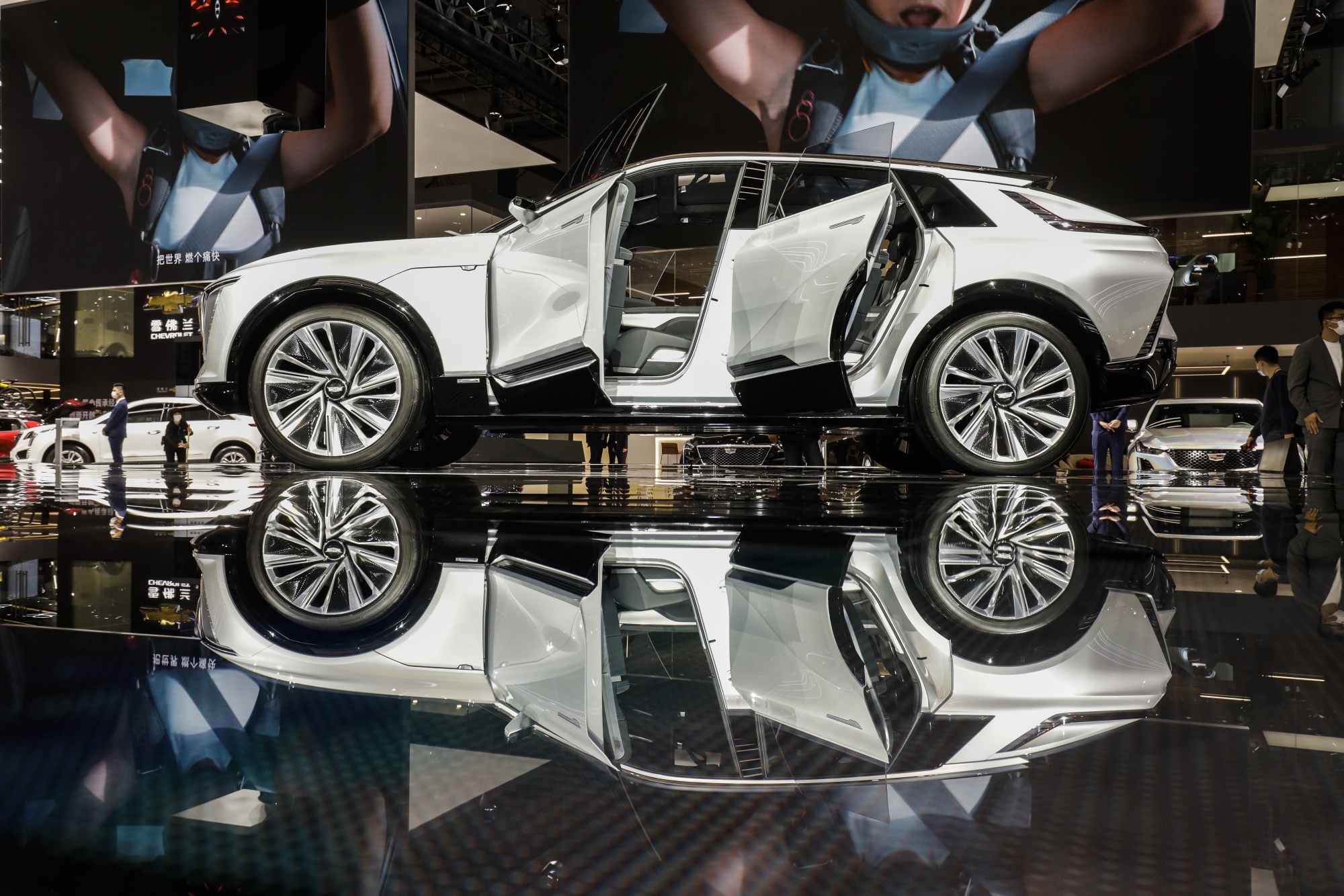

| Thanks for reading Hyperdrive, Bloomberg's newsletter on what's reshaping the auto world. Read today's featured story online here. Tesla's last few years have been remarkable on several fronts. The company built and sold far more electric vehicles than other manufacturers with just a handful of models. Not only that, it kept growing volume without substantially redesigning those models every five to seven years, evading common practice that carmakers have observed for decades. The incumbents would ditch this convention if they could — reengineering architectures and retooling plants to assemble new-look vehicles costs billions. The trouble is, models that go without this investment for long tend to grow stale and tail off on the sales charts. Tesla is learning this the hard way with its two most expensive vehicles, the Model S sedan and Model X sport utility vehicle. The company cut prices not once, but twice early this year, by totals of almost $23,000 on average. Deliveries nevertheless slumped to just 10,695 vehicles, the lowest since the third quarter of 2021. Tesla has been selling the Model S since June 2012 and the X since September 2015. Demand for the two languished after the much cheaper Model 3 sedan finally reached mass production and was followed shortly thereafter by the Model Y. Initially, CEO Elon Musk allowed for the possibility there was some cannibalization going on, while also blaming the trend on speculation that redesigns were in the works. He denied this several times in 2019, saying Tesla had already bettered the S and X through a series of minor ongoing changes that added up to marked improvement. "To be totally frank, we're continuing to make them more for sentimental reasons than anything else," Musk said during an earnings call in October 2019. "They're really of minor importance to the future." Musk eventually caved, signing off on changes significant enough to require a complete production pause in the first quarter of 2021. But while new versions of the S and X offered improved performance and spiffier interiors, some alterations weren't well received. Tesla slid in Consumer Reports rankings in part because of the switch to a yoke-style steering system before restoring a round steering wheel option (and even began offering a $700 remedy to yoke buyers' remorse).  A Tesla Model S on display during the Seoul Mobility Show last month. Photographer: SeongJoon Cho/Bloomberg Tesla started offering the steering wheel in early January, so there were other factors at play here. Per usual, the company offered up little detail in its quarterly production and delivery statement this week, only alluding to some S and X vehicles being in transit to Europe and Asia. Musk may reveal more information during the next earnings call on April 19. The CEO was on solid ground a few years ago when he minimized the role these two vehicles play relative to the Model 3 and Y. Tesla produced about 22 of those models for every one S or X last quarter, and the deliveries disparity was even greater at roughly 39-to-1. While the 3 and Y continue to far outpace other EVs, Tesla's experience with its lower-volume models shows its vehicles aren't immune from the effects of aging and product-cycle missteps. The company is reportedly working on revamped versions of its two top-sellers — codenamed Highland and Juniper — and can't afford for those to go the way the S and X refreshes have. — By Dana Hull  GM's Cadillac Lyriq electric vehicle. Photographer: Qilai Shen/Bloomberg Steve Carlisle, president of GM North America, discusses first-quarter sales results with Bloomberg Television's Caroline Hyde and Ed Ludlow.  The front grille of the Mercedes-Benz EQG electric SUV concept. Photographer: Alex Kraus/Bloomberg Sila, the Silicon Valley-based battery-materials company, has finalized a mass-manufacturing process for the first silicon-based anodes that it says will boost maximum vehicle ranges by 20%. Mercedes will use the anodes in its EQG SUV, the electric version of its boxy G-Class. Porsche, meanwhile, will source silicon-carbon material for battery anodes from Group14 Technologies, which announced Tuesday that it's begun construction on an advanced battery-technology plant in Washington State. |

No comments:

Post a Comment