| China's losing its title as the world's most populous nation. It's ceding the top spot to India, with a population of 1.4286 billion that's slightly higher than its rival's 1.4257 billion, according to mid-2023 estimates by the UN's World Population dashboard. The reason: India had more than twice as many babies born than China last year, when it started shrinking for first time in six decades. China's numbers didn't include Hong Kong, Macau and Taiwan.  Shoppers in Wuhan, China. Photographer: Qilai Shen/Bloomberg India's burgeoning population — half of which is under the age of 30 — will add urgency for Prime Minister Narendra Modi's government to create employment for the millions of people entering the workforce as the nation moves away from farm jobs. Fortunately, its population is young, which could play a critical role in unlocking economic growth. With over two-thirds of its people of working age — between 15 to 64 years old — India could produce and consume more goods and services, drive innovation and keep pace with the constant technological changes.

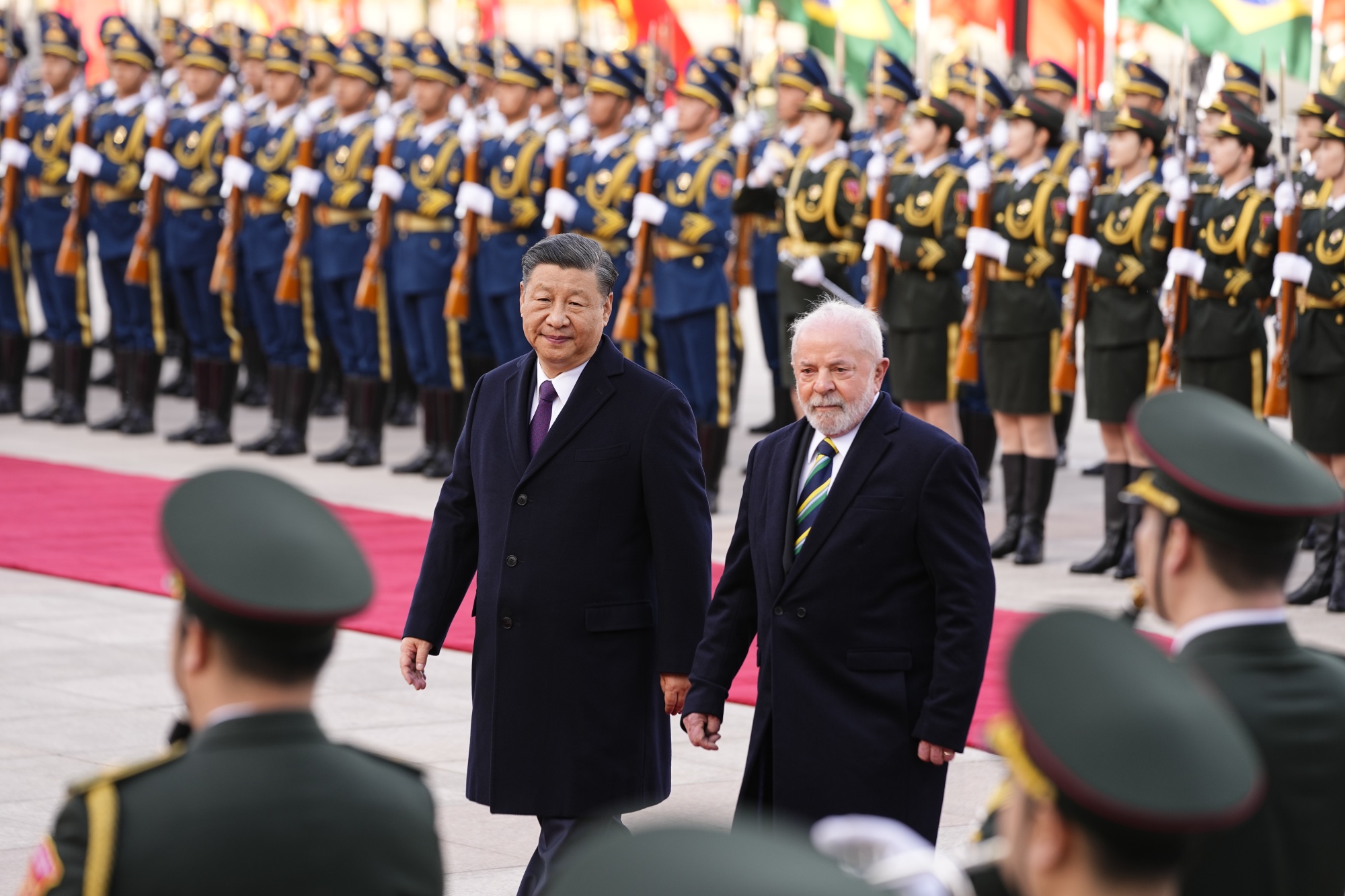

Its new status as not only the world's biggest democracy, but the most populous, could also bolster its claim for a permanent seat in the UN Security Council.  India surpasses China as world's most populous nation in 2023. Photographer: Manjunath Kiran/Getty Images China's declining population, meanwhile, threatens economic growth, as the amount of people who are working age continues to shrink. The country's decades of expansion had been predicated on a vast labor supply — not to mention there may not be enough able-bodied people to take care of all those seniors in the coming years. Yet Beijing this week downplayed the shift, borrowing a line about how it wants to grow its population in the way it does the economy. "I want to tell you that population dividends don't only depend on quantity but also on quality," Foreign Ministry spokesman Wang Wenbin said. "China's population is over 1.4 billion. As Premier Li Qiang pointed out, our population dividend has not disappeared, our talent dividend is forming and the impetus for development is strong." For India, to fully cash in on its demographic dividend and reshape the global economy in the process, Bloomberg Economics says the country needs to advance on four broad fronts — urbanization, infrastructure, up-skilling and broadening its labor force, and boosting manufacturing. It lags China in all these areas. Labels alone won't be enough for India to take over as the world's biggest growth driver, just as having the most people wasn't enough for China until it carried out economic reforms from the late 1970s. The Chinese consumer is back with a vengeance. Retail sales soared 10.6% in March from a year earlier, the biggest monthly gain since June 2021. That's good news for the world's second-biggest economy, which needs people to return to their pre-Covid free-spending ways for it to meet or exceed the government's growth target of about 5% for the year. Overall, China's gross domestic product expanded 4.5% in the first quarter, the fastest pace in a year. Additional data suggested the property industry has turned the corner, too. Other figures were mixed as both industrial output and fixed-asset investment grew slower than expected. The jobs front also looked less than rosy, especially for youth employment. "What was arguably most significant, however, was the way consumption now clearly exceeds growth in fixed-asset investments," said Bloomberg Opinion columnist John Authers. "China's explosive expansion of the last two decades has been fueled by big outlays going into the latter, eluding officials' attempts to 'rebalance' growth toward services and the consumer. At least in the first quarter of this year, it looks like rebalancing has finally happened." The