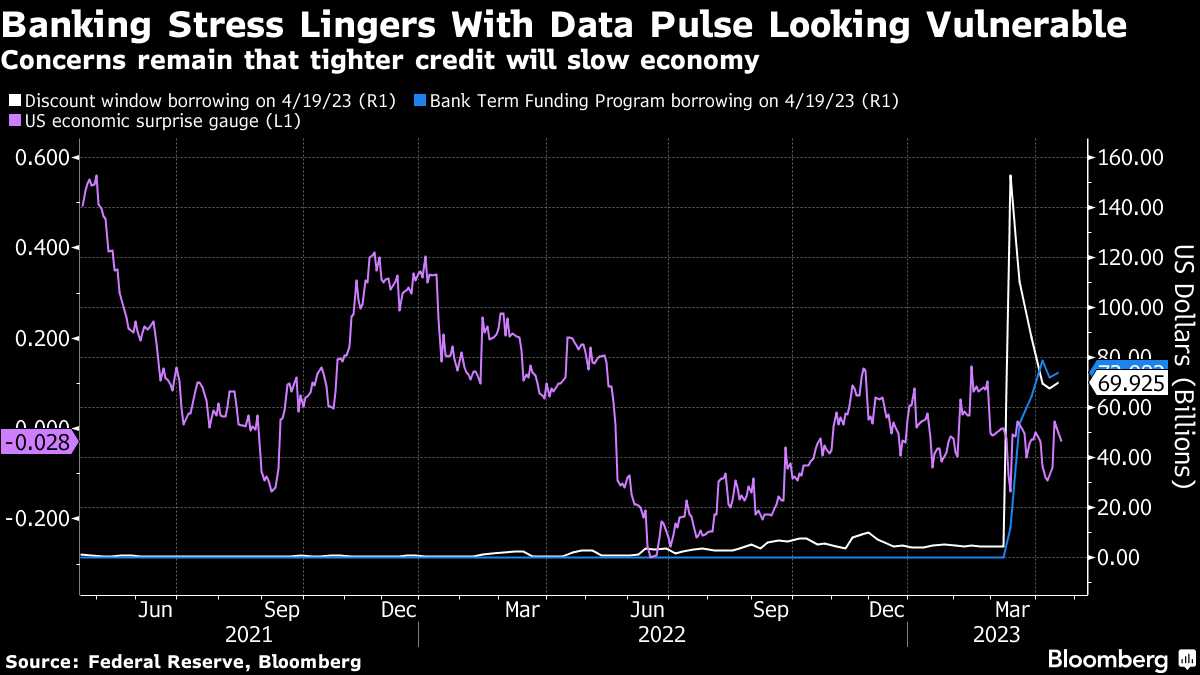

| SpaceX blows up Starship after malfunction. Chinese EV shares soar 620% in US IPO. Biden to sign order limiting US investment in China. Here's what you need to know today. SpaceX's attempt to send its Starship system into space ended after an engine failure forced it the company to blow up the rocket shortly after liftoff. The company said it blew up Starship and its Super Heavy booster after they failed to separate, four minutes after blasting off in Texas. It cited problems with some of Starship's 33 Raptor engines. The mishap potentially complicates CEO Elon Musk's goal to send humans to the moon and Mars. Nevertheless, Musk put a positive spin on the event, tweeting: "Learned a lot for the next test launch in a few months." Here's a deep dive into the challenges SpaceX faces in getting people to the moon. The raucous debut for China-based U Power sent shares soaring 620% and triggered a bevy of trading halts for volatility as investors flipped shares of the newest company to list in the US. The startup, which aims to focus primarily on battery-swapping technology for electric vehicles, surged as high as $75 before closing at $43.18 after pricing its initial public offering at $6. It capped the best debut among companies to list in the US this year after blowing past the 255% boom seen for shares of Multi Ways Holdings. US President Joe Biden aims to sign an executive order in the coming weeks that will limit investment in key parts of China's economy by American businesses. The administration plans to take action around the time of the G-7 summit due to start in Japan on May 19, sources say. The US has been briefing G-7 partners on the investment curbs and hopes to get an endorsement at the meeting. Other countries are not expected to announce similar restrictions at the same time. Meanwhile, as tensions with the US simmer, China's military plans to conduct at least five military drills in waters off its coast and in the South China Sea. Asian stocks are poised for declines after tech equities led Wall Street lower and bonds rose on data that showed some softening in the labor market, housing and a gauge of business outlook. Futures for equity benchmarks in Japan and Hong Kong signal markets will open lower. Meanwhile, wagers are in place for the Bank of Japan to adjust its stance, months after it doubled its yield cap to 0.5% in a surprise move that jolted global markets. And oil fell the most in more than a month, wiping out almost all of the gains stemming from OPEC+'s surprise output cut. Former Fugees member Pras Michel, a Grammy-winner rapper who reinvented himself as political influencer, was paid $100 million to try to end US probes of Malaysian tycoon Jho Low, and to aid the Chinese government in seeking the US extradition of a billionaire dissident, a prosecutor told jurors. Michel, 50, was central in a plot to convince Donald Trump's administration to end a probe into Low's alleged embezzlement of billions of dollars from Malaysia's 1MDB fund, prosecutor Sean Mulryne argued. As the four-week case winds up, get the full story here. Signs of banking stress remain even as leading figures debate whether the collapse of Silicon Valley Bank, Credit Suisse and others was serious enough to warrant the term crisis. While bank earnings have passed off without triggering fresh alarms, the key concern was also how severe the impact of the second- and third-order effects of the financial system's struggles would be. Banks increased emergency borrowing from the Federal Reserve for the first time in five weeks in the period to April 19, underscoring the potential that significantly tighter credit conditions are going to further brake a slowing economy.  With inflation and payrolls figures coming in strong enough to make markets expect a Fed rate hike next month, the current expansion is facing plenty of hurdles. All this at a time when the data pulse had already started weakening. That's the sort of set up that's going to keep encouraging traders to bet on rate cuts by the end of this year, despite central bankers insisting that such moves will be out of the question. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment