffected. As in previous eras of technological advancement, many displaced workers will likely be employed in new occupations that emerge either directly from AI or as a result of the economic expansion produced by greater productivity, they said. "The combination of significant labor-cost savings, new job creation and a productivity boost for non-displaced workers raises the possibility of a labor-productivity boom like those that followed the emergence of earlier general-purpose technologies," Briggs and Kodnani wrote. Once at least half of firms worldwide adopt AI technologies, annual global GDP could enjoy a 7% boost in the subsequent decade, Goldman said. In the US, labor productivity—which only expanded 1.3% on average in the past decade—could get a 1.5 percentage point-per-year lift, over a decade, the bank estimates. Oxford Economics pencils in a similar-scale bump to productivity in a report analyzing the implications of the rollout of 5G networks (which, by way of disclosure, the research group notes was commissioned by the telecommunications-equipment company Qualcomm Inc.) The group said "modeling indicates that the connectivity improvements enabled by mid-band 5G mobile networks are projected to contribute 1.1% to global GDP in 2030 through productivity gains." Traffic-capacity improvement and faster internet speeds of course bolster the take-up of technology such as AI. And Citigroup's Global Perspectives & Solutions (GPS) group sees a particularly rapid spread. "Mass adoption for AI could be as early as 2-4 years, driven by the rapid recent increase in data availability and computing power, improved algorithms, and models that have led to products such as ChatGPT." Broad take-up of blockchain technologies is likely just a little further out, but "we are approaching an inflection point," where its promise "will be realized and be measured in billions of users and trillions of dollars in value," Citi GPS's Kathleen Boyle wrote in her group's report. The finance sector in particular could see a major revamp thanks to blockchain, particularly with its ability to "tokenize" assets—creating a transparent, digital record of ownership that then allows fractions of them to be traded in ways that have up to now been impossible. Real estate, agriculture, carbon credits, intellectual property and items such as art tend to be difficult to trade. The Citi team cited one study that showed some $16 trillion of assets, or nearly 10% of global GDP, could be tokenized by 2030. Financial assets such as trade invoices, private loans and mortgages, as well as more common securities could also be tokenized. The reason using blockchain technology to tokenize things is important is because it spurs new ways of funding investment. Citi anticipates change such as "new financing avenues for small companies and small and medium enterprises," for example. And new support for infrastructure. Legal and regulatory changes will be needed to support the new technology, but at least in one area such moves are already underway. Citi highlighted moves in the UK to allow for the acceptance of digital documents—a "huge step for the global trade finance industry, as around 80% of global volumes are governed by English law." Beyond the current banking-sector turmoil and inflation woes, all of these developments bear watching. —Chris Anstey Get Bloomberg's Evening Briefing: Sign up here to receive our flagship newsletter in your mailbox daily, along with our Weekend Reading edition on Saturdays. |

No comments:

Post a Comment