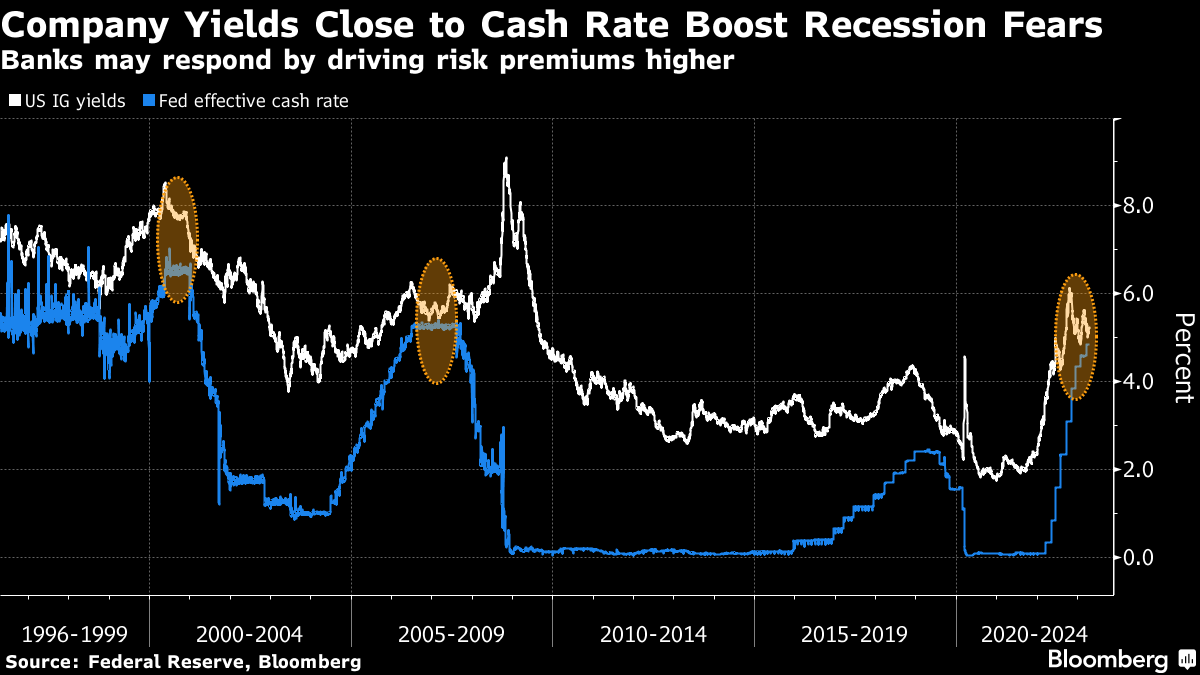

| India overtakes China as world's most populous nation. Tesla misses profit estimates. Alibaba's grocery chain looks at Hong Kong IPO. Here's what you need to know today. India has overtaken China as the world's most populous nation, according to the United Nations. India's population surpassed 1.4286 billion, slightly higher than China's 1.4257 billion people, according to mid-2023 estimates. The burgeoning population — half of which is under the age of 30 — will add urgency for Prime Minister Narendra Modi's government to create employment for the millions of people entering the workforce as the nation moves away from farm jobs. India's population is forecast to touch about 1.66 billion by 2050, when China's population is forecast to contract to about 1.31 billion. These are some of the pros and cons of India's swelling population numbers. Tesla missed first-quarter profit estimates after a series of price cuts designed to boost demand squeezed margins. Revenue rose 24% to $23.33 billion in the quarter, while free cash flow slumped to a two-year low of $441 million. Analysts had expected free cash flow to reach $3.24 billion in the quarter. The Texas-based electric-vehicle maker has been slashing prices to protect its leading market position. The starting price of a Model Y has been cut by 29% in just three months. The stock is up 47% so far this year. Meanwhile, the company blamed "volatile weather" for a drop in US rooftop solar installations, and Chinese authorities say Tesla should be punished for a worker being crushed to death at its Shanghai factory. Alibaba's grocery chain Freshippo, known for selling cooked lobsters and grouper freshly plucked from fish-tanks in the store, has started preparations for a Hong Kong IPO, sources say. The size of the offering is still under consideration. Freshippo is among the first of several Alibaba units in the pipeline to be listed after the Chinese tech giant last month made a surprise announcement to split up its $250 billion business. The firm will be divided into six main units in sectors including e-commerce, media and cloud computing. Cainiao Network Technology, Alibaba's $20 billion logistics arm, is set for an IPO as soon as the end of 2023. Shares in Asia are primed for a steady open after stocks closed little changed on Wall Street and a gauge of volatility slid to the lowest level in more than a year. Contracts for benchmarks in Japan and Australia were incrementally lower while those for Hong Kong's Hang Seng Index rose slightly. The yield on the policy-sensitive two-year Treasury rose five basis points to the highest level in a month. First-quarter US earnings were mixed. While Tesla missed profit expectations, IBM and Morgan Stanley beat forecasts. HSBC said proposals from Ping An Insurance Group for a minority listing of its Asia businesses, would destroy shareholder value and mean lower dividends. The London-headquartered bank delivered a stark riposte to the Chinese insurer — the bank's largest shareholder — describing the plans as a "financial engineering approach" that misunderstood the company. Ping An on Tuesday publicly called for the creation of "a separately listed Asia business headquartered in Hong Kong," and said HSBC had refused to engage "verbally" in discussions about the proposals. Recession remains very much on investors' minds even as central bankers in the US and across much of the globe give such concerns short shrift. Policymakers are overwhelmingly focused more on fighting inflation and are welcoming signs of a slowdown as proof the steep interest-rate hikes they have deployed are gaining some traction in the fight against inflation. Even the Reserve Bank of Australia, which burnished its reputation as a relative dove, has scorned talk of the potential for rate cuts before the end of 2023.  Still, TD Securities says US markets are flashing a fresh warning signal that a recession, and therefore rate cuts, is closer than many investors and policymakers believe. Investment-grade yields are now perilously close to the Fed's effective funds rate, a proxy for banks' funding costs. That means that banks — a key part of the market for corporate debt — may become more reluctant to trade the debt, which could drive a damaging surge in the risk premium for investment-grade notes. The so-called "carry spread" has only been this tight twice before over the past 27 years, and each of those occasions came just before recession hit. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment