| Sunday brought a classic retro oil shock. The OPEC+ cartel, which combines the traditional Organization of Petroleum Exporting Countries with Russia and a few others, announced that it was cutting production at the end of this month. It was just the kind of ugly supply shock that created mayhem in the global economy in the 1970s, and again as recently as last year after the invasion of Ukraine. The immediate reaction was that this would pitchfork the world back into an inflationary morass. When Brent crude jumped 8% at Monday's Asian opening, that seemed to be confirmed. Just as the entire macro narrative changed overnight three weeks ago with the collapse of Silicon Valley Bank, so it seemed that this was a shock that would shift the debate back toward inflation and higher rates. It hasn't taken long for markets to digest the shock, though. One macro strategist summed it up nicely in an email to his clients: Wow… a bit of "was this your best shot?" Reaction to oil!

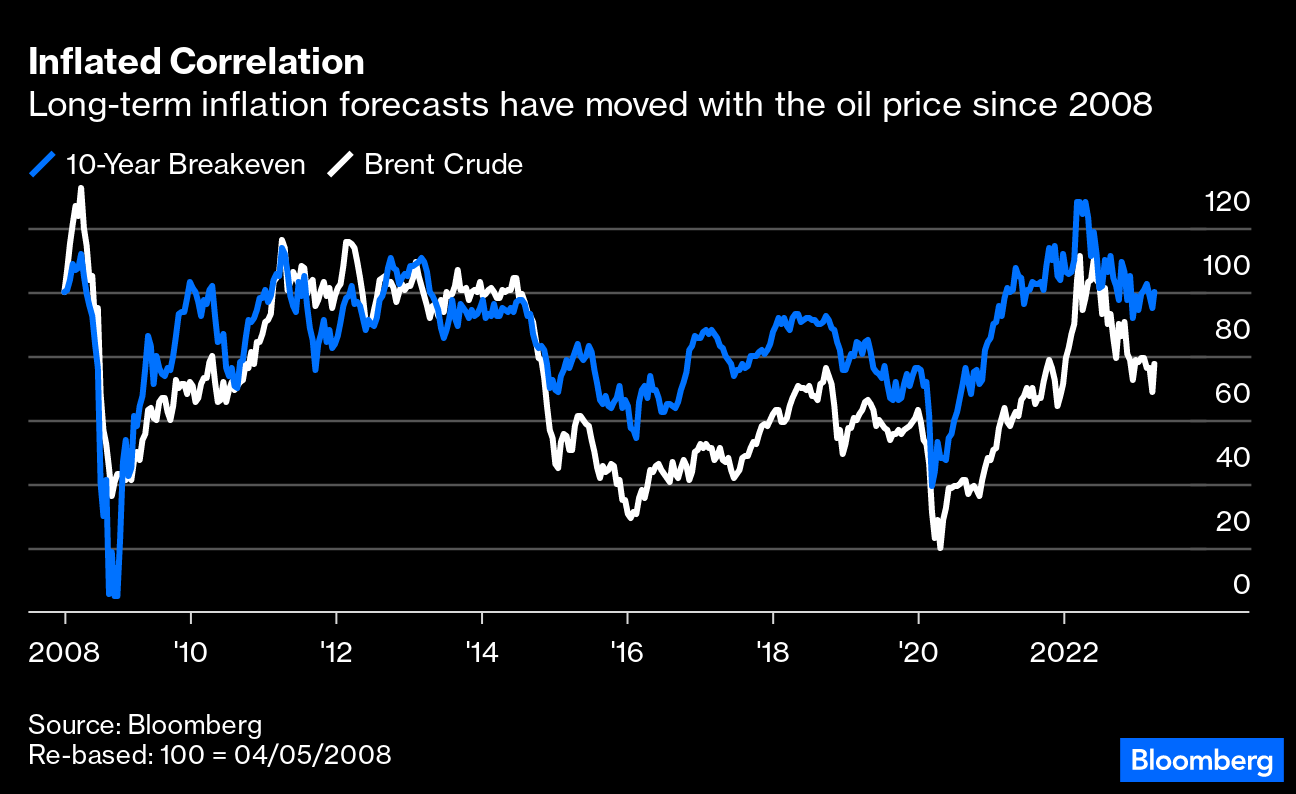

That's about right. The market reaction, indeed, seems to confirm that some of the stronger market correlations of the era since Covid hit, and indeed since the Global Financial Crisis of 2008, are abating. They also suggest that growth is taking over from inflation as the greatest cause of concern. An increase in oil prices can be an indicator of growing demand and economic strength, in which case it also implies a risk of inflation, and strong performance for stocks relative to bonds. This has been particularly pronounced since late 2018, with stocks and oil tracking each other closely throughout the pandemic era — and then parting company last summer as the oil price receded and stocks carried on their way: If there is a justification for this, it's that oil was seen as a proxy for global demand. The parting of the ways came after the price hit an extreme in the wake of the Ukraine invasion. From then on, its decline was cause for ever greater relief that the US and European economies weren't going to be squeezed by intolerable energy costs. Higher oil prices are no longer seen as good news for stocks. Meanwhile, the trade-off between oil and long-term inflation projections is murkier. In the short term, costlier oil means near-term inflation estimates should also rise, because energy is a large component of inflation. Over a decade, the oil price should be irrelevant to where we expect overall inflation to move. And yet, the link between 10-year bond market breakevens and the oil price has been iron-clad, ever since the GFC:  This has something to do with the tendency of traders in TIPS (Treasury Inflation-Protected Securities) to use oil futures as a hedge. But it does also suggest that the notion rising oil prices should increase expectations of future inflation have become deeply engrained in the investor psyche. However, Sunday's news from OPEC+ was greeted by a fall of 2.2 basis points for the 10-year breakeven, which now stands at 2.305% — a level that implies that OPEC+ hasn't shaken the market out of the conviction that inflation is under control. Bond yields fell across the curve, again the opposite of what would be expected if an oil price rise was regarded as inflationary. US stocks made very slight gains, largely thanks to the big rally in energy stocks. The bottom line is that OPEC+'s action is not currently seen as hugely inflationary, or even very significant. By the close, Brent crude's rally had drifted back a little to 6%. This was a good day for anyone who was holding crude oil futures, but viewed in context this was not a particularly remarkable event. Crude prices tend to be variable, and oil has had several weekly rallies on about this scale since it recovered from the initial Ukrainian shock last summer: Big move though this undoubtedly was, then, it's not perceived to have changed the game in the way the banking crisis did last month, or the UK gilts crisis did last fall. Why not? In part, it's because traders have come to doubt the power of oil producers to hold prices upward through limiting supply. This is the comment of Konstantinos Venetis at TS Lombard: As a rule, the recipe for sustainable oil market turnarounds is positive demand surprises, not pre-emptive supply reductions. Just like the production cuts announced in autumn 2022, this essentially amounts to a defensive move in the hope that the world economy skirts a severe economic downturn in 2023. Our sense is that at this juncture sticky oil prices are more likely to weigh on growth than arrest the broad disinflation process already under way. For bonds, this means that spikes in yields on the back of renewed inflation concerns are likely to be short-lived. For equities, firmer oil prices will (if anything) weigh on already falling earnings expectations.

That's a common belief. Matt Maley, chief market strategist at Miller Tabak + Co., wrote that a supply-driven spike in prices was a different animal from a demand-driven one: If the price of oil is going to remain high due to supply issues rather than demand issues, those supply-induced higher prices will have a negative impact on demand. In other words, the high oil prices will not indicate a pickup in demand. Instead, it will CREATE a downturn in growth just like it did in during the 1970s. A supply-induced rise in oil prices is not good for an economy, especially one that is very likely just about to face a significant contraction in the supply of credit.

