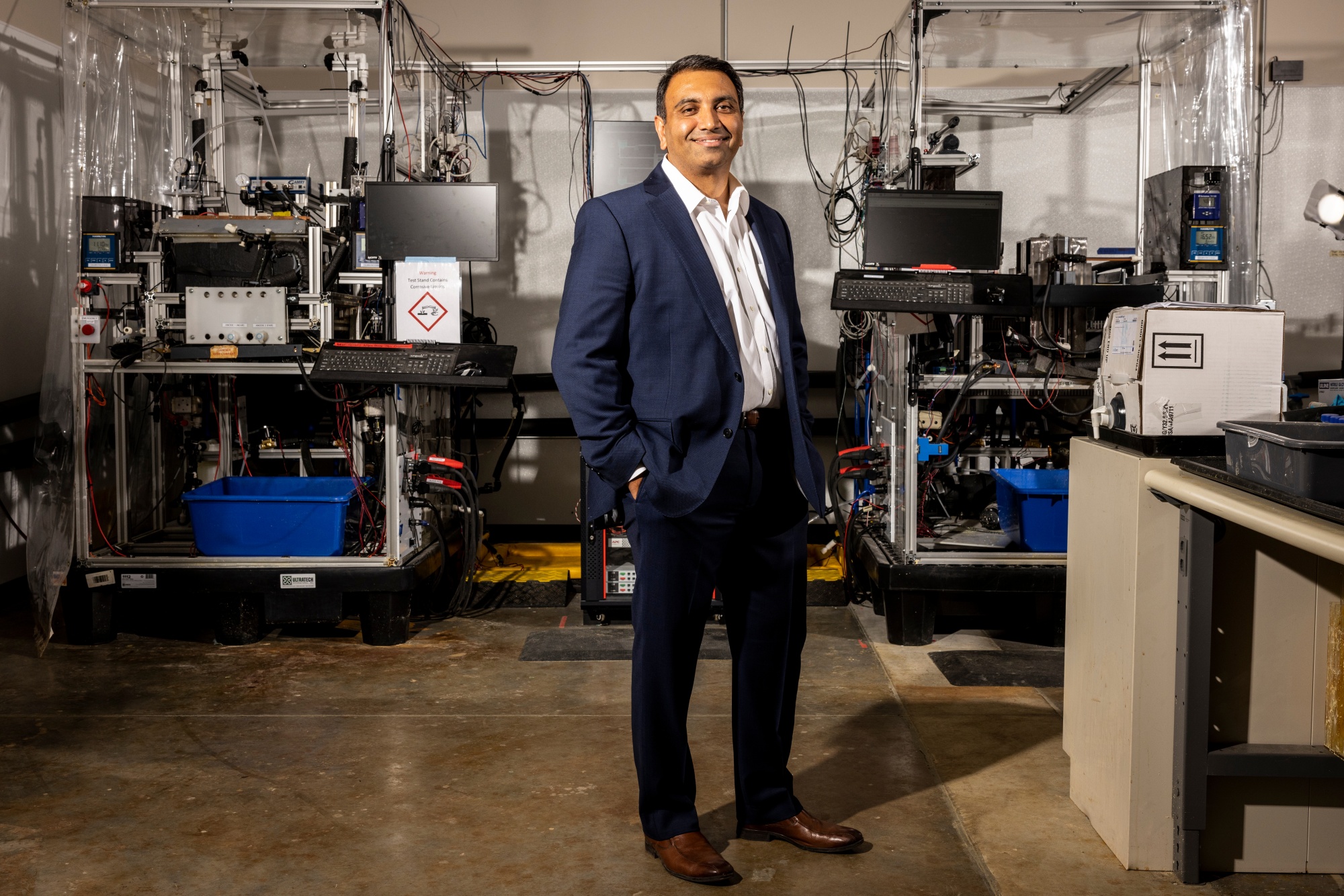

| The electric future will require a massive increase in the supply of metals such as lithium, cobalt and nickel, which are essential components of today's EV batteries. Shortages of rare minerals and metals could drive up the cost of the energy transition — and potentially hold it back. Mines, meanwhile, take years to build and can have a devastating impact on soil, water, wildlife and local communities. Thankfully a new generation of startups is working on ways to mine more efficiently and more cleanly — and to recycle the metals and materials that have already been used. Others are developing technologies that require fewer rare materials in the first place. They include this year's three Pioneers winners, Nth Cycle and Li-Cycle, which have come up with very different ways to recycle old batteries and materials, and Jetti Resources, whose novel technology gets more out of existing copper mines. You can read about them here. There are other material challenges. The world needs green solutions for hard-to-abate industries like steel and cement. In today's newsletter, we highlight one BNEF Pioneer winner, Electra, which has found a way to refine lower-grade iron ore at reduced temperatures using intermittent renewable power to eliminate emissions. Boston-based startup Sublime Systems, another of this year's Pioneers, announced earlier this year that it had raised $40 million to develop a new technology to produce low-carbon cement. But first, we look at a company that's trying to make the EV supply chain more sustainable by mining lithium in abandoned oil fields, a story you can also find in the latest issue of Bloomberg Green's magazine. Click here to read the full version of this story on Bloomberg.com. Chris Doornbos pulled up to Alberta's foundational oil field in a baby-blue Tesla Model Y, a not-so-subtle nod to a new world order. It was a crisp January afternoon in Canada's top-polluting province and a biting -5C (23F), and the 40-year-old mining executive squinted at a patch of dirt that midcentury prospectors had once scoured for oil. It doesn't look like much now, he admitted, but what counts is the lithium beneath the soil.  E3 Lithium CEO Chris Doornbos at an active well in the Leduc Formation north of Calgary. Photographer: Amber Bracken for Bloomberg Green The Leduc oil field was discovered in the 1940s, when a group of Imperial Oil Ltd. workers stumbled upon a well so profuse with petroleum that, on first drill, it burped a gaseous fireball almost 15 meters (49 feet) into the air. The discovery effectively birthed Canada's oil and gas industry. Before long, prospectors were drilling thousands of holes across Alberta in pursuit of black sludge. Oil companies drilled more than 4,000 holes in the Leduc field alone. Today many of those wells have been depleted and abandoned. The cavities have been filled with cement, and some of the salvageable areas are now occupied by wheat farmers. What remains underneath these vast expanses, now that the oil's gone, are large deposits of saltwater known as brine that contain traces of lithium, the coveted ingredient in electric-vehicle batteries. Early-stage mining companies such as the one Doornbos runs, E3 Lithium Inc., are betting they'll one day be able to extract lithium from those underground aquifers at commercial scale.  The well where E3 Lithium Ltd. is testing its extraction technology. Photographer: Amber Bracken for Bloomberg Green Doornbos's company leased a chunk of the Leduc field in 2018 to test technology designed to refine and process lithium. The silvery-white mineral has been lingering in aquifers underneath Alberta's oil rigs for a century, but refining it into an acceptable grade of the metal isn't straightforward. It requires a type of technology that's very much in its infancy and barely used to produce lithium at scale. In addition to being E3's chief executive officer and president, Doornbos is a geologist, and if he figures it out, he'll be the first to extract commercial-grade lithium from an abandoned oil field. The vast majority of the world's lithium is mined from salt flats and hard rock using an expensive, lengthy process that requires specialized equipment and a staggering amount of fresh water. It's a paradox in the move to clean energy: Getting away from fossil fuels presents environmental hazards of its own.  