better-than-expected showing for the broader economy prompted a slew of brokerages to upgrade their forecasts for Chinese growth this year. JPMorgan boosted its estimate to 6.4% from 6%, while UBS increased its forecast to 5.7% from 5.4%. Rising optimism over the economy isn't translating into increased demand for Chinese equities. The Hang Seng China Enterprises Index has been among the worst performers globally over the past three months. Long-only funds trimmed their China exposure last month, putting them solidly in the underweight positions, according to Bank of America. Investors are most worried about geopolitics. In the latest survey of BofA's investors more than half viewed intensified US-China tension as the most likely catalyst for them to turn sour on Chinese markets. China scored another major diplomatic coup after Brazilian leader Luiz Inacio Lula da Silva visited, pledging to build stronger ties in defiance of the US. Lula's trip irked the Americans. He toured the US-sanctioned tech company Huawei, backed the creation of an alternative currency to replace the dollar in foreign trade and admonished the Biden administration for not doing enough to end the war in Ukraine — despite that fact Chinese President Xi Jinping has so far failed to hold a call with his Ukrainian counterpart as promised. "It's important that the US stops encouraging war and starts talking about peace," Lula said.  Luiz Inacio Lula da Silva with Xi Jinping in Beijing. Photographer: Pool/Getty Images AsiaPac Lula believes that an end to the conflict may come if China, Brazil and Turkey mediate negotiations with Vladimir Putin. While the US is concerned about Brazil's drift towards its chief rival, Lula's reason for doing so looks to be more economic. The leftist president is in a hurry to create jobs and deliver on his promise of prosperity. Lula won office by the slightest of margins and is already facing waning popularity as he struggles to navigate a deeply polarized country amid sluggish growth. China has been pouring resources into South America in recent years, chipping away at the U.S.'s historic dominance and making itself the continent's No. 1 trading partner. It's still struggling to win hearts and minds though. During a recent trip to Cusco in Peru, I spoke to residents about their take on China's growing influence. While Spanish teacher Tania Silva welcomed the investment and potential job creation, mining engineer Gonzalo Alberto Candia Camacho was more circumspect, saying he was concerned about the perception that China looks the other way when it comes to corruption. Peru has been hit by waves of social unrest in recent years, dogged by a deep rural-urban divide and allegations of political corruption. It is currently on its fifth president in three years. Another worry: Peru getting caught in the middle of another Cold War. "China and America are in an economic war," said Camacho. Like something out of a James Bond movie, China has developed a so-called electromagnetic gun that fires projectiles shaped like coins and can be used to quell protests without killing anyone.  The coilgun China unveiled on state media to break up riots. CCTV Electromagnetic weapons allow the user to set the intensity and frequency that the gun fires, which can reduce the danger they pose to people. Still, the devices have the potential to cause serious injury. A video on Chinese state media showed the coin projectiles shredding thin plywood. Bloomberg Wealth Asia Summit returns on May 9. Join us in Hong Kong or online as we sit down with the region's leading investors, economists and money managers to discuss investing in art, the mindset of next gen investors, wealth and Web3, and more. Register now to secure your spot. What We're Reading Finally, a few other stories that caught our attention: |

No comments:

Post a Comment