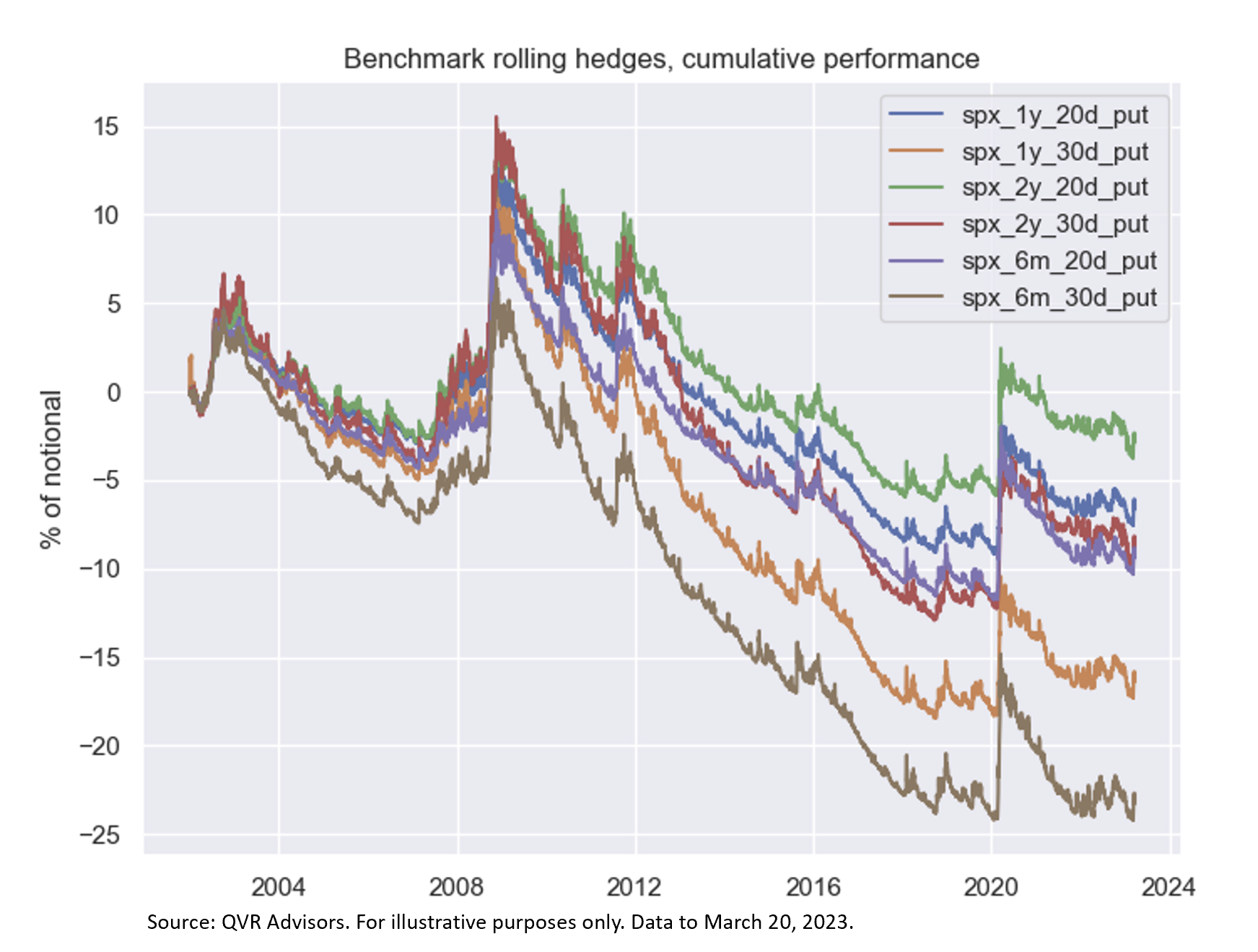

| Good morning. A Swiss central banker reveals the true stakes behind Credit Suisse's rescue, an ECB official warns of another 50 basis-point hike and L'Oréal buys Aesop. Here's what people are talking about. Had Credit Suisse Group AG not been sold to UBS Group AG, it would have gone bankrupt the next trading day, causing a global financial crisis, according to Swiss National Bank Vice President Martin Schlegel. If the government-brokered takeover hadn't come together, it's "very, very likely a financial crisis in Switzerland and worldwide would have happened," Schlegel told broadcaster SRF in an interview that aired Monday. "CS would then have been bankrupt." With the merger agreed upon — "the best among bad solutions" — financial stability concerns won't keep the SNB from raising interest rates, he said. European Central Bank Governing Council member Robert Holzmann said another half-point increase in borrowing costs is "still on the cards" if the turmoil that's rocked the global banking system doesn't worsen. While acknowledging that the episode, sparked by the collapse of Silicon Valley Bank, could have a comparable effect to interest-rates hikes by curbing credit, Holzmann said his "feeling would be to stay on course." Similarly, Sunday's announcement by OPEC+ of a surprise production cut isn't likely to have a major impact on the path ahead, the hawkish Austrian central-bank chief said. "If things in May haven't really become more terrible, I think we can afford another 50 basis points," he said. French skincare giant L'Oréal has agreed to acquire luxury cosmetics brand Aesop, which was founded in Melbourne before developing a cult global following, for an enterprise value of $2.53 billion. The transaction, which is expected to close in the third quarter, caps months of negotiations for the asset. Other companies, including private equity firm Permira and Chinese investment firm Primavera Capital also showed interest in buying a stake in the Australian brand, owned by Brazil's Natura & Co., people familiar with the matter told Bloomberg last month. The deal will help Brazilian beauty giant Natura reduce its debt burden and focus on turning around other businesses. The surprise OPEC+ production cut was aimed squarely at one audience: speculators betting that oil prices would fall. It's a return to the tactic first used by Saudi Energy Minister Prince Abdulaziz bin Salman in 2020, when he famously said he wants "the guys in the trading floors to be as jumpy as possible" and vowed that "whoever gambles on this market will be ouching like hell." The new attack on short sellers was successful. Markets were wrong-footed and oil futures surged as much as 8%, repricing assets from equities to bonds. Yet OPEC+ also caught consumers and the global economy in the crossfire, spurring concerns about inflation and prompting bets on further interest rate hikes. European stocks are poised to nudge up as traders continue to assess the inflationary impacts of OPEC+'s oil production cut. Credit Suisse holds an annual general meeting in Zurich. NATO foreign ministers begin two-day meeting in Brussels. The EU-US Energy Council also meets in Brussels, with US Secretary of State Antony Blinken to attend. BOE Chief Economist Huw Pill speaks in Geneva. Expected data include eurozone PPI, German trade balance and Spanish unemployment. This week's MLIV Pulse: How will recent turmoil in the financial sector affect corporate earnings? Will tech earnings be strong enough to support the recent rally? What will be the biggest positive and negative drivers this season? Share your views in our MLIV Pulse survey. It's short and anonymous. One of the best (and worst) things about Twitter is watching celebrities, billionaires and leaders of industry get into spats about seemingly niche, sometimes trivial matters. Perhaps it reminds the rest of us that, despite the rarefied air they breath, we are all still the same species. One such spectacle is occurring because of the investment returns claimed by Mark Spitznagel and his Universa Investments. Over the years these have included a 3,612% return in a single month when Covid hit, and, more recently, that a small investment in Universa was equivalent to an annuity paying 114%. The point of contention here is that the firm calculates its return based on premia spent instead of return on assets. What Universa in effect does is calculate the return on an insurance policy using the premium paid in one month, ignoring the capital bleed that occurs in less successful years.  Buying puts is a money-losing proposition when considered in isolation. Chart shows the performance of hedges rolled every quarter with delta hedging, as a percentage of notional amount protected. Bloomberg The chart above, via QVR Advisors, illustrates the basic idea. Buying puts occasionally deliver outsized returns, but at the cost of long runs of losses. As reporter Justina Lee points out, Universa's numbers aren't technically incorrect, and calculating the firm's performance is complicated. The firm argues that the unconventional reporting technique matches its unconventional business. But it's not how most people think of returns. Generally speaking, returns might be measured as income (from say dividends and yield) plus change in price, divided by assets held. Rarely, though, does the general translate well to the specific. For instance, the complexity of the real-world setting is such that even the CFA Institute, the gold standard in investment professional training, leaves performance evaluation to late in its third and final level, and then generally simplifies what it refers to in its Global Investment Performance Investments Standards. The point is that investors taking part in exotic investments -- and even those who don't -- should take the time not only to understand what they're investing in, but also on how their returns will be reported and taxed. On such matters fortunes can be made or lost. Eddie van der Walt is Deputy Managing Editor of the Markets Live blog on the Bloomberg Terminal, based in London. Follow him on Twitter at @EdVanDerWalt |

No comments:

Post a Comment