Water pools around the base of a still active well head in the Leduc Formation north of Calgary. Photographer: Amber Bracken for Bloomberg Green Enter direct lithium extraction, an early-stage technology that seeks to hasten extraction while reducing water consumption—at a fraction of the cost. DLE consists of relatively small, modular machines that suck brine from the ground and separate the lithium, kind of like a coffee filter. Proponents say the technology is far less destructive than traditional mining; it operates on a much smaller scale, for one, and it doesn't require carbon-heavy evaporation ponds that miners typically use to process lithium. DLE offers "significant promise" for increasing supply while reducing the environmental impact of lithium mining, according to a 2022 report by McKinsey & Co. But it's still so young that only one company uses it commercially.  Doornbos's company leased a portion of the Leduc field. Photographer: Amber Bracken for Bloomberg Green The long and winding research and development process has delayed DLE companies and sparked impatience among investors. Doornbos acknowledges scale is a challenge but insists DLE can get there. When E3 started experimenting in 2016, "there was no technology out there, and that caused risk," he says. "Today the landscape is drastically different. Tons of companies have matured their technology, so the risk factor that was there a few years ago has been reduced." Click here to continue reading and to share the full version of this story on Bloomberg.com. Like getting the Green Daily? Subscribe to Bloomberg.com for unlimited access to breaking news on climate and energy, data-driven reporting and graphics and Bloomberg Green magazine. There's a stiff competition for scrap. A global rush into battery recycling is good news for automakers worried about future raw material supplies. But the wave of new factories poses a big risk for the recycling industry itself: there's nowhere near enough scrap yet to feed them all. The US is charging up battery recycling. Tesla co-founder J.B. Straubel is building US recycling plants that turn batteries for consumer electronics into those used to power electric vehicles. Meanwhile, the US subsidiary of Li-Cycle Holdings Corp. has received a $375 million loan offer from the Biden administration for the expansion of a New York lithium-ion battery recycling plant. There is a future without lithium. The battery world is buzzing about sodium-ion cells. Sodium is more abundant and offers potential safety benefits over lithium, but the latter offers superior energy density. Earlier this year, Chinese automaker JAC unveiled a test version of its Sehol E10X electric car that was packing sodium-ion cells.  The Sehol E10X. Source: JAC Group Steel production is responsible for 7% of greenhouse-gas emissions dumped into the air each year — more than the climate impact of shipping and aviation combined. The best way to reduce its impact is to focus on iron, which makes up 98% of the substance in steel. Usually iron is produced using high temperatures and lots of coal. Boulder, Colorado-based Electra says its using renewable electricity to make carbon-free iron at merely 60°C. Click here to read more about how the technology works. You can also listen to Akshat Rathi's conversation with Electra CEO Sandeep Nijhawan on the Zero podcast.  Sandeep Nijhawan Photographer: Chet Strange/Bloomberg Imagine a financial tool that solves three problems at once — lowering greenhouse gasses, rejuvenating forests and improving the lives of the poor. That's the promise of carbon offsets, but far from the reality. In this episode of Getting Warmer, Kal Penn explains how carbon offset markets work, or in most cases don't.  In the US, Penn takes a look at the public forest credits snapped up by big companies like JPMorgan and Disney. Their contracts promise to save forests under threat, but the land was never threatened in the first place. In Iceland, the Climeworks carbon capture plant offers a quantifiable premise: purchase a credit, and in return they will remove a specific amount of carbon from the air. But even though it's the world's largest carbon capture plant, it barely moves the needle when it comes to cleaning up the atmosphere.

In a guest segment, climate storyteller Jack Harries explores why so many tree planting programs fail, and whether planting trees is actually the easy and straightforward solution to the climate crisis that we've been promised. |

No comments:

Post a Comment