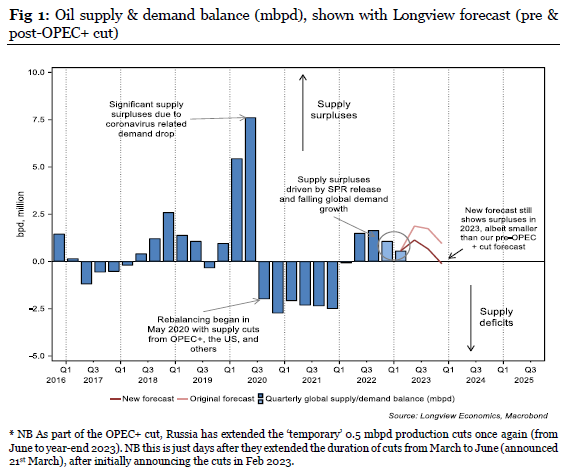

Nothing said "downturn" 50 years ago quite like running out of gas. Photographer: HUM Images/Universal Images Group/Getty Beyond this, there was a widespread perception that this OPEC+ move was fundamentally defensive, responding to a fall in prices. Bradley Waddington of London's Longview Economics pointed out: While the OPEC+ cut has bolstered prices in the short term, the nature of the announcement reveals some underlying bearish factors. In particular, the cuts were announced in response to lower oil prices, further highlighting how OPEC+ are 'price-responders' and not 'price-makers.' In other words, it shows how OPEC+ only cut supply after oil prices have already weakened. As such, OPEC+ are unlikely to cut again unless prices move even lower, i.e. oil prices would likely have to move even further below ~$65 for OPEC+ to cut supply again.

