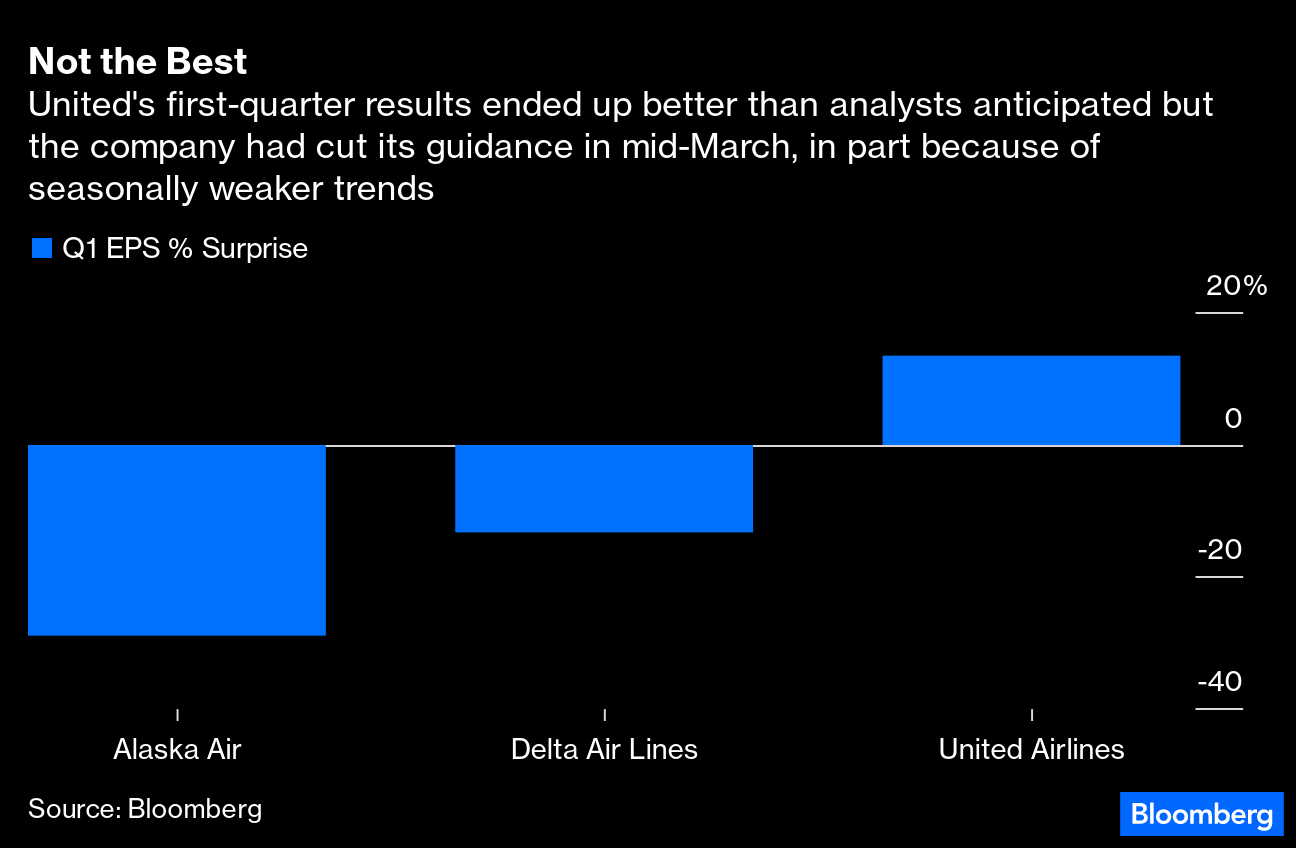

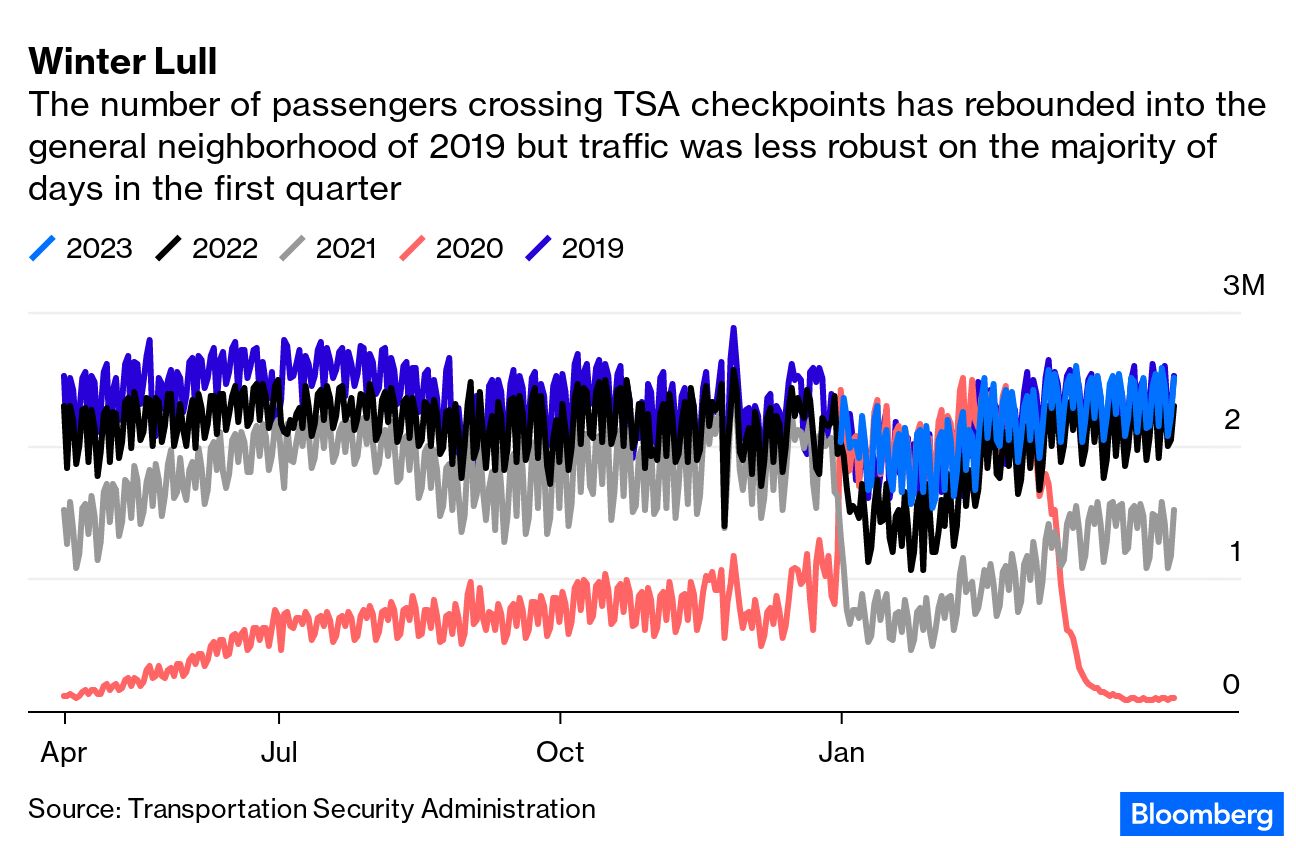

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net Business travel still hasn't fully bounced back from the pandemic slump, and recent economic gyrations make the recovery path from here much trickier, leaving airlines dependent on leisure travelers whose post-Covid habits may prove fickle in a downturn. First-quarter earnings for US airlines have been disappointing, with the top carriers that have reported full results so far — Delta Air Lines Inc., United Airlines Holdings Inc. and Alaska Air Group Inc. — all citing a shift in traditional booking patterns that made the already seasonally weak months of January and February even weaker. Airlines broadly abolished change and cancellation fees during the pandemic, and this has made leisure travelers more comfortable buying plane tickets further in advance but also more comfortable scrapping trips at the last minute if needed. Before Covid, business travelers would regularly buy flights closer to the departure date, even if that meant paying a premium, and were also more likely to take trips in January and February than vacationers. But with the corporate travel recovery still lagging, that backstop isn't there.  "We believe demand is just structurally different than it was pre-pandemic, and we're still figuring out that new normal," United Chief Executive Officer Scott Kirby said this week on a call to discuss the airline's first-quarter results. Read more: Will Business Travel Come All the Way Back? None of the large airlines that have reported so far this earnings season are forecasting substantial improvement in business travel this year, but they also aren't projecting a deterioration in demand, either. Delta is counting on stabilization in corporate flying traffic at about a 75% recovery relative to pre-pandemic levels, President Glen Hauenstein said on the company's earnings call last week. Recent data, however, suggest this category of corporate spending is particularly vulnerable in times of financial stress, and airlines are starting to acknowledge that this stress is tangible. After projecting nothing but blue skies for air-travel demand for months, United offered the first break in this narrative. "It seems clear that the macro risks are higher today than they were even a few months ago," Kirby said. "Our base case, therefore, remains a mild recession or soft landing." This feels like a mismatch.  Demand for corporate trips from the technology sector was gaining momentum in the third quarter of last year but has since taken a step back amid a wave of layoffs and tighter cost controls in the sector, Alaska Air said this week. The airline primarily caters to leisure travelers, but its focus on the West Coast makes it particularly reliant on the technology sector for the corporate side of its business. On a volume basis, business flight demand in the technology industry has recovered to only about 50% to 60% of pre-pandemic levels, compared with a 75% recovery in overall corporate travel at Alaska. The carrier characterized the lackluster West Coast business travel recovery as an "opportunity," particularly as more technology companies bring workers back to the office, but Alaska is also weighing capacity adjustments that suggest it's not expecting corporate road warriors to fill up planes in the winter months in the near future. "We need to do a much better job at matching supply and demand in what seems to be a weaker January and February," Chief Commercial Officer Andrew Harrison said on the company's earnings call. "Some of the hub-to-hub heavy traditional business traffic markets, we're going to sort of trim back and maybe put that capacity elsewhere," he added.

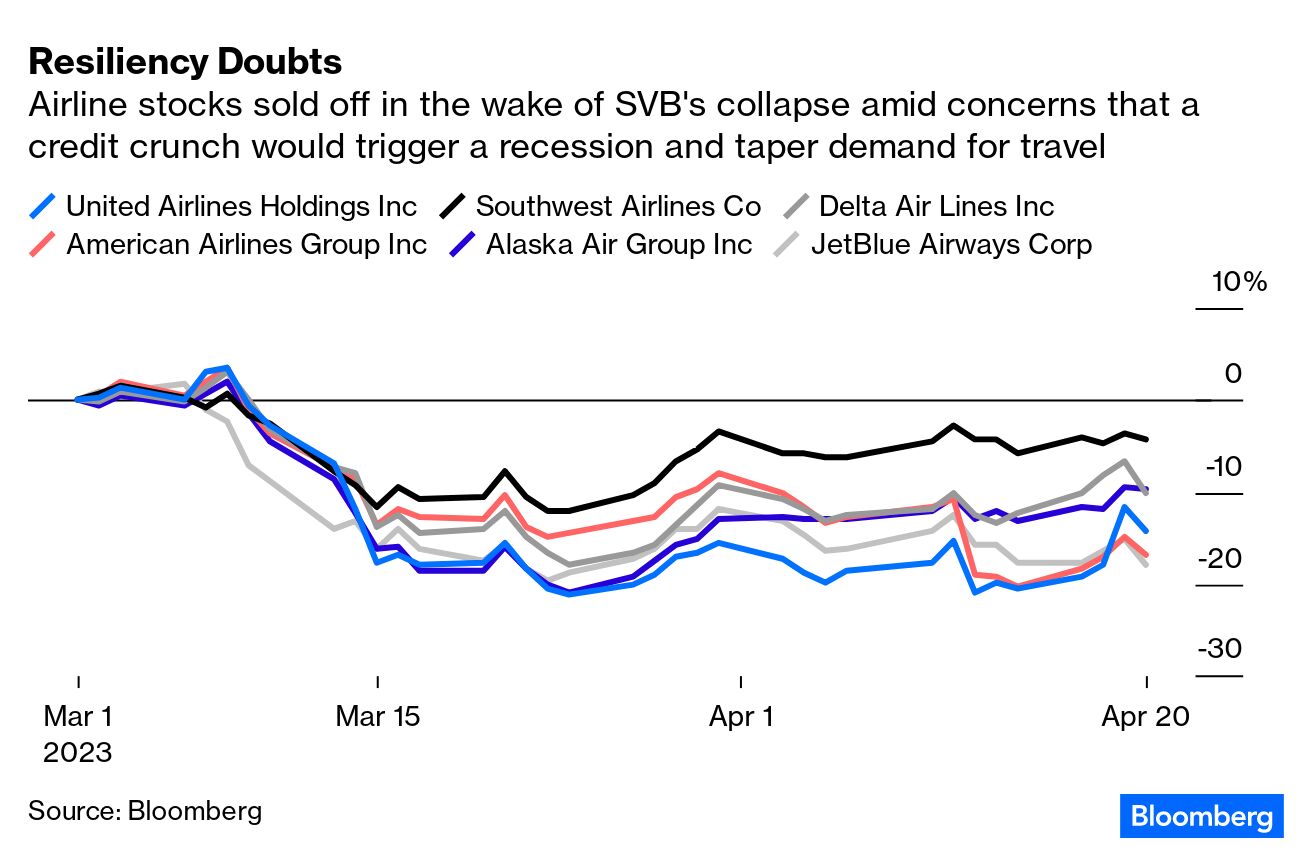

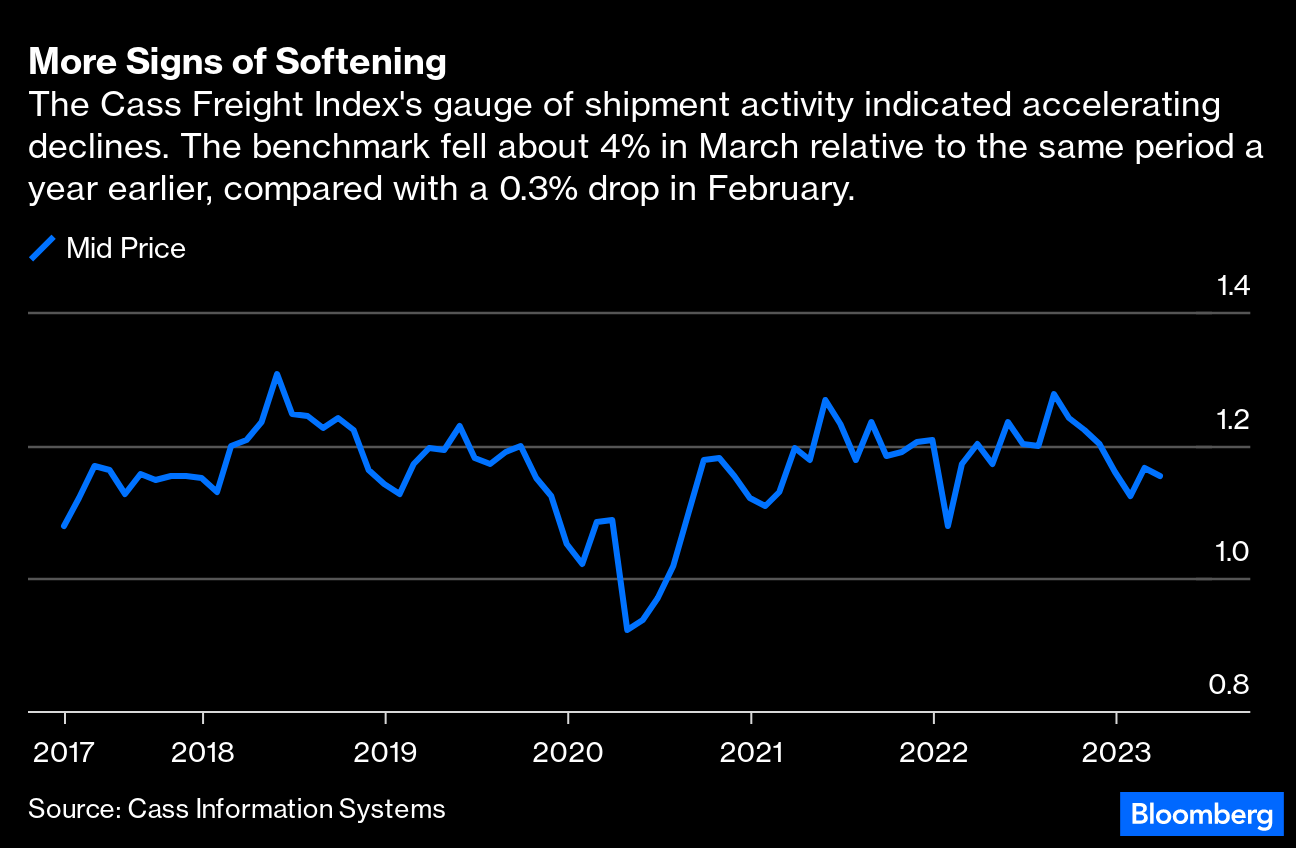

Meanwhile, the collapse of Silicon Valley Bank into Federal Deposit Insurance Corp. receivership on March 10 triggered a noticeable drop in near-term domestic business travel at United. This only lasted about two weeks, and demand has since bounced back to previous trend lines. But it's worrying that there was such a quick reaction in travel budgets to the banking sector woes. While corporate travel has always been vulnerable to economic downswings, the successful migration of many meetings to virtual platforms during the pandemic forced a reevaluation of how much in-person face time was actually necessary. There's no replacement for key client meetings and certain large group gatherings such as conferences and conventions. Contrary to the early predictions of the pandemic, business travel is far from dead. But the corporate world did manage fairly well for quite a long time with Zoom calls, so when costs need to be cut, travel is an even easier bucket to target than it was before. Read more: Covid-19 Didn't Kill Conventions After All United looks at business travel through three lenses: large corporations with airline contracts, trips booked through agencies that specialize in this kind of traffic and certain types of tickets that are more likely to be purchased by businesses, including small and medium-sized ones. Recovery rates to pre-pandemic levels across these three categories ranged from 95% to 101% in the first two weeks of April, United said, up from 85% to 97% in the first quarter. These are revenue measurements, though, meaning they encompass the effect of ticket-price inflation. In light of how much the economy has grown over the past few years, a 100% recovery in business travel to 2019 levels isn't truly a full recovery.  The airlines are still bullish about the summer travel season overall, particularly in international markets that were still relatively closed off last year. They're justified in that enthusiasm. Somewhat incredibly, consumer travel demand has remained robust despite soaring ticket prices and a series of unfortunate operational blowups at the airlines. (United, to its credit, said it had the lowest first-quarter seat cancellation rate since 2012 in the most recent period, even as weather conditions affected many of its routes.) But the demand outlook in the fall and winter is murkier. Even a mild recession may crimp certain spending habits that have helped make up for still-stilted corporate spending. For example, leisure travelers have been more willing to splurge on premium seats. Work-from-home policies also mean they're filling up more seats on off-peak days that were previously the domain of business travelers, rather than the typical weekend rush. If money is tighter, though, an economy seat will probably do and these blended business-leisure trips may become fewer and farther between. It's always telling when companies start talking about resiliency, and usually not in a good way. "If the economy softens further, we've prepared for it," Kirby of United said. The company has reduced its total debt load by about $4.6 billion over the past year, putting its balance sheet in a better position to weather any additional weakness in the economy, and United also has flexibility to cut costs by trimming capacity, he said. Southwest Airlines Co. and American Airlines Group Inc. are due to report results on Thursday. American warned earlier this month that its first-quarter profit would likely fall short of estimates. The airline said revenue for each seat flown a mile is expected to increase about 26% in the period relative to the year earlier, hitting the midpoint of its previous guidance. That surprised some analysts who had been expecting a particularly robust revenue performance at American given its strong positioning in Latin American markets that are typically popular for sun-seekers in the winter months. "We're in a challenging freight environment, where there is deflationary price pressure for an industry that continues to face inflationary cost pressures. Simply stated, we're in a freight recession." — J.B. Hunt Transport Services Inc. President Shelley Simpson Simpson made the comments on a call this week to discuss first-quarter results at the trucking company that fell short of analysts' estimates amid a slump in demand as consumers temper their spending on goods and retailers work through bloated inventories. It was only the latest negative data point for the logistics and transportation economy. Freight hauled by US trucks under contracts declined by 5.4% in March, the largest monthly drop since April 2020 amid the depths of the pandemic, according to data released this week from the American Trucking Associations. Trucking rates have slid amid a loosening of capacity. Meanwhile, first-quarter