| Hello. Today we look at the outlook for US credit, China's economic recovery and how the pandemic's effects on American cities have washed through. The pivotal question for the US economic outlook just now is what happens to the flow of credit in coming months. And the past week has seen increasingly divergent opinion on that score. Treasury Secretary Janet Yellen, to some observers, seemed captured by politics when on Tuesday she claimed, "I've not really seen evidence at this stage suggesting a contraction in credit, although that is a possibility." After all, just four days earlier, Federal Reserve data had shown the biggest drop in US bank lending on record, for the last two weeks of March. But, as it turned out, it amounted to a "phantom drop," as Goldman Sachs analysts explained. It was more of an accounting issue, with regard to a transfer of assets for collapsed lenders Silicon Valley Bank and Signature Bank. Then a slew of earnings reports from big banks — JPMorgan Chase, Citigroup and Wells Fargo — at the end of the week underscored that the biggest lenders are hale and hearty. So, Yellen was right? No big credit crunch? No recession? Other economic luminaries, gathering in Washington for spring meetings of the IMF and World Bank, warned against overconfidence. - Tobias Adrian, the IMF's director of monetary and capital markets, said "there is certainly evidence in the data of some contraction in lending and some tightening of lending standards."

- We cannot say that "accidents" are over at this point, former IMF chief economist and Indian central bank chief Raghuram Rajan said.

- IMF First Deputy Managing Director Gita Gopinath said that while activity among the big banks is stable, among smaller lenders, "you certainly see credit supply slowing."

To Gopinath's point, a survey Tuesday indicated the sharpest tightening in the availability of loans to small businesses in about a decade. Yellen added to her public analysis on Saturday, saying that "banks are likely to become somewhat more cautious in this environment," but reiterated her outlook for moderate growth, not a recession. "I'm not seeing anything at this time that is dramatic enough or significant enough, in my view, to significantly change the outlook," she said on CNN. Coming months will prove key to whether the tremors that followed Silicon Valley Bank's collapse are truly done. "The more time passes, the better" are the "chances that none of these storms morph into a systemic hurricane," Barclays economists led by Christian Keller wrote Friday. For now, the question is whether "the current calm after March's banking storm could eventually prove to just have been the calm before yet another storm in yet another sector," they wrote.

—Chris Anstey Bloomberg New Economy Gateway Europe will be held in Ireland, April 19-20. Join us as leaders gather to discuss solutions to the most pressing challenges facing the European economy. Request an invitation. China's key economic data in the coming week is likely to show a pickup in growth after Beijing dropped its Covid Zero rules, though it's not yet clear how solid or sustainable the recovery will be. Official figures on Tuesday are expected to show gross domestic product grew 3.9% in the first quarter compared to a year prior, according to the median estimate in a Bloomberg survey of economists. While that would be an improvement on the 2.9% expansion recorded in the October to December, it's still below the official target for full-year growth of around 5%. See here for the rest of the week's economic events. - Hawkish hikes | The European Central Bank is set for three more quarter-point increases in interest rates in May, June and July, economists polled by Bloomberg say.

- Emerging markets | With inflation easing and many central banks nearing the end of their rate hikes, a growing chorus of investors say the best place for bond buyers to juice returns is in emerging markets.

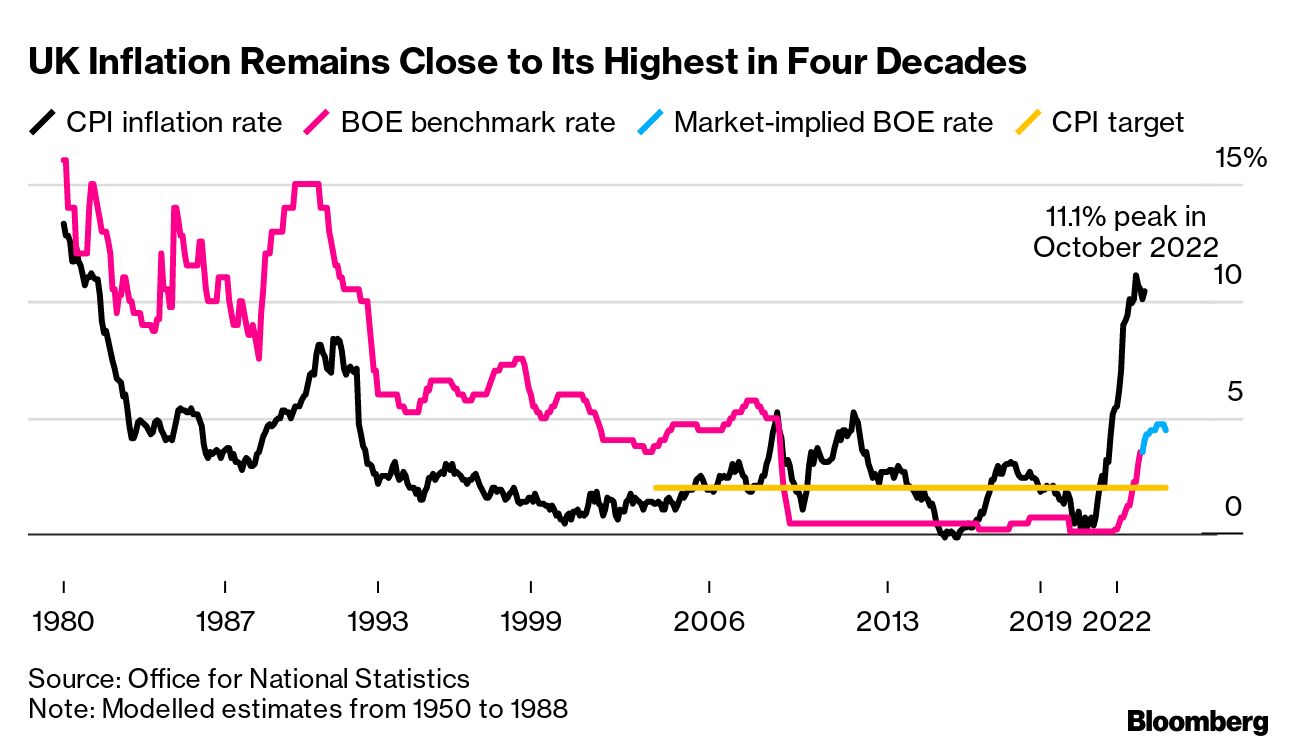

- Pause prospects | UK Prime Minister Rishi Sunak may receive a boost this week as inflation slips back into single digits. Meanwhile the pound is this year's unlikely comeback story.

- Bearish bellwether | Signs of an economic slowdown are flashing in the global diesel market.

- Chinese recovery | China injected the least amount of medium-term cash into the banking system since November, a that policymakers are watching the effects of past easing with the economic recovery on track.

- Egypt reforms | The IMF is waiting to see Egypt enact more of the wide-ranging reforms it pledged before carrying out the first review of a $3 billion rescue program.

For all the assumptions that the pandemic would forever upend where people choose to live, data are accumulating to suggest that in fact US geography is largely unchanged, according to Richard Florida, a University of Toronto economist. "Big cities ultimately proved incredibly resilient. The urban exodus, such as it was, proved mainly temporary," Florida wrote. Many who left came back, and immigrants once again started to flow into large US cities as pandemic-era restrictions waned, with the 20 largest cities seeing the number of immigrants triple from 2021 to 2022. Manhattan, for example, gained an estimated 17,500 residents over the last year after significant losses in prior years, according to US Census Bureau estimates. Despite its much-publicized challenges with crime and luring workers back to the office, Chicago now has more people living downtown than before the pandemic. Read more reactions on Twitter |

No comments:

Post a Comment