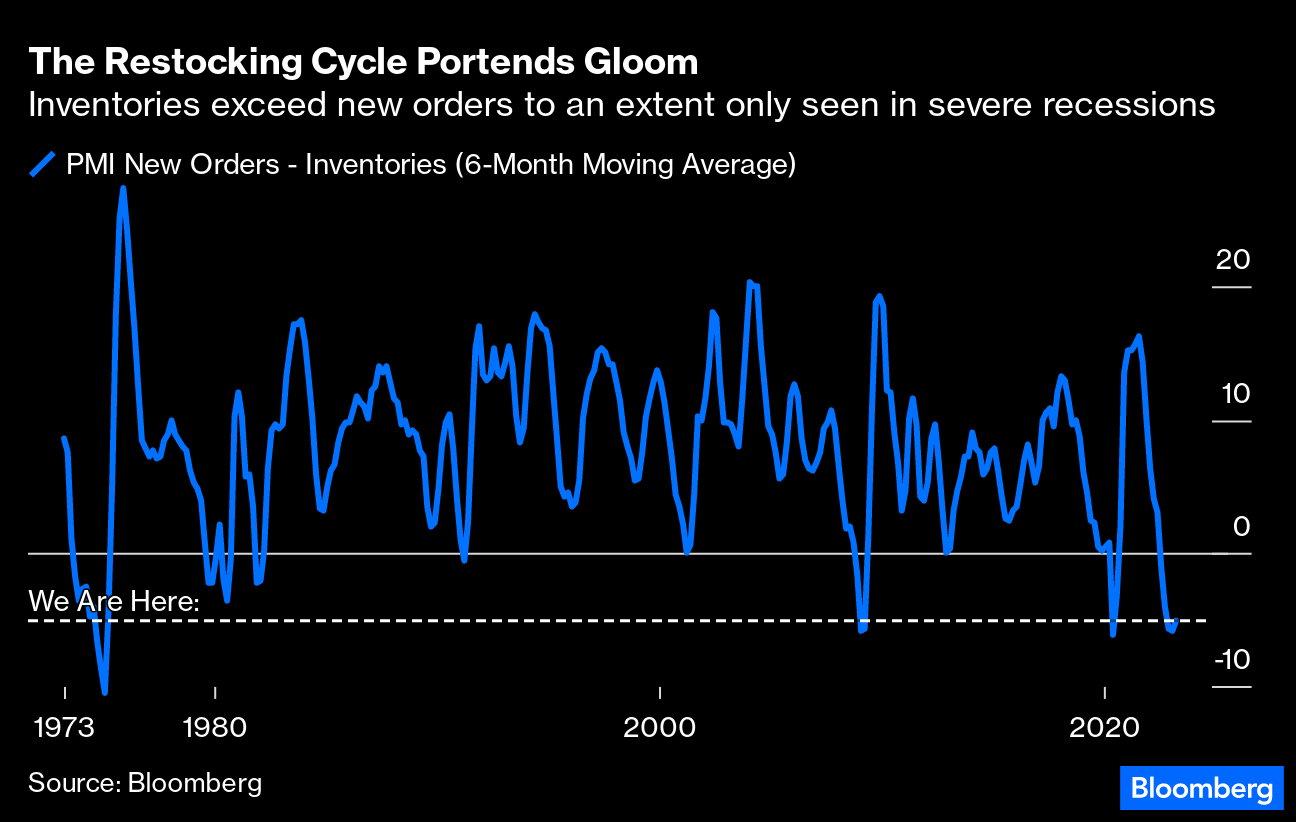

On Longview's calculations, OPEC+'s move should bring supply and demand into balance by the end of this year, when previously they were on course for surplus supply. In other words, it was a move born of weakness rather than strength:  The reception for the oil news also had much to do with the fact that it was swiftly followed by manufacturing PMI purchasing manager surveys, which tended to emphasize that growth, or the lack of it, may now be more of an issue than inflation. One classic measure of economic risks homes in on the restocking cycle. If companies have boosted inventories and then new orders fall, the likely solution will be to cut back production (presumably taking employment with it). The ISM's measure of inventories has now exceeded new orders without a break since last June, the longest such run since the mid-1970s. As the following graphic shows (using a six-month moving average to handle occasional big blips in the series), new orders have only previously been so depressed compared to inventories three times in the last half-century — during the disastrous downturn that followed the first oil embargo of 1973, at the worst of the GFC in 2009, and the Covid shutdowns in 2020:  Meanwhile, the ISM gauge of prices fell, suggesting cost-push prices were abating, while its overall measure dropped further into territory suggesting a recession: Kristen Bitterly, head of North America investments at Citi Global Wealth, commented that the market's behavior had been "super interesting" because we first got the news about OPEC and then about the manufacturing data. Her interpretation was that the total package could prove disinflationary: What's going to drive consumer sentiment and also consumer spending? If we're in an environment where energy, where gasoline, is going to be more expensive because of these production cuts, then that very quickly changes the consumer spending patterns and behaviors and the areas where we've seen those types of pressures obviously have been from an inflationary standpoint more services focused. This could actually show a more material decline in consumer spending in those areas if we see this ultimately flowing through to gasoline prices and forcing consumers to make some challenging decisions as we embark upon the spring and summer months.

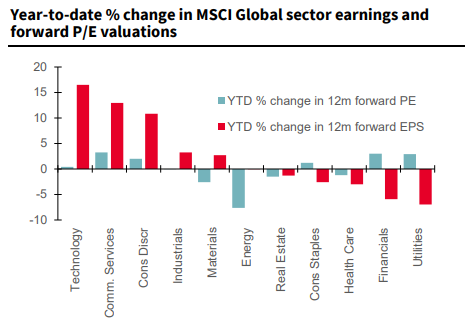

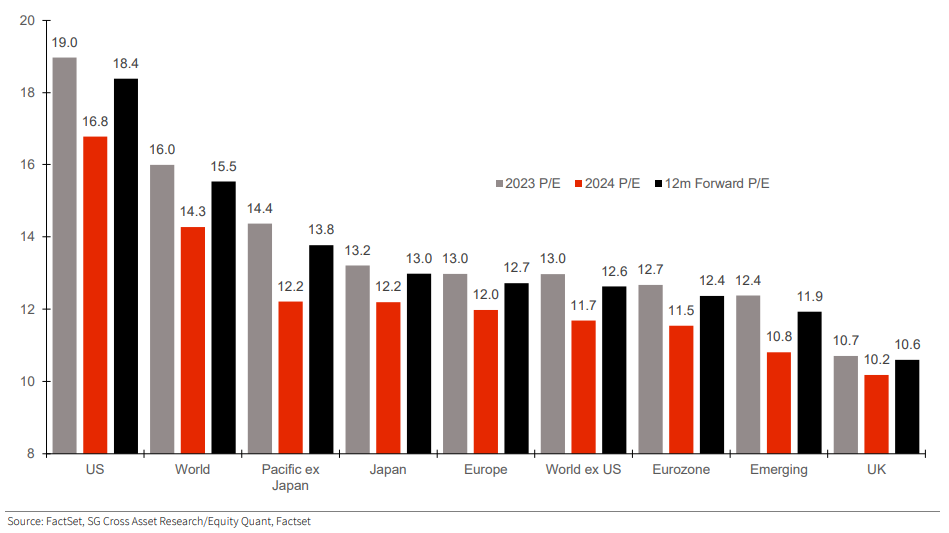

Gasoline prices in the US have stabilized this year at levels that cannot make the government comfortable, but which are at least politically conscionable. A sustained rise from here would signal serious limitations on hopes for growth: Nobody thinks that OPEC+'s output cut is great news. But its reception has emphasized that the global environment is changing, and concerns are now dominated by the possibility of an economic slowdown. Which brings us to a strange paradox... The chances of global economies entering a recession have grown higher this year. That was already the implication of a string of bank failures on both sides of the Atlantic, combined with continuing aggressive monetary tightening, before the latest manufacturing surveys. But even if a near-consensus has been reached that a downturn will indeed unfold, and that it's just a matter of when, one important corner of the market does not seem to agree. Corporate earnings expectations imply that everything is going to be alright. While analysts downgraded their earnings-per-share estimates significantly earlier this year, many have not revised lower their forecasts for the second and third quarters, as demonstrated here by Andrew Lapthorne, chief quantitative strategist at Societe Generale SA:  Source: Societe Generale "If they intend to do so, it should happen over the coming weeks," Lapthorne wrote on Monday note. "Without any guidance downgrades, it is hard to square the market's latest recessionary view with still buoyant corporate profits." Moreover, the US forward price-to-earnings ratio is still much more expensive compared to its global peers, suggesting that earnings disappointments could leave share prices with a long way to fall:  Source: Societe Generale It may come as somewhat of a surprise to some that earnings downgrades haven't happened, because as a general rule, economic recessions tend to overlap with earnings recessions. The following chart shows the past 50 years, which have seen seven economic downturns. Looking closely, only two coincided with a general uptrend in earnings — and they were in the stagflationary environment of the 1970s and 1980s. The profits downturn in 2020 was relatively mild as massive gains in the technology sector offset the losses everywhere else. To be sure, this argument may be moot to some who expect analysts to downgrade anyway — as they often do. S&P 500 earnings estimates for 2023 have been falling since June last year, according to data compiled by Bloomberg Intelligence's Wendy Soong. For this year, she expects S&P 500 EPS to be at $219, down 12% from its peak in June 2022, while S&P 500 EPS for 2024 has taken a bigger hit to stand now at $244.3, down more than 10% from the May 2022 peak. Regardless, the next quarter's earnings will be "really, really critical," according to Bitterly, as the lagged impact of financial tightening flows into corporate results. This can be seen through the lens of expense control. "Not a lot of great stories about topline revenue growth," she added. That means that companies will have to cut costs — which is after all what the Fed wants them to do to control inflation if they wish to maintain their profits. For Chris Harvey, head of equity strategy at Wells Fargo & Co., the upcoming earnings season may well be the first of several difficult quarters. The period just before a recession is typically challenging, he told Bloomberg TV, particularly since neither the Fed nor the economy is able to bail out underperforming companies. In a note on Monday, he wrote: We believe 1Q23 will be one of the most unforgiving earnings seasons in some time. With the specter of recession on the horizon, a material EPS miss will likely be penalized more than in previous quarters. It is still difficult to identify the most at-risk companies, but the more cyclical firms (especially within Financials) could see some of the bigger penalties for EPS weakness.

But most of the guessing will soon come to an end. Earnings season in the US will kick off at the end of next week. Investors had better hope that it will not be as punishing as Harvey predicts. —Isabelle Lee  There's nothing like a good Fraudian, er, Freudian slip. Photographer: Victor J. Blue/Bloomberg Political Freudian slips, you can't beat them. Monday saw a classic of the genre when one of former President Trump's lawyers referred to him as "President Fraud" in an interview on Fox News. There've been others. George W. Bush referred last year to Vladimir Putin's "unjustified and brutal invasion of Iraq." Former British Prime Minister Gordon Brown was lampooned for claiming that "we saved the world" during the financial crisis. Former Texas Governor Rick Perry's hopes of the presidency evaporated when he was unable to remember that he was planning to abolish the Department of Energy; John Kerry never lived down his assertion that he had voted for a big spending bill "before I voted against it." Other Freudian slips are subtler, and instead reveal over-confidence or a lack of grasp of the situation; witness Howard Dean's scream after finishing a disappointing third in the Iowa caucuses, which doomed his presidential campaign, or British Labour leader Neil Kinnock's over-the-top greeting to his party's "mega-rally" in Sheffield, a week before going down to a shocking defeat to John Major in 1992. Any more Freudian slips out there? More From Bloomberg Opinion: |

No comments:

Post a Comment