volumes at the key West Coast port of Los Angeles were about a third lower than the record reached in the period a year earlier, and March activity was more than 13% below the five-year average. J.B. Hunt said its intermodal business — so named because containers can be transferred between ships, rails and trucks — had the people and capacity available to handle 15% to 20% more than its current volume, which implies a significant oversupply. Intermodal volume also dropped at CSX Corp. and Union Pacific Corp. in the first quarter, the railroads said this week, with the former lowering its full-year carload outlook as a result. Union Pacific still expects volumes to exceed the pace of US industrial production in 2023, but the railroad cut its estimate for this economic metric to a 0.7% decline.  J.B. Hunt had been more optimistic about a turnaround in shipping demand in the back half of this year when it reported results in January, but customer follow-through on bids has hit an all-time low, and the volumes that it anticipated failed to materialize. Even so, J.B. Hunt remains committed to long-term investments in people, technology and capacity, with an eye toward being better able to service a bounce-back in demand, whenever that does materialize. "It's not a question of if this is coming back. It's just a question of when and what position will we be in when our customers start ringing our phone again in ways that they have in the past," CEO John Roberts said. Boeing Co. hosted its annual meeting this week, which gave shareholders an opportunity to ask CEO Dave Calhoun about the company's latest snag involving the 737 Max. The company is temporarily pausing some deliveries of the Max after discovering that supplier Spirit AeroSystems Holdings Inc. didn't follow proper manufacturing procedures for certain rear fittings that attach the plane's body to the vertical tail. Boeing has said the issue affects a "significant" number of undelivered aircraft and some in-service jets built as far back as 2019. Details are still light, but Calhoun said that this latest hiccup wouldn't hinder the planemaker's plans to boost output of the Max and also wouldn't prevent the company from reaching its target of generating $10 billion in free cash flow by 2025 or 2026. We'll see. In a regulatory filing, United said that six Max planes that it was expecting to receive in the second quarter have been delayed because of this manufacturing issue and that there may be an impact on handoffs in the third quarter and the rest of the year as well, although it's not expecting the delays to significantly derail its capacity plan for 2023 "at this time." Ryanair Holdings Plc will have to curb its flying schedule in July because it anticipates that 10 of its Max deliveries will get held up, Reuters reported. Uponor Oyj, the Finnish plumbing-equipment manufacturer, received an indicative takeover offer valued at €25 a share in cash, or about €1.9 billion ($2 billion) including the assumption of debt, from Belgian building-materials company Aliaxis SA. The proposed offer is a 45% premium to where Uponor was trading at the end of last week but a discount to where the stock was trading in mid-2021. Oras Invest Oy, Uponor's biggest shareholder with a roughly 25% stake, said the Aliaxis proposal "does not reflect the full value" of the company and that its "intention is therefore not to accept the potential offer." Aliaxis said that it initially approached Uponor in May 2022 but that talks were "inconclusive." Uponor says the earlier deal negotiations were terminated and that the company is focused on executing a strategic transformation initiative laid out in February. It hasn't yet made a decision on the latest proposed offer from Aliaxis. A takeover, should one happen, would join a more than $200 billion wave of M&A in the building materials industry in the US and Western Europe since the start of 2020 amid a surge in pandemic-driven home-improvement spending.

Griffon Corp., a $1.6 billion manufacturer of garage doors and tools, said a strategic review launched last year failed to drum up bids that reflected the value of the business. Griffon instead increased its share buyback authorization to $258 million and issued a special dividend valued at $2 a share. Recall that steelmaker Nucor Corp. last year bought C.H.I. Overhead Doors, a maker of garage and warehouse doors, from KKR & Co. for $3 billion. Rocket motor shortage foils missile supply chain

AM radio is a victim of capitalism, not politics

More reasons this will be a hellish summer for travel

Dell customers are demanding supply chains shift from China

Battling climate change will make flying more expensive

Combatting PFAS in old rain coats

Can a logging company be eco-friendly?

High prices aren't cutting into demand for ice cream, tater tots |

No comments:

Post a Comment