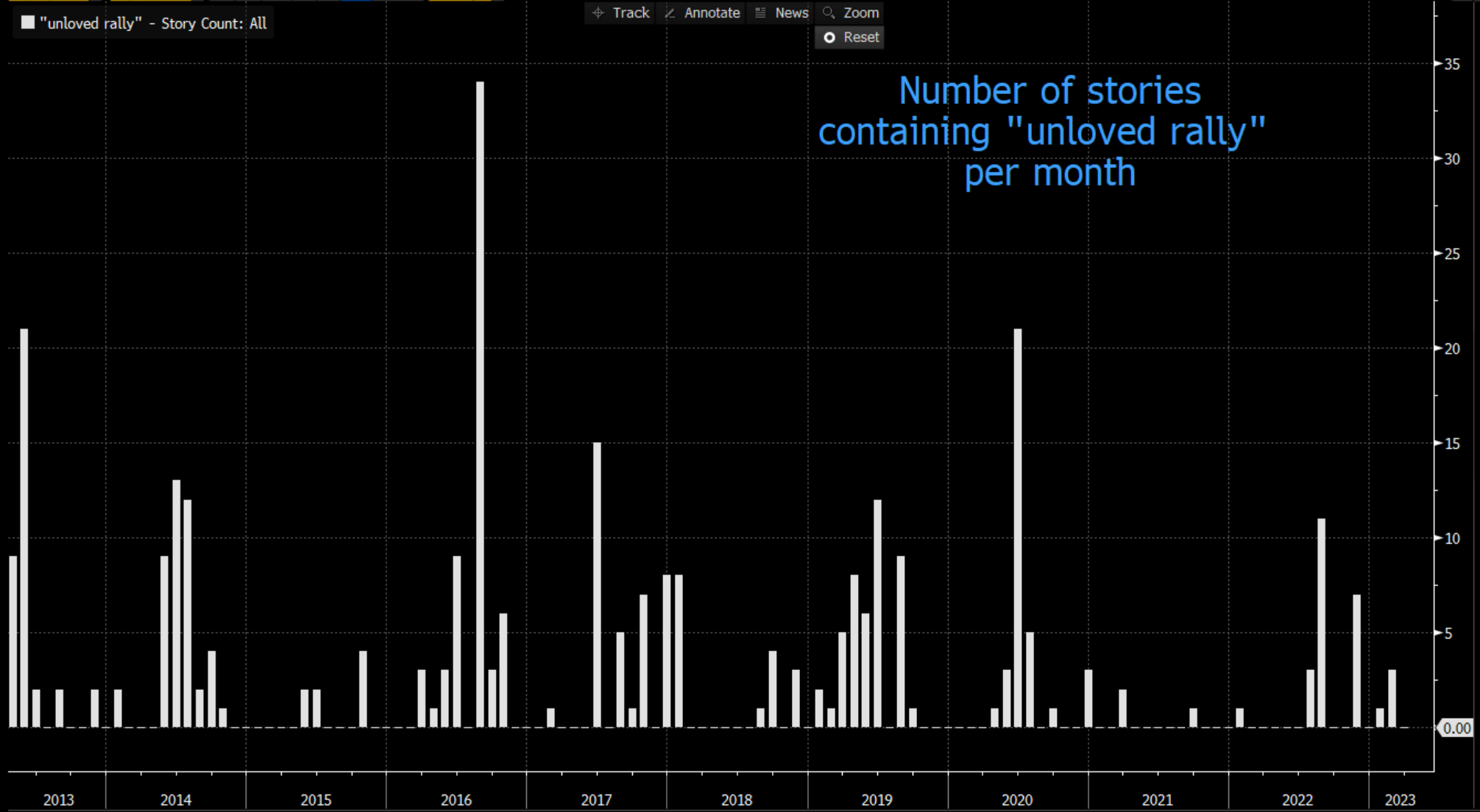

| Good morning. Russian officials are worried about relying on Chinese tech, Fox settles the Dominion lawsuit and Goldman Sachs fails to capitalize on a fixed-income trading bonanza. Here's what people are talking about. Senior Russian officials privately raised concerns some 10 months ago about the risks of becoming too dependent on Chinese technologies after sanctions by the US and the European Union shut off access to alternative suppliers. A previously unreported assessment from inside Russia's Ministry of Digital Development, Communications and Mass Media suggests that some senior officials are worried that Chinese companies such as Huawei Technologies could come to dominate the Russian market and may pose a risk to the country's information security and networks. European officials familiar with the document said it suggests that Russia has backed itself into a corner since it struggles to produce advanced technology domestically and has been cut off from other foreign markets following the invasion of Ukraine. Fox News agreed to pay $787.5 million to settle a voting machine maker's defamation lawsuit over the network's 2020 election broadcasts, striking a deal on the brink of a potentially embarrassing trial. The settlement — for almost half the $1.6 billion Dominion Voting Systems sought and far above some analysts' estimates — came to light on Tuesday in a Wilmington, Delaware, courtroom. After more than two years of legal skirmishing over whether the network defamed Dominion by airing bogus claims that it rigged the vote against Donald Trump, and with a jury of 12 selected, the trial was about to get underway. Instead, following an unexplained one-day delay Monday, it was held up for hours more in the final moments of deal-making. Goldman Sachs traders failed to capitalize on the fixed-income bonanza the rest of Wall Street generated last quarter, contributing to firmwide revenue that fell short of analysts' estimates. Fixed-income trading revenue declined 17%, the firm said in a statement Tuesday. Goldman was the only major Wall Street bank so far to have posted a drop for that business, even though the performance was the firm's third-best in the past decade. Equities-trading revenue beat expectations, helping to soften the blow. The bank also offloaded a chunk of its roughly $4 billion Marcus loan book, which led to a $440 million reserve release. The firm's profit was higher than analysts expected, but earnings were still down 19% from a year earlier. For decades London was the main nexus of European finance, melding continental money with transatlantic ideas of what to do with it. But two years after Brexit became a reality, there's been a clear shift across the Channel. The spoils are being shared by European Union cities, creating a more fragmented landscape. It's one where banking of various stripes gets done in Paris, shares trade in the Netherlands, and corporate lawyers and accountants pore over the details in Frankfurt. Dublin, Milan, Madrid and Warsaw are playing important supporting roles. But if any city can make claim to being the bloc's new pre-eminent hub, it's Paris. The city's allure may have been tarnished this year by protests against President Emmanuel Macron's plans to raise the retirement age, which led to nationwide strikes and images of burning garbage in the streets. But the numbers working at the offices of Wall Street titans point to a new European banking reality. European shares are headed for a flat open as traders focus on earnings season and the Fed's policy path. ECB executive board member Isabel Schnabel and BOE policymaker Catherine Mann speak at separate events. Bloomberg's New Economy Gateway Europe begins in Dublin and will explore the forces of change in trade and industry. Expected data include eurozone and UK CPI. ASML, Heineken and Tesla are on deck for earnings. This is what's caught our eye over the past 24 hours Ever heard the one about the unloved rally? Every once in a while, the notion takes flight that a given rally in risky assets is somehow not trusted or believed by the collective hive-mind of the investment community. Over the past ten years, there were eight months in which the words "unloved" and "rally" appeared at least ten times in all the news sources that make their way to the Bloomberg Terminal.  Photographer: /Bloomberg The idea is a little problematic. Mostly because markets are a pretty good money-weighted democratic forum. At any given moment price direction in everything from Alphabet shares to zinc futures capture the change in sentiment of the money flowing in and out of the market. For every buyer, there is a seller. And if the price goes up, the buyers are willing to pay more than those who came before them. One could almost say there was an invisible hand at play. The second problem is that there is no collective mind. Some people don't like the rally, and others do. Some people think that Bitcoin is worthless and others don't. Those who don't think it is worthless, and who also actively put money towards that view form part of the market. In other words, a market isn't a place or a digital trading venue in cyberspace, it's a collective noun for a group of people who engage in the business of buying and selling. The third and final problem for our discussion is that it isn't particularly predictive. Following the end of those ten events, only one was followed by a >10% decline in the MSCI All-Country World Index. The "unloved rally" in 2016 only saw a 3.6% drawdown and shares ended the year up. In 2020, the post-pandemic rally was widely derided as hated by all, and look how that turned out. Eddie van der Walt is Deputy Managing Editor of the Markets Live blog on the Bloomberg Terminal, based in London. Follow him on Twitter at @EdVanDerWalt |

No comments:

Post a Comment