| Hello. Today we look at the Fed's policy path, the week ahead in global economics and when the US labor market will start to weaken. Data and Federal Reserve commentary in the past week suggest the US central bank remains on course to pull the interest-rate trigger at least one more time, much as policymakers penciled in in their latest quarterly forecasts. Late Friday, the Fed reported that deposits at small banks had edged up in the week to March 22, offering corroboration for remarks by Treasury Secretary Janet Yellen and other officials assuring that the exodus of customers from smaller lenders had stabilized. The release also showed that business lending dropped significantly — by about $20 billion — but at least some part of that is a reversal of companies in the previous week drawing on lines of credit, analysts said. That again suggests some retreat from the sharp stress that followed the collapse of Silicon Valley Bank and Signature Bank in early March. While overall deposits dropped again, that was likely more to do with corporate treasuries sending cash to higher-yielding money-market funds than a sign of continuing fears with regard to regional US banks, said Stuart Paul at Bloomberg Economics. Meantime, the latest reading on the Fed's preferred inflation gauge showed that, while core price pressures had eased somewhat in March, the overall pace of gains remains way too high for comfort. Excluding food and energy costs, the personal consumption expenditures price index rose 0.3% from the previous month, down from 0.5% in February. The year-on-year headline rate was 5%, still more than double the Fed's 2% target. "We still do have more work to do and more to see to know that inflation is really on a sustained downward path," Boston Fed President Susan Collins said in a Bloomberg Television interview Friday. "At the same time, early days yet in terms of assessing whether we really have gone as far as we need to go."

Collins and other Fed officials said that upcoming data will determine whether the Fed raises rates again at the May 2-3 policy meeting. As far as economic indicators go, the monthly jobs report has effectively retaken its spot as the most important, after many months when the consumer price index had shunted it aside. That's because the Fed's key concern is service-sector inflation, which is heavily influenced by wages — and the jobs report offers the most timely look at earnings trends. Neil Dutta, head of US economic research at Renaissance Macro, notes that the survey week for the jobs report coincided with the time of stress from SVB's collapse. That could augur for a softer set of data, and Dutta is penciling in a pause for the Fed in May. The March report, out on Good Friday, is expected to show average hourly earnings increased 4.3% in March from a year ago, the smallest annual advance since July 2021. The pace of hiring in March likely continued to show firm yet moderating labor demand, Vince Golle reports here. —Chris Anstey Elsewhere in the world of central banking, the Bank of Canada will release two closely watched surveys of business and consumer sentiment, along with a fresh batch of labor-market data to inform trader bets for the central bank's April 12 rate decision. The Bank of Japan will get a new governor, while central banks from India to New Zealand may hike rates while peers in Chile and Poland probably keep borrowing costs on hold. Australia's policy decision hangs in the balance. See here for the rest of the week's economic events. - Price pressure | OPEC+ announced a surprise oil production cut of more than 1 million barrels a day, abandoning previous assurances that it would hold supply steady and posing a new risk for the global economy.

- Factory funk | China's manufacturing activity unexpectedly eased in March, a private survey showed, leading a slide in factory gauges across Asia as the global economic outlook darkened.

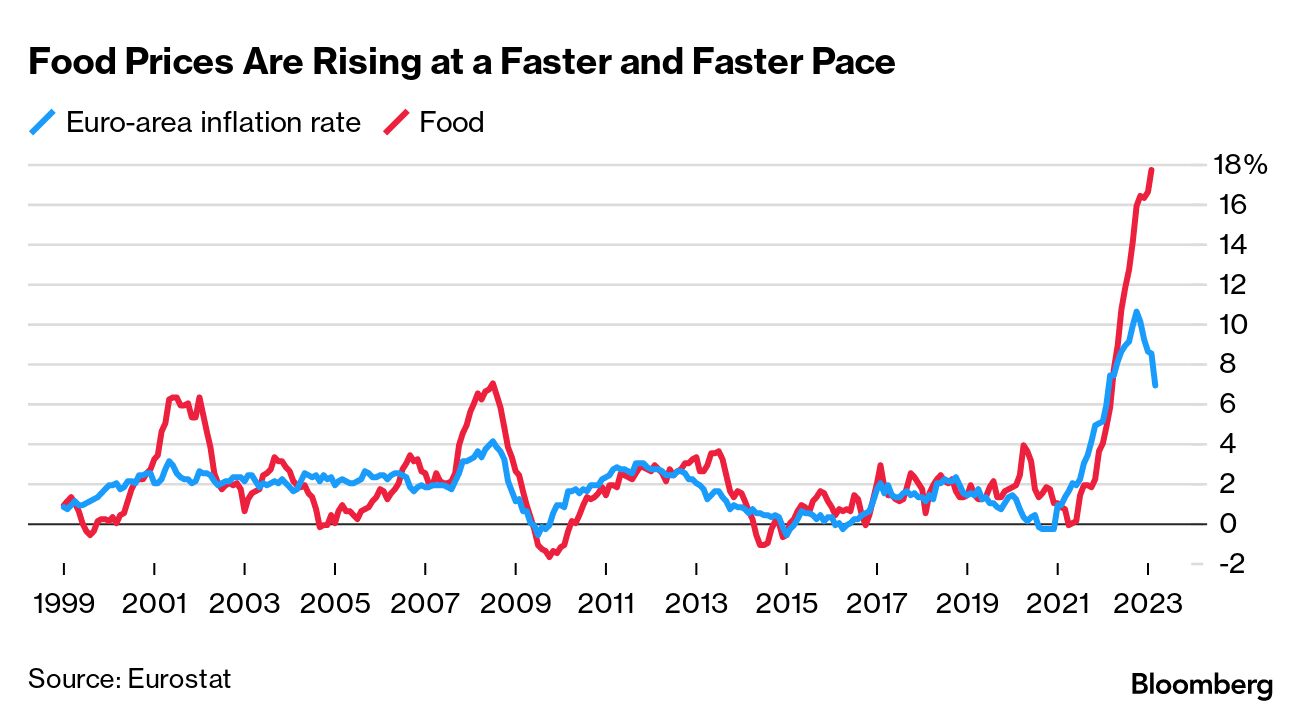

- Food fight | Europe's battle with the worst cost-of-living crisis in a generation is far from over, and food is the latest focal point.

- Argentina approval | The IMF's executive board approved a $5.4 billion disbursement to Argentina, a key step forward in the government's program that has faced setbacks amid a worsening economic outlook.

- Tough times | San Francisco is facing a constellation of economic challenges unlike any in its boom-and-bust history.

- Falling again | Swedish single-family homes extended a housing rout in the largest Nordic nation last month, with stubbornly high inflation and growing borrowing costs clouding the outlook.

One year into the US rate-hiking cycle, the labor market remains tight, keeping up pressure on inflation. But things may shift soon, if history is a guide. New research from the Kansas City Fed shows that it takes about a year for job-market momentum in occupations that are less sensitive to rates — particularly, the service sector. That's based on trends from the policy-tightening cycle of the mid-1990s, and two prior ones in the 2000s. "Recent labor-market dynamics are consistent with historical norms," with the interest-rate insensitive part of the job market showing less of a reaction to Fed moves, economists Karlye Dilts Stedman and Emily Pollard wrote. "While labor markets in these industries continue to tighten, the pace has slowed." Bloomberg New Economy Gateway Europe will be held in Ireland, April 19-20. Join us as leaders gather to discuss solutions to the most pressing challenges facing the European economy. Request an invitation. The Chinese yuan: an update... Read more reactions on Twitter here |

No comments:

Post a Comment