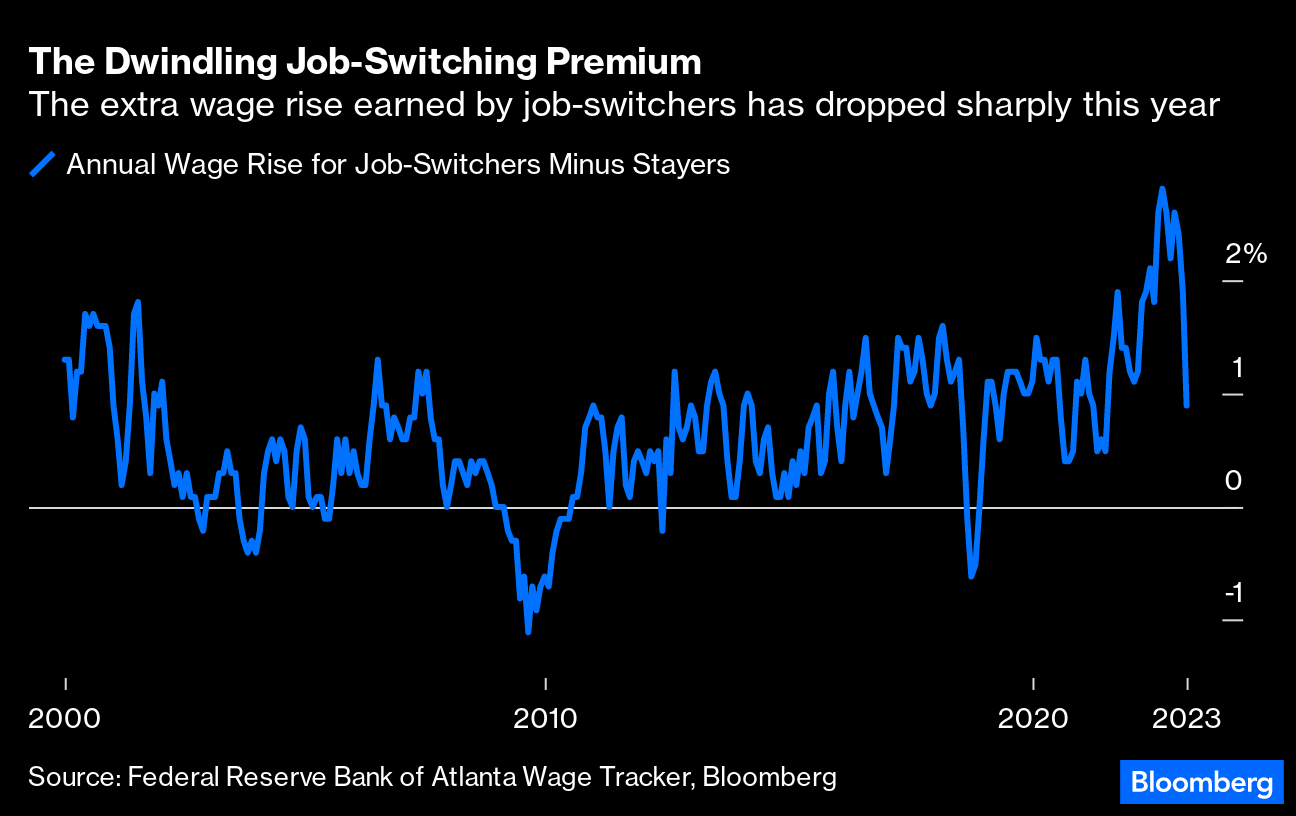

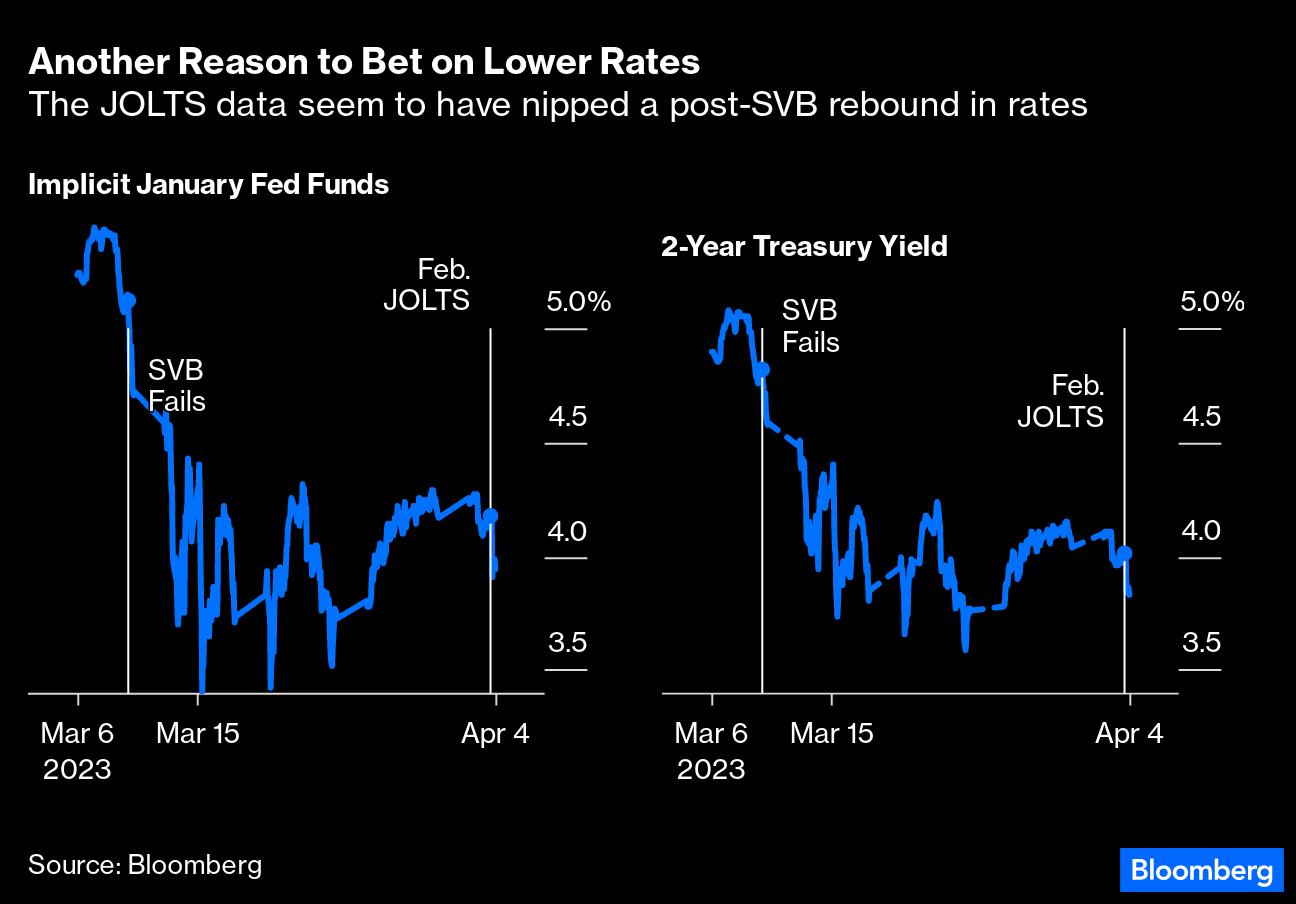

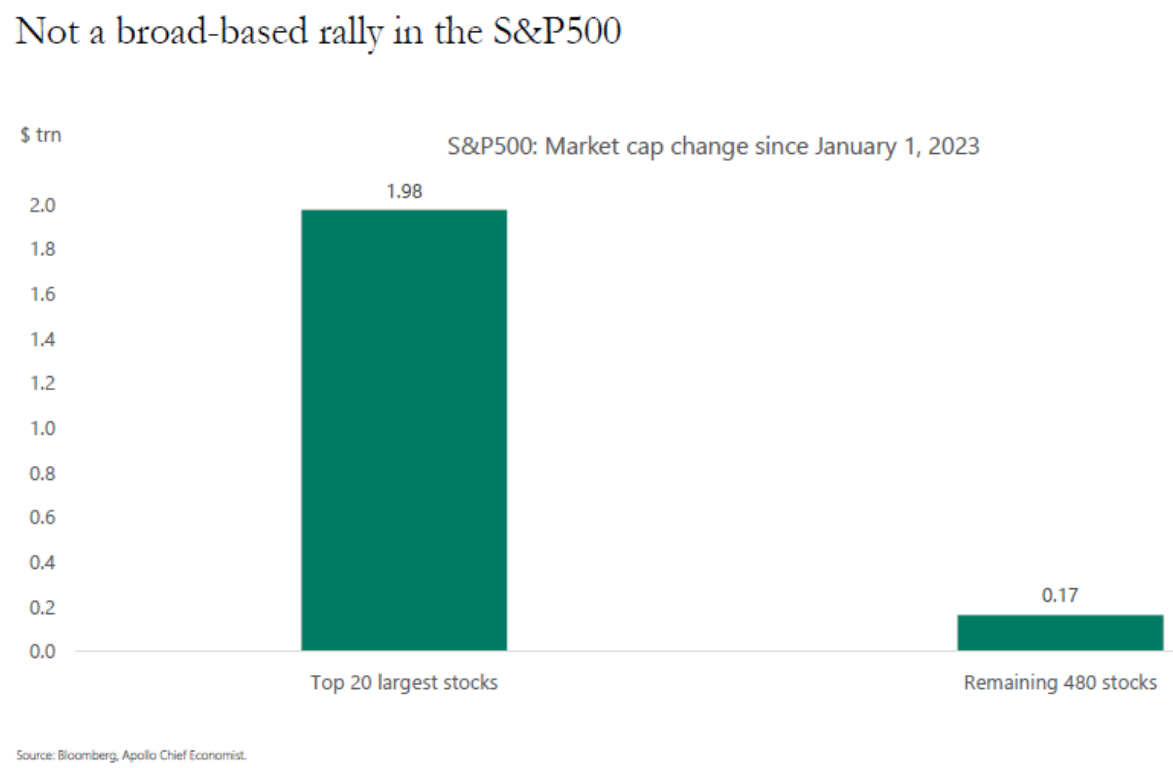

| Back in 1985, the world of soft drinks was rocked by the biggest marketing disaster in its history. New Coke arrived, with a more syrupy, sweeter flavor, and within months Coke Classic had to be reintroduced. But that year also saw the launch of a drink that has more resonance for the economy today. Jolt Cola's slogan was "All the sugar and twice the caffeine." Teenagers loved it. (The company went bankrupt in 2009.) If you wanted US rates to come down, Tuesday's JOLTS (Job Openings and Labor Turnover Survey) had all the sugar and twice the caffeine of any data point to have hit the market during the inflation of the last two years. Much against expectation, it showed that the number of official job vacancies in the US had dropped below 10 million for the first time since May 2021: This also begins to bring a historically loose labor market toward something like normality. At points last year, there were more than two vacancies for each unemployed person — an unprecedented position. That number is now down to 1.67 vacancies per job-seeker. The gap between openings and the unemployed, named as a critical factor by Jerome Powell, the chairman of the Federal Reserve, has reduced by some 20%. While vacancies still look historically elevated, it begins to appear as though the trend is finally shifting:  Further, there is more evidence to support the notion that the pressure on employers, and hence also the upward pressure on wages, is abating. The Atlanta Fed maintains a "wage tracker" based on census data, which breaks down increases in wages by a number of different factors. Usually, those who switch jobs will obtain higher wage rises than those who stay. In voluntary moves, after all, a higher wage is often the main motivation for taking the new job. It's only in recessions, when job-switchers have often been laid off or taken a buyout, that there is a premium for staying. The latest Atlanta Fed numbers, covering the month of February, showed that the premium for job-switching was falling very significantly after hitting an all-time high last year. This suggests, like the JOLTS numbers, that the bargaining position of workers is weakening. That's bad news if you're hoping for a higher salary, but good news for the Fed in its fight against inflation:  But wait, there's even more sugar for those expecting lower rates. The JOLTS numbers are backward-looking, and have only just caught up with February. March's sudden spate of bank failures, and the well-publicized layoffs at companies like McDonald's Corp., are not yet in the data. So the "hope" — for those who want lower rates — is that the trend toward fewer vacancies per job-seeker will be reinforced once the March JOLTS comes out. That will be in time to influence the next Federal Open Market Committee meeting in May. All that sugar and caffeine jolted rates into a big move, even though non-farm payrolls and inflation are both due in the next few days. Estimates for the fed funds rate in January of next year tanked during the bank failures, and then steadily rebounded as the immediate contagion proved more limited than feared. That implicit fed funds rate dropped sharply again after the JOLTS. The same can be said of the two-year Treasury yield, which is very sensitive to short-term rates. Rate expectations are still above their lows from when the banking system seemed to be heading for a major crisis, but they are far below the highs set at the beginning of last month. Volatility remains extreme, but this is another turn toward lower rates:  If short-term rates aren't at their low for this cycle, however, the dollar very nearly is. The recovery spurred by the surprisingly strong macro data that came out in February is over, and the dollar index, comparing the currency against its biggest developed economy peers, is close to a low for the year that would also be its lowest in 12 months: The dollar has benefited, as it usually does, from "safe haven" flows during the crisis, and its ascent during 2022 overlapped almost exactly with the growing hawkishness of the Fed. Its peak came in October, as the possibility of "stepping down" from 75 basis point hikes at each FOMC meeting began to be publicly debated. For over a year, the dollar has been little more than a manifestation of investors' views of the Fed, even though most other central banks have been similarly hawkish. Whether that makes sense or not, it's had a direct effect on the relative performance of the US stock market. Over the last five years, the outperformance of the S&P 500 compared to FTSE's index for the rest of the world has been spectacular. This was driven in part by the strong dollar, and the peak of the "America First" trade came with the peak in rate expectations last October. Now, not even the resurgence of the FANG stocks (of which more below) has been enough to reverse the "America Second" trend. US leadership is over, at least for now, and this will make it all the easier for those wishing to sell ETFs investing outside the US:  Can this trend last? There are some crucial data ahead, starting with the non-farm payrolls for March that will, profanely, be published on Good Friday. Inflation figures will follow. We've learned a lot about macro surprises of late. But the job vacancies data are perhaps more persuasive than any other evidence to date that the labor market might at last be turning. Now for a trend that's been around for a while, but after the tech-heavy Nasdaq 100 (known by the ticker symbol as NDX) entered what is widely called bull market territory last week, it's really gaining attention. People allege that only a handful of stocks have driven that rally. And that's true. Torsten Slok, chief US economist at Apollo Management, illustrates the dominance of a few mega-caps in this remarkable graphic. The biggest 20 stocks in the S&P 500 have added roughly $2 trillion in market cap so far this year; the other 480 have added $170 billion:  This begins to call into question the use of indices that have become so dominated by a few giants. Just seven companies comprise half of the 100-member NDX's weight, with the top two stocks alone — Microsoft Corp. and Apple Inc. — making up 25%. To Steve Sosnick, chief strategist at Interactive Brokers, this shouldn't be a surprise. In fact, between two tech-heavy gauges, the outperformance is evident. Take a look at the NDX, which tracks the largest non-financial firms, and the Nasdaq Composite (CCMP), which captures the performance of the nearly 3,000 stocks that trade on Nasdaq. The two have correlated exceptionally well, with an R-squared of 0.97 or more since 2002, according to Sosnick. That's not unexpected, as you would expect the larger index to be led by the biggest companies at its heart. Yet the spread between the two indices is at a width not seen in 30 years: Here's more from Sosnick in his Monday note: Many of these stocks were disproportionately oversold in December when a bout of year-end tax-loss harvesting turned into a bit of a rout. That negative catalyst was gone when the calendar turned, and the ensuing relief rally morphed into a full-fledged run.

It's not a surprise that tech stocks have been leading the rally for the better part of this year. They had fallen the most, and had the furthest to bounce. Everyone knows tech was the biggest beneficiary during the pandemic as more people relied on various technologies to maintain their professional and personal lifestyles while largely stuck at home. But as the pandemic waned and the so-called "reopening trade" gathered steam, tech stocks felt the pressure the most. Once optimism that rates would soon decline took hold, it was those companies that fell furthest in 2022 that regained the most. Indeed, as Bespoke Investment Group illustrates in this chart, the first quarter was an almost exact reversal of 2022: Using the benchmark gauge, the S&P 500 posted a negative total return of 18.13% in 2022. The top 20 stocks contributed 10.26 percentage points to that, or over half the fall. (This can all be calculated using the Portfolio function, or PORT <GO> on the terminal.) The biggest holdings last year that also suffered massive losses were Apple, Microsoft and Amazon.com Inc. During 2022, the top 20 stocks made up 37% of the S&P 500 on average. Deutsche Bank Research strategists led by Binky Chadha said that while mega-cap tech and growth performed in line with the market from mid-2020 through end-2021, they massively underperformed in 2022 as the pandemic waned. As the pandemic boom continues to dissipate, they expect the premium of the sector to falter as forward earnings rise. Chadha & Co. said they are staying with their tactical long through the the end of the season as "baton passes from positioning to earnings." Here's more: Popular concerns have flipped 180 degrees and focused on whether the secular uptrend has ended. Our read however remains the same, that there is no evidence yet that the trend has shifted up or down and the boom-bust cycle in their earnings is largely explained by the historical top-down drivers of global growth and the dollar.

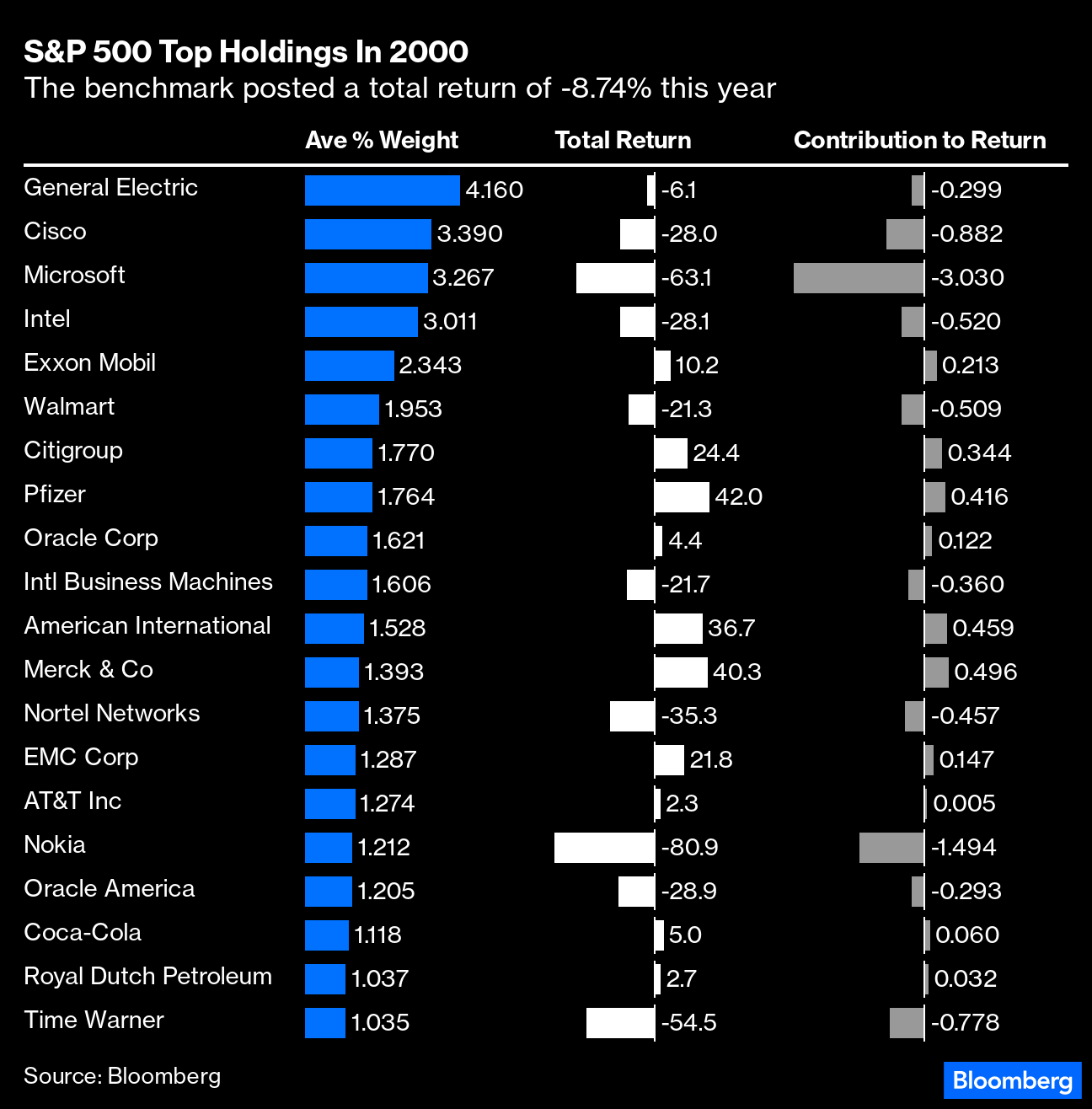

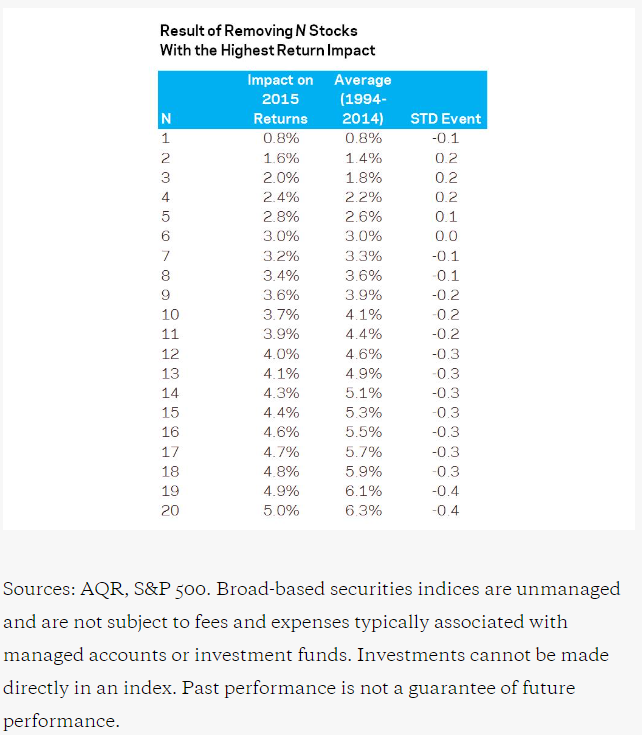

So it's not surprising that these large companies would lead markets both up and down at a time when they're being moved by big macroeconomic factors. But concentration in itself isn't quite as novel as it might appear. Compare that to 2000, the tail-end of the dot-com bubble, when the benchmark gauge shed 8.74%. The top 20 stocks 23 years ago contributed 6.32 percentage points to the slide, or 72.3% of the entire fall — much more than the top 20 contributed to the drop last year. Then as now, the top 20 stocks made up 37% of the gauge, although they were far more diversified and less tech-oriented. Remarkably, the only top 20 stock from the turn of the century that remains there today is Microsoft, so be warned that in the long term, buying only the largest companies by market cap probably isn't the greatest strategy:  For another exercise in keeping FANG-hysteria under control, take a look at this piece by AQR's Cliff Asness, from way back in 2016. The FANG acronym — which then stood for Facebook, Amazon, Netflix and Google — had first taken hold the previous year, and Asness wanted to fight back at the notion that the market was unduly concentrated. This is his list of how much of the S&P's return each year could be attributed to the top stocks. In the "N" column, each number refers to the stocks that gave the most to overall return. When N is 10, for example, it tells us the amount of return that has been contributed by the top 10 stocks alone:  Comparing the numbers in the two columns reveals startlingly little variation. In 2015, the first Year of the FANG, concentration was barely out of line with norms for the previous 20 years. Indeed, if you looked at 20 stocks with the most impact, their contribution was 0.4 standard deviations below the mean. Since then, however, returns have grown somewhat more concentrated. Using the back of an envelope and summing the eight biggest contributors to the S&P's decline last year — Apple, Amazon, Microsoft, Tesla Inc., Meta Platforms Inc., Nvidia Corp. and the two classes of Alphabet shares — we find that they collectively reduced last year's S&P return by 10.98%. Exclude only those companies, and your loss for the year could have been more than halved from 18.13% to 7.15%. That's a big deal. The large internet platforms do matter. Here's Gillian Wolff, senior associate analyst at Bloomberg Intelligence: The concentration of tech stocks in the S&P 500 is getting larger and larger so the benchmark has become more concentrated over time. Even the top 10 stocks have grown as a percentage of SPX weight.

At least for now, their impact on the S&P is tightly linked to the perception that they benefit disproportionately from lower rates, which is questionable. It's best to treat the phenomenon as yet another symptom of the current preoccupation with rates and the battle against inflation. Whatever the macro data have in store over the next few days, they can be expected to move the market. — Isabelle Lee  Gaffes happen: Jimmy Carter 27 years after his failed reelection bid. Photographer: Neil Hamberg/Bloomberg Politicians are fallible. I have nominations for some more Freudian slips from people who wanted others to vote for them; the time when President Jimmy Carter rechristened former Vice President Hubert Humphrey as Hubert Horatio Hornblower did him no favors as he ran for reelection in 1980. Then there was the startling and unprompted "joke" by Texas gubernatorial candidate Clayton Williams that bad weather was like rape: "If it's inevitable, just relax and enjoy it." Almost unimaginable in today's political climate, this was key in his eventual loss to Ann Richards, a Democrat whose daughter would go on to head Planned Parenthood. For an altogether more message-disciplined approach, try Wag the Dog. Any more suggestions? More From Bloomberg Opinion: - Lionel Laurent: Half a Million Job Cuts Could Be Just the Start

- Jonathan Levin: Are Offices Truly Worth as Little as REITs Imply?

- Eduardo Porter: Latin America Has Learned How to Fight a Financial Crisis

|

No comments:

Post a Comment