| China deepens crackdown on bankers. Taiwan defends president's US visit. The four-day work week gains ground in Australia. Here's what you need to know today. Chinese authorities warned the nation's top banking executives that a corruption crackdown on the $60 trillion industry is far from over, as they announced a probe into the most senior state banker in nearly two decades. Executives from at least six state owned banks were summoned by regulators to discuss a probe into Bank of China's former Chairman Liu Liange, who is suspected of "serious violations of discipline and law." Regulators said the bankers should draw lessons from Liu and strengthen self discipline, sources said. At least 20 financial executives have been probed since late February. The surprise OPEC+ production cut was aimed squarely at one audience: speculators betting that oil prices would fall. It's a return to the tactic first used by Saudi Energy Minister Prince Abdulaziz bin Salman in 2020, when he famously said he wants "the guys in the trading floors to be as jumpy as possible." The new attack on short sellers was successful. Markets were wrong-footed and oil futures surged as much as 8%, repricing assets from equities to bonds. Yet OPEC+ also caught consumers and the global economy in the crossfire, spurring concerns about inflation and prompting bets on further interest rate hikes. Meanwhile, US exporters may see the OPEC+ move as their opportunity to grab more market share in Asia. Australian companies are increasingly offering four-day working weeks in a bid to attract employees and undercut rivals in an environment of acute labor shortages. The share of job postings that mentioned a shorter work week jumped by 50% in early 2023 compared with its pre-pandemic average, according to global recruitment site Indeed Inc. The world's largest trial of the four-day work week, carried out in the UK, showed revenue gains, lower turnover and less burnout, with most participating firms opting to make the change permanent. Taiwan defended President Tsai Ing-wen's plan to meet US lawmakers led by House Speaker Kevin McCarthy, as China vowed to respond to the meeting. McCarthy, a California Republican, confirmed Monday that the expected meeting with a bipartisan group of US lawmakers will take place as Tsai passes through the state following a trip to Central America. "China will take resolute measures to safeguard its sovereignty and territorial integrity," Mao Ning, Foreign Ministry spokeswoman, said. Equity futures point to Asian stock markets opening little changed as investors weigh weak factory data against inflation concerns fueled by OPEC+'s plan to cut oil output. Contracts for Japan fell marginally while those for Hong Kong suggested little change. Futures for US benchmarks dropped fractionally following a mixed session on Wall Street. Treasuries gained after a gauge of factory activity contracted by more than expected. That came after China's manufacturing activity unexpectedly eased in March. - How will recent turmoil in the financial sector affect corporate earnings? What will be the impact on bank profitability? And will tech earnings be strong enough to support the recent rally? Share your views on the upcoming 1Q earnings season in our MLIV Pulse survey here.

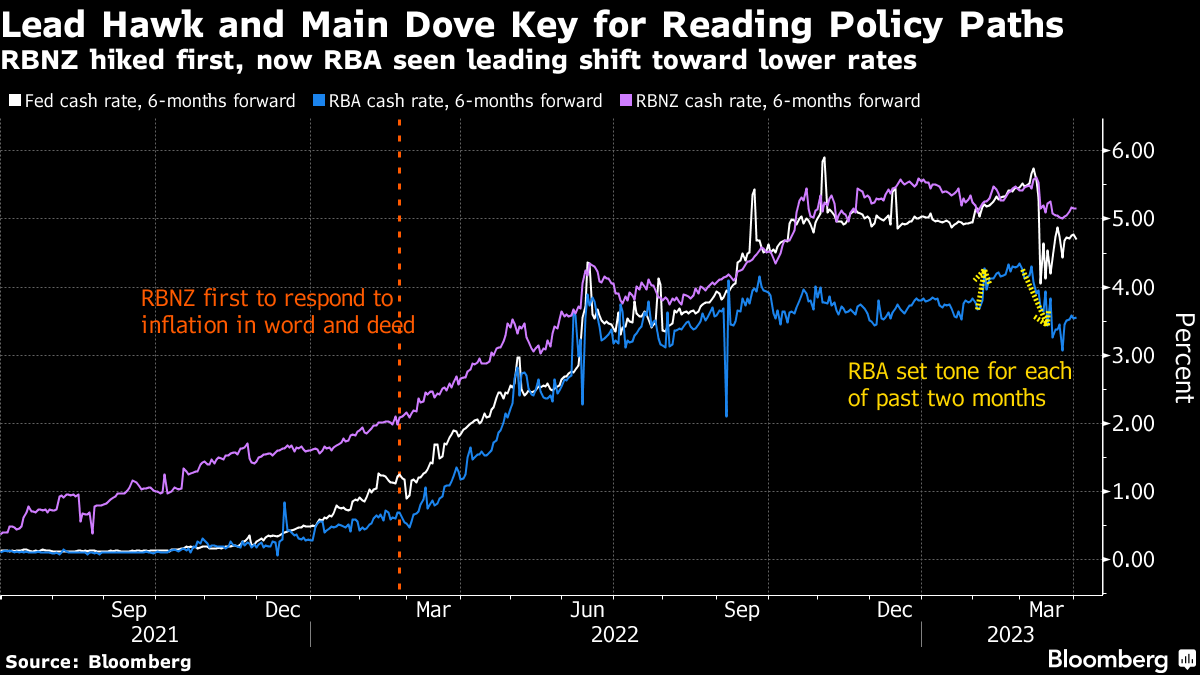

Global markets face a key, 24-hour test of their optimism that central bankers are all set to pivot away from aggressive tightening toward a much easier path. Kicking off Tuesday afternoon, the Reserve Bank of Australia is expected to hold policy and snap a streak of 10 straight interest-rate hikes. A day later we get the Reserve Bank of New Zealand's meeting — it's expected to slow its pace of increases to a quarter point — and half an hour after that RBA Governor Philip Lowe will give a speech to Australia's National Press Club.  While the two central banks are a long way away (in size and geography) from the Federal Reserve and other policymakinng behemoths, they've tended to play a, dare I say it, pivotal role in global monetary trends. The RBNZ, an early promoter of inflation targeting, took a lead role in the current global tightening cycle. The RBA dragged its feet more than most, and its now seen joining the Bank of Canada on the sidelines. An RBA hike, or a hawkish hold that pledges more hikes will come, could set the stage for an April rout to echo February's meltdown. In contrast, an decision by the RBNZ to hold, or to hike and signal that may be the peak, would confirm bond bulls' conviction that hawkish policy stances are past their use-by